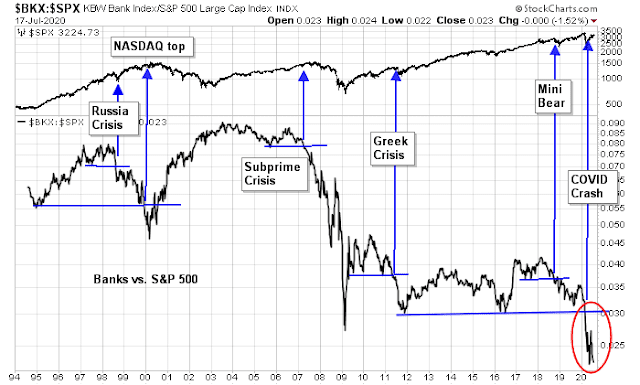

Earnings season has kicked off with reports from the major banks. The market reaction has been mixed so far. From a big picture perspective, history shows that whenever the relative performance of banking stocks have breached a major support level, such events have usually signaled periods of financial stress and bear markets.

This time, the Covid Crash saw the market fall and recover in the space of a few short months. This begs two important questions for investors.

First, the financial sector is the third largest weight in the index, behind technology and healthcare. Can a bull market begin without the participation of a major sector like this?

Brian Gilmartin pointed out that the sector represents about 10% of S&P 500 weight, but 17% earnings weight, indicating that financial stocks are value stocks. What does the lagging performance of these stocks mean for the growth/value dynamic?

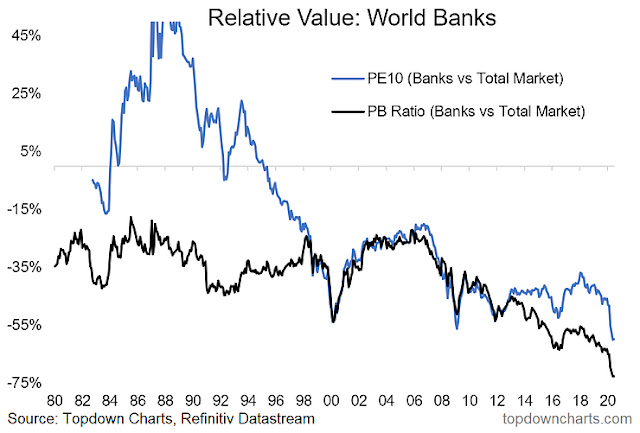

How cheap are banks?

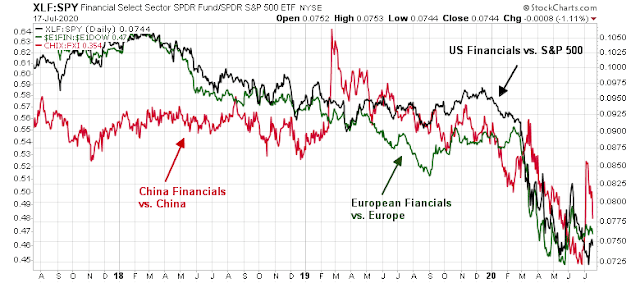

Financial stocks have lagged the market, not just in the US, but globally. The relative performance of this sector has been synchronized globally in the last two years. Even in China, banking stocks staged a relative rally when the Chinese market surged, but their relative returns have retreated as the market cooled off.

How cheap are they? Callum Thomas at Topdown Charts found that global banks are indeed very cheap by historical standards, whether measured by a relative PB ratio, or relative PE10 ratio. He observed that global banks have never been cheaper based on both absolute and relative valuation, and they trade at a “massive 60% discount to the rest of the market on a PE10 basis”.

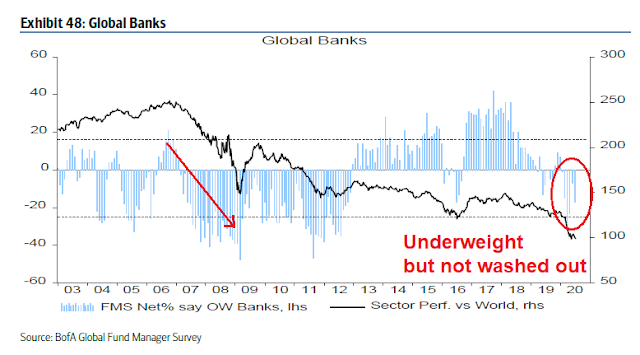

That may not be enough from a sentiment perspective. The BoA Global Fund Manager Survey reported that managers are underweight banks, but sentiment does not appear to be panicked in the manner of the Great Financial Crisis of 2007-09.

Waiting for the next shoe to drop

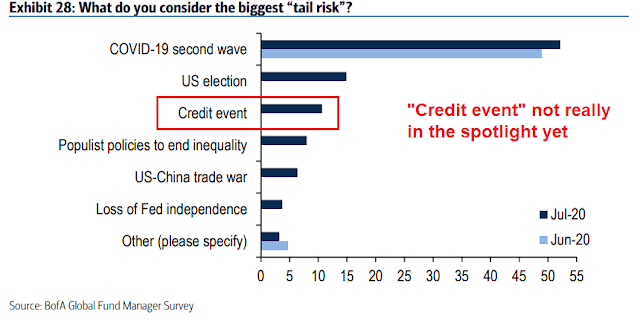

I would argue that this sector has not seen the capitulation event needed for a turnaround. In the past, periods of financial stress has been associated with banking crises. We have not had the credit event that sparks a banking crisis just yet. The latest BoA Global Fund Manager Survey shows that investors are overly focused on the COVID-19 Crisis, and the risk of a credit event is barely in the spotlight.

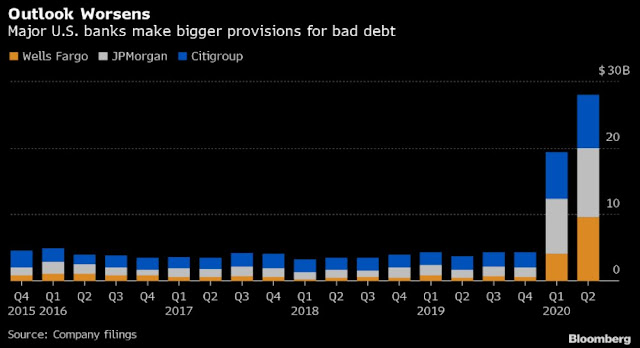

That may be about to change. Just when you thought the banks had “kitchen sinked” by writing off all of the bad loans in Q1, Bloomberg reported that JPM, C, and WFC have set aside about $28 billion in loan loss provisions in Q2.

Is this as bad as it gets? I am not sure. Just consider some of these comments from banking CEOs during the earnings calls.

“This is not a normal recession. The recessionary part of this you’re going to see down the road,” JPMorgan Chief Executive Officer Jamie Dimon said Tuesday. “You will see the effect of this recession. You’re just not going to see it right away because of all the stimulus.”

“I don’t think anybody should leave any bank earnings call this quarter simply feeling like the worst is absolutely behind us and it’s a rosy path ahead,” Citigroup CEO Michael Corbat told analysts. “We don’t want people leaving the call simply thinking the world is a great place and it’s a V-shaped recovery.”

Banking executives are echoing the message of the Fed. The path of the recovery depends on progress against the pandemic. This is not your father’s recession.

The number of corporate bankruptcies has spiked to levels last seen during the last crisis, though the value of liabilities in bankruptcy is still relatively tame.

The slowdown is also starting to bite into the household sector. A study by the nonpartisan consumer advocacy group Families USA found that a record 5.4 million Americans had lost their health insurance between February and May. In addition, high frequency economic data shows that consumer spending began to roll over mid-June. What’s more even worrisome is the high-income households are leading the decline. This may be an indication that layoffs are reaching the better paying white collar jobs.

Mortgage delinquencies, which were the first signs of the last housing crisis, have surged.

The CEO of Apartment List gave further details about housing market stress in the latest earnings call:

During the first week of this month, 19 percent of Americans had made no housing payment, while an additional 13 percent paid only a portion of their monthly bill… From June to July, the share of renters who are either “very” or “extremely” concerned about being evicted rose from 18 percent to over 21. Similarly, the share of homeowners concerned about foreclosure ticked up from 14 percent to 17 percent.

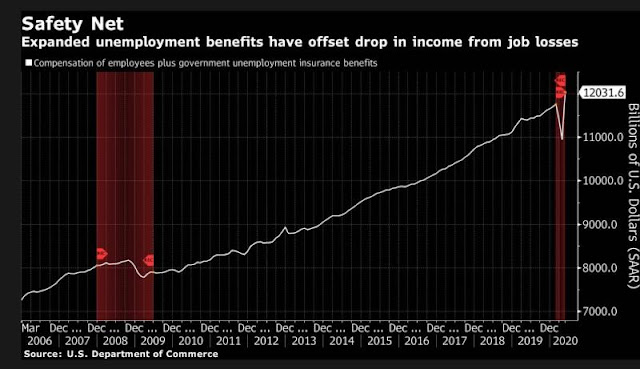

So far, the fiscal support provided by the CARES Act is creating a limited safety net for consumer spending. Joe Wiesenthal at Bloomberg observed that despite record job losses, total compensation for unemployed workers actually rose because of the CARES Act, whose provisions are set to expire at the end of July. For some perspective on the scale of fiscal support, George Pearkes at Bespoke estimated that a full expiry of the $600 per week unemployment insurance payment would cost the household sector 4.8% of Q1 nominal GDP at an annualized rate.

Whether any fiscal support is forthcoming is an open question. The latest tentative proposal from the administration calls for a reduced level of support that is capped at $1 trillion, plus a payroll tax cut. The House Democrats passed a $3 trillion relief bill with very different spending priorities. It is unclear whether both sides of the aisle can come to an agreement before the Congress recess in August.

Financial repression ahead

How is the Fed likely to react? Fed watcher Tim Duy analyzed a recent speech by Fed governor Lael Brainard and concluded that the Fed is likely to engage in yield curve control. Brainard began with an assessment of the path of recovery, and provided a Fed policy roadmap.

Looking ahead, it will be important for monetary policy to pivot from stabilization to accommodation by supporting a full recovery in employment and returning inflation to its 2 percent objective on a sustained basis. As we move to the next phase of monetary policy, we will be guided not only by the exigencies of the COVID crisis, but also by our evolving understanding of the key longer-run features of the economy, so as to avoid the premature withdrawal of necessary support.

She went on to open the door to yield curve control (YCC) as an additional policy tool.

Forward guidance and asset purchases were road-tested in the previous crisis, so there is a high degree of familiarity with their use. Given the downside risks to the outlook, there may come a time when it is helpful to reinforce the credibility of forward guidance and lessen the burden on the balance sheet with the addition of targets on the short-to-medium end of the yield curve.

Duy concluded:

The Fed will feel pressure to do more without expanding the balance sheet further. That leaves yield curve control as the next likely path forward. [Though] they have to talk it out first.

The Fed last engaged in YCC during World War II, which forced savers to subsidize the government’s finances. Let’s call it what it really is, financial repression. We have seen what different forms of financial repression does to the banking system. In the eurozone, the ECB pushed rates deeply negative, and it cratered bank profitability. The difference becomes obvious when we compare the performance of US and European banking stocks in the last decade (all figures in USD).

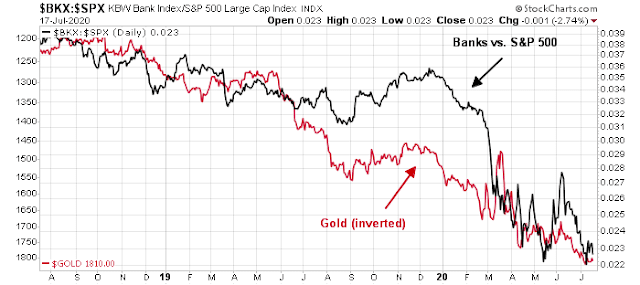

We also have a real-time price signal for the degree of financial repression. The price of gold responds to real interest rates. If the Fed were to artificially push down real rates, it puts upward pressure on gold. As the following chart shows, the relative performance of bank stocks are inversely correlated to gold.

Brace for more pain

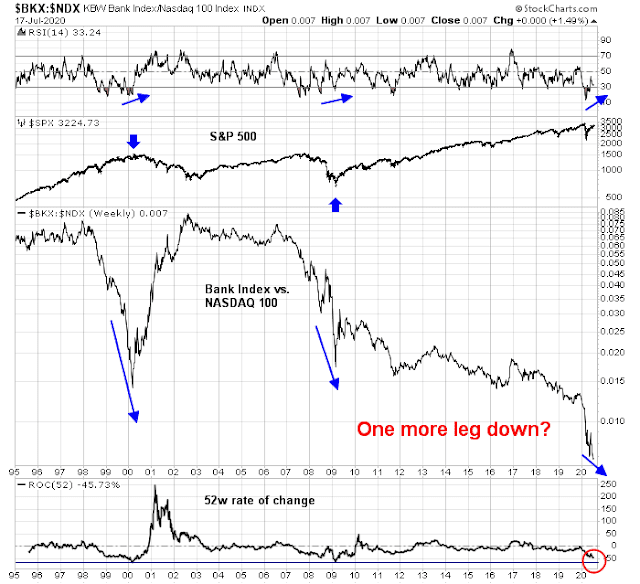

In conclusion, investors should expect more pain ahead for the banking sector. The credit cycle is not yet complete for the latest expansion cycle, and banks are bracing for a wave of bankruptcies. The Fed is about to engage in financial repression that will depress banking profitability. From a technical perspective, the relative performance of the NASDAQ 100 to the Bank Index isn’t washed out yet, indicating that growth is likely to dominate value for the time being. Historically, the relative performance of this ratio has not bottomed out until the 52-week rate of change reaches -70%. That said, the 14-week RSI is exhibiting a positive divergence, which is a signal that the final capitulation is near.

The banks will have their day, but not yet. By implication, there is one more leg down for this bear market, and one more leg up for the growth/value trade before it’s all over.

Cam, I would be grateful for any tips on how to trade volatility (or similar) to profit off this potential credit event in future articles.

A meaningful response to the question depends on how one interprets the question.

(a) Has a bull market in global stocks already begun, and if so where do we peg the starting point?

(b) If one has already started, then it appears possible to make significant headway without the participation of bank stocks.

(c) If it’s still a bear market, then at what point would the move off the March lows transition from ‘bear market rally’ to ‘the beginning of a bull market?’

Having mulled over the above points off and on during the day, my own take comes down to-

(a) It’s been a bull market since SPX 2950 – that’s the number I recall most often cited as the high end for a retracement rally.

(b) Sure, banks have lagged. But I think the sector pulls out of what will be a very short recession stronger for the experience. Many branches are likely to remain permanently downsized or closed – consumers have learned to bank remotely, and they won’t be going back to the way things were.

(c) This is not a bear market rally. It’s a bonafide bull, and the SPX is likely to surprise to the upside for an extended period of time.

Needless to say – just my opinion.

See my reply to DV. If you believe that this is a renewed bull then you need to be long NASDAQ leadership. This is a bubble that will go on for longer than you may expect.

Do you believe that?

I have followed James Stack at Investech for thirty years. This issue he unveiled a new tool which is simply an index of the big winning stocks. He didn’t say which but they are obviously FANNG plus MSFT and whatever other parabolic high tech wonder stocks. His theory is that these stocks peaking and plunging will mark the end of this market cycle.

He has high credibility since he did the same thing in 2000 with the Dot.com peak and in 2007 with real estate stocks. make perfect sense. His chart of the current index is scarily parabolic just like every stock market bubble.

So as we concentrate on Covid and the economy the market might implode due to a tech crash from unsustainable heights.

It may be happening sooner rather than later. I do a ranking of 65 ETFs every week. These are countries, factors and industries and sub-industries. This week saw a very large plunge in ranking for everything tech oriented.

Ken,

Thanks for the interesting and tactical read on your website. I am going through the US Industries, tactical research currently.

Thanks again for your perspective.

The comparisons with 2000 tech bubble and crash need to be done in context. Then, any company with an i or dot com in their name got ridiculous valuations. Today the FAANGM are dominant players, masters of their universe, global in reach, and generating tons of free cash flow. In a zero interest rate environment, non existent inflation, supportive fiscal and monetary policy and structural changes in how we live and work, these and other growth companies will continue to grow. There are headwinds. Europe which doesn’t have any tech companies to speak of wants to regulate them. Politicians see them as easy targets ( and source of cash). I am on this train now for a while and not intending to get off any time soon.

Other cyclical sectors, other than materials, are not doing well. In this environment, they probably will not do well but no one knows when sentiment shifts.

The real question is – can one divine the future direction with whatever tea leaves they have? No one knows and if they claim they do, run as hard as you can.

Cam’s analysis is very thoughtful but not always right in hindsight. No one expects it otherwise. After four plus decades of hard knocks, I have found success in staying on the boat with a diversified portfolio leaning towards the future.

I hear you Ravindra and well said. Historically stock market investors take excellent companies with great futures too high in their enthusiasm. When their prices go parabolic it is a worry.

More or less in agreement. I think we’ll look back in a year or two and realize 2020 was a superb buying opportunity that investors did their best to dismiss (ie, talk themselves out of).

Based on the positioning of global fund managers (underweight equities) and reported outflows from mutual funds, it’s hard to say we’re in an environment of irrational exuberance. My take is that we’re experiencing rational pessimism – yet markets are anything but rational. Understand the playing field – if buy and sell decisions were entirely rational and thus predictive, then mathematicians and economists would rule the roost. That’s not the case. What makes the capital markets a worthy pursuit and a lifelong challenge is the realization that in order to succeed, we must each develop a highly individualized approach to trading – and even then we’ll always be at the mercy of the markets.

Excellent point rxchen2. We mostly follow people with experience and demonstrated skills yet we construct different approaches and portfolios to meet our needs, fears, personalities, life stage and time. Market offers only two free lunches so to speak – diversification and rebalancing.

It’s time to look beyond the recession. Perhaps the recession is already over.

Ken

Are you still maintaining a high cash position in portfolios and potentially selling even more in the near future if stocks maintain current buoyancy? Thanks for your insightful comments.

Cam

Your banking index non performance is scary!! Would it be right to conclude that the banking/financial stocks are indicating a looming market peak in stocks and indicate a huge selling opportunity in stocks?

The bear market warning would be the standard interpretation, but you could also argue that we had the downdraft in March already. The Fed has rescued the market and we are back to the races. If that view is correct then expect NASDAQ stocks to continue to lead the market higher – which would be anomalous given their extended nature.

Two views. You pay your money and you take your chance.

Will watch Nasdaq, though from what you have said, Nsdaq rally will stretch it even more.

I read somewhere that the Nasdaq had it’s worst relative performance (to SP) this week since 2009. (-1.8 vs +1.3).

Maybe some profit taking?

Cam

Timing aside, should the bank vs tech turnaround prove true, how would you best take advantage of such inflection? i.e. do you own the large/stewards e.g. JPM, GS, WFC etc or do you play the high beta small cap banks?

I am using the banks as an indicator. If there is a turnaround there are probably better ways of participating in the upside, such as small caps.

Cam, what does yield curve control mean here?

I thought it’s already a standard practice for fed to target short term rate, does YYC mean med/long term rates?

In countries where this has been tried, how did the markets react?

YCC as per Fed governor Lael Brainard:

Forward guidance and asset purchases were road-tested in the previous crisis, so there is a high degree of familiarity with their use. Given the downside risks to the outlook, there may come a time when it is helpful to reinforce the credibility of forward guidance and lessen the burden on the balance sheet with the addition of targets on the short-to-medium end of the yield curve.

“Under yield curve control (YCC), the Fed would target some longer-term rate and pledge to buy enough long-term bonds to keep the rate from rising above its target. … Under YCC, the central bank commits to buy whatever amount of bonds the market wants to supply at its target price.”

Also see:

https://www.investopedia.com/what-is-yield-curve-control-4797189