Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

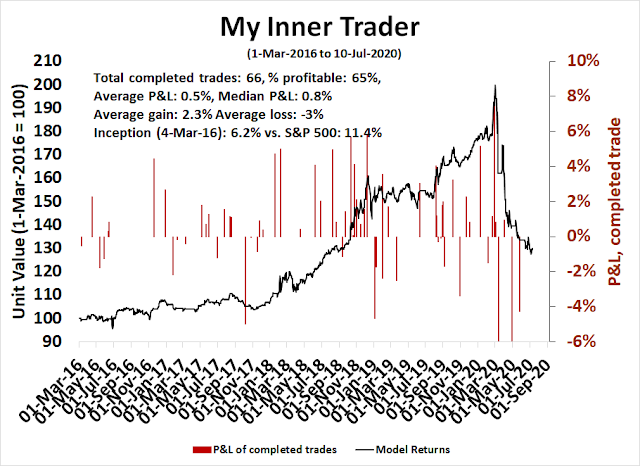

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities

- Trend Model signal: Neutral

- Trading model: Bearish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

A holding pattern

After several weeks of back-and-forth, the stock market remains in a range-bound holding pattern. A breakout or breakdown may be depending on upcoming news in the form of Q2 earnings season, and the resolution of negotiations in Congress over a second round of fiscal stimulus.

How will the headlines develop over the next couple of months? Will the narrative be an out-of-control pandemic, no or inadequate fiscal stimulus, an economic disaster, and skyrocketing bankruptcies; or will it be a vaccine by late 2020, renewed fiscal stimulus, and an economic revival in 2021? Long-dated implied option volatility and the SKEW Index, which measures the price of tail-risk hedge, are telling the story of mildly elevated risk, but there are no signs of outright panic,

Waiting for earnings season

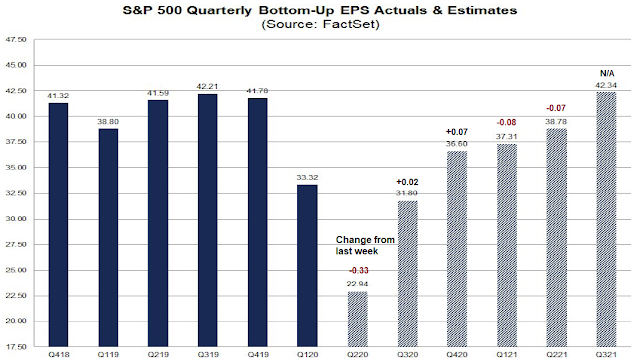

How far has the market discounted a slowdown as we approach Q2 earnings season? FactSet reported that forward 12-month EPS is rising, indicating positive fundamental momentum. On the other hand, the forward P/E is highly elevated at 22.0, indicating valuation risk.

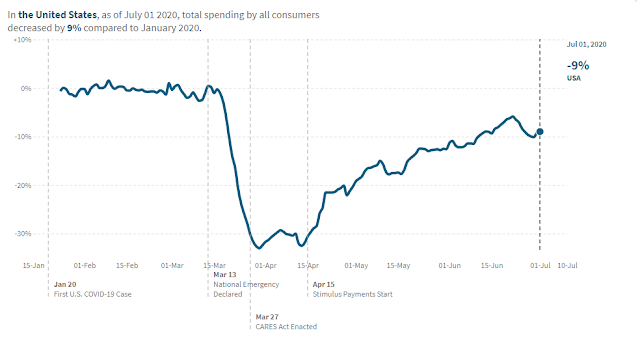

High frequency economic data from Tracktherecovery.org shows that consumer spending peaked out and began to retreat mid-June, followed by stabilization in late June and early July.

Chase card spending shows a similar pattern of flattening sales.

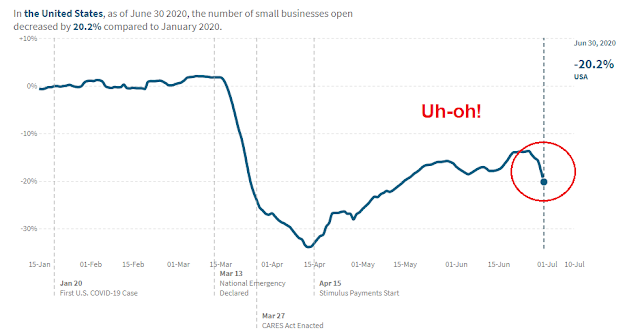

More worrisome is the health of small businesses, which peaked out in the same time frame, but saw no signs of stabilization. Instead, the number of open small businesses are plunging.

Much of the progress in reopening depends on the pandemic, and the news isn’t good. The COVID Tracking Project reported that case counts are skyrocketing. As expected, hospitalizations lag the new case count, and fatalities are turning up as they lag hospitalizations.

At its peak, New York reported 595 new cases per million on April 15. Arizona (580) and Louisiana (568) are nearing that figure. As the case counts surge, other states are likely to follow. This is what Dr. Anthony Fauci meant when he said that we are in the middle of the first wave, not the second, as the lagging regions catch up with Washington State, New York, and New Jersey. Fear is rising, and expect consumer sentiment to get worse before it gets better.

Back on Wall Street, a more detailed analysis of quarterly estimate revisions shows that the Street dramatically cut Q2 estimates last week, raised H2 estimates, and cut 2021 estimates. The lack of H2 downgrades indicates that consensus estimates have not fully incorporated the downdraft seen in the high frequency data.

Discounting a mild slowdown

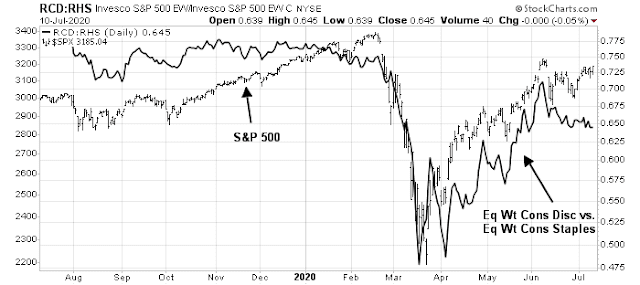

Real-time market signals are telling the story of a mild slowdown. I am seeing numerous signs of minor negative divergences, or warning flags but no outright sell signals. As an example, the relative performance of the equal-weighted consumer discretionary stocks to equal-weighted consumer staples is rolling over. (The indicator uses equal-weighted indices in order to minimize the massive weight of Amazon in the consumer discretionary sector). This rollover is a minor negative divergence and a sign of waning equity risk appetite.

Similar minor negative divergences can be seen in the credit markets. The relative price performance of high yield (junk) bonds and leveraged debt to their respective duration equivalent Treasures are also signs of reduced credit market risk appetite. More worrisome is the behavior of the 10-year Treasury yield, which tested and bounced off support last Friday. A violation of support would be a potential trigger for the risk-off trade.

Waiting for Washington

In addition to Q2 earnings season, there are two developments of importance to investors in the month of July. First, the deadline for filing income taxes is coming up on July 15. Historically, the stock market experiences brief weakness as taxpayers scramble for liquidity around the tax deadline date.

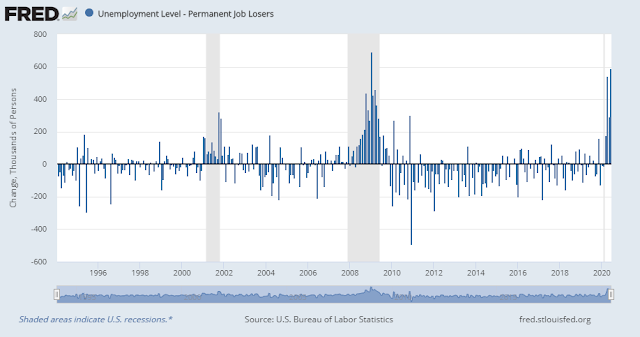

More importantly, the $600 CARES Act individual weekly payments expires on July 31, and there are no signs that the Democrats and Republicans have come to any agreement for another round of fiscal stimulus. Despite the better than expected June Employment Report, permanent job loss has spiked to recessionary levels. Notwithstanding the debate about whether additional support represents a disincentive to work, or a necessary or essential support for people, the macro outlook appears dire without a second round of fiscal stimulus.

The Payroll Protection Program (PPP) was not the best designed rescue package. You can’t really fault the drafters of the CARES Act. It was battlefield surgery, and battlefield surgery is imperfect. PPP is paying companies to artificially lower the unemployment rate, and now the media and politicians are bickering over the interpretation of the results. The focus is now over who received the loans, e.g. the aha! moment for the libertarian Ayn Rand Institute, and who is deserving of them. These details miss the big picture of the urgency of a second round of stimulus, without which the economy could enter a death spiral.

What about the Fed? Can’t the Fed step in and play a role? This NY Times account of the Fed’s troubled Main Street lending program which had little take-up from small and medium business borrowers is a cautionary tale of dysfunctional bickering bureaucratic institutions.

The central bank and the Treasury, which is providing money to cover any loans that go bad, spent months devising the program, negotiating over credit risk and vetting terms. Many officials within the Fed wanted to create a program that businesses would actually use, but some at Treasury saw the program as more of an absolute backstop for firms that were out of options. Steven Mnuchin, the Treasury secretary, has resisted taking on too much risk, saying at one point that he did not want to lose money on the programs as a base case.

What has emerged after three months, two overhauls and more than 2,000 comments filed with the Fed is a program that seems to be incapable of pleasing much of anyone.

The latest update from CNBC indicates that the Trump administration favors a reduced and targeted fiscal stimulus package.

As the end of July draws closer, tens of millions of Americans are set to lose the $600 a week in federal unemployment benefits meant to tide them over during the coronavirus pandemic. Though some lawmakers have suggested the benefits could be extended, they likely will not be as generous in the next stimulus package, according to Treasury Secretary Steve Mnuchin.

In the next stimulus package, the Trump administration wants to cap the benefits so that workers don’t receive more in unemployment than they did at their jobs, Mnuchin said Thursday on CNBC. With the extra $600 per week, an estimated two-thirds of displaced workers are eligible for benefits in excess of their normal wages, according to a recent paper from the National Bureau of Economic Research.

This means extended unemployment insurance, but at a lower $200-$300 level; another $600 style stimulus payment, also at a lower level; some state and local government aid; and some small business aid. Whether House Democrats can agree to such a package is anyone’s guess, as both sides will undoubtedly be jockeying for political advantage this close to an election.

As Congress grapples with what will be in the next relief package, CNBC reported that almost 32% of households missed their July housing payments, and eviction moratoriums are either set to expire or have expired about now. Tens of millions of households are facing an imminent income cliff.

The idea of creating incentives for people to return to work in the face of weak demand, or to force people to work in the face of a local pandemic wave will be disastrous health policy and further tank the economy. Congress has 10 legislative days left before households go over the income cliff. No pressure at all.

The week ahead

Looking to the week ahead, I continue to have a slight bearish bias. II sentiment has normalized, and readings have returned to levels just before the COVID Crash, which makes the market vulnerable to a downdraft.

The Citigroup Panic/Euphoria Model remains in euphoric territory, which is intermediate-term bearish but tells us nothing about the short run market outlook.

The NYSE Summation Index (NYSI) has rolled over from an overbought reading after bouncing from a deeply oversold condition in March. This is a rare condition that has occurred only three times in the last 20 years, and the market has weakened in two of the three. Even in the one episode in 2019 when stocks continued to advance, the index paused and pulled back briefly before resuming its advance.

Here is a close-up look at the relationship between the NYSI and S&P 500.

Let Q2 earnings season begin!

Disclosure: Long SPXU (daylight hours only)

By daylight hours only, I assume you are buying and selling SPXU daily during regular hours; hardly a realistic method of investing . Any record yet of results compared to holding overnight? A more accurate method of investing would involve more technical expertise versus continued fundamental analysis which obviously has not been working. Technical interpretation of the chart of SPXU does not warrant holding SPXU long and hasn’t for months.

For reasoning, see analysis at https://humblestudentofthemarkets.com/2020/07/08/my-inner-trader-returns-to-the-drawing-board/

A good question is “Why is overnight trading so powerful?”. It doesn’t have anywhere near the volume of the day trades. If the small overnighter traders say the S&P 500 index stocks should, as a group, open 1% lower or higher, what compels the individual stocks to do so?

At the market morning opening, the arbitragers must be pushing the individual shares to match the overnight index level.

Individual stocks also trade in the overnight market but only popular or news worthy ones trade significant volumes.

Seems to me this speaks of institutional investors simply indexing rather than having real valuation disciplines. I don’t blame them. The difference in performance between the FAANGs and the rest of the market is incredibly huge. FAANGs soaring to bubble valuations while the rest of the market shrinks in worry about the pandemic and old forgotten measures like earning. This is a schizophrenic market and money managers have stopped trying to guess how each part of the market will proceed.

Given that:

– the view of the administration that the stock market being up is positive towards reelection

– the futures market is “cheap” to move the indexes overnight

– the RobinHood effect of chasing the indexes during the day

it is easy to start seeing a conspiracy theory developing that the market is being manipulated by someone. I wonder who…..?

Does it matter whether the markets are manipulated? If it’s possible to manipulate prices, then it’s always been possible and I’m not going to be the guy who puts a stop to it. My only goal is to game the markets well enough to fund my retirement goals, and whether or not any conspiracies were involved in the process isn’t something I plan to waste time thinking about.

Yes it matters because then one i s no longer an investor, one is a gambler.

Then basics (P&L, EPS, reliable business model, etc.) don’t matter any more and stock values become whatever the manipulators want. Go to Las Vegas. At least there you can figure out the odds.

Well, I think most of us feel that the market going up makes no sense, but markets can be irrational and stay that way longer than one would think.

The trend followers may keep pushing up if the trend looks that way, but there has been a ton of damage to small businesses, and even if they reopen, will they survive? Will zombie companies be hiring or spending on Capex?

How will we get wage growth if there are so many who stay unemployed?

The S&P could go much higher, but I think that eventually it will be much lower, only what is the time frame?

The best financial move at this time is to refi your mortgage if you have one. Lock in a 30 year at 2.7 percent. That lenders will lend at such low rates when so many are not making payments is also irrational, but it is what it is.

Yes, small businesses are suffering and many will not reopen but a big company will take advantage of that.

Take Olive Garden for example. Many Italian restaurants won’t reopen. In fact my favorite in my city won’t. Suddenly, Olive Garden has much less competition.

Recently, I went on a day trip to a tourist lake resort. Night one we went to a large chain family restaurant. The servers all had masks and anti-Covid cleanliness was everywhere. The next night, we went to a small privately-owned restaurant. Servers had no masks and the establishment was laid-back on anti-Covid measures. I’m of an age that is paranoid, rightfully about the pandemic and I will stick with bigger restaurants with company-wide strict Covid programs.

Hell, I might go to Denny’s for the first time in forever. LOL

Not just in food, larger companies in all industries that survive will take the business of those that don’t. Maybe the 500 in the S&P Index are doing well as people understand that.

Due to slippage and turnover costs, it doesn’t seem reasonable to only trade SPXU during daylight hours. Those frictional costs will add up enormously over time. I get you don’t want to hold it overnight but the costs of not holding it overnight can offset the benefit.

My impression from watching the overnight markets for the last 6 months or so is that you get a big move at night but often during the day there is no follow through. Look at SPY vs ESmini, and GLD vs /GC.

Nasty.

I am doing position trades, not holding for long, and if I am lucky and get a good day trade, I get out. If it looks like I should hold, then I do…but not for long…simple rule is, “if it goes your way take your gain, if it diddles around, get out” I don’t trust this market.

Thanks Cam for the insightful update.

Texas continues to deteriorate. Wearing a mask and social distancing has somehow turned into a political issue. Despite the governor’s order to wear a mask, I still see quite a few people not wearing them.

Stay safe and be careful out there.

Reference:

https://www.tmc.edu/coronavirus-updates/total-tmc-covid-19-positive-patients-in-icu-beds/

https://cbsaustin.com/news/local/timing-couldnt-be-worse-as-austin-businesses-are-asked-to-reduce-capacity-to-25-percent

https://www.nbcdfw.com/news/local/texas-news/san-antonio-patient-dies-after-attending-covid-party-doctor-says/2404937/

https://austin.maps.arcgis.com/apps/opsdashboard/index.html#/0ad7fa50ba504e73be9945ec2a7841cb

https://www.houstonchronicle.com/news/houston-texas/houston/article/Record-number-of-COVID-19-patients-hospitalized-15400914.php

Alex and everyone in a hot zone, be safe. Be paranoid. Covid 19 is a devious, dangerous enemy that keeps spreading by infecting the self confident.

I am paranoid. My wife has her office on a covid ward…nice huh? Personally I would boycott establishments that don’t respect the threat of covid. There are enough of us, you’d think they would get the message. Any place that does not take covid seriously does not deserve to stay in business.

Bakersfield is exploding with covid but people still ignore the signs that say masks are mandated in the stores. I get practice at anger management…still failing miserably….these.people should be shunned.

Why you can get a dui citation because it endangers others, but not wearing a mask when the government mandates endangers others, only no citation. These people should be dragged out back to the woodshed…see, I fail again lol.

Even the constitution in the preamble mentions promoting the general welfare…but yeah, who cares?

I’m going to take you up on that twist thing, thanks

Now a thought about markets. The next month of earnings announcements will be make or break time. Are we in a bull market? Or finishing a bear market rally with a deep dive ahead?

I construct and track two factor-based indexes within each index (general indexes or industry). I call them Vulnerable and Sturdy. Vulnerable is made up of economically and investor sentiment sensitive stocks. It swings aggressively up and down. It also marks low points with what I call a Twist which is when after a big decline, the Vulnerable Index on a given day leaps up statistically much more the the Sturdy Index.

The Vulnerable had a huge run higher and peaked on June 8th. Since then it has fallen back a very long way. I expect this is because companies in it will have nasty earnings reports. But let’s say that over the earnings reporting period, investors stop worrying about today’s earnings and look out to 2021 or 2022. This could cause a Twist that could kick-off a new big upleg in stock markets.

On the other hand, the companies in the Vulnerable Index might just keep going down, leading market indexes lower. They are the companies that will feel the economic stress the most.

If you want me to send you a notice of a Twist event, just email me at tacticalfactorresearch.com

Ken,

Thank you so much for the invite to Tactical Factor research. I created the account. Thanks again for all your help with your commentary over the years and now for providing your research via the new site.

Sincerely,

–Mohit

Thanks Ken, I sent you an email

As always Joyce is right the market is rigged by guess who ?

FAANG earnings are what are going to matter. The rest not so much.

If these companies deliver not so bad results, indices may keep going higher (!).

AMZN usually loses 10% after earnings, only to regain that loss and power higher in the next few weeks, providing an entry point. The digital revolution is likely to power higher, no question about it.

Old line stocks (Banks, Oil, Restaurants, Consumer staples, well, we already know what is in store for them).

As I write this, S&P futures are up 16 points to 3195. This is how indices trade, before the cash markets open at 9-30 AM EST.

https://www.yahoo.com/huffpost/morgue-trucks-covid-19-phoenix-texas-counties-012258256.html

As reality of death sets in, stocks continue to rally. We shall await actual numbers.

https://www.schwab.com/resource-center/insights/content/what-covid-19-second-wave-means-investors

See last but one graph. Market is tracking deaths not number of cases.

Please stay safe friends. Take all precautions and protect yourself. Take care.

From my perspective, there is an element of group think in the prevailing opinion that markets have become irrational. I don’t think so. The markets are doing what they’ve always done – confound the majority of pundits who insist that their own opinions hold more weight. Is today’s market really any different (or any more irrational) than last year’s or any other given year?

I’m still seeing articles in my Google news feed about the market dropping 40% or the coming housing crash. On one hand, I understand all the rationale behind it, but on the other, market hasn’t sold off despite all the bad news.

I’m still in cash in my LT accounts. For day trades (flat at close), most of my positions have been long during RH.

Without being rude to Cam who I respect for his analytical skills and for being more right than wrong, he has taught us an important lesson in a perverse way:

1. Never follow any analyst blindly.

2. Always use stops and if you do, do not change them to give more “room” because you think you are right and the market is wrong.

3. 1000 indicators may say that the market is going up or down but the final arbitrator is price. Unless price breaks an important support or resistance the trend is what it is i.e.up or down. The choice is yours either to buy, sell or have no position.

https://www.washingtonpost.com/opinions/the-stock-market-and-economy-have-parted-ways-its-a-fomo-market-now/2020/07/12/c14246d8-c2bf-11ea-b4f6-cb39cd8940fb_story.html

Exactly the kind of headline I want to see right now:

https://www.marketwatch.com/story/sp-500-earnings-set-to-plunge-as-the-coronavirus-batters-all-sectors-with-wall-street-counting-on-a-bounce-that-may-not-come-2020-07-11?mod=mw_latestnews

Everyone knows that Q2 earnings is going to be awful. The bigger question is what guidance companies can give for Q3 and Q4.

Rajiv, you are right as far as being rude to Cam here. I think we all need to give Cam a little more respect. I know I’ve not exactly praised him over political views but when it comes to the market Cam, as far as I’m concerned, is miles ahead of other analysts.

Some times the markets become irrational with regard to fundamental and even technical considerations. We are in one of those periods now. Do we want Cam to abandon his tried and true analysis and just tell us to go long with this trend? I know I want Cam to stick to his guns and not to deviate from what has worked for years over a few months of pandemic related irrational market moves.

So, let’s lighten up on Cam and stop with the “What Have You Done for Me Today” attitude. I’m not disrespecting any other posters here either. I consider every one of you a friend. I’m just saying lets hold our criticism a bit of what Cam is telling us and give him a little of the respect he deserves.

Cam was quite clear that his right brain had signaled the potential for a melt-up. He always presents both sides of each trade, and ultimately needs to make a decision. The decisions end up being right most of the time – by definition, that means he’ll be wrong some of the time.

Cam, suggest you read this re: trying to only trade during the daytime:

https://alphaarchitect.com/2020/06/16/trading-costs-wipe-out-the-overnight-return-anomaly/

I recognize the problems of trading costs. That’s why I wrote there are two alternatives, either step aside in cash, or try and trade this way during the day with the caveats about trading costs and slippage.

If I was misconstrued about Cam then I apologize. I think the statement that I made was to help us become better traders/investors. The point was that nobody is infallible hence the discipline to use stops and price as the ultimate indicator of trends.

When you have a good handle on the trend, you don’t really have to worry about trading cost or drawdowns very much. The following chart is a buy on close, sell open using TQQQ (this is an example and I am not advocating that anyone should trade this leverage ETF) showing 49 trades in 15 months with a 5.15 Profit factor and 77.5% win rate and more importantly a maximum drawdown of 3.4% of initial equity https://ibb.co/C9cdH1v . It is hard to argue against an equity curve like that shown given the maximum drawdown . Notice that the strategy stopped trading on the long side when it recognized the trend change solely based on relative strength. This is a 3 data strategy variation on the relative strength idea of Appel and Hannah which I posted the code earlier in a thread that began a few days ago. The posted strategy code only has a few lines to it and studied two instruments but is enough to get you started. I am not selling anything here, just showing readers what is possible. The text to the Tradestation Easylanguage code is here https://textuploader.com/1gnik The code also include a switch to allow taking a sellshort trade position when the user switched the ‘Overnight’ input to ‘false’ which makes the strategy a swing trading system. Traders are forewarned: trends and relative strengths, like all good things they eventually come to an end, so don’t expect any trading system to last forever.

Rebalance feel to today’s market. DJIA/ banks/ industrials/ energy outperformed Nasday/tech.

From Briefing.com:

Several factors have contributed to the pullback action:

The release of the June Treasury Budget at 14:00 ET, which revealed a gaping $864.1 billion deficit

A joint announcement from the Los Angeles and San Diego Unified School Districts that classes for the 2020-2021 academic year will begin in an online-only format

The inability to maintain a posture above the June 8 closing high (3232.39) on a breakout try

A report in The Wall Street Journal that the U.S. plans to oppose certain Chinese territorial claims in the South China Sea

A material pullback in Tesla

RX, I think your third point was the star of the show. Everything else were just supporting cast members.