Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities

- Trend Model signal: Neutral

- Trading model: Bearish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

Island reversal signal intact

A little over a week ago, the market traced out a bearish island reversal formation after violating a rising trend line. While the bullish island reversal signal in April saw the market advance immediately afterwards, the aftermath of the most recent signal resolved itself in a sideways consolidation, indicating that the bulls still had some life left in them, and they were struggling to maintain control of the tape.

Nevertheless, market internals revealed a number of bearish setups, with no obvious trigger. As an example, there is a divergence between the VIX Index and VVIX, which is the volatility of the VIX. I interpret this to mean that VVIX is not buying the recent fall in the VIX, and it is discounting an increase in volatility, which tends to be inversely correlated with stock prices.

Bearish setups

I can cite a number of other bearish setups, or divergences. The advance off the March bottom had been led by cyclical stocks. Indeed the relative performance of cyclical to defensive stocks had been rising steadily. The cyclical to defensive ratio rolled over even as the market tried to rally and trade sideways last week, which is a negative divergence.

A similar relationship can be seen in the ratio of equal-weighted consumer discretionary stocks, which I use to minimize the sizable weight of Amazon in the cap weighted consumer discretionary sector, to equal-weight consumer staples stocks. This ratio has long been used as a risk appetite indicator. The equal-weighted discretionary to staples ratio rolled over and continued to fall even as stocks consolidated sideways last week, which is another negative divergence.

There have been a number of warnings sounded about the extended nature of the put/call ratio, indicating crowded long positioning. These words of caution from SentimenTrader is just one of several examples.

There is also an ominous divergence between the equity-only put/call ratio (CPCE) and the index put/call ratio (CPCI). It is commonly believed that CPCE measures retail sentiment, as retail traders focus mainly on options on individual stocks, while CPCI measures dealers and institutions sentiment because they use those instruments for hedging purposes. The CPCE-CPCI spread has reached an extreme, and, if history is any guide, such episodes tend to resolve themselves bearishly.

That said, these divergences can only be regarded as bearish setups. Last week’s sideways market action was a signal that the bulls were not fully defeated. The bears need a trigger before they can seize control of the tape.

Don’t blame the Fed

So what might be a bearish trigger? First, I would not look to the Fed for a durable excuse for the stock market to rise or fall.

Consider the market reaction on June 11, 2020, the day after the FOMC meeting. The financial press reported that market skidded -6% because the Fed’s economic outlook was insufficiently upbeat. On the other hand, Jerome Powell made it clear in the post meeting press conference that the Fed was not concerned about the level of stock prices, and it was focused primarily on reviving the job market [emphasis added].

MICHAEL MCKEE. Mr. Chairman, Michael McKee with Bloomberg Television and Radio. I came across a statistic the other day that amazed me. Since your March 23rd emergency announcement, every single stock in the S and P 500 has delivered positive returns. I’m wondering, given the levels of the market right now, whether you or your colleagues feel there is a possible bubble blowing that could pop and setback the recovery significantly, or that we might see capital misallocation that will leave us worse off when this is over?

CHAIR POWELL. What we’ve targeted is broader financial conditions. If you go back to the end of February and early March, you had basically the world markets realized at just about the same time, I remember that Monday, that there was going to be a global pandemic and that this possibility that it would be contained in one province in China, for all practical purposes, was not going to happen. It all — it was — you know, it was Iran, Italy, Korea, and then it became clear in markets. From that point forward investors everywhere in the world for a period of weeks wanted to sell everything that wasn’t cash or a — a short term treasury instrument. They didn’t want to have any risk at all. And so, what happened is markets stopped working. They stopped working and companies couldn’t — couldn’t borrow, they couldn’t roll over their debt. People couldn’t borrow. So, that’s — that’s the kind of situation that can be fair — financial turbulence and malfunction. A financial system that’s not working can greatly amplify the negative effects of what was clearly going to be a major economic shock. So, what our tools were — were put to work to do was to restore the markets to function. And I think, you know, some of that has really happened, as I — as I mentioned in my opening remarks, and that’s a good thing. So, we — we’re not looking to achieve a particular level of any asset price. What we want is investors to be pricing in risk, like markets are supposed to do. Borrowers are borrowing, lenders are lending. We want the markets to be working. And again, we’re not looking to — to a particular level. I think our — our principal focus though is on the — on the state of the economy and on the labor market and on inflation. Now inflation, of course, is — is low, and we think it’s very likely to remain low for some time below our target. So, really, it’s about getting the labor market back and getting it in shape, that’s — that’s been our major focus.

It’s difficult to see how much more dovish Powell could have been, but the market cratered on Thursday/

By contrast, the market rallied on Monday when the Fed announced that, in addition to buying corporate bond ETFs, it planned to create an index of corporate bonds and buy the individual issues. Stock prices rallied on the announcement, even though the Fed had already announced that it would buy individual bonds several weeks ago.

Did any of that market reaction make sense? Be wary of attributing market moves to the Fed.

That said, the Fed is scheduled to publish the results of bank stress tests next week. The NY Times reported that while it will publish a system-wide report card under different stress scenarios, individual bank results will not be part of the disclosure.

The central bank’s vice chair for supervision, Randal K. Quarles, said the Fed would determine capital requirements — essentially the financial cushions that banks must keep to withstand losses — based on economic scenarios developed before the pandemic took hold. While the Fed is testing the strength of banks against multiple dire scenarios that reflect how the virus might play out, the central bank will not publish bank-specific results.

“We don’t know about the pace of reopening, how consumers will behave or the prospects for a new round of containment,” Mr. Quarles said. “There’s probably never been more uncertainty about the economic outlook.”

Powell has warned about what delayed bankruptcies could mean for bank balance sheets. The Fed’s lack of transparency on individual bank stress tests may mean there are hidden fault lines in the system. In the past, breaches of relative support of bank and regional bank stocks have signaled market dislocations. How bad will things be this time, and why is the Fed not telling us?

A second wave

The market has shown itself to still be sensitive to COVID-19 news. As an example, stock prices gapped up at the open on Friday by about 1%, but it sold off dramatically when Apple announced it was closing selected stores in Arizona, Florida, and the Carolinas over COVID-19 concerns.

Confirmed new case counts are spiking again, especially in the south and southwest. In particular, new case counts reached all-time highs in Arizona, California, Florida, and North and South Carolina.

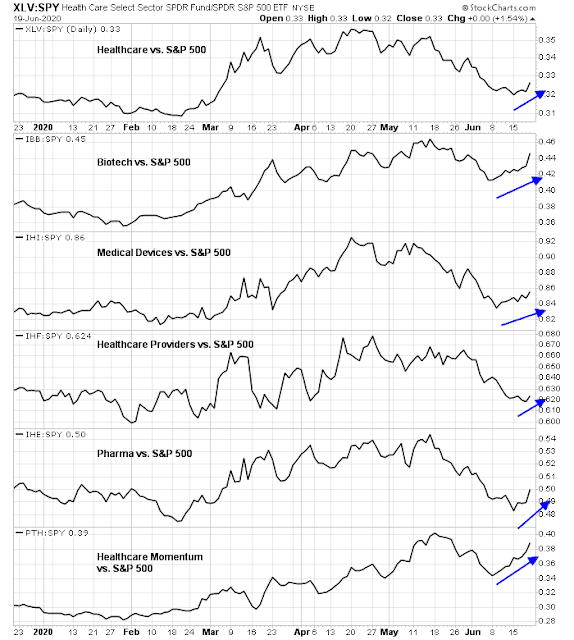

The relative performance of healthcare stocks have begun to perk up again, possibly in response to heightened COVID-19 concerns. After lagging the market for several weeks, these stocks have begun to revive and lead the market again. The only laggard in the sector are healthcare providers, which probably reflects investor concerns about hospital profitability during the pandemic.

Q2 earnings season surprise?

Another possible negative trigger may come from reports from Q2 earnings season. FactSet reported that earnings estimates are rising again, even though prices and estimates had diverged in a major way since the crisis began.

The latest weekly update showed some an unusual estimate revision pattern. Analysts are becoming more optimistic this year, while less optimistic next year. The chart below shows the current level of quarterly estimates, plus the weekly revisions for each quarter. The Street has revised near-term estimates upwards, especially for Q2 and Q3, while longer term estimates in 2021 are flat to down.

The revival of near-term optimism is setting up the potential for disappointment. As the economy begins to reopen again, corporate guidance may turn to the increased cost structure that companies have to face in the new environment. As an example, Bloomberg reported that a Deloitte Consulting study concluded that the money banks will have to spend as much as 50% more for each employee to work in their office towers in the post covid-era.

As well, CNBC reported that retailers will have to compete with the liquidation sales of competitors.

Going-out-of-business sales are getting ready to be, well, basically everywhere this summer.

Retailers that have been forced shut for weeks because of the coronavirus pandemic are beginning to reopen their doors as cities such as New York reopen. That means liquidation sales that had been upended by the pandemic are starting again, or just getting ready to kick off. And that will be added to the usual seasonal sales by retailers looking to get rid of old inventory.

“I have never seen so many [liquidations] happening at the same time, ever,” said Scott Carpenter, president of retail solutions in B. Riley Financial’s Great American Group. “It’s one after another, after another, after another. And there’s more to come.”

Lastly, Biden has been steadily gaining on Trump, both in the polls and the betting markets.

Biden has promised to reverse the Trump 2017 corporate tax cuts, which would subtract about $10 from 2021 S&P 500 earnings. The strategy team at Goldman Sachs estimates an additional negative secondary order effect of $10, which reduces earnings by a total $20. To be sure, I made the point that there will be offsetting positive earnings effects as Biden’s anti-inequality proposals broaden out consumer spending (see What will a Biden Presidency look like?), but the market is likely to shoot first and ask questions later by focusing on the negatives.

The market’s P/E ratio based on 2021 earnings is already very elevated. How would it react if it begins to discount a Biden victory?

Waiting for the downside break

Looking to the week ahead, the market is in wait-and-see mode. Short-term breadth has recovered from a deeply oversold reading, and it could go either one of two ways. The pattern is reminiscent of the pattern in March when the market staged a brief relief rally before plunging further, or it could resolve with a sideways consolidation as it did last August.

The Fed’s balance sheet surprisingly shrank last week, and the shrinkage was attributable to reduced swap lines with other central banks, and lower liquidity demand for repos from the banking system. The Fed’s QE asset purchase program remains intact.

While the reduction in dollar swap lines is an indication of falling offshore dollar funding stress, the USD Index did catch a bid last week, and EM currencies weakened. Further greenback strength and conversely EM weakness could be the proverbial canaries in the coalmine that puts downward pressure on risk appetite.

However, the S&P 500 remains in a rising channel, and until we see a breakdown, it would be premature to be wildly bearish. My inner investor is neutrally positioned at roughly the levels specified by his investment policy statement. My inner trader is short, but positioning is light.

Disclosure: Long SPXU

Worth a listen: Prof. Jeremy Siegel on excess reserves , M1/M2, and how they will power a new bull market and drive inflation. https://podcasts.apple.com/us/podcast/masters-in-business/id730188152?i=1000478723627

Being bearish is the ‘easy’ stance – the reasons are clear. Being bullish is the ‘hard’ trade – there are no clear reasons to be bullish.

So almost everyone is ‘waiting for the downside break.’ But as someone here pointed out a few weeks ago, the bears are in fact frustrated bulls – they’re waiting for prices to revisit the March lows for another shot at the rally they’ve missed.

This bull market is doing what it’s supposed to do – it’s climbing a wall of worry. The pullbacks along the way? Price discovery, backing and filling, consolidation – all part and parcel of every bull trend.

VIX vs VVIX divergence: After a surge in VIX the VVIX should also respond. If there is a divergence, the ratio $VIX/$VVIX would show it up, but after the transient effect there is no divergence for the last 4 days. (A slip of the pen?)

What I find more interesting is that the VIXM (medium term VIX) is not dropping. Surely this tells us about market expectations?

https://www.marketwatch.com/story/the-markets-in-la-la-land-and-one-warren-buffett-buff-warns-of-an-imminent-reckoning-for-oblivious-investors-2020-06-18?mod=home-page

Typical Marketwatch headline. It’s not a warning from Warren Buffett, it’s a warning from a fan of Warren Buffett who claims to have learned the ropes by reading a stack of Berkshire Hathaway letters to shareholders. Is this really headline news?

Marketwatch is a very dangerous place for inexperienced market participants. It looks glossy and somewhat legitimate, but in reality is bogus and in fact a financial tabloid. It is worse than Cramer’s program. Cramer’s program is obviously peddling snake oil. Even the most naive of investors can see that. So people think of it as a financial comedy show. No harm caused, and Cramer made his money by providing a value-added service.

It’s a dangerous place even for experienced market participants. Almost any news story has the ability to influence our outlook – I make it a habit to always consider alternative viewpoints.

Update from Texas, local mayor is predicting that another shutdown may happen in about four weeks from now. The infection rate has increased 40% since Friday 6/19.

Precautions for stemming infections is not being observed in many instances, such as social distancing, avoiding large public gatherings greater than 10 people, and wearing a mask.

References:

https://www.statesman.com/news/20200620/2-downtown-bars-lose-alcohol-permits-for-defying-coronavirus-rules

https://www.statesman.com/news/20200620/travis-county-sets-another-daily-record-in-new-coronavirus-cases-418

https://austin.maps.arcgis.com/apps/opsdashboard/index.html#/39e4f8d4acb0433baae6d15a931fa984

https://www.austintexas.gov/page/covid-19-risk-based-guidelines

Everyone’s seen the employment numbers by now. My own employer and customers are starting to talk more freely about the economic impact in our meetings. Sales pipeline for 2020 is still strong, but our customers are laying off employees en masse – some cases in the hundreds per day as of last week. There is strong concern that business will decline significantly come post election. Mitigation for revenue loss is heavily focused on government bailout funds that are just now coming into federal, state, and city budgets which many competitors are also vying. Many sales departments that use to have accounts in small businesses no longer exist. I don’t think the jobs impact will be fully realized this quarter or the next. We’re also pitching a lot of refinancing deals (as is everyone else), but the uptake has not been high because most budgets have been frozen or delayed due to uncertainty beyond end of year.

As for the market, I don’t think the market will stop rallying until a tipping point is reached where liquidity from the Fed or confidence in the Fed will no longer be enough to instill confidence. I think this point will be reached before the election in November, possibly as soon as next month if a wave of shutdowns are initiated in major cities.

Here is a possible trigger similar to Lehman in 2008. Wirecard is a German global payments company that was a huge success story until this week when auditors refused to sign off on their financials. Seems $2 billion is missing and the CEO just resigned on Friday. This large company is in the German DAX 60 Index replacing Commerzbank. The story is huge in Europe but Trump’s upcoming rally, the rising U.S. pandemic numbers and BLM protests kept the story in the background in North America.

The stock has fallen from 157 Euros last year to 26 on Friday. Even scarier, it was 100 on Thursday so it fell 75% on Friday alone.

Here is a news link. Cam, is this a big enough trigger?

https://www.nytimes.com/2020/06/19/business/wirecard-scandal.html

It’s a problem for Wirecard, which expects to earn EUR 1 billion this year.

Not so sure it’s that big a problem for the DAX.

I recall the London Whale lost $6.2 billion for JPM eight years ago – but JPM earned >$20 billion that year.

Someone correct me if I’m wrong, but my impression is that the “everything’s just fine, don’t fade the Fed” crowd is not relying on just actions already taken by the Fed but also relying on future moves they anticipate the Fed will need to take. I have no problem with this view of the future, but I’ll point out that the reason for the further action will likely be unfavorable to the economy (and stocks) in order to prompt the action.

I’m suggesting that there should be a better time in the future to buy than the present, given this mindset.

Here’s the thing. Stop for a moment and ask yourself if you’ve seriously considered the possibility that the global economy has now begun a sustainable recovery free of further shocks. To me, that’s what the market seems to be ‘saying.’ I absolutely understand the skepticism. But what if the ‘everything is fine, don’t fight the Fed crowd’ is actually betting that things will turn out fine without any future interventions? Are we that cynical/ jaded to automatically assume it’s naive to trust the Fed? What if the Fed got it right?

Imagine if the Fed, the ECB and other central banks declared that the recovery is self sustaining and it’s time to start withdrawing stimulus. What happens to the global economy and how does the market react?

I think that’s one reason they’ll refrain from saying anything until it becomes self-evident. Right now, they don’t know and we don’t know. Whether the market knows is open to question – but if we’re trading the market then we must respect its price movements above our own opinions.

RX, the problem I always see with your analysis is that you will only trade from the long side and so you analysis is always bullish to support your desired position. On one hand, the Fed IS pumping $55 billion weekly into markets infinitum. But on the other hand, Covid is increasing and there are other severe economic problems in our path.

The bottom line is that this is an election year. The Fed will not let the markets crash and will lend support before any potential economic disaster. Therefore, the markets are at a stand-off until after November.

Wally- I’m not always bullish, not by a long shot. I’m just averse to shorting. I was quite bearish in March and April – don’t recall exactly when I turned bullish; it was more of a gradual transition.

Wally

RxChen is right. Somewhere along the line, (s)he started to see the logic of buy the dips and hold long term portfolio positions, without selling. The huge countertrend rally from Marc 23rd, was opposite of what may professionals expected, which was a game changer for RxChen.

RxChen has also indicated a portion of portfolio as being dedicated to trading, or so it appears to me.

As an aside, last nights flush out in the futures markets and bounce off from 3027, after the somewhat unexpected drop on Friday pm, was instructive. It was an instruction not to sell Futures long positions in what seemed like some kind of forced volatility, that one would expect would subside. The downside volatility did subside and we are up about 60 points from yesterdays bottom. The game starts again this AM!

Right, thanks Ravindra (it’s safe to use ‘he’).

The transition process was at first anticipatory (ie, it’s generally correct to expect a retest of the low), followed by a reactionary shift to bullish as the continued climb in markets forced me to reconsider the evidence.

RX, I’m not trying to refute your comment but I recall you saying recently that you only play the long side. And I remember you going long after the first big drop in the indexes just as they were about to take another big leg down. But I’ll take your word that you not a perma-bull.

Wally- You are correct in saying that I only play the long side. However, that doesn’t make one a permabull. When I turn bullish, I refrain from shorting – but I will move to 100% cash +/- bonds +/- an occasional foray into precious metals (usually just cash). So I would say that a bearish stance for me simply means cutting exposure to equities.

I understand, RX. I was only trying to point out that your analysis is somewhat long biased because that is the direction you trade. I didn’t mean to imply that you don’t turn bearish and go to cash – just that you have a bias. I value your opinion and don’t mean to cause you any grief. You’re my bud here.

If we also assume that Fed gets it right in the future as they have apparently done now, Market may be happy. Lot of conjecture but I tend to think they are open to changing course as they did in December 2018.

The Fed has already stated that the Fed Fund rates will remain low until 2022 at least. Other Central Bankers will also keep the rate as low as possible to keep their currencies from appreciating (and unless the inflation raises its ugly head). I don’t see the central bankers withdrawing stimulus in near-term at all.

I think of the Federal intervention and the government stimulus providing a bridge to a full recovery. The economy won’t recover in full until we find a vaccine, have treatments or develop full immunity. That won’t happen until late 2021 at the earliest. The economy will continue to recover while the Fed and government stimulus provide the bridge meanwhile.

The number of cases is rising but the number of deaths is on decline. May be the doctors now better understand how to treat the patients. Or, the people most at risk (of death) are taking more precautions. The odds of a shutdown are really low, IMO.

Having said that, I reserve the right to change my mind.

“the number of deaths is on decline.”

median age much lower

https://twitter.com/ScottGottliebMD/status/1275074495464607751

From the same tweet thread:

“Death demographics in the US not shifting younger. Changes in median age of confirmed cases is caused by testing criteria, not actual infection demographics.”

https://twitter.com/_stah/status/1275075019312214023

“They say there are two sides to everything. But there is one side to the stock market; and it is not the bull side nor the bear side, but the right side.”

~ Jesse Livermore

Well said. We’re always trying to determine the right side to play.

A global health crisis for which governments were woefully unprepared became an economic crisis perforce. Now government is far better equipped, mobilized and conscious of the challenge. Health crisis, serious as it is, has become something to deal with. People are less willing to trade off their economic necessity and well being. Many millennials I have talked to want to get on with their lives knowing there is a chance of getting sick but very low chance of mortality for that age group. It’s the seniors who continue to be in the crisis mode. The balance is shifting to economic activity. Yes, there will be flare ups but economic shutdowns are less likely.

No scientific data but based on empirical observations.

Cam – Shouldn’t your ultimate timing model be neutral rather than sell if you are at your neutral investment weight? Or are you invested more than your model is recommending?

That model was set up to only have a buy or sell signal. Since we are still in a recession state and the trend model hasn’t gone to a buy signal yet, it’s at a sell.

Thanks

Cam

Does the Island reversal pattern still hold and apply as of today?

We dipped down to 3027 last night in the futures markets and bounced off. We have not reversed the bullish trend yet, after the Island reversal triggered, nor have we broken above the 3200, level from where the Island reversal started.

Thanks for the clarification.

If we back out the recent dividend, it looks like a move to SPY ~323 would negate the island reversal pattern.

Quoting from another venerable analyst, who called for five times rise in March 2009, in ten years, and is calling for another five time rise in another decade.

Final note: The latest Bank of America poll of large money managers shows that they are net overweight equities for the first time in three months. SentimenTrader.com ran a study to see how stocks tend to perform when managers move from net overweight cash for two months or more then switch to an overweight in stocks. Turns out that there tends to be turbulence and modest losses in the first one to two weeks, but positive results a month to 12 months later in all instances, with as much as +17% to 24% gains in the one year time frame. Basically there is a digestion period and then the managers prove their worth by getting materially long near what turns out to be a solid bottom. …

— Final Part 2: To be more direct, let’s say you missed buying the exact low of March 6, 2009. The next few months were great but there was a lot of fear of rising unemployment, bankruptcies and a return to the lows for a test. Turned out all the fears were already discounted into prices, and a ten-year bull market lay straight ahead. … The Nasdaq 100 (QQQ) is +928% from March 6, 2009, til now. But it is also up 650% from June 20, 2009 til now, which ain’t too shabby either. … We’re in a bull market, as weird as that may be considering covid, high unemployment and weak leadership in DC. Don’t overthink it.

That makes sense, D.V. As managers move from underweight or neutral equities to overweight equities they have to buy equities which pushes prices a bit higher. After they are positioned the market reverts back to the lower level where the buying started. Then later, if they are correct, the market advances.

Us little guys have the advantage that we don’t move the market when we change positions and can move in or out in the blink of an eye.

GMO 7-year asset class forecast.

https://www.gmo.com/americas/research-library/gmo-7-year-asset-class-forecast-may-2020/

So GMO expects cash to outperform just about everything except international small-caps and emerging markets (debt or equities). Any idea if the numbers include dividends?

Study the last decade of GMO forecasts. They have been bearish for a while now.

I am sure they do include dividends.

They use the forecast to manage this fund:

https://www.gmo.com/americas/product-index-page/multi-asset-class/benchmark-free-allocation-strategy/benchmark-free-allocation-fund—bfaf/

Hasn’t exactly shone in the last few years. They expect asset classes to mean-revert, not happening. Been in a new era for a while now, it seems.

When will the market begin to pay attention to the election results? I think Trump losing election (e.g. higher corporate taxes and probably more regulation) is the biggest risk to the market over the coming months.

https://www.realclearpolitics.com/elections/betting_odds/2020_president/

Add to that risk: Reversal of Trump tax cuts.

Hot off the press. Don’t know how real this news is. President Trump has probably decided to make China-bashing his primary platform for his re-election.

===

Peter Navarro declares trade deal between Trump, China is ‘over’

https://www.foxnews.com/media/peter-navarro-trump-china-trade-deal-over

Or, is this a play to divert the media attention from the Bolton book and the size of the Tulsa crowd? It will only dent the market in short-term.

I watched the video and the response to the question was short and didn’t sound convincing. I think we will have a correction from the White House soon.

Sorry about that.

Sanjay

I think you know how this works when it comes to November 2020 elections. It does not take much to figure out what is being politicized and what is not. Let us leave it at that and see what shakes out in November 2020.

DV,

Totally. We will experience more of these air pockets in coming weeks and months until the election day.

https://finance.yahoo.com/news/stock-market-news-live-june-23-2020-221548702.html

Navarro “reportedly walked back the remark in a subsequent comment to the Wall Street Journal.”

We just dropped 60 points on the S&P 500 futures and recovered by 50 points all in a matter of minutes. That is how volatile things are under the hood. Granted, this is after hours trading, and volume is thin, but I have never seen such volatility at this time of night. I am not buying that everything is hunky dory. FWIW, Japan is open.

The market dropped because Navarro said the China trade deal is cancelled. It is still down but I think the market is not buying this.

Expect the WH to walk it back tomorrow morning.

The drop in futures markets happened in the last 30 minutes. The Peter Navarro news was known earlier in the evening and did not affect futures. This was most likely an algorithmic move.

A massive sell algo that took out lot of stop loss orders along the way, pushing prices way down. Once the price dropped to a certain level, the algo reversed, bought the short positions. This could be a new strategy and may be a test of a this idea. I have not seen this before when cash market was closed, but I am not an expert in this field of HF trading. I am unsure if this is or not a zero sum game (means if the trader made money during this move).

Could have been a “fat finger”.

DV, I think you’re right. I don’t know why the media continue to attribute the drop to this news.

https://www.cnbc.com/2020/06/22/stock-market-futures-open-to-close-news.html

European and Japan Flash PMIs were not exactly exciting, but the simple notion that the French service sector is doing better than during lockdown times (suprise, surprise!) has lead to strong buying in European shares. This indicates that money managers simply want to be invested and the bullish stance is being rationalized. But at the end of the day equities are being bought (probably due to lack of alternatives) The sharp drops (like on the Navarro news) could be a result of the bullish positioning and the lack of willingness to hedge. Let’s see how US markets react to the Flash PMIs, yesterday there seem to have been no worries at all.

Happy to have entirely bypassed the drama in the futures market last night. Another advantage of buy-and-hold is a good night’s sleep 🙂

SPY making another attempt to breach 3153.

3154.90. Not quite to the high of two days ago but over the 3153, RX.

It may be an overnight thing-

https://twitter.com/ukarlewitz/status/1275474264062214144

An interesting article from Aurora. Seems like he is looking for a top in here.

https://www.marketwatch.com/story/heres-the-secret-sauce-to-handle-the-stock-markets-election-and-virus-fears-2020-06-22

Any idea re his track record, Wally? Arora may be as good as he comes off sounding on his Marketwatch articles, but that’s what concerns me – he always seems to nail it.

LOL. LOL.

Yeah, I don’t know anything about the guy or his ‘real’ track record.

I’ve never understood his analysis because he uses Elliott Wave and I find EW to be overly interpretive. Depending on how you look at it you could be in any one of different wave formations.

https://www.yahoo.com/news/trump-hints-generous-second-coronavirus-120856815.html

More Trillion $ stimulus may be in the pipeline!

I just don’t know about more Congressional stimulus. I think we need to see layoffs start increasing again first. But what do I know?

I raised this question at the end of first quarter whether the money will flow from bonds to equities. Now with equities gaining in 2nd quarter, will the selling hit the market?

===

There’s a wave of selling estimated to be in the billions that’s about to hit the stock market

https://www.cnbc.com/2020/06/23/theres-a-wave-of-selling-estimated-to-be-in-the-billions-thats-about-to-hit-the-stock-market.html

Woh!

Sorry, here is the link:

https://twitter.com/GeoRebekah

Under-counting of cases and deaths in FL.

Bulls trying to make a stand around minor support at 3080. Next stop under 3000 if it punches through.

Planning to buy under 3000?

Somewhere under 3000 or maybe under 2000. LOL Trying to get a small trading short on at the moment if we get a bounce.

I think SPY 302.xx is a buy.

The question is-> Was today’s SPX intraday low of 3032 close enough to Cam’s ‘measured downside minimum target [of] about 3020?’

If the TRIN (for the NYSE) did in fact exceed 2 as noted in the article below, then I would answer with a ‘Yes.’

https://www.marketwatch.com/story/stock-market-seeing-panic-like-selling-in-nyse-shares-but-nasdaq-exhibiting-panic-buying-conditions-as-dow-sinks-400-points-2020-06-24?mod=MW_article_top_stories

What does your crystal ball say, RX? I got my short on but covered for lunch money when we failed to make new lows.

You don’t need a crystal ball, Wally. Based on what I’ve seen, you do a good job both managing your money and executing your trades.