Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

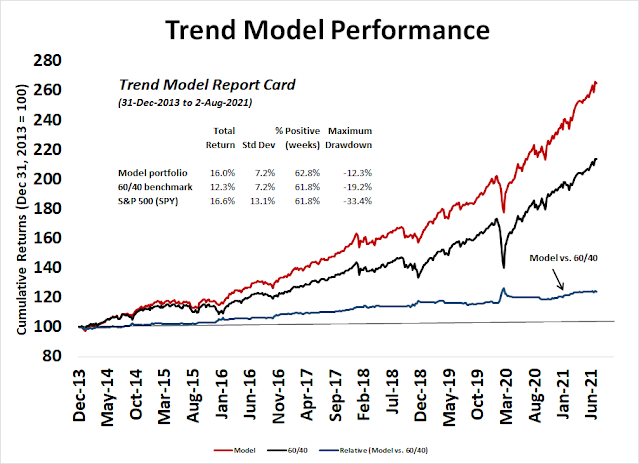

The Trend Asset Allocation Model is an asset allocation model that applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

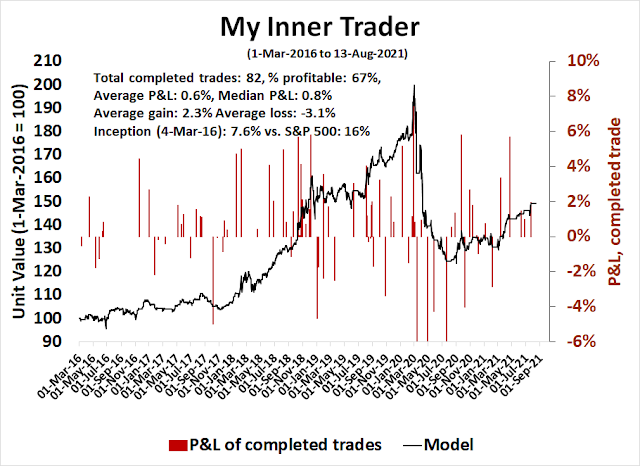

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Neutral

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

Growth leadership faltering

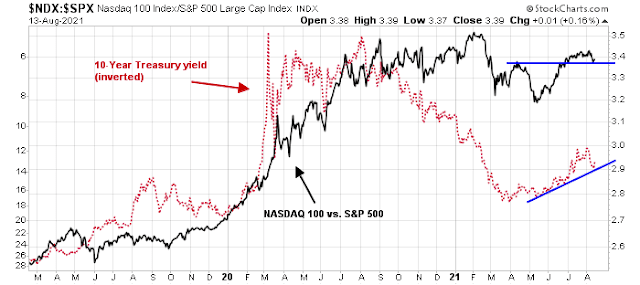

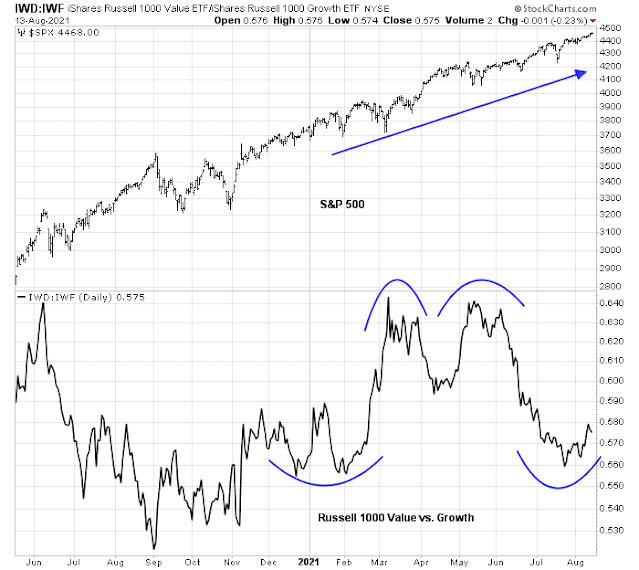

Changes in macro conditions are setting up for a growth stock correction. The strength in the 10-year Treasury yield is putting downward pressure on growth stock leadership. The growth style is a duration play because it is more sensitive to changes in interest rates than value.

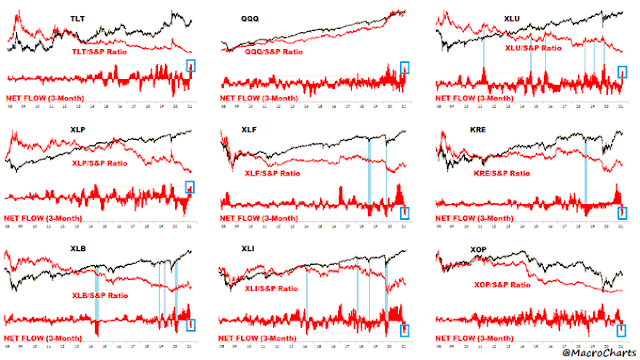

In addition, I made the case yesterday for a value style revival which is negative for the growth stock leadership (see Constructive value and reflation green shoots). The blogger Macro Charts also observed that ETF flows indicate crowded long positionings in growth and defensive sectors and capitulation in cyclicals. This sets up the potential for a violent rotation should the cyclical and reflation outlook improve.

A short-term warning

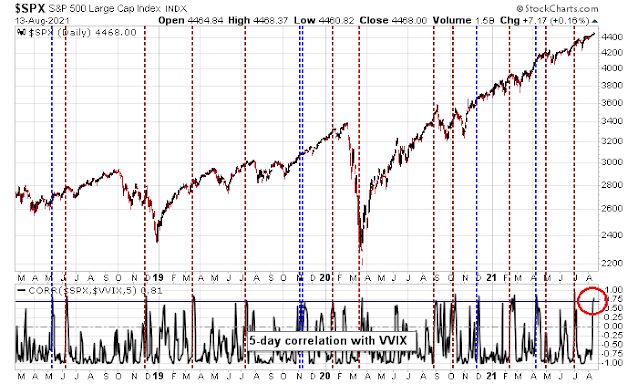

The stock market may be vulnerable to a short-term setback. The rising correlation between the S&P 500 and VVIX, or the volatility of the VIX Index, is flashing a tactical sell signal. Such correlation spikes have indicated discomfort in the option market with the market advance. In the past three years, similar conditions have resolved themselves with market weakness of about 4-5% two-thirds of the time.

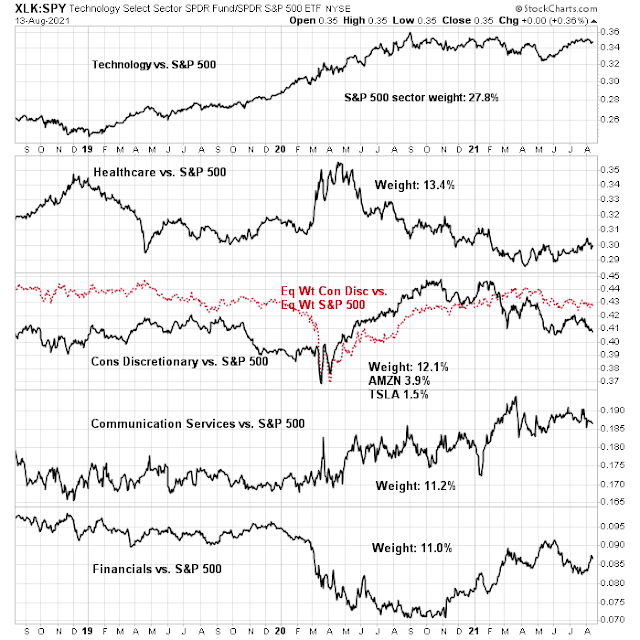

However, I expect that any S&P 500 pullback should be relatively shallow. The analysis of the relative performance of the top five sectors tells the story of nascent weakness by growth sectors and strength by value stocks. Technology, communication services, and cap-weighted consumer discretionary (Amazon and Tesla) stocks are all either trading sideways or weakening relative to the market. Financials, which is the only value sector, is gaining relative strength, I interpret these conditions as a setup for an internal rotation from growth to value. Since growth stocks have a higher weight in the S&P 500 than value, the rotation may manifest itself as overall minor market weakness.

Constructive breadth

In other words, the bad news is that growth stocks are weakening. The good news is the weakness is unlikely to significantly drag down the S&P 500 as leadership rotates into value and reflation names.

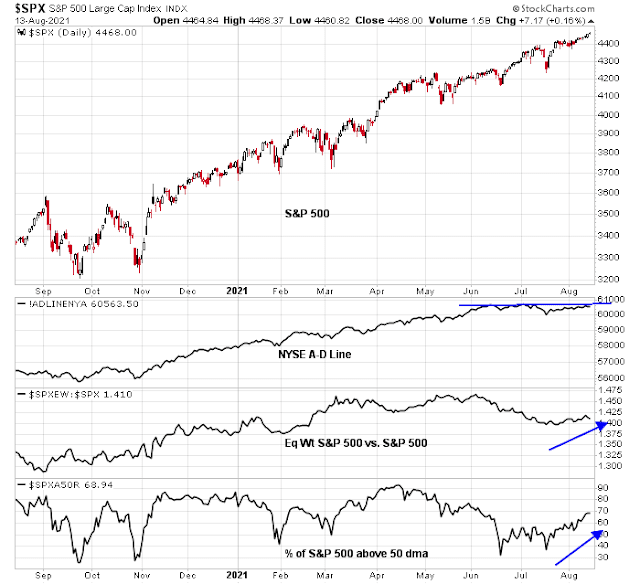

That’s because market breadth is starting to improve after a long period of deterioration. The NYSE Advance-Decline Line is rising and testing overhead resistance. The Equal-weighted S&P 500 is outperforming the S&P 500, indicating small and mid-cap relative strength. Market internals, such as the percentage of stocks above their 50 dma, are also recovering.

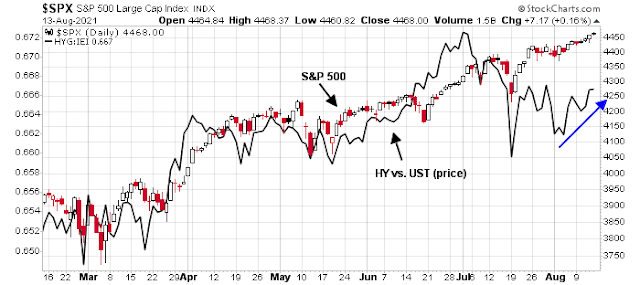

Even credit market risk appetite, which measures the relative price performance of junk bonds relative to their duration-equivalent Treasuries, is trying to make a bottom.

Supportive sentiment

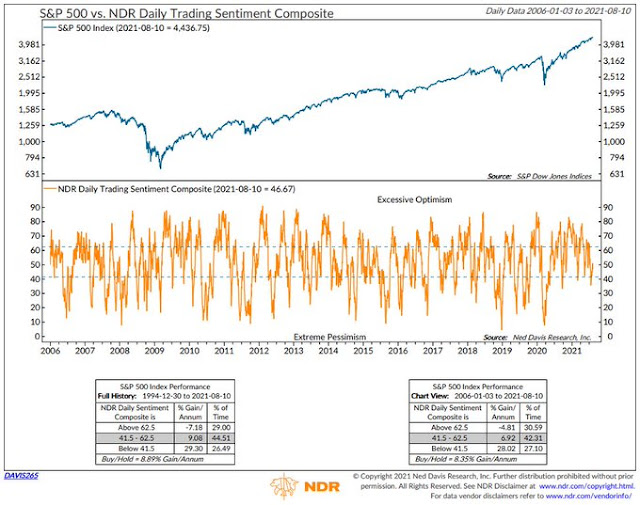

Notwithstanding any weakness by growth stocks, sentiment model readings are likely to put a floor on overall stock prices. Ned Davis Research’s daily sentiment index is only in neutral despite the S&P 500 reaching record highs. The market is climbing the proverbial Wall of Worry.

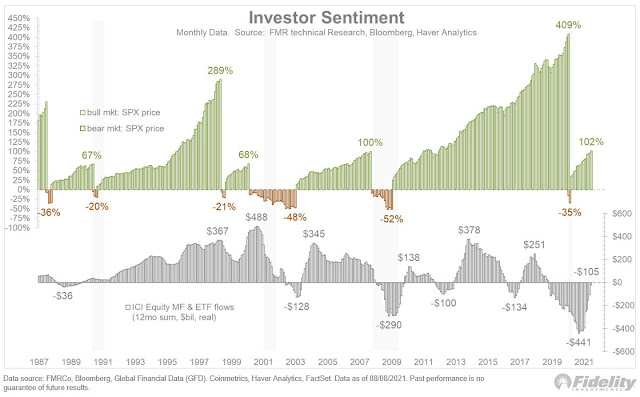

Jurien Timmer at Fidelity also observed that “the 12-month rolling net flow into stocks is only now turning positive” after a gargantuan S&P 500 rally.

Still a bifurcated market

In conclusion, the 2021 stock market has been characterized by a steady advance by the S&P 500. Beneath the surface, the market remains bifurcated between growth and value and internal rotations between the two styles have served to put a floor on overall market weakness.

Value is in the process of regaining the leadership baton from growth. I expect that the trajectory of the market to be flat to up. Investors may have to allow for the possibility that the S&P 500 could start to trade flat to down as large-cap growth has a much larger weight in the index than value.

I fear a non-trivial correction is imminent:

The VIX was already approaching its lower BB, and old data are set to drop out, causing the BBs to narrow.

The AD to S&P line divergence represents unfinished business, and has in fact widened in the last two sessions.

I see the Value/Growth like a passenger boat where people run from one side to the other and tilt the boat back and forth. The rush to Value side from the Vaccine Day Twist was enormous. The shift back to Growth from Mid-May was big but not huge. I expect future shifts will be less and less violent.

Equal-weight Growth ETF RPG is holding up better than the Growth oriented subindexes Cam has mentioned above. It includes Growth stocks in all subindexes.

Growth Factor does take the markets forward from mid-cycle onwards eventually.

Value stocks will have to sort themselves out now. All went up from the bleak lows. Now the sorting begins.

Fundstrat’s Tom Lee is forecasting:

A. Peak in Delta Variant infections this month

B. Rally in Bitcoin to $100,000 by the end of the year

C. An ‘Everything’ rally in equities. This implies buying the whole market rather than a particular flavor.

I am sticking with my portfolio tilted towards growth for the long haul. Quality Factor should provide defensive positioning in case of temporary turmoil.

It is remarkable how well the cyclical sectors are holding up in light of pretty significant misses on China economic data and consumer confidence. The market is probably buying into the “peak delta” narrative and sees economic weakness from Asia as temporary. I’m not sure this is the right way to see it, but we may have to wait until after opex for more clarity on the market’s intentions. I’m not at all in the bullish camp (expecting more economic data misses, probably very bad misses as the Asia lockdowns are only just starting to get factored in)

Seems like a good time to stay out of the way. Almost every August, my wife and I remark on the consistency of selloffs.

Every strategy has its day, and cash may outperform for a day or two. Looks like I would have made money buying a few positions in the hole, but that would have been eclipsed by much larger losses in the other positions I would taken as well.

https://www.nytimes.com/2021/08/16/well/live/vaccine-long-covid-breakthrough-infection.html

This scene from British Columbia looks like a replay of the Bay Area skies last August:

https://twitter.com/KyleTWN/status/1427045556145180674

That record close in light of the Chinese data and the stunningly bad consumer confidence data seems a little “disconnected”. Maybe the market knows something about US retail sales data tomorrow, Morgan Stanley said things could start to roll over now.

Opening a few positions in the waning minutes of the after hours session. KWEB/ FXI/ EEM.

Adding MJ.

Could I have picked a better set of ETFs?

The overnight selloff in Asia was a rude awakening. Yes, I knew the trend was down, and that it was likely to continue. In fact, I had (and still have) a LT entry target for BABA ~160. My bet was on a bounce prior to further downside.

No point in rationalizing my entries. I was wrong. And I have exited all positions (MJ included) within the first few minutes of the premarket session.

What I’ve learned over the years comes down to this:

(a) When opening positions, I am likely to be wrong about half the time. There’s nothing wrong with being wrong – it’s how the game is played. If I were to wait only for trades that approach 100% odds of success – I wouldn’t make much money.

(b) When I’m wrong, I take losses immediately – no questions asked and no second-guessing. This one rule has saved me more money (and in the long run preserving capital has the same effect on P/L as a gain) than anything else.

My positions sizes were larger than I would like (which is always the case when positions move against me). I had 13.7% of the portfolio invested in KWEB/FXI/EEM/MJ which was heavily weighted toward KWEB. Taking a -0.29% hit to start the day. Being back in cash clears my head and allows me to refocus.

https://www.theatlantic.com/health/archive/2021/08/why-pandemic-so-bad-florida/619761/

EWC. Anyone looking for an entry into Canada might see an attractive entry this week. July 19 low was 35.50.

I think the selling will abate – although it’s only a bet.

Going long VT ~104. No point in guessing which sectors will outperform.

Early morning losses erased and now back in the green. I might have done better holding the earlier positions, but I estimate the odds of having sold them into the early downdraft at 80/20.

Added to VT ~104.3x and now ~55% invested.

Adding back and/or reopening positions after hours in emerging markets/ China.

EEM/ FXI/ ASHR/ EWZ/ BABA.

It’s my opinion that we witnessed at least a ST selling climax today.

Adding a few positions premarket.

XLF/ XLE/ JETS.

GDX.

PLTR.

PICK.

Adding a position in EWC.

Adding to KRE/ PICK.

COIN.

PLTR off here.

Closing COIN here.

Closing KWEB here.

Closing KRE.

Scaling out of VT beginning here.

Dumped VT just in time.

All remaining positions off here.

If I were bullish I’d be reopening VT on the downdraft. However, I’ve been bearish for at least two weeks.