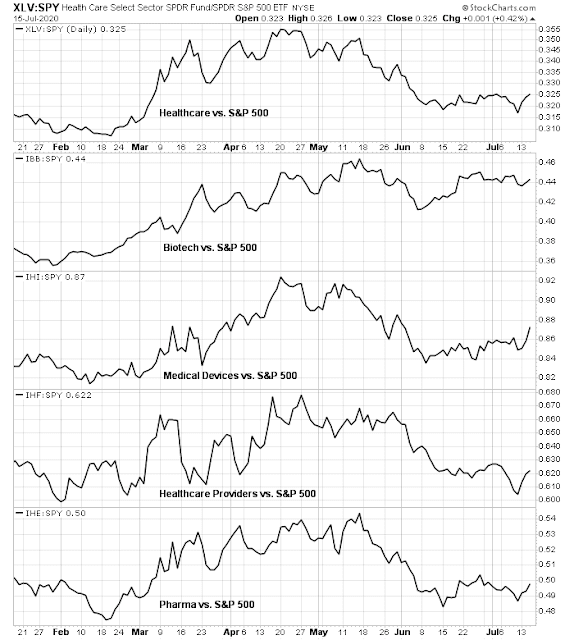

Mid-week market update: The market has taken on a risk-on tone as news of a promising Moderna vaccine trial hit the tape. While the relative performance of healthcare stocks haven’t done much for several weeks, they did catch a recent bid.

As well, cyclical stocks have also perked up as they responded to the hopes of a post-pandemic world.

Is this the start of a COVID recovery? I analyze the issues surrounding vaccine development and provide a framework for evaluation.

The approval process

Vaccines have historically taken years to develop. Dr. Anthony Fauci recently laid out the criteria for approval in a Bloomberg article:

“You’ve got to be careful if you’re temporarily leading the way vs. having a vaccine that’s actually going to work,” he told the BBC recently. Most vaccines in development fail to get licensed. Unlike drugs to treat diseases, vaccines are given to healthy people to prevent illness, which means regulators set a high bar for approval and usually want to see years’ worth of safety data. In the Covid-19 pandemic, it’s not yet clear what regulators will accept as proof of a successful and safe vaccine. The U.S. Food and Drug Administration has said a vaccine would need to be 50% more effective than a placebo to be approved and would need to show more evidence than blood tests indicating an immune response. Regulators in other countries haven’t spelled out what would be acceptable.

History is littered with instances of over eager drug developments. Just look up the Guillain-Barré syndrome, which was an unexpected side effect of the 1978-79 flu vaccine that President Ford rushed into production. Then there is thalidomide, which was promoted for anxiety, insomnia, “tension”, and morning sickness . The drug was found to cause severe birth defects. Babies were born with either no arms or legs or horribly disfigured limbs. That’s why the drug approval process takes so long. Take shortcuts and you don’t know about the long-lived side effects like birth defects.

Investors need to temper their expectations and not overreact like a puppy chasing after a new squeaky toy whenever a company announces a promising result.

The leading candidates

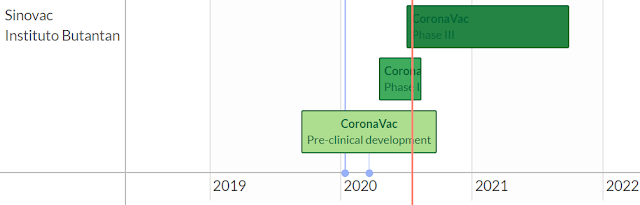

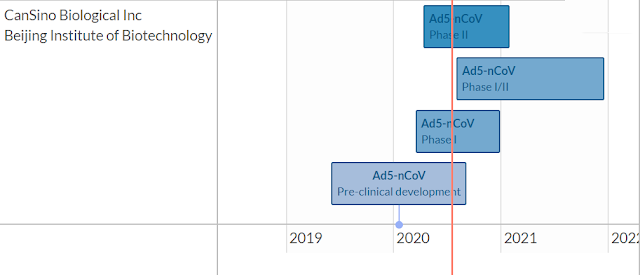

Courtesy of a useful vaccine tracker website, here are the outlines of four leading candidates that are in either phase II or phase III trials.

Two potential vaccines that are furthest in development are Chinese. Reuters reported that China’s Sinovac has a potential vaccine in a phase III trial in Brazil. Even so, the phase III trial is not expected to be completed until the last half of 2021.

Reuters separately reported that China’s CanSino has a promising candidate. The company is contacting Russia, Brazil, Chile, and Saudi Arabia for phase III trials involving 40,000 patients. As well, the vaccine is being given to Chinese troops on an experimental basis. The timeline for the completion of phase III trials is also late 2021.

The two remaining lead candidates are being developed in the West. The Moderna vaccine, which the market got all excited, emerged from a phase I trial with promising preliminary results. Before everyone gets all excited, the trial only consisted of 45 healthy volunteers aged 18-55, and the trial was designed to test whether the vaccine is safe, not whether it’s effective. Nevertheless, the study showed that all subjects showed the production of neutralizing antibodies against SARS-CoV-2, though there is no indication how long the antibodies lasted in patients.

The company is now going into a phase III trial by recruiting 30,000 patients. Still, this process can’t be rushed. Even the process of recruiting 30,000 appropriate subjects can take months. For some perspective, 30,000 is roughly the size of the 101st Airborne Division. Imagine if you had to create the 101st from scratch. What’s the bureaucracy to recruit that many people, induct them, and put them through the first level of basic training. As with the other vaccine candidates, it is unrealistic to expect robust results until 2021.

There are other issues with the Moderna vaccine, it is based on mRNA technology which may be difficult to scale in production. As well, an analysis of insider activity in the stock finds mass selling. In the last six months, there was one timely insider buy by a director in February, and a whopping 78 sales by officers and directors. If insiders are so confident about the vaccine, why are they selling?

Finally, there is the Oxford vaccine backed by AstraZeneca. The vaccine is in a phase III trial that is not expected to be complete until the second half of 2021.

There is also some controversy over the Oxford vaccine. A Forbes article cast some doubt over the effectiveness of the vaccine in animal tests. All of the rhesus monkeys became infected when exposed to SARS-CoV-2, and the level of neutralizing antibodies was very low. However, the vaccine did protect the animals when they were afflicted with COVID-19. In other words, the vaccine does not protect a patient from infection, but it does stop you from going to the hospital and dying if you become ill. It is unclear whether vaccinated patients acquire immunity should they become infected, though the vaccine seems to mitigate the effects of the virus.

The hurdles facing the Oxford vaccine may not be an overwhelming problem. Not all vaccines prevent infection. As an example, the Salk polio vaccine also doesn’t prevent infection, but it does mitigate the effects of the illness.

Assuming that Oxford vaccine is successful, it creates a public health policy problem. Vaccinated patients who become afflicted with COVID-19 could in theory infect others. Authorities would need to effect a high vaccination rate in order to create herd immunity. This begs the question of whether enough people are willing to be vaccinated.

Bottom line, temper your expectations. Even with promising results and shortened approval process, a realistic timeline for a vaccine to be available is probably mid to late 2021.

Limited upside potential

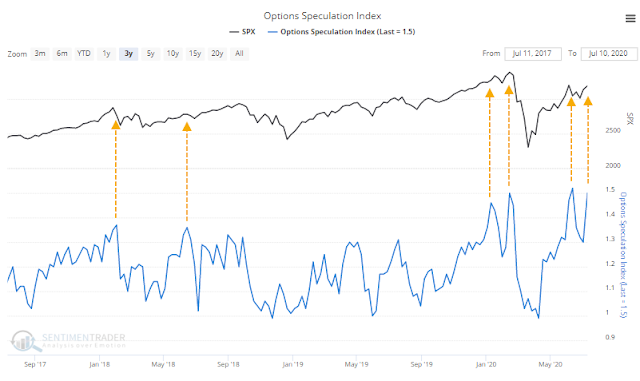

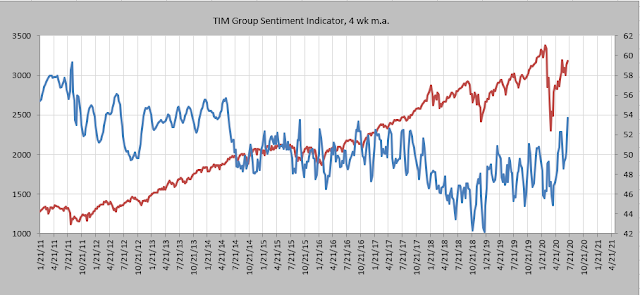

In the meantime, sentiment appears extended in the short run. Jason Goepfert at SentimenTrader pointed out option sentiment is at a bullish extreme, which is contrarian bearish.

Brokerage firm sentiment has also become extreme. This indicator measures the percentage of stocks with buy ratings, and the last time it was this high was 2014.

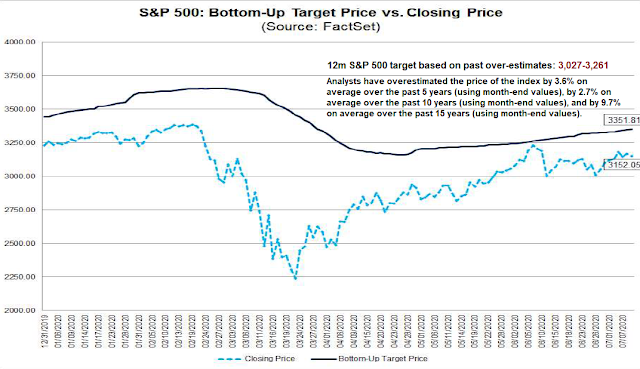

As well, FactSet calculates a bottom-up aggregated target price. The 12-month target is 3,352. Historically, analysts have over-estimated the actual prices by 3.6% in the last 5 years, by an average of 2.7% in the 10 years, and by 9.7% in the last 15 years. This makes the 12-month target range 3,027 to 3,261, which represents very little upside potential from current levels.

In addition, there are two sources of near-term uncertainty. We are entering Q2 earnings season, and most companies have withdrawn guidance. That’s like sailing in fog with possible icebergs in the water. In addition, it is unclear whether Congress with agree to a compromise bill for more fiscal stimulus. The latest round of CARES Act stimulus ends July 31, and states will have trouble re-programming their computers to effect new payments after July 25, which is only 10 days away. The Republicans, who control the Senate, and the White House have not even agreed on the details of a package. The lack of a united front has prevented them from presenting a proposal to the Democrats, who control the House.

My inner investor remains neutrally positioned at the asset allocation weights specified by his investment policy. My inner trader is short, but only during daylight hours (for more details, see My inner trader returns to the drawing board). He has set a stop just above the top of the island reversal at 3240.

Disclosure: Long SPXU

Hi Cam

On the unusual movement in options these days, have you had a listen to Mike Green^ of Logica’s recent interview** on the Grant Williams podcast? https://ttmygh.podbean.com/e/teg_0003/

Pretty wild stuff….he mentions the option trader speculative flows we are seeing in the context of his main thesis….fascinating stuff.

This paper of theirs touches on some of it, but the interview is excellent, especially in his discussion of ASHR and the Singapore futures market back in 2014.

As for the vaccine, it just needs to alter the narrative in this highly charged “information space”, it doesn’t actually have to work 😉 ( Carl Miller’s work, over in the UK…his “warring songs” piece, for example https://demos.co.uk/people/carl-miller/ )

_____________________________________

**Bill and Grant welcome a towering intellect in the shape of Mike Green of Logica Advisors, to discuss the role passive investing may have to play in The End Game.

What follows is a good old-fashioned schooling, as Mike outlines the genesis of his work on passive’s effect on the markets, the extraordinary influence it has on the world today and the way that’s likely to change as we move towards The End Game.

If your head isn’t spinning after this remarkable conversation, then that sure as hell isn’t Mike’s fault…

^https://www.institutionalinvestor.com/article/b1k6b2fhz66hkj/Portfolio-Manager-for-Thiel-s-Family-Office-Moves-to-Quant-Hedge-Fund

Whoops, forgot the Logica paper…here it is: https://www.logicafunds.com/policy-in-a-world-of-pandemics

Merck CEO Says Raising COVID-19 Vaccine Hopes ‘a Grave Disservice’-Report

https://www.nytimes.com/reuters/2020/07/15/us/15reuters-health-coronavirus-vaccine-merck-co.html

The market trades on emotions – not necessarily on outcomes. How many times were investors warned about the dangers of investing in dot-com companies with no earnings? It didn’t stop them from bidding up the share prices of companies like PlanetRx or eToys high enough and long enough to create real wealth for many portfolios.

The longer I’m in the game the less attention I pay to the narratives. What works best for me is sentiment – not necessarily in the form of reported data, but simply what I sense when checking into my own psyche. I’m not that different from most people, and if I’m feeling bullish or bearish then it’s usually a pretty good barometer. Then it comes down to trading against my own psyche. It’s actually not that simple, or perhaps it is. In any case, I came pretty close to being a raging bull early this morning – which ultimately led me to step on the brakes. Going back to June 8 – I should have done the same. No one’s perfect.

There’s a rhythm to the markets. Last year it was the on again/ off again US-China trade talks. Now it’s the shutdown/ reopen +/- the nuances of vaccine research/production that drive the price movements – or not. No one really knows whether it’s the narratives that drive the price movements, or the price movements that drive the narratives.

It should be obvious that the last paragraph above should be positioned as the middle paragraph – I inadvertently switched them when going back to edit.

rxchen2: Great comment, thanks for taking the time.

I understand exactly what you are saying.

Additionally in “famous quote” form 😉

What gets us into trouble

is not what we don’t know

It’s what we know for sure

that just ain’t so

– Mark Twain

But, in a massive irony, it turns out that the Mark Twain quote is not by Mark Twain!!! Source: https://quoteinvestigator.com/2015/05/30/better-know/

The older I get the more comfortable I’ve become saying ‘I don’t know’ – because that’s really the bottom line when trying to explain why prices move up or down.

I say that all the time to get out of “Honey Do’s.”

On that topic of “not knowing”, I guess the rule of governing is always “do something, never think”…for example, on lock-downs, it might have helped if the literature was accessed prior to 2019 😉

“…Six of 12 men wintering at an isolated Antarctic base sequentially developed symptoms and signs of a common cold after 17 weeks of complete isolation. Examination of specimens taken from the men in relation to the outbreak has not revealed a causative agent…”

From way back in 1973: An outbreak of common colds at an Antarctic base after seventeen weeks of complete isolation in a British Medical Journal

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2130424/

Great post. Two thoughts for near term:

-Helene Meisler and Urban Carmel both called attention to the historically low put/call ratio. Even the responses to the tweet reflect bullish sentiment among traders: https://twitter.com/hmeisler/status/1283549202249916422?s=20

-I am wondering about the direction of the dollar given the Fed’s statements about “Yield Curve Control” and the Fed’s continued support. Any thoughts on this, Cam and others? https://twitter.com/MacroCharts/status/1283450720260370433?s=20

A cure for Covid? Listen to this from a Texas Doctor.

https://www.youtube.com/watch?v=s5eK5Cx4NR0

Moderna says their vaccine induced adverse reaction in more than half of test subjects.

https://justthenews.com/nation/science/moderna-covid-19-vaccine-induced-adverse-reactions-more-half-trial-participants?utm_source=justthenews.com&utm_medium=feed&utm_campaign=external-news-aggregators

Interesting that Chinese market drops 4% given the headline: Chinese economy rebounds more than expected.

Consumer weak. Retail sales missed.

“Trump administration takes control of Covid-19 data in U.S.”:

Step 1: WHO out.

Step 2: Manage your own data.

Step 3: Sack Fauci.

Step 4: All problems solved!

3 Isn’t going to happen anytime soon but Fauci is reminding more and more of pinocchio.

I’d say Fauci is the only well-known person in the administration who isn’t a compulsive liar.

He did lie about the use of masks when he said they were ineffective because he wanted the public to stop buying them up. He just comes across really weird to me. Also, he did an interview a few years ago (video of it is out there) in which he said his greatest wish was for a bird flu pandemic so he could try to manage it. That statement scared the bejesus out of me.

I would take a swing @ SPY on a drop to 316.xx followed by a recovery above 317.xx->but it’s never that easy.

Because of the recovery in retail sales, Bonddad is saying ” most job losses could be made up within the next two months, even if many States at least partially reclose”.

What’s the implication for stocks? Should we buy some?

http://bonddad.blogspot.com/2020/07/june-retail-sales-some-actual-good-news.html?m=1

Thanks for the link, Min. Many years ago I studied a book about market direction. The author was very much opposed to using Retail Sales in his data because they are constantly being revised months later. He called the data the UnRetailTale.

Don’t get too excited. High frequency data shows that consumer spending has plateaued and began to roll over about mid-June.

The SPX feels like a spinning top.

A UFO spinning up getting ready to take off for the stars.

You may be on to something there, Wally.

To be honest, it’s hard to remain bearish given the resilience of this market.

It looks like Adam Patinkin of David Capital Partners up in Chicago agrees with you: https://empirefinancialresearch.com/articles/a-very-different-analysis-of-the-covid-19-pandemic

thanks for this link, Donald.

It is an interesting read, but sounds like it was written in May. For example, it claims there is no difference in mortality rates between Sweden and the Netherlands, which is quite wrong.

And, it uses quite odd examples (a team in the Antarctic that caught colds) to “prove” that social distancing and contact tracing do not work.

I like it when they say that statistics, and not medical data, are key when forecasting how hard C-19 will continue to hit. But if it’s statistics, then I’d rather listen to Nassim Taleb, and not to Adam Patinkin.

Hi Martin. At least you read it 😉

Which is a compliment of great value in these binary times, where no evidence from either side makes a difference to either side.

Karl Popper is most likely rolling in his grave! https://en.wikipedia.org/wiki/Falsifiability

In that spirit of both sides…what Patinkin actually wrote is:

“Let’s start with a story. In 1969, twelve men over-wintered in Antarctica at the British Survey Base on Adelaide Island, about 1,000 miles south of the Falkland Islands.”

But follows soon after with:

“…In 2006, researchers at the Center for Biosecurity at the University of Pittsburgh Medical Center reviewed the evidence for non-pharmaceutical interventions (“NPI’s”) that could be employed to reduce the number of cases or deaths resulting from a flu pandemic. The researchers cited a World Health Organization (“WHO”) report published earlier that year and concluded some NPI’s are likely effective (isolation of sick people in hospitals and at home; hand-washing and respiratory etiquette) but that large-scale quarantine measures are inadvisable…”

“…researchers at the Center for Biosecurity at the University of Pittsburgh Medical Center reviewed the

evidence…” being the key point, not the “Let’s start with a story”? 😉

On comparing Sweden to the Netherlands. Each country decides it’s own approach. Sweden looks like this https://experience.arcgis.com/experience/09f821667ce64bf7be6f9f87457ed9aa

One doesn’t need to speak Swedish to understand what each graph is indicating on the arcgis page is showing.

This market seems to be discounting the risks of:

c19 shock econ dmg round 2, biden victory, other geopolitical events.

Or…. maybe, the market, somehow, collectively, has decided the virus is a non-issue, trump will win reelection (polls and odds are all wrong??), and there will be world peace.

I wonder if the Wall Street is getting comfortable with a Biden presidency. After all, he is known to be a centrist, pro-Wall St, and will bring much needed stability in the world economic and trade affairs.

The market almost tripled under Obama/Biden.

Pretty sure Cam is of the opinion (which I agree with) a Biden presidency would mean roll back on tax cuts which is bearish.

Wasn’t that the cover o f the debut album for the band “Boston”?

https://twitter.com/saxena_puru/status/1283545709166202880

Any guesses as to which fund he’s referring to? I’m quite certain you’ll recognize the name.

Don’t underestimate this market.

Flipping to bullish.

Scaling into selective entries. For instance, ASHR ~33.1x.

Added back (re)starter positions in XLF/ XLE and a new position in JETS.

I hope I didn’t influence you, RX, with my UFO analogy. This is a dangerous place on the chart.

I think you did influence me, but in a good way.

The fact that I’m reopening positions with a little trepidation (as opposed to being outright bullish) is a positive. We’ll see.

So long as you don’t let me bias you because I KNOW NOTHING!!! LOL

That makes two of us.

Reopening a position in SPY ~320. Target 330.

Though two weeks away, it is worth noting:

A July close of $SPX 3270 or higher would turn monthly MACD positive.

https://twitter.com/mark_ungewitter/status/1284090196082987009

I would bet on it. In fact, I am betting on it.

This market doesn’t want to go down.

I read an article that said because of the purging of a lot of weak businesses that when we do come out of this CoronaVirus Pandemic the economy is going to scream higher. It’s going to be a lean and mean recovery.

In other words, any earnings shortfalls in one company/ sector may be eclipsed by earnings increases in another.

Hydroxychloroquine might works:

https://twitter.com/gummibear737/status/1283840177497088001

Why can’t we figure this out? (one way or the other)

smh

Because it has been politicized, Allen. If the President suggests it, the democrats will say it doesn’t work even if they have to create false studies. However, the latest study shows it works if treatment is started early enough.

Sorry, I mean Allan.

Will the bulls be able to drive the SPX to a close above 3240?

Looks like we will see a dump.

I think they’ll blitz the index in the final 10-15 minutes – if I had to guess, the SPX closes ~3250.

Just got lucky there. I know NOTHING about daily gyrations of stock market.

The bull-bear tug of war continues next week. I’m not a technician, but it looks like three spinning tops in three days.