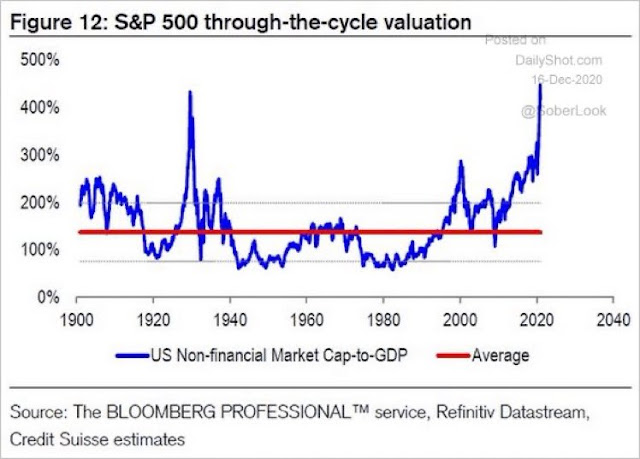

There has been some recent hand wringing over Warren Buffett’s so-called favorite indicator, the market cap to GDP ratio. This ratio has rocketed to new all-time highs, indicating nosebleed valuation conditions for the stock market.

Worries about this ratio are overblown. Here’s why.

Dissecting market cap to GDP

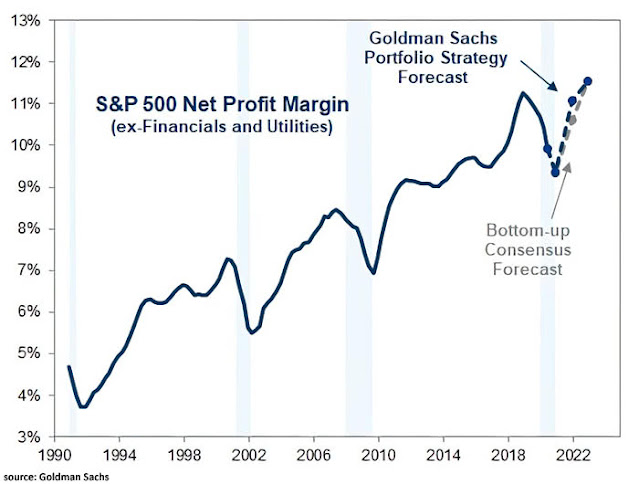

Let’s begin by dissecting the market cap to GDP ratio, which is really an aggregated price to sales ratio for all listed companies. While the price to sales ratio is a useful metric for valuation, a more commonly used ratio is the price to earnings (P/E) ratio. The P/E ratio is really price/(sales x net margin).

To understand the market cap to GDP and P/E ratios, we need to decompose net earnings and how it have evolved over time:

Net earnings = (Gross earnings [or EBIT earnings] – interest expense) x (1 – tax rate)

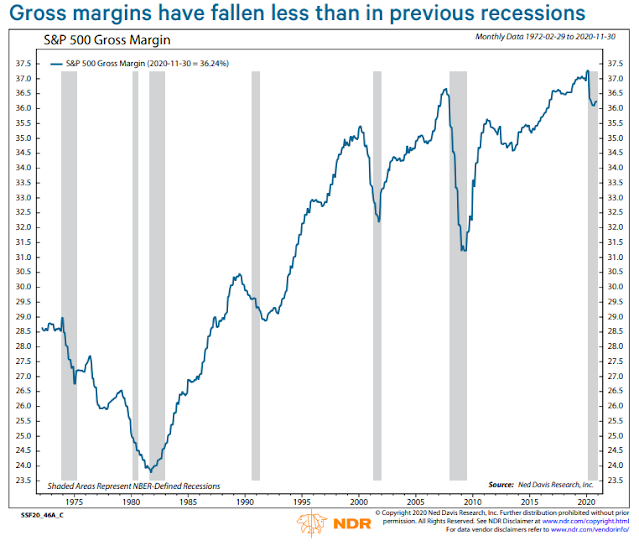

Over the years, both interest rates and the corporate tax rate have fallen substantially. In addition, Ed Clissold of Ned Davis Research documented how gross margins have risen since the early 80’s.

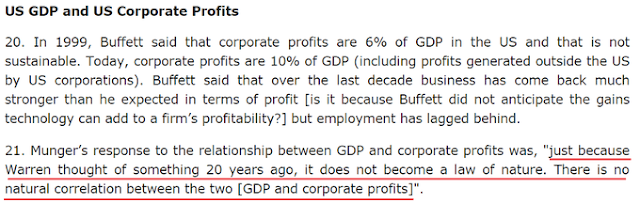

The validity of the Buffett Indicator’s valuation warning therefore depends on a mean reversion in net margins. Ben Carlson documented how Charlie Munger, Buffett’s long-term partner, addressed this issue.

As the economy recovers from the latest recessionary downturn, net margins are expected to rise substantially, which will provide a boost to the E in the P/E ratio.

Do you feel better now?

Not out of the woods?

While an explanation of the relationship between the market cap to GDP ratio, net margins, and the P/E ratio provide some comfort about valuation, a nagging problem remains. P/Es are substantially elevated relative to history. The S&P 500 forward P/E ratio of 22.1 is well ahead its 5-year average of 17.4 and 10-year average of 15.7.

Shiller CAPE (Cyclically Adjusted P/E) readings are above levels seen just before the Crash of 1929.

A CAPE of 33 implies roughly 0% real returns over the next decade.

Robert Shiller recently addressed this issue in a Project Syndicate essay. Stock prices are cheap in most regions after adjusting for interest rates.

The level of interest rates is an increasingly important element to consider when valuing equities. To capture these effects and compare investments in stocks versus bonds, we developed the ECY, which considers both equity valuation and interest-rate levels. To calculate the ECY, we simply invert the CAPE ratio to get a yield and then subtract the ten-year real interest rate.

This measure is somewhat like the equity market premium and is a useful way to consider the interplay of long-term valuations and interest rates. A higher measure indicates that equities are more attractive. The ECY in the US, for example, is 4%, derived from a CAPE yield of 3% and then subtracting a ten-year real interest rate of -1.0% (adjusted using the preceding ten years’ average inflation rate of 2%).

We looked back in time for our five world regions – up to 40 years, where the data would allow – and found some striking results. The ECY is close to its highs across all regions and is at all-time highs for both the UK and Japan. The ECY for the UK is almost 10%, and around 6% for Europe and Japan. Our data for China do not go back as far, though China’s ECY is somewhat elevated, at about 5%. This indicates that, worldwide, equities are highly attractive relative to bonds right now.

At the press conference after the December FOMC meeting, Fed Chair Jerome Powell embraced the equity risk premium, or the Fed Model, as a way of valuing the stock market. For what it’s worth, the Fed Model has liked the market since 2002.

Similarly, the Buffett Indicator (inverted) does not appear expensive when investors factor in the level of interest rates, notwithstanding the improvement in net margins.

In summary, concerns about valuation are overblown. Stock prices are not overvalued in light of the low rate environment.

While low rates can be a risk factor over the long-term, they are not a problem over the next few years. The Fed signaled a form of passive easing after the latest FOMC meeting. It raised its growth projections for each of the next two years, marked down unemployment, and raised core inflation estimates. Despite all that, it is holding rates steady. That’s a medium-term friendly environment for equities.

Don’t be afraid to buy.

According to John Hussman the valuation of US Stocks has never been more extreme, even at the 1929 and 2000 market peaks. He uses the Margin-Adjusted P/E, which is very well correlated with actual subsequent market returns. Any comments?

I have followed John Hussman’s work for many years. He has been warning of extreme stock overvaluation since 2012. His track record up to the GFC was great but with the low interest rate world since then, he could not adjust.

His valuation work is VERY similar to the Shiller PE which was a great measure pre GFC but even Bob Shiller has made subsequent adjustments whereas Hussman has not.

I think he was warning about extreme valuation since the 2009 bottom. He never turned bullish since the GFC.

Everything you need to know about John Hussman’s analysis in one chart.

https://finance.yahoo.com/quote/HSGFX?p=HSGFX&.tsrc=fin-srch

Before the 1950’s stocks were bought as individual businesses. They were considered risky having experienced the Depression and WWII. Stock dividend yields were much higher than bonds for those reasons.

Then in 1952 came Harry Markowitz and Modern Portfolio Theory (MPT) where stocks were bundled in a portfolio and were analyzed as such. Stocks as a group are safer. This also was the start of a huge wave of institutional stock ownership as pension funds arose. Dividend yield ratios to bond yields kept falling until they were much lower than bonds. Portfolio managers had to readjust their value metrics to this new world.

From the GFC onward, extremely low risk-free interest rates have had valuation methods in a flux. If rates are 1%, you can’t have stocks at 100 PE (earnings yield of 1%).

Now with the advent of negative real interest rates and even negative actual interest rates, we enter a new theoretical valuation world. This theoretical world involves massive pools of institutional money crunching massive big quant data that will get further beyond simple company by company understandable human measures of value.

The other complication is the flood of liquidity awash in the developed world thanks to Central Bankers. It results in a huge excess savings pool that has to go somewhere. If you want to see a great performing index that goes up EVERY week, check out the Venezuela stock index. Of course, their currency is falling in value to offset this. But a Venezuelan would certainly rather own a share of say a cement plant than a wheelbarrow full of paper money. We won’t have that kind of inflationary money printing but money printing leads to searching for alternate investments and in my opinion will lead to analysts going further and further into the theoretical to justify owning stocks in a negative interest rate world.

So, I agree with Cam. Valuation is not an impediment. We should expect veteran great investors to constantly warn of overvaluation. They are of the old world of rational company by company valuation and not the quant theoretical current one. Those veterans no longer manage huge money. Even Ray Dalio, the biggest money manager is performing poorly and losing assets.

I realize this all sounds like the dangerous, “This time it’s different.” But, the evidence says it is.

Price discovery is lost. For now the markets may go up, but how will the lower 90% fare? This distortion of prices will not improve their lives. We may look back at the election of 2020 as the last sane one. Dystopia ,is it different too? I get it why central banks are doing what they are doing, to keep things afloat, but I don’t get the feeling that there is a soft landing when this is all done…we will have social unrest like we have not seen in a long time…all we can do is try to protect ourselves.

It is with great regret that I agree with every word you said yodoc.

You know, we have heard the “bad news is good news” narrative before, and I think we have had more of this recently. It’s not right (in the sense of rational thinking), bad news is bad. So for me it is a sign of the euphoria stage. I can say with conviction that euphoria does not last forever…it could last quite a while of course, but one day bad news will be bad news and things will be correcting, and eventually that despair where even good news is pointless because it’s all going down the tubes as they say. May we have the foresight to be in cash then and the temerity to buy.

Good news is bad news will likely happen when the economy recovers and corporate interest rates rise with inflation. Zombie companies being kept alive with easy and cheap money will stumble. Hopefully the dominoes don’t fall too far and wide.

Quality companies will have stronger earnings with the upbeat economy but stock valuation measures might hurt as rates rise and quality corporate bonds offer a decent alternative to equities.

Agree:

1. Price discovery is dead. We are now entering central asset administration regime. Equity market is modern alchemy. Without it our country will collapse. Where will CIA get its operation funding and how can Americans retire? Think about it. Gov has millions of incentive to keep it afloat. Working bees have incentives to continue to invest in 401k/403b, with the belief of implicit/explicit gov backing.

2. As a result, count on relentless bid to go on forever. Ignore this and you will languish financially.

3. Everything is just a concept: gender, share price, value system, … whatever you can imagine. Whole world is a virtual reality or a multi-dimensional cosmic simulation.

Disagree:

4. There will not be major social unrest, because newer generations are pretty wimpy and much distracted. I observe my kid (freshman at UC this year) and her circle of friends, and realize this. Gov will resort to appeasement and things will be fine. With MMT the possibilities are endless.

Do not believe the world is just a concept and share price is just an opinion? Look no further than TSLA. Should I say the word “absurd?” I surely will offend and even enrage a large group of people. George Carlin once said to not underestimate the stupidity of a large group of people.

I wrote a small crude search engine and headline aggregator. Not as polished as Google algos, but it cuts to the chase. Whenever I feel the market is too high I run it to read the headlines to see what stock pumpers (analysts) come up with to justify the valuation. You know this is one of several wonderful ways to get relaxed. The reading provides comic relief, and occasionally even intellectually stimulating.

The last 10 years regarding TSLA:

1. The car will drive itself.

2. The auto-taxi market is worth trillions. TSLA will have the lion’s share.

3. Its charging stations will power themselves.

4. It will have very fast-charging stations. Like, in minutes.

5. Its solar roofs and solar tiles will revolutionize home utility market.

6. Its energy storage business will be even bigger than car business.

7. It is a technology company and should be valued as such.

On and on … One magic word: ZEV.

Remember Solar City? It is a fraud and inconvenient. Now Musk is floating an idea of a holding company to put all his companies under it. Surely it will be convenient. No more agonizing over certain financial engineering