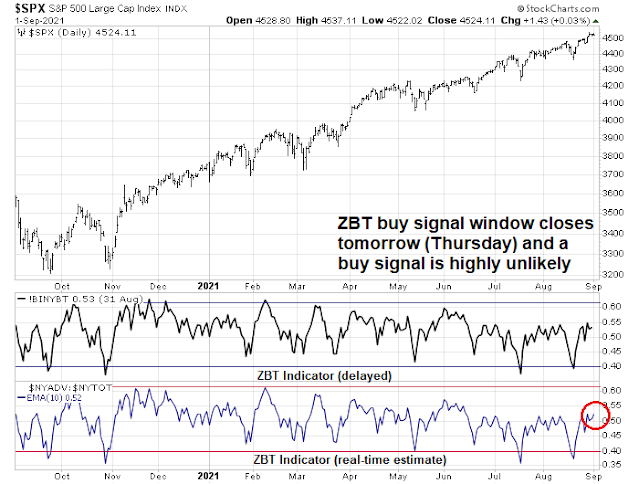

Mid-week market update: I recently highlighted the possible development of a rare momentum-based Zweig Breadth Thrust buy signal (see The Zweig Breadth Thrust watch). The window for the ZBT buy signal closes tomorrow (Thursday). While the S&P 500 has been advancing slowly, we are unlikely to see the buy signal barring some gargantuan melt-up tomorrow.

However, the failure of the ZBT buy signal doesn’t mean that the outlook has turned bearish. Instead, the stock market appears to be undergoing a slow grind-up.

Improving internals

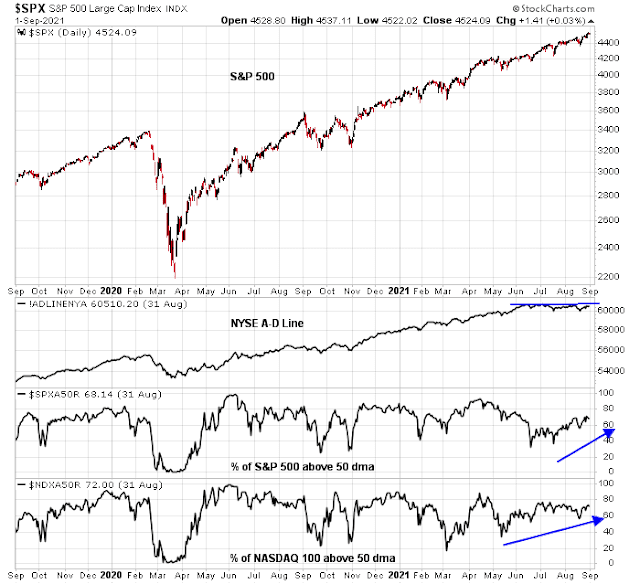

From a technical perspective, many of the negative divergences from poor internals have been improving. While the NYSE Advance-Decline Line has not made a fresh high yet despite new highs in the S&P 500, the percentage of S&P 500 and NASDAQ stocks above their 50 dma have been steadily rising.

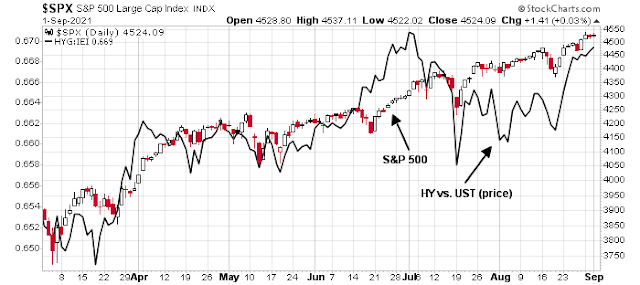

Similarly, credit risk appetite, as measured by the relative price performance of junk bonds to their duration-equivalent Treasury counterparts, have also been steadily rising.

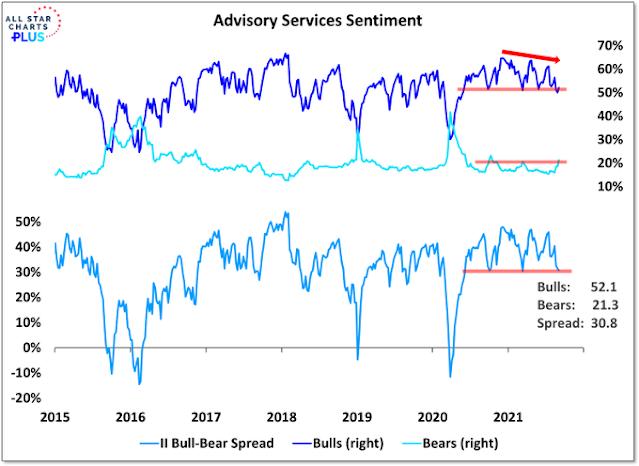

Sentiment readings are likely to put a floor on stock prices should they pull back. The latest Investors Sentiment Survey shows a decline in bullish sentiment and a rise in bearish sentiment. The bull-bear spread is consistent with past trading bottoms, not tops.

Lessons from market history

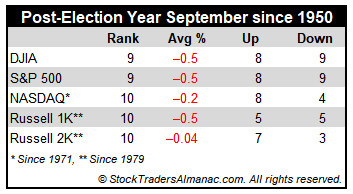

On the other hand, the lessons from market history are mixed. Almanac Trader pointed out that the month of September is one of the worst for stock market returns since 1950. The poor historical returns appear to be a statistical anomaly. In the last 17 years, he observed that “S&P 500 has advanced 11 times in September and declined six times.”

Ryan Detrick is another market historian with a different take. The S&P 500 has risen for seven consecutive months. Such episodes have resolved with strong positive returns over a six-month time horizon 13 out of 14 times.

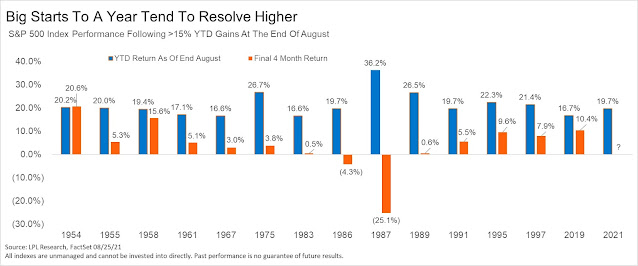

Detrick also found that whenever the S&P 500 rose 15% or more by the end of August, the rest of the year tends to have a bullish bias. Price momentum lives (notwithstanding the Crash of 1987).

I interpret these conditions as the market is ripe for a slow grind-up. While stock prices could weaken at any time, any pullbacks should be shallow and there are few signs of a major correction on the horizon.

Disclosure: Long SPXL

Anecdotally, there is again a run on household items like toilet paper! WHO is talking about another variant dubbed ‘mu’. New mask mandates around us. Conflict with schools reopening and masks for children as young as 2 years. Supply chain issues not abating. Inflation running ‘hot’ for now. Fed ready to start taper. Unemployment bonuses running out next week. Enough of a wall of worry? If not a taper tantrum, then a small pullback has a good probability in the seasonally week period ahead.

It’s studies like the one below that I find troubling – there are many dimensions to an infection with Covid-19.

https://www.bloomberg.com/news/articles/2021-09-01/painless-silent-organ-damage-seen-in-large-long-hauler-study

It’s understandable and completely appropriate at this point in the pandemic for the media to be focused on hospitalizations and deaths. But attention will begin to shift toward the long(er)-term effects of infection. It may be years before scientists have a clear understanding of this complex virus.

+1 for muted pullbacks. Makes you wonder when that real correction will happen.

The main risk is the market freaking out over higher corporate taxes. See my recent post.

A poster on Sep seasonality:

When H1 is up > 13% (as was 2021 – 10th best in 100 years), Sept is positive 67% of the time. Median gains = 1.4%

https://mobile.twitter.com/bootsiejones/status/1433133214747578373

market seasonality is well cited in the social media, which makes me believe it is less likely to eventuate.

Also seasonality is average yet we deal with (will always be) in real time a single point observation.

https://www.marketwatch.com/story/coronavirus-tally-global-cases-of-covid-19-top-2185-million-and-study-finds-long-covid-risk-halved-by-dual-vaccination-2021-09-02?mod=mw_latestnews

‘ The risk of so-called long COVID drops nearly in half after a person receives two doses of coronavirus vaccine, according to a new study. The study, published on Wednesdayin the medical journal The Lancet, found that the odds of having symptoms for 28 days or more after post-vaccination infection were approximately halved by having two vaccine doses. It also found almost all symptoms are less common in vaccinated people, that more people in the vaccinated than in the unvaccinated groups were completely asymptomatic and that COVID-19 was less severe (both in terms of the number of symptoms in the first week of infection and the need for hospitalization) in participants after their first or second vaccine doses compared with unvaccinated participants.’

That’s a positive.

Closing WFC here.

Closing TIP here.

OK forgive me…this is off topic

micro macro thing

All this carbon reduction, green etc…so the move away from coal fired to NG fired power plants….any guesses to how much NG will be needed? Replace the coal being used…huge…but then you have to replace the gas all those ICE cars are using, also huge. Is there enough NG for all this?

So the uranium story…I have a nice stake in Cameco CCJ which has been really hot.

I wonder if the rise in NG prices which if it breaks a little higher will bust out of a 5 year consolidation…double digits ahead if it does.

There is a big unknown with uranium demand in when Japan fires up it’s nuclear fleet… it makes sense with nat gas so cheap to run on gas, but rising prices might get Japan to get cracking on starting up the reactors which would cause a rally in all the uranium space…

Something to look at

As long as credit conditions are liquid, things can run

I have roughly 10% of my portfolio in uranium. The supply has been drastically cut down over the last few years while the demand remains steady for now and will rise as new reactors come online.

The dramatic explosion in the shares of uranium companies over the last week or so is being caused by the entry of Sprott Uranium Trust (U.U) which is buying physical uranium in the spot market. It is a tiny market and the entry of financial instruments / players can cause the price to steepen.

We’ll see.

I thought they started that trust a while ago, not this week. The big volume in CCJ is very recent, and it’s not like U.U was a big secret, they knew it was coming.

Interesting times though

The trust is not new (a few months old news now) but I guess investors waited to see the impact of its buying uranium in the spot price before jumping into the market.

U.U also had to raise funds via an ATM. They would be able to do so wasn’t a sure thing either.

So, a few reasons to be skeptical or be on the sidelines. I bought a ton earlier this year based on the demand-supply dynamics in the industry.

There was buying on the spot market by CCJ and UEC and Denison earlier this year, so I dunno. I’m hoping it is something more substantial, like rising NG prices getting Japan to speed up on it’s nuclear fleet, or recent climate events getting the pols to act, or a combination of forces. Curious to see if the big volume persists, and something happening before a long weekend makes me wonder if something else isn’t afoot