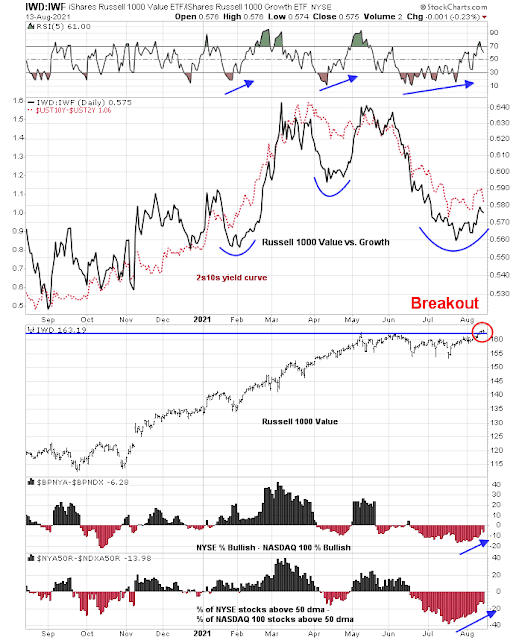

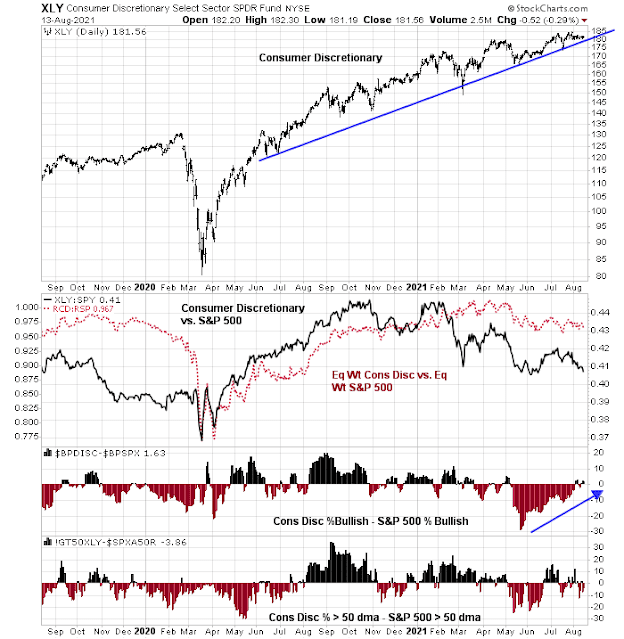

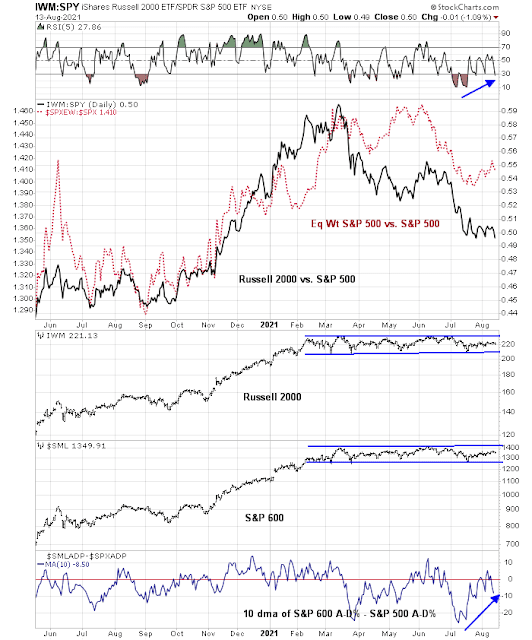

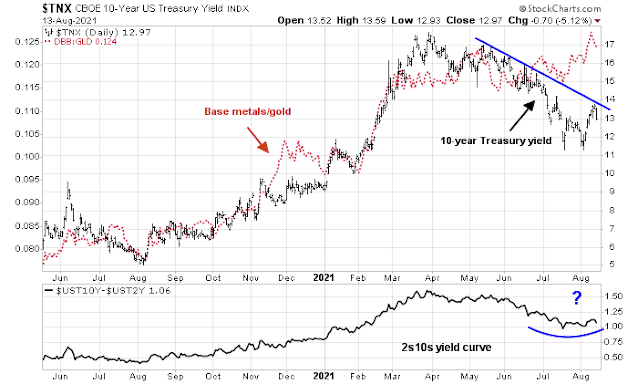

One of my principal tools of market analysis is the use of trend-following techniques to spot changes in macro conditions. My models are seeing some early green shoots in the value and reflation trade. It began with the stronger than expected July Jobs Report. The subsequent tame core CPI print also helped to reinforce the narrative of non-inflationary growth. As a consequence. the value/growth ratio is turning up after exhibiting a positive RSI divergence and relative internals improved. The Russell 1000 Value Index even rallied to a fresh all-time high.

A value revival

The Fed’s response

Tapering could help take some of the pressure off the need to raise interest rates in the future, according to the Dallas Fed president. “Adjusting these purchases sooner might actually allow us to be more patient on the Fed funds rate down the road,” he says. It’s a nice reminder that tightening monetary policy doesn’t have to be a monolithic or even linear activity.

As we approach the Fed’s annual Jackson Hole conference, investors can expect an outline of a decision framework on a QE taper. An announcement of an actual taper should follow shortly afterward. So far, the markets have not been unsettled by the prospect of a taper, which is supportive of further equity market gains.

Key risks

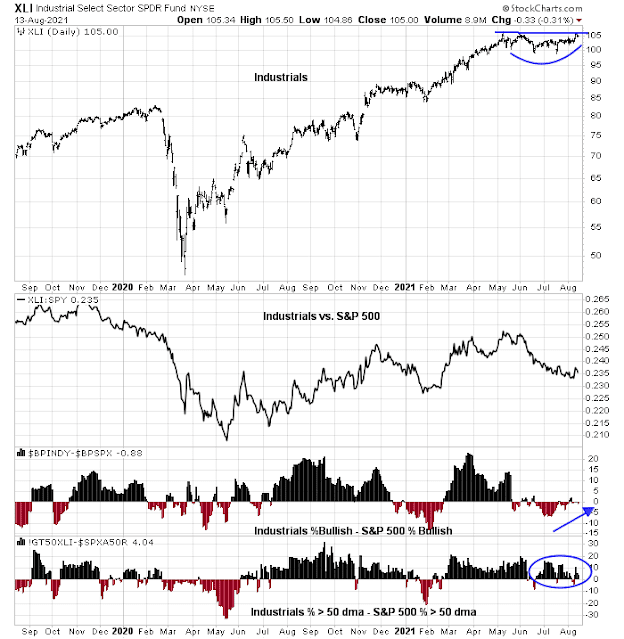

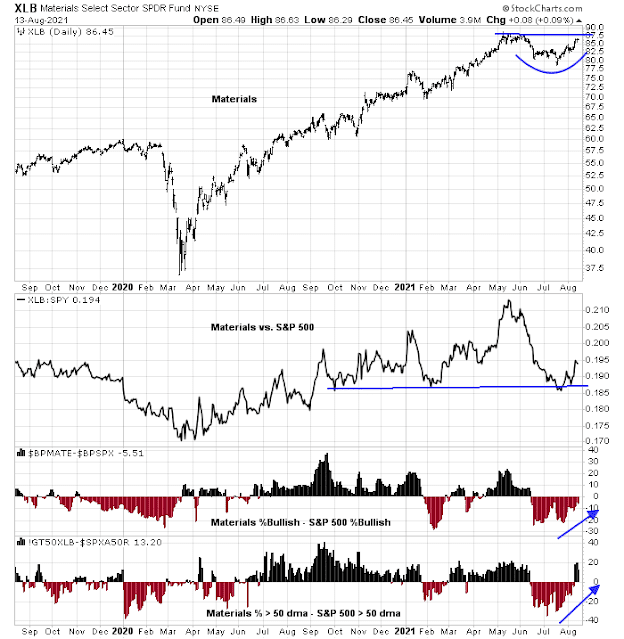

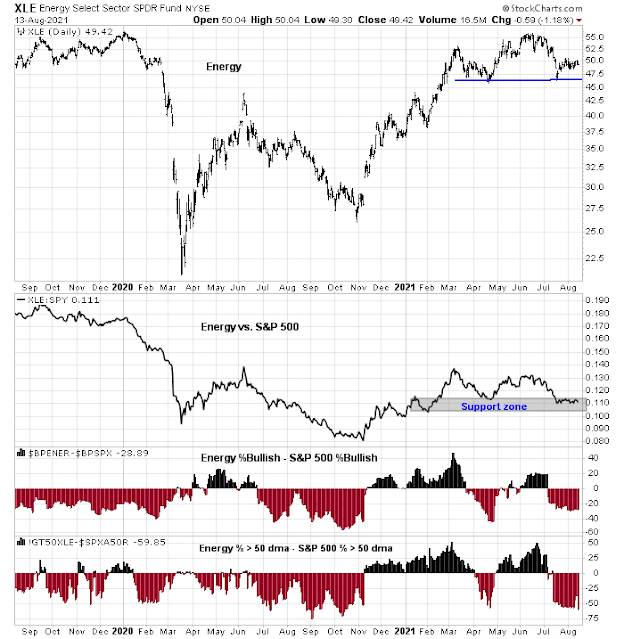

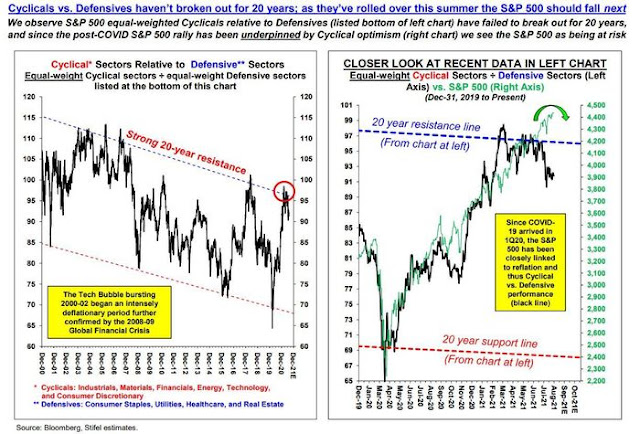

The stakes are high if value and reflation stocks don’t recover. Marketwatch reported that Barry Bannister and Thomas Carroll, strategists at Stifel, observed that the cyclical vs. defensive ratio had rolled over. The Stifel team is calling for a summer top for the stock market, followed by weakness for the remainder of the year.

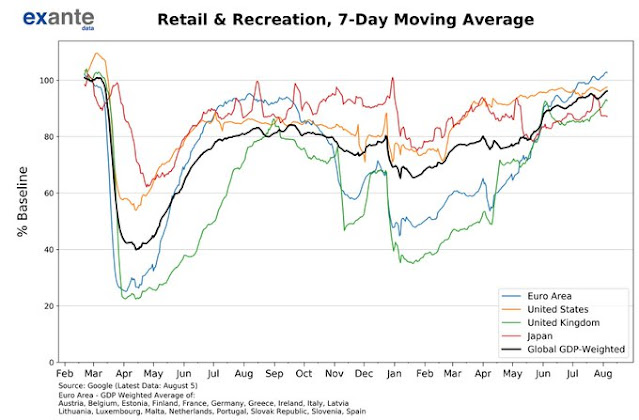

While Google’s mobility survey of retail and recreational activity shows that most developed markets have shrugged off the effects of the Delta variant…

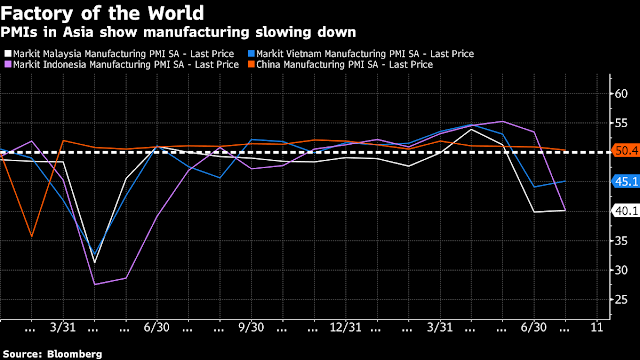

…much of Asia has been hard hit. Asian manufacturing PMIs are tanking.

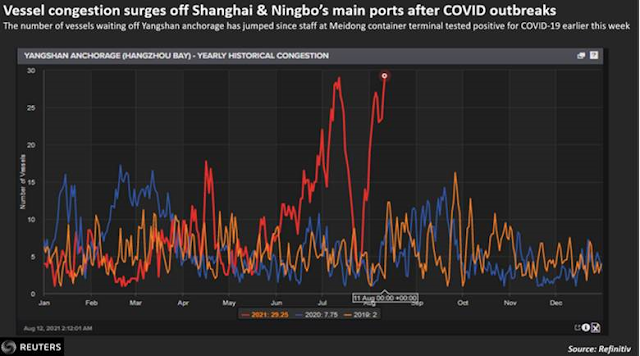

Even worse, a COVID outbreak in China has created congestion off China’s top two container ports. The port of Ningbo shut down a container terminal when a COVID-19 case was detected this week. The Meidong terminal suspended all operations since early Wednesday, while other terminals in Ningbo imposed restrictions limiting the number of people and cargo entering port areas. These shutdowns represent about one-quarter of the capacity of the world third largest port and these kinds of supply chain disruptions have the potential to bring global trade to a sudden stop and stall the growth recovery.

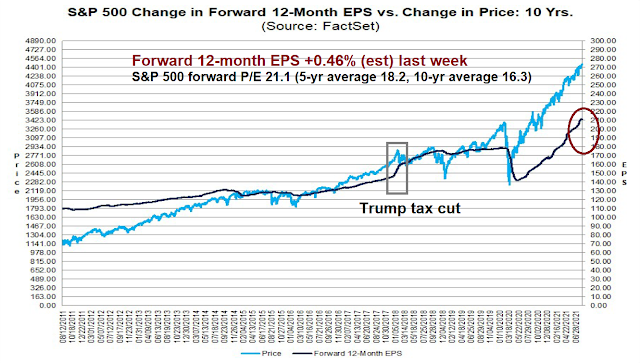

As well, a political storm is brewing in Washington despite the passage of the bipartisan $1 trillion Infrastructure Bill in the Senate, which now goes to the House for consideration. House Speaker Nancy Pelosi has vowed to pass both the Infrastructure Bill and a separate $3.5 trillion budget at the same time, assuming there are no defections among Democrats. The budget is expected to include a corporate tax increase and corporate minimum tax. So far, Q2 earnings season results have been very strong and forward 12-month EPS estimates have risen, but Street analysts have not begun to factor in the possibility of a tax increase. The 2017 Trump tax cut had been well telegraphed in mid-2017, but the market did not respond until late 2017.

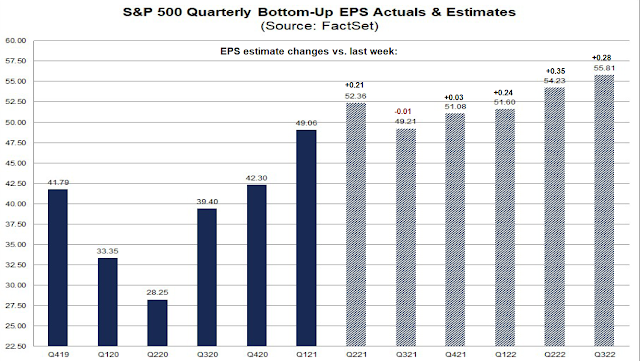

A detailed analysis of changes in quarterly EPS estimates shows the market’s vulnerability. Estimate revisions for the remainder of 2021 are roughly flat, but they are rising strongly in 2022, which is most likely to be affected by any changes in the tax code. While some top-down strategists have tried to estimate the effects of a tax increase, company analysts have not revised their estimates because they cannot make changes without knowing the exact details of the legislation.

In conclusion, a review of market internals shows that the value and reflation trade is gaining ground. If this trend continues, it would translate into a bullish intermediate-term outlook for equities. However, investors have to be aware of the supply chain disruption risks from the Delta variant, the chances of a political storm in Washington, and the possible negative effects to earnings from a possible corporate tax increase.

A chart of the equal weight S&P 500 shows a consolidation from May with a triple bottom and triple top that now has a breakout that started from the July 19 intermediate low.

This is the next leg of the bull market that I believe will take us into bubble territory. The last nine months has not seen a correction in the stock market, one of the longest on record, and 100% of developed world stock markets are above their 200 day moving average, another record. One might say a correction is therefore overdue but this is more likely a setup for a confident runup to bubble highs.

I rebased my ETF sectors from the July 19 intermediate sentiment low and things are progressing perfectly with Value, Growth, Small Cap (all equal weight) up strongly with Low Volatility lagging and bonds and gold down. That is a setup for a significant leg up, not one that will fail soon.

The other things happening are Defensives lagging, Innovative Growth failing, Resource Value ex-energy doing well, Europe becoming a global leader, China in a bear market and all Far East being dragged down with it.

Those of you who received the one-shot J&J/Janssen vaccine and are seeking an mRNA booster, San Francisco’s Zuckerberg seems to validate the strategy:

https://www.mercurynews.com/2021/08/06/q-a-what-we-know-about-covids-delta-plus-variant-boosters-and-the-end-of-the-surge/

Q: Is the Johnson & Johnson vaccine equally durable?

A: We haven’t yet heard any recent news about its clinical trial data. But there’s ‘real world’ information about J&J’s protection against the delta variant, and it’s worrisome: Of the five vaccinated people hospitalized for “breakthrough” infections in a cluster of cases in Provincetown, MA, three had been immunized with the J&J vaccine. A study of a similar vaccine, made by Astra Zeneca, found that it stopped only 30% of delta cases.

This suggests a substantial reduction in efficacy against severe COVID for the one-dose J&J vaccine. And there are no updates about J&J’s long-awaited two-dose trial.

But this problem can be fixed: Multiple studies show that a J&J-like vaccine, made by Astra Zeneca, generates a strong immune response when combined with the Moderna or Pfizer vaccine. It even outperforms two doses of Moderna or Pfizer.

It is now time for people who were vaccinated with J&J to get immunized with a dose of Pfizer or Moderna to boost their immunity. At hospitals like Zuckerberg San Francisco General Hospital, J&J recipients can make a special request to get a “supplemental dose” of an mRNA vaccine.