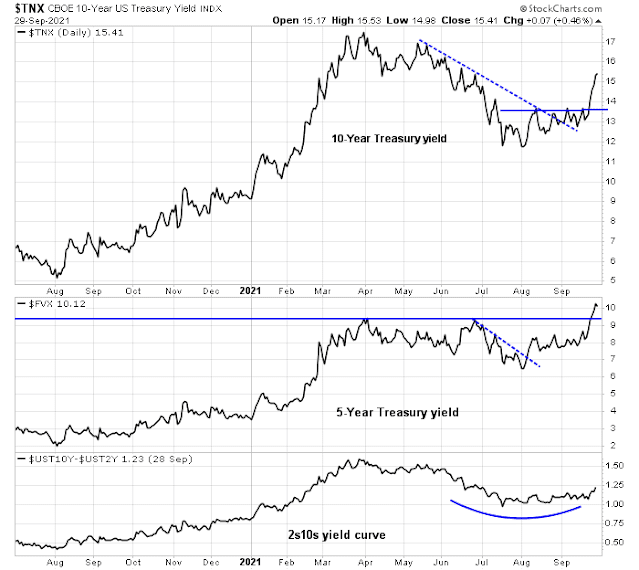

Mid-week market update: Last week, the market was rattled by the prospect of an Evergrande default. This week, it’s rising yields. Both the 5 and 10 year Treasury yields surged decisively this week and the 2s10s yield curve has steepened.

Are rising yields destined to spook stock prices?

Good news, bad news

The answer to that question is a “good news, bad news” story. Let’s start with the bad news. A Goldman Sachs study reveals that stocks struggle when rates rise too rapidly.

Equities, as an asset class, compete with fixed income instruments for funds. A simple way of rating the relative attractiveness of stocks and bonds is the Fed model, which compares the E/P ratio with the yield on a default-free Treasury. If bond yields rise. Equity prices can maintain their level or rise even further as long as the E in the E/P is rising faster than the increase in Treasury yields.

Silver linings

102 companies in the index have issued EPS guidance for Q3 2021, Of these 102 companies, 47 have issued negative EPS guidance and 55 have issued positive EPS guidance. The percentage of companies issuing positive EPS guidance is 54% (55 out of 102), which is well above the 5-year average of 39%.

Credit market risk appetite, as measured by the relative price performance of junk bonds and investment-grade bonds to their duration-equivalent Treasuries, made fresh all-time highs before retreating.

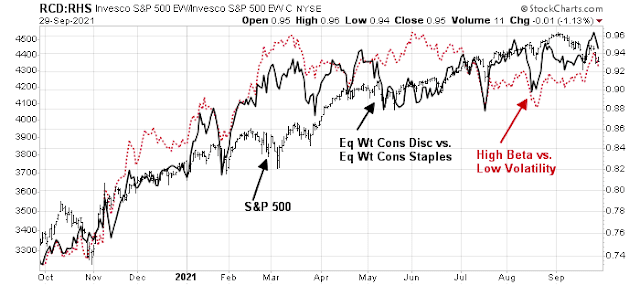

In addition, the relative performance of defensive sectors and industries to the S&P 500 are weak. The bears haven’t taken control of the tape. Major corrections and bear phases simply don’t look like this.

Here is some good news from Hong Kong. The shares of China Evergrande is trying to make a bottom.

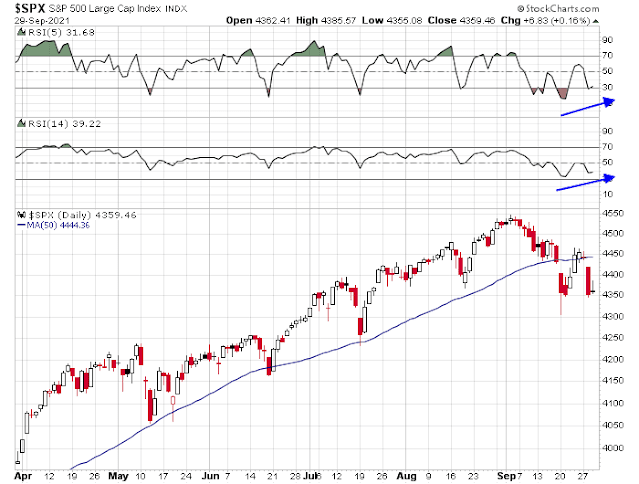

Don’t panic about a major correction. Barring some catastrophe such as a default by the US Treasury, the market is unlikely to decline much further. One short-term bullish ray of hope are the minor RSI divergences even as the S&P 500 tested the recent lows.

Positioning for rising rates

The increase in sovereign yields is likely extended in the short run, interest rates have made a turn upwards. That begs the question of how equity investors should position themselves.

The 5-year Treasury yield has been moving in lockstep with the cyclically sensitive base metals/gold ratio, which is an indication that the market is discounting a cyclical rebound and a better growth outlook.

While I would not personally recommend the purchase of the Rising Rates ETF (EQRR) because of its minuscule AUM which is an invitation for the issuer to wind up the fund, the sector exposures of EQRR is nevertheless a useful guide to how investors should position themselves for a rising rate environment, namely cyclical stocks.

I am also keeping an eye on the semiconductor industry. These stocks are growth cyclicals and have both growth and cyclical characteristics. The industry has been stuck in a sideways pattern relative to the S&P 500 since June (bottom panel). If the market were to truly embrace the cyclical rebound investment thesis, they should stage a relative upside breakout.

Stay tuned.

Disclosure: Long SPXL

A consensus seems to be developing that inflation is more structural than transient. Under that scenario, rates may rise higher and faster than generally forecast. That would draw funds from equities into fixed income. I think it’s prudent to keep this scenario in the investment plan.

The central bankers remain reluctant to tighten based on inflationary pressures resulting from current supply issues. Andrew Bailey, governor of the Bank of England, said in a speech on September 27: “Monetary policy will not increase the supply of semiconductor chips, it will not increase the amount of wind, and nor will it produce more HGV drivers. Moreover, tightening monetary policy could make things worse in this situation by putting more downward pressure on a weakening recovery of the economy.”

The issue we are faced with is inflationary expectations as major central banks continue to drag their feet. Eventually they are going to hike says the market, Deutsche came out with a chart yesterday showing that the ECB pretty much hiked every time oil prices went up. Personally I would also still expect more of a hawkish shift by the Fed and ECB in the not too distant future. That may be the driver behing a slow and steady “valuation correction” going on in the market.

Long SPY ~432.xx.

Adding a second allocation ~430.xx.

Wild guess->we’ve seen this week’s low for SPY.

Another wild guess->next week we may revisit 428, and perhaps finally see 425.

Reopening a position in BABA.

Reduced position size into the modest post-close bounce to 429.5x.

Not that I’m sized up big to begin with, but when selling accelerates into the close there is a tendency for the selling to continue the following day. A -0.2% hit today is entirely manageable, and I’m OK with carrying risk overnight – but I will do my best to keep the loss from sliding into something more painful.

It’s no longer an easy market so I try to take care.

Anything can happen on Friday, especially in October.

Closing the remainder of my SPY position after hours. Also closing a small position in BABA.

We may see a gap down on Friday more brutal than I’m prepared to weather – I would give it 50/50 odds. Perhaps the market is ready to show its true colors.

I agree that inflation looks more structural than transient. Particularly energy shortage will affect heavily Europe. Do you see opportunities in the energy sector?

Inflation is both a threat and an opportunity. if there is inflation relative prices also change and some companies earn more than before.

Companies with ‘pricing power’ should benefit. It’s a difficult exercise to figure out. I generally think healthcare, technology and discretionary companies with strong brands and loyalty should be in this group.

Maybe Cam can shed more light on it.

If the Quantifiable Edges Capitulation Breadth Index was 6 on Tuesday, then I’m guessing it will be pushing 10 today.

ES 4275. Ideally it breaches 4250 overnight and then recovers to open green.

My game plan is for buying the market around 7.5% off from ATH or around 4200-4225. Next level is at 14% off from ATH. Won’t hit the bottom but has been a good plan during pullbacks and corrections. I don’t see a bear market any time soon.

Given that rates seem to have stabilized, the market might want to go back to ~4350 SPX, that would be Goldman’s most bearish year-end target. Morgan Stanley is far more bearish, saying that a 20%+ correction may be in the cards given the market’s correlation with consumer confidence readings. Friday + new quarter has usually been a buillish combination, but beware, Mike Wilson will be coming out with a new note on Monday 🙂 Our task for today, I believe, is to wait and see how strong the bounce is going to be.

https://www.marketwatch.com/story/gold-investors-have-become-super-bearish-which-suggests-a-buying-opportunity-is-at-hand-11633095853?mod=mark-hulbert

Hitching a ride on VT ~102.4x.

FDX ~222.6x.

Taking another swing at BABA as it hits another 52-wk low.

Closing the VT rental @ 102.8x.

Closing FDX and BABA.

Basically, I recovered all of yesterday’s (minor) losses.

I would be very surprised to see another ‘V’ recovery unfold in the markets next week. Today’s action felt like a snapback prior to another leg down.

Great weekend read.

https://www.atlasobscura.com/articles/kowloon-walled-city

I recall visiting the Walled City with a distant cousin in 1984. What a trip.

Our agent (A Taiwanese) took us around the Walled City (not inside) in 1988/1989). This article brings to life the story so vividly. Some of the factories making opium for the British were in Eastern part of India. A historical fiction book (Sea of poppies) is a gripping tale of the times.