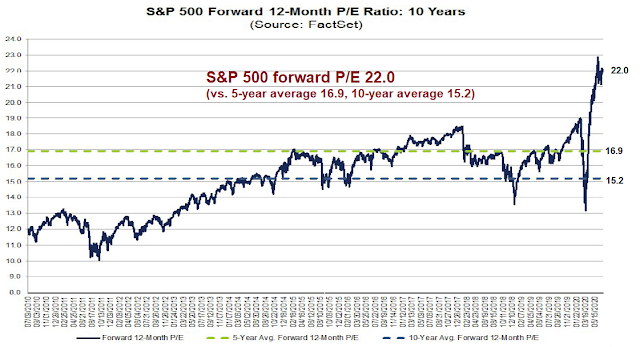

As Elon Musk passes Warren Buffett in net worth, it is time to sound one more warning about the market’s valuation. FactSet reported that the stock market is trading at a forward 12-month P/E of 22.0, which is well above its 5 and 10 year averages.

Here is why these circumstances are highly unusual.

The historical record

The following chart compares the forward P/E ratio to the Misery Index, which is the sum of the unemployment rate and inflation rate. In the past, P/E multiples have have been inversely correlated with the Misery Index. P/Es have weakened whenever the Misery Index rose to a local peak, usually because of the recessionary stress of rising unemployment. Today, the unemployment rate spike to levels only exceeded by the Great Depression, and the forward P/E rose instead of falling.

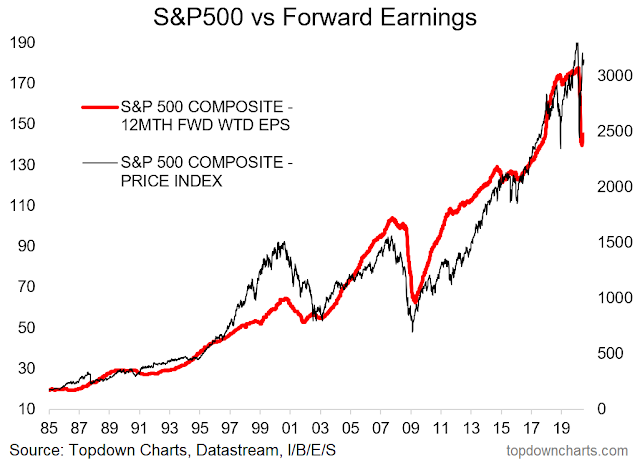

Earnings do matter. Callum Thomas presented a long-term perspective of stock prices and forward EPS. The only significant divergence that occurred between since the two series began in 1985 is today.

One explanation is US equity market leadership has been concentrated in a handful of large and profitable technology names. The stock market isn’t the economy, and the economy isn’t the stock market. Nevertheless. forward earnings are still highly correlated with business sales, which have tanked.

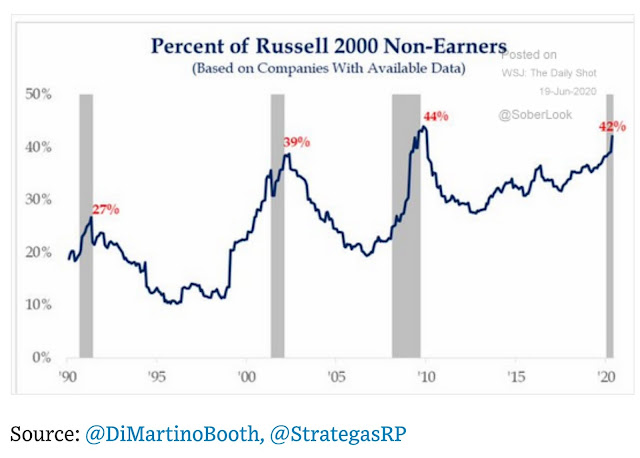

Stress levels are already evident in the especially vulnerable small cap stocks. 42% of the Russell 2000 are not profitable, which is a level consistent with recessionary conditions.

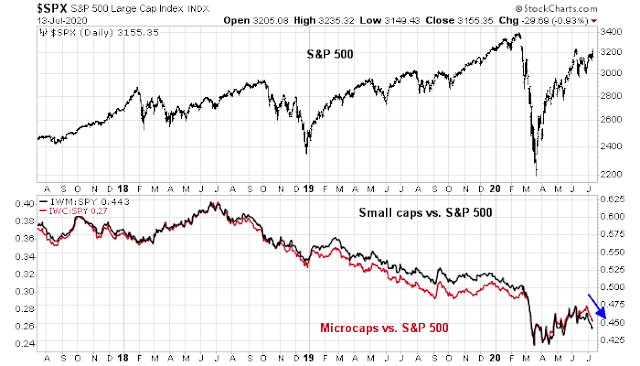

Is it any wonder why small caps are continuing to lag large caps?

Health care warnings

Can the development of a vaccine be cause to celebrate, in light of the recent hopeful news?

The economy may not be able to take much comfort in the development of a vaccine. The Guardian reported a UK (non-peer reviewed) study found that antibody protection fade rather quickly over time. This means that it man be difficult to achieve herd immunity. At best, vaccinations will require annual booster shots. At worst, they won’t provide much protection at all.

In the first longitudinal study of its kind, scientists analysed the immune response of more than 90 patients and healthcare workers at Guy’s and St Thomas’ NHS foundation trust and found levels of antibodies that can destroy the virus peaked about three weeks after the onset of symptoms then swiftly declined.

Blood tests revealed that while 60% of people marshalled a “potent” antibody response at the height of their battle with the virus, only 17% retained the same potency three months later. Antibody levels fell as much as 23-fold over the period. In some cases, they became undetectable.

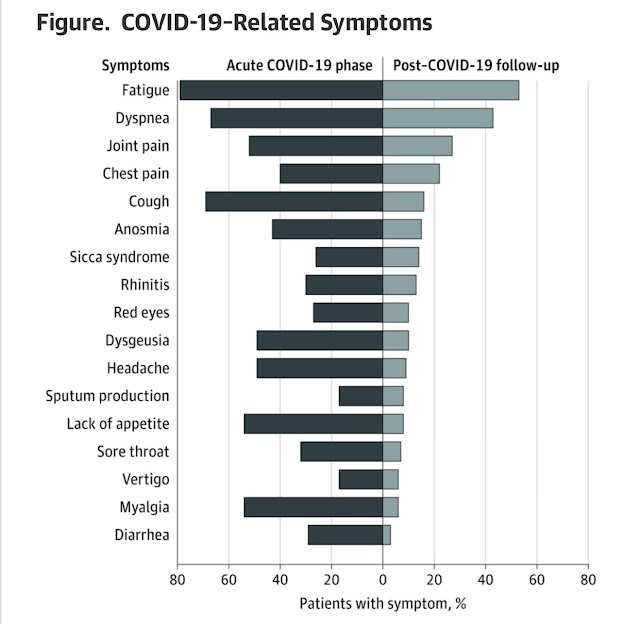

To be sure, some vaccines are not designed to prevent infection, but to mitigate symptoms once a patient is infected. An Italian study found that patients with post-COVID infections suffer symptoms two months after recovery. Only 13% had no symptoms after two months (ht George Pearkes).

If the results from these studies hold up, it implies that this virus will have a far more lasting impact on the growth outlook than consensus expectations. COVID-19 will have a long-term negative effect on productivity. Analysts will have to downgrade their growth and earnings expectations – with a corresponding downward revision in equity price targets.

It seems that some patients sadly get multiple symptoms and may not be as productive as they were previously, if at all. Do all patients have one or more symptoms post COVID-19? Or, majority do not have any of these symptoms?

Fed has clearly indicated that they will keep printing money. Especially in this election year. The excess liquidity as measured by (M2+etf+MF) in excess of money needed for growth is still very high. That should keep the markets afloat. Yes, there are periods of corrections. Also, if there is additional fiscal support which is politically popular, market should go up. Yardeni and others have given up on historical yardsticks with zero interest rates, very low inflation, Fed and fiscal support.

Cam,

I have noticed that you ignore the sensitivity of PE ratios to interest rates when presenting historical ratios. I once studied this relationship and have located the data compiled. While dated, I think the study is still instructive.

Defining Average Interest Rate as 1/3 of the combined rates of the T bill, 2yr and 10yr rates, the results as of July 2010 are :

AIR from 0 to 5, 4 qtr trailing P/E = 23.86

AIR from 5 to 10, 4 qtr trailing P/E = 19.44

AIR > than 10, 4 qtr trailing P/E = 9.35

With rates as low as they currently are I would expect higher (perhaps much higher) P/E ratios. While I list an AIR as 0 to 5, I can assure you I never studied rates anywhere near as low as they are now.

What you are referring to is a variant of the Fed Model, which compares forward E/P to the 10 year Treasury yield. This model worked well in backtest but failed when it was put into practice in the late 90s.

See charts here https://www.yardeni.com/pub/valuationfed.pdf

Cam,

Look at the fall in the S&P forward earnings yield shown in Fig. 1 from 2011 until the present. That seems to confirm what I point out in my post : one would expect higher P/E ratios as yields fall.

The yardeni paper just shows that the 10 year is not a great fit, not that the concept is in error.

Wes

There are other analysts who are in support of what you have said. That said, also consider low inflation that goes hand in hand with low interest rates. The low inflation is the key here (interest rates are subservient to inflation not the other way around). A low inflation environment with a supportive Fed can be a good environment for stocks (last decade was such an example).

I partially agree with your assessment, but that kind of empiricism only gets you so far. The Fed model says:

Equity Risk Premium = E/P – 10 year yield

That relationship is obviously flawed. What adjustment would you then use? You need some theory behind your model. Arm waving about P/Es and rates only gets you so far.

Maybe. But I will point out that one does not need to know how to play 3rd base to know when the 3rd baseman has made an error.

I repeat that with rates as low as they are currently I would expect higher (perhaps much higher) P/E ratios than we have had traditionally. Not being able to say how much higher does not make the statement less true.

Cam

It would help the rank and file members like me if you would write on ERP (historic and current ERP). This is important for all of us to understand. Thanks.

https://www.cnbc.com/2018/10/11/warren-buffett-on-why-interest-rates-matter-so-much-for-investing.html

Yeah, Net Present Value ftw

https://www.yahoo.com/news/virus-immunity-may-disappear-within-months-study-111110164.html

What the above tells you is that we are highly dependent on a vaccine.

D.V. that is very bad news if it means what us laymen think it means. But does it?

I don’t know how the immune system functions when we get down to the nitty gritty. Maybe this is normal for anti-bodies to disappear when there is no more virus to fight. But maybe now the immune system is trained how to create them in a hurry. Or are we supposed to have a high supply of anti-bodies in our blood forever once our system has eradicated a disease? It seems our blood would be nothing but anti-bodies if that were the case. I don’t know if that is how it works or not? Do you?

And then there is the life of a vaccine; does it produce anti-bodies and once they are gone we have no more defense? Or does it train out system how to create more anti-bodies quickly if we are infected? I just don’t know those answers and I don’t trust the authors of those articles to know or share that information with us.

A lot of vaccine candidates are using new, even unproven technology, the RNA vaccines, Adnovirus vector based, aduvants, to mount much higher antibody responses than natural infection as did the Pfizer one.

Lots more details that make another case of … the recovery, vaccine, LT changes… will play out much longer than people are thinking.

Thanks for that info, Allan.

My non-techncial persepective is this: Much of the market’s bouancy is based on hope: that the billions poured into accelerated work on vaccines and treatments will pay off handsomely in 2021, If the results are ho-hum forcing us to live with this virus as a persistent background cause of deaths and weakened immune systems, then the markets will adjust. By 2021 Fed and federal financial transfusions will loose their potency. This is when the ugly word, Reality, returns. Bob Millman

Well said.

I agree wit Ken, Robert. What you said is exactly what is going on with the markets.

Pay attention to execution, and forget the valuation. Read the biography of Jeff Bezos. Elon Musk is showing similar traits!!

“ Elon Musk passes Warren Buffett in net worth”

Elon is a genius, and one day this statement may prove to be justified. For now, this is the equivalent of the shoe shine boy trading stocks, or Pets.com.

Either that or one day Elon just totally blows up taking along with him those who believe he is a genius.

Healthy rotation into banks/ energy/ industrials.

Pfizer, BioNTech expect COVID-19 vaccine approval as early as December

‘New York City-based drugmaker Pfizer and BioNTech, the German biotech company it partnered with to develop a COVID-19 vaccine, estimate their vaccine could win regulatory approval as early as this December, according to a July 10 report from The Wall Street Journal.

The vaccine candidate, which uses messenger RNA, is entering phase 3 of testing at the end of July. Researchers plan to enroll 30,000 participants in the upcoming round of trials and complete testing by the end of the year.

BioNTech CEO Ugur Sahin, MD, told The Wall Street Journal the candidate’s success in early testing rounds makes him confident the vaccine will earn regulatory approval sooner than expected, as early as the end of this year.

“Our early data so far has shown that our vaccine candidate can produce antibodies at a higher level than those found in people who have recovered from a COVID-19 infection,” Dr. Sahin said.’

‘Pfizer and BioNTech are ready to produce hundreds of millions of doses before winning approval and could manufacture more than 1 billion doses by the end of 2021, according to Dr. Sahin.’

That’s good news, RX. I and my friends are really getting tired of this virus and the protocols we have to follow. Our summer is already ruined!

Several vaccines should be available about the same time, I think. I hope they work and work longer than a few months. This virus needs to be eradicated in humans.

Wally, I am getting tired of the mask police. Yesterday, I was in the hotel pool with my 6′ social distancing and just put down my drink. One hotel staff and another hotel guest was on my case about leaving my mask on to protect others. OMG! It was just seconds people and the temperature was 90 degrees.

Mark, those masks get hot in the summer. Besides, how do they expect you to drink your drink with the mask on? I did see one for sale somewhere with a hole for a straw! LOL

Anyone who didn’t sell yesterday or this morning isn’t about to sell now. Good chance the SPX breaches the ‘moat’ overnight and holds its gains into Wednesday’s close. JMO.

Looked like short covering by those who went short yesterday afternoon.

That too – although I think the short-covering will begin in earnest if/when banks start flying.

Financials lagged the S&P today

Understood. ‘If/when’ they start flying – which obviously hasn’t happened yet. Personally, I think they are about to take off – but I’m aware that my takes are often wrong. JPM did well, WFC was a disapointment. More banks/brokerages will report tomorrow. Sometimes it’s a delayed reaction – for whatever reason, I sense an imminent reversal in financials/ energy.

I think at least part of the problem with financials is the 1) brokerages are cutting their commissions to zero and 2) banks need higher interest rates to make any money. When are those two factors going to improve for them?

WFC is an island of its own. Let us see how far this premise is correct as remaining banks report later in the week.

Ask the questions if Financials, Energy, Discretionary stocks (excluding AMZN) and staples start to move, what happens to the indices. The market outside US tech is not that expensive!!

Maybe when everyone realizes these same brokerages are funneling the record amounts in cash/money-market funds to their prop desks who in turn are minting record returns on the rally no one believes in.

We may be seeing a further consolidation in the banking sector.

GS just bought FolioFn.

Schwab bought Ameritrade.

So, who says, WFC may not be broken down to pieces and sold?

We are seeing a consolidation in the retail sector.

We are likely to see a consolidation in the Energy sector also, sooner or later.

Maxim Integrated was bought out by Analog devices (not sure which other chip companies are there in the Analog sector).

Self driving cars may come in one of two flavors an Android/Google software driven or Tesla driven (the Apple of car world).

Ken, has already told us he favors chain restaurants over mom and pop places!

See what happens to the indices when such consolidation takes place?

Pence said the government will start manufacturing a vaccine by the end of this summer in anticipation of a vaccine approval this fall. That’s probably the main news that moved the market today.

https://www.marketwatch.com/story/moderna-stock-surges-17-on-coronavirus-vaccine-trial-news-2020-07-14?siteid=bnbh

It wouldn’t surprise me if the vaccine no one believes possible prior to the election – suddenly becomes muliple vaccines available several weeks before the election!

That would be good news but keep in mind that

1) Moderna uses a unique technology that makes vaccine production difficult to ramp

2) It takes a couple of months just to enroll enough people in a phase 3 trial. Then it’s going to take 6-12 months to get the full results because they need to monitor people for side effects, efficacy, etc. Assuming they get good preliminary results and get quick approval, would you want to beta test a vaccine?

This is a constructive step, but don’t get too excited just yet.

Never underestimate highly-motivated homo sapiens. A 2-month enrollment process can be condensed into 2 weeks. It’s not possible to speed up the production of antibodies, of course – but it is possible to speed up the sampling/ analytical process, the reporting of results, and the final decision-making process.

I made a bet once with a classmate in an East Asian Studies class at Michigan my sophomore year. The final exam would be in essay format – a list of questions would be handed out one day prior to the exam, with the caveat that only four of the eight would appear on the actual exam. The point being they wanted us to have some idea about what to focus on, but not have enough time to write responses ahead of time. The bet was that I would ace the exam while walking out of the lecture hall within twenty minutes. Of course, no one in their right mind would do what I did- but in order to win the bet (ie, high motivation) I spent the evening writing responses to all eight questions, memorized all of it, and then breezed through the four selected essays in 15 minutes the following day.

Life is full of similar anecdotes – for instance, the 100 lb Mom who manages to lift the front end of a two-ton sedan in order to free a trapped child.

I’m convinced that there are scientists/ researchers/ research assistants/ even the janitorial staff in companies like Moderna working 24 hours a day at extremely high levels of efficiency to make happen what needs to happen. JMO, of course.

Rxchen2, you are a super (wo)man! Kudos!!

More seriously, I believe the US is putting a Herculean effort behind developing this vaccine. This reminds me of the effort the US made in WW2 (memory of that time has started to elude me’ I am getting old! Lol!!, :-), :-))

Let us all watch this space, as American Science puts forth its best foot for the entire (wo)mankind. In the mean time, stay safe, please drink your Rhums and Whiskeys and enjoy company of wo(men), responsibly, by keeping social distance, and do not smoke another persons Cigar. Apologies to those who may think I am politically incorrect. I have tried to make a gender neutral narrative here. Lol. Cheers. It is five ‘O clock somewhere!

I wouldn’t be surprised if this was the biggest lab trial in our lifetime. To ascertain safety and long term effects, most trials last at least a year just to obtain data.

Be skeptical of pseudoscience and statistics, lots of snake oil salesman out there.

1. Vaccines generally take multiple years to develop. There are many dead ends along the way, is one reason why it may take so long.

2. Enrolling enough patients in a Phase 3 trial may take time (Phase 1-3), however in the current environment, we are likely to see rapid enrollment. This removes the hurdle of generating a sufficiently large number of “guinea pigs” which can cause delays.

3. The US government is providing money to several Pharma companies to develop a vaccine (Moderna I think got about 0.5 Billion). Moderna published their results today, in the apex New England Journal their Phase 1 trial, and they move on to Phase (2) 3, right away.

4. There are several other companies in the fray. One of you may post a list. This is not a pitch to promote Moderna or any other company for that matter. I am just using this one company as an example.

5. Immunity development takes time. A natural infection like Covid creates antibodies that appear not to stay around for more than say three months. This is emerging science but this is what we know as of today. This information is changing almost everyday. Vaccines on the other hand, may be given repeatedly, forcing your body to create a durable “memory” of an antigen. So, some of the childhood vaccines are given as three doses, to boost immune response. Shingles vaccine in adults is given two times to create an efficient immunity. It would appear that the Covid vaccine will need to be given multiple times, since one “exposure” is not enough to create a durable response (One exposure = A Covid positive person who is recovered).

6. There is no certainly that any of these attempts will be successful in creating a vaccine. That said, how would you value a company whose product will be used to be the entire (wo)mankind? As an example Bill Gates and company created a product that is used by say half the (wo)mankind.

7. Here is a website that lets you participate in a Phase 3 trial;

https://www.coronaviruspreventionnetwork.org

Exactly. Everyone involved in the effort realize it’s a once-in-a-lifetime give-it-all-have opportunity to make a real difference in the world. They’re not working 9-5 and turning it off when they leave. They’re bouncing ideas off each other or in their heads 24/7, adrenaline pumping the entire time. They’re in top form – the Beatles writing/rehearsing the Sgt. Pepper album/ Mark Spitz training for the ’72 Olympics/ Jack Kerouac writing ‘On The Road’ in three weeks. I think one or more of these companies will come through with a vaccine in record time.

Also don’t forget Challenger, and Operation Eagle Claw, the failed attempt to rescue the hostages in Iran in 1980. What happens when you take shortcuts and don’t dot the i’s and cross the t’s.

Two sides to every argument. In this case, taking the time to dot every i and cross every t results in x number of infections/ deaths per day of delay. Even the decision as to whether/when to release a vaccine can be more art than science.

RxChen2, I disagree with you.

Releasing a vaccine is not art. It is Science. American Science is pretty well grounded (for the more part), unless, of course, ill informed, ill educated managers are given the ability to make such decisions.

Just my 1 c.

Cam, this is a test of American science not American politicians!

Even the Challenger shuttle that failed, was a failure of American managers, not of American Engineers.

Cam,

American engineers were overruled by US managers, or so I understand. The engineers told the managers not to take the risk.

The mangers, chose to take the risk and killed astronauts.

Who do you really think is going to make the decision to approve a vaccine, especially so close to an election? The researchers?

Cam

Your point is well taken. I agree with you that the “current managers” will make the decisions. I shall await your insights in this regards, in the next few posts.

Again, thanks for helping us learn “how to fish”.

The (development of a) vaccine should be seen as a “Covid Put” option, similar to a Bernanke Put or Powell Put. Yes, Puts can cut both ways, no doubt about it.

One may buy the rumor and sell the news. For now, this is probably what we are seeing, no doubt about it. The Fed is complicit in it.

Cam, the US bought all Remedesvir supplies from Gilead.

https://www.bbc.com/news/world-us-canada-53254487

Though it is true that vaccine production may take time, the “infrastructure” around it will be built before conclusion of Phase three trials. Mass manufacturing will be ramped up very very quickly.

The grants US government has made to these companies will have “strings” attached to them, ensuring “first dibs’ at the vaccine for Americans. The virus is an existential threat to the entire mankind.

I am sure there will be trials that will fail along the say, creating a steep market pull back. Time will tell whether such dips should be bought into or not. I suspect such pull backs will be great entry points into the markets.

The QEs, PPPs (and XYZs) are mechanism to “buy time” and sure will be seen as politicization of the process (let us leave this thought right here).

Some of the companies in the fray to develop will be bought out, for a very handsome premium (?). Big Pharma is already sniffing out opportunities.

Please post investments made by big Pharma into smaller companies that are in the Covid vaccine race.

Cam, please continue to do the good work you do, so that humble students like me may continue to learn of the inner workings of the markets.

Just my 1 c.

https://www.yahoo.com/news/virus-immunity-may-disappear-within-months-study-111110164.html

https://www.yahoo.com/news/leading-antibody-expert-says-coronaviruses-132200359.html

https://medicalxpress.com/news/2020-06-immunity-covid-higher-shown.html

https://www.marketwatch.com/story/why-the-s-p-500-doesnt-underperform-despite-u-s-inability-to-contain-covid-19-11594759536?mod=home-page

If one were to be a contrarian, value and equal weighted indices may be the places to be!

RxChen2

I would disregard the Swedish paper for now. They have been completely off base in what they have been doing (never quarantined their population and are now paying the price, and apologizing, based on one Epidemiologists opinion).

The 200 people in the paper you quote seem all from Sweden, not exactly a representative population!

The experience of the rest of the world does not match that of Sweden. More specifically, what is being seen is that the immunity does not last (regardless of what the Swedes are saying).

Every path should be pursued. It’s often the one detail that is dismissed or disregarded that ultimately proves to be key in arriving at the solution. Maybe it’s the argument between an antibody guy and a T-cell guy that leads to a revelation neither one considered in ‘isolation.’

If the T-cell argument is a dead end, no worries. That in itself is valuable intel.

‘Most great people have attained their greatest success just one step beyond their greatest failure.’ – Napoleon Hill

It’s OK to be wrong, as long as it doesn’t stop researchers from continuing the search for an answer.

RxChen2

Good thoughts. It is not a T cell versus B cells. Both work in conjunction. pay attention to the bottom line, whether a vaccine works or not.

For now, “buy the rumor” is where we are!

What we are seeing is a challenge to American Science (not to the managers of American Science)!).

Ignore the rhetoric and pay attention to the science. Eventually, science wins, with or without the managers/politicians/ushers/cheer leaders.

Again, I repeat, focus on the science, and start posting. That is where the right track is!

Cam, will get it right, in the end.

There will be pullbacks along the way, as it is a tortuous path. Unsure how all of this will play out in time.

https://www.yahoo.com/news/absolutely-pelosi-willing-cancel-august-193750841.html

Yes, more stimulus is coming.

Would it lower the $ index? We shall wait to see what Cam reports on this.

https://twitter.com/JamesTodaroMD/status/1283152964732018690

to quote Sven Henrich, “Covid Vaccine is the new China Trade Deal”

https://twitter.com/mark_ungewitter/status/1283383704279285761/photo/1

I’ll go with the comments at that link, RX. Probably a thrust unless it isn’t. LOL

Making a U-turn and now officially bearish.

I plan to exit my buy-and-hold stance at market close. I think it’s partly driven by the fact that the global index (VT) has recovered to its June 10 high (just prior to the -7% plunge on June 11) – and I recall being pretty happy with the portfolio on June 10! I’m as prone as the next guy to sell at break even and why not recognize there will be many other traders with the same inclination? I think another pullback will be needed to launch the next leg higher.

50/50 odds we see another +2% before that happens.

A bearish position for me translates into 100% cash.

Hope it works for you. I wish today had been the day I turned officially bearish!!

RX2, I guess you are just expecting a short pullback (in single-digit), and then you expect the (new) bull market to continue upwards and onwards?

Hope it works for you. I wish today had been the day I turned officially bearish!!