Is this GameStop’s “shoeshine boy” moment? Tracy Alloway pointed out that GME had made it to dog Instagram.

If dog Instagram wasn’t enough of a shoeshine boy moment, how about this Michael Bathnick observation?

Regardless, there are a number of other opportunities in the short squeeze space to consider (other than silver).

Most shorted ETFs

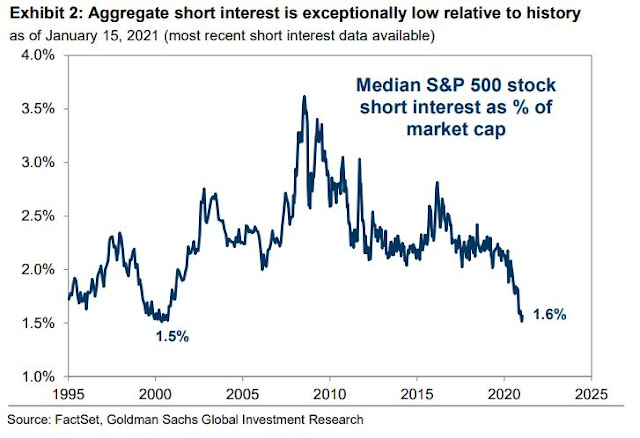

The short squeeze play is getting played out, especially when short interest is falling to historic lows indicating there is little short covering demand should the market weaken.

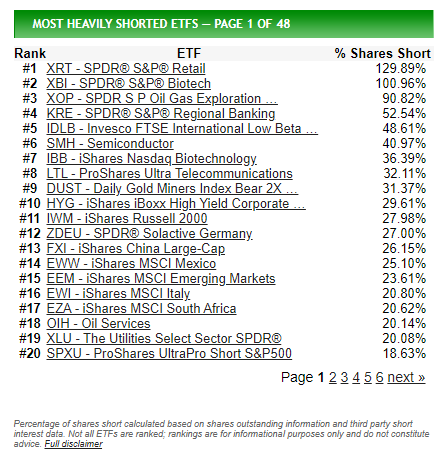

Instead of looking for short squeeze opportunities in individual stocks, have you considered a list of the most shorted ETFs? These represent possible contrarian plays in unloved industries that may be poised to move up. For the purposes of this analysis, I focus on the top four, with the cutoff being 50% or more of the shares sold short.

The first ETF on the list, XRT, can be ignored as it represents a synthetic way of shorting GME. GME represents roughly 10% of XRT. For what it’s worth, there may be an arbitrage opportunity between XRT and GME put options.

The second ETF, XBI, is the equal-weighted Biotech ETF. XBI represents a unique growth opportunity. The ETF has been outperforming the S&P 500, and the industry is heavily shorted owing to disbelief over its strength. The ETF recently made a fresh all-time high, both on an absolute and relative to the S&P 500. As an aside, IBB, the cap-weighted Biotech ETF, ranks #8 on the list and IBB is not performing as well as XBI. XBI can be characterized as the growth play among the most shorted ETFs.

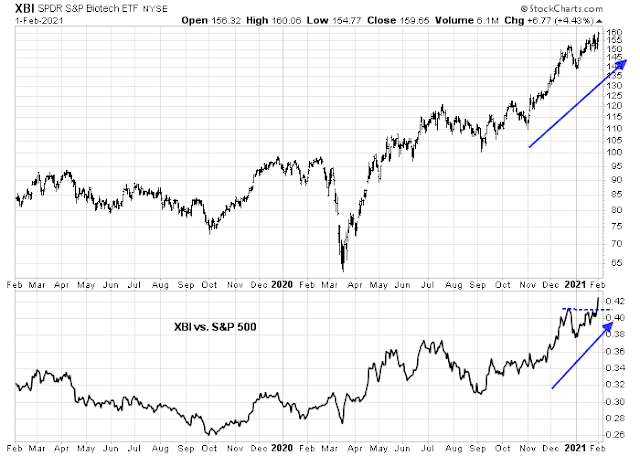

The next two on the list are value turnaround plays. XOP is the Oil & Gas Exploration ETF. The Energy sector has been unloved for most of 2020. Energy went from the biggest sector in the S&P 500 during the early ’80s to the smallest today. The world is shifting away from fossil fuels. GM recently announced that it will only sell zero-emission vehicles by 2035. Energy has become the new tobacco – an industry in decline.

The negatives may be overdone. Despite the secular downtrend in energy demand, oil and gas prices should rise as the economic cycle rebounds. From a technical perspective, XOP rallied through a falling relative trend line and it appears to be forming the constructive pattern of a saucer-shaped relative bottom.

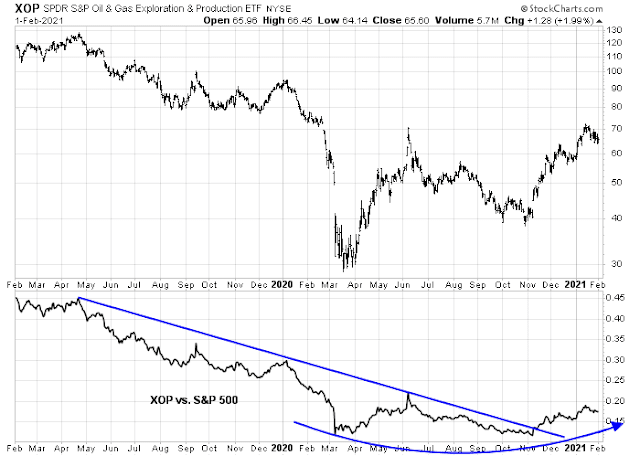

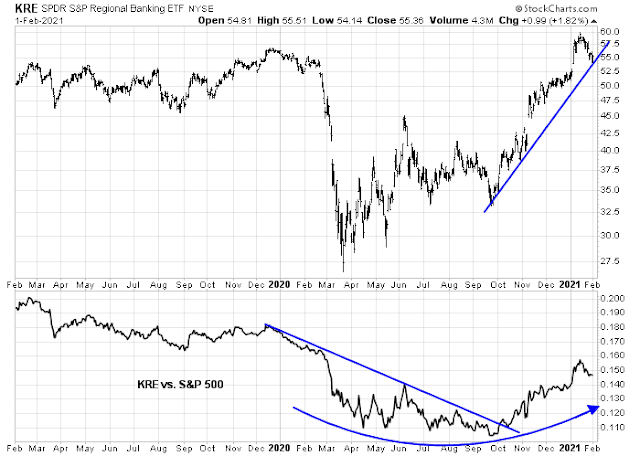

Similarly, KRE, which represents the regional banks, is forming a better defined rounded relative bottom. This indicates a turnaround for the group and foreshadows further outperformance in the future.

In conclusion, the analysis of the most shorted ETFs reveals three possible and diversified candidates for superior returns in the weeks and months ahead. Moreover, they don’t need to sponsorship of the r/WSB to rise. One can be thought of as a growth play, and the other two are turnaround value plays. All of them are rising on skepticism, as measured by the high level of short interest.

Still not sure why, but despite the follow-through moves in most global indexes I remain bearish.

Open to changing my mind.

Opening positions in three flyers on early pullbacks. SOL/ PLTR/ UAVS.

Opening a position in SLV.

All positions off for losses.

So a combination of being wrong re the major indexes + taking losses on all flyers = break time.

I see 3920 is a possible longer term top, about 2% up from here. If we hit 3900 or so I will rebalance to a much more conservative positioning with fingers crossed for the long overdue pullback from there.

That would match DeMark’s target of 3905.

After which he predicts (or at least predicted) a significant decline.

Trading takes a psychological toll, which is probably why most investors stick with buy-and-hold. There will be days when you’re on, and days when you’re off. It’s how we handle the off days that determines how long we’re able to play the game.

I spent the remainder of the day away from the markets – but also reflecting on my approach to the markets over the past year.

(a) I’ve been trading in and out at an unprecedented rate for almost twelve months. That may no longer be necessary.

(b) This morning’s rally caught me offguard – a distraction I found difficult to ignore. The fact is, I’ve made two roundtrips in the index funds within the past week, and I’m ahead of the SPX. And still near-term bearish. So I was able to dispense with that distraction.

(c) The trades I entered this morning have lost none of the validity that prompted me to open positions. I reopened UAVS/ SOL after hours at prices marginally above my earlier exits.

(d) I’m ready to begin accumulating a couple of longer-term positions in BABA/ QS/ PLTR. I like all three companies for different reasons, and rather than continue to day trade them maybe it’s time to build positions. The key (at least for me) is to maintain a core position around which I trade – that works much better for me than a simple buy-and-hold approach.

Realistically, why should I bother to use the SPX as a benchmark?

(a) I trade in and out of the markets in an attempt to reduce volatility. I’ve been doing it for over thirty years. My returns aren’t as impressive as that of the SPX, but then neither are my drawdowns. I’m OK with a lower average annual percentage return in exchange for lower volatility.

(b) Managing money isn’t a full time job – although I take the responsibility seriously. To compare my returns to that of a benchmark makes sense up to a certain point- beyond which I would basically have to make it a full time pursuit.

Transitioning to bullish.

Opened/ reopened positions in a string of ETFs premarket/ in the first 45 minutes. XLF/ XLE/ XLI/ PAVE/ JETS/ FXI/ ASHR/ EWZ/ GDX (which works better for me than XME). Then broadened out to VEU/ VTV/ EFV/ EEM.

BABA/ PLTR/ QS/ SOL/ UAVS all doing OK from last night’s entries.

Reopening a position in RYSPX at the 730 am window.

Rationale.

My early morning take came down to this.

(a) I’ve been expecting a -5% to -10% correction.

(b) You know what? We’ve had two of them – back to back – within the past week. Two successive downdrafts may have an effect on sentiment equivalent to a single decline of let’s say -7%. Or not – but that’s my take. In any event, it certainly affected my sentiment. I was pretty clear about turning bearish the past two days.

Here’s what I see->

SPX: -3.6% correction last Wednesday, followed by a -4.6% correction last Friday (or -5.3% in the ES). VT: -3.8%/ -4.7% VT: -3.5% last Wednesday, followed by -4.7% last Friday. EEM: -44%/ -6.2%. FXI: -6.2%/ -7.5%. ASHR: -5.6%.

In addition, banks/ energy/ industrials have corrected even more.

Adding a position in KRE.

Already +0.56% just from last night’s + this morning’s entries. Not sure how much of the gain derives from the small-cap flyers.

Probably closer to +0.65% once the morning print for RYSPX becomes available. For whatever reason, a high percentage of intraday lows for the SPX occur at 730 am pst.

RYSPX filled @ 60.71 this morning – not exactly an intraday low but I’ll take it.

Betting we see Ravindra’s SPX 3920 targeted exceeded by Friday.

Reopening positions in VTIAX/ VEMAX at the close.

The weak close doesn’t really concern me. Today was destined to be a consolidation day given the move on Monday/Tuesday. It also provided better reentry points for VTIAX/ VEMAX.

It’s encouraging that emerging markets/energy/banks/tanks/value (EEM/XLE/ XLF/KRE/XLI/VTV/EFV) all closed at their respective highs – so Cam’s recommendation to overweight ex-US/ value seems to be working.