Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model that applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts are updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

The seasonal party

Don’t overstay your welcome

The federal government has already purchased 400 million COVID-19 vaccine doses, or enough for 200 million people, from Moderna and Pfizer but needs additional funds to purchase more doses. It also signed contracts with other companies for vaccines that have yet to be authorized. Private companies, including McKesson, UPS and FedEx, are distributing the doses but have been relying on staff in the Department of Defense and the Department of Health and Human Services for support.

States have received $340 million from the U.S. government to help offset costs they’ve borne from the vaccine rollout but say they face a shortfall of around $8 billion. A shutdown would halt plans by Congress to distribute funding to make up for that shortfall.

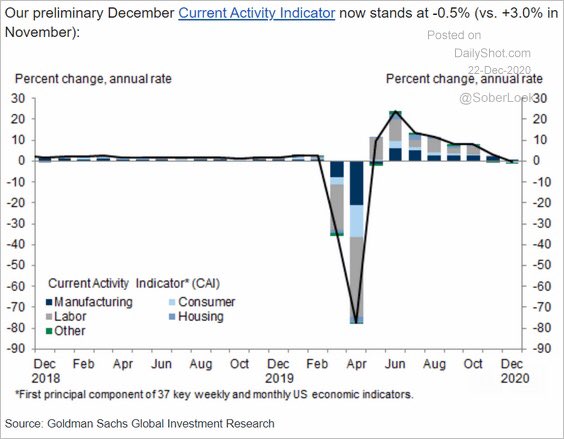

As well, high-frequency indicators are showing signs of weakness. The Goldman Sachs Current Activity Indicator turned negative in December. The combination of incipient weakness and any hiccup in the delivery of fiscal support could be enough to shift investor psychology.

In addition, market internals are flashing warning signs that the Santa Claus rally may be on borrowed time. One of the bearish tripwires I had been monitoring is the performance of the NYSE McClellan Summation Index (NYSI). In the past, NYSI readings of over 1000 were signals of “good overbought” advances, but rallies tended to falter when NYSI began to roll over. NYSI showed definitive signs of weakness last week, which is a warning for the market.

How far can the rally run?

More room to rally

The bulls shouldn’t panic just yet. The seasonal Santa Claus rally is following the script of a rally into early January, followed by a correction.

Short-term breadth and momentum readings are not overbought, and the market has more room to rally.

The percentage of S&P 500 at 5-day lows are more oversold than overbought, which is indicative of more upside potential.

However, the challenge for the bulls is to overcome the trend of lower highs in breadth and momentum.

My inner investor remains bullishly positioned. Even though the market may experience a pullback in January, the intermediate-term trend is bullish (see Debunking the Buffett Indicator) and he isn’t overly concerned about minor blips in the market. The near-simultaneous upside breakouts by the Dow and the Transports flashed a Dow Theory buy signal. The primary trend is up, though short-term corrections are not out of the question.

My inner trader is also long the market. If it all goes according to plan, he will be taking profits in early January and contemplate reversing to the short side at that time. All of the technical projections cite the first or second week of January as the likely peak of the current period of market strength. Upside S&P 500 potential vary from a low of 3750 to a high of 3907. What follows would be a 5-10% correction.

Disclosure: Long SPXL

In the ‘Bad is Good and Good is Bad’ argument, I see everything domestically China is doing badly even though their economy is surging.

I think the kicker will be inflation. My uneducated thinking runs along the lines of “where does the money go?” When the Fed bails out some banks or buys bonds, the money really goes nowhere, at least not into the general mainstreet circulation. So the market is up over 400% since 2009. If it were the price of food up 400%, then they would call it inflation. So these trillion dollar handouts that covid has triggered, this will be much more in the general circulation and the velocity of money will increase. So what can the Fed do about rates if we start to get inflation? If rates go up the debt will crush us, rates near zero in the face of inflation, how will that work?

My advice, invest in basic stuff that people will always need…when the price is right of course.

As an aside on inflation, I have wondered how much the inflation of the 70s was due to credit cards. They were not as popular in the 60s but definitely so in the 70s…instant credit increasing money to be spent.

Last week saw banks outperform mightily. They seem to be starting a new positive trend. Any comments about whether we can trust them even though they have disappointed so often in the past. Will Elizabeth Warren attack? Will commercial real estate crash and burn the banks?

Well, something like 18% of the companies in the USA are zombies. If you look back over the past 50 years we are poorer. Go shopping, and in most places there are malls with chain stores. The small independent store is becoming rare except those that cater to the elite. They were put out of business by the larger chains, due to cost and selection.

The cost of things matters, and it matters more the poorer one is, so choices are made based on this reality.

Some want to believe that nothing replaces that personal contact so business travel will resume, but it is expensive, so some will curtail it. The millennials are more comfortable with online meetings, and the technology will improve , virtual reality etc….but I think that ultimately it will be a cost issue, just like outsourcing evolved as the communication technology made it more feasible, but it was cheaper labor that made it happen. So I think commercial real estate will get a bounce, but in the long run it’s in trouble, but I could be wrong.

Taking profits on XME/ XLI/ OIH, basically b/c it comes down to a second roundtrip in the positions.

Closing small positions in RIOT/ ETCG.

Clearing VEU/ VTV/ XLE/ EEM as well->betting I’ll be able to reopen somewhat lower later in the day or on Tuesday.

Out of KRE/ RIG.

Closing BABA/FXI for minor hits.

RYSPX off at the 730 pst window.

Reopening partial positions in XLE/OIH.

Adding to XLE.

Adding to OIH.

Reopening XME.

Reopening XLI.

Restarting a few of the high-octane names that are selling off today-> NIO/ FCEL/ PLTR.

Will be closing VTIAX/ VEMAX end of day. Mainly due to the once-daily trading window – it allows me to book gains when I have them, and then reopen on Tuesday using VEU/EEM if we see early weakness.

After hours-

Reopening partial positions in XLF/ KRE. A bet that today’s relative strength carries over.

Reopening a half position in FXI. Staying away from BABA.

Opening flyers in SOLO and QS.

Hoping to reenter VEU/EEM premarket.

Probably means BABA is ready to reverse and rally.

Partials in JETS/ USO.

Interesting support levels for IWM/QQQ and EEM/SPY.

Is it time for the trade to reverse?

https://twitter.com/IanCulley/status/1343606673852784640

That’s the sort of leadership reversal that I have been writing about since November. Small caps, non-US, and value should perform better going forward.

BABA does in fact reverse.

I spent the first 30 minutes closing all positions – giving back almost all of Monday’s gains.

Now 100% cash and in no rush to wade back in. It’s been an incredibly forgiving market – until today. At least, that’s how I see it.

I plan to wait for a significant pullback.

As of this morning, +8.36% ytd, which doesn’t sound like much – but relative to where I was back in early June, it’s actually been a great year.