Mid-week market update: Experienced investors know the story about the difference between trading sardines and eating sardines. Here is how Seth Klarman recounted the story:

There is the old story about the market craze in sardine trading when the sardines disappeared from their traditional waters in Monterey, California. The commodity traders bid them up and the price of a can of sardines soared. One day a buyer decided to treat himself to an expensive meal and actually opened a can and started eating. He immediately became ill and told the seller the sardines were no good. The seller said, “You don’t understand. These are not eating sardines, they are trading sardines.”‘

Like sardine traders, many financial-market participants are attracted to speculation, never bothering to taste the sardines they are trading. Speculation offers the prospect of instant gratification; why get rich slowly if you can get rich quickly?

Klarman continued:

Speculation involves going along with the crowd, not against it. There is comfort in consensus; those in the majority gain confidence from their very number. Today many financial-market participants, knowingly or unknowingly, have become speculators. They may not even realize that they are playing a “greater-fool game,” buying overvalued securities and expecting—hoping—to find someone, a greater fool, to buy from them at a still higher price.

There is great allure to treating stocks as pieces of paper that you trade. Viewing stocks this way requires neither rigorous analysis nor knowledge of the underlying businesses. Moreover, trading in and of itself can be exciting and, as long as the market is rising, lucrative. But essentially it is speculating, not investing.

In light of the surprising and powerful stock market rally off the March bottom, you have to ask yourself, “Am I looking for trading sardines, or eating sardines?”

The trader’s bull case

Traders and speculators have far shorter time frames than investors. One example of a successful speculator is Stan Druckenmiller, who admitted on CNBC that he was humbled by the market comeback, and he had said made just 3% during the market’s 40% rally off the March bottom

The bull case can be summarized by the strong breadth exhibited by the advance. The NYSE Advance-Decline line has already made an all-time high. The beleaguered small caps, which had been lagging the market on the way down, has revived.

In addition, the ratio of cyclical to defensive stocks have turned up dramatically and made a new recovery high.

These are all market signals of a cyclical revival off the recession bottom. The market is rising while flashing a series of “good overbought” RSI signals. It’s time to buy.

The bear case

The bear case consists of cautionary signals from sentiment and valuation. The Citi Panic/Euphoria Model has risen to euphoric levels last seen in 2002.

That’s no surprise, because the market’s forward P/E and median stock’s forward P/E have risen to levels not seen since 2001, which was the descent from the dot-com bust.

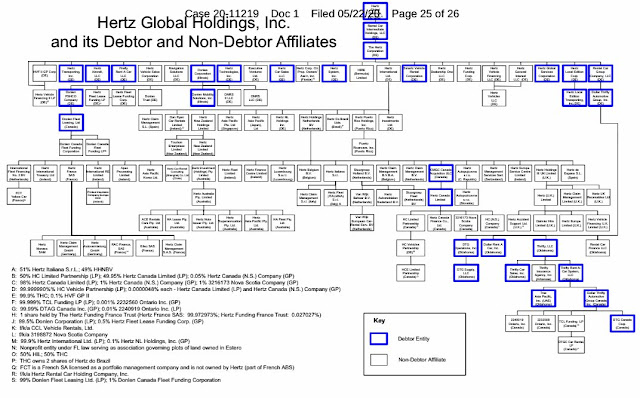

The degree of retail speculation has become rampant. Here is another example. Robinhood traders have been piling into the common shares of Hertz, which recently filed for Chapter 11 bankruptcy protection. The shares have bounced sharply off their bottom, and nimble speculators could have made ten-bagger gains.

At last report, Hertz unsecured bonds, which rank ahead of common shareholders on liquidation, were trading at at between 12c and 33c on the dollar. If the market believes the unsecured bondholders are that unlikely to be fully paid out, common shareholders are certain to be wiped out in any restructuring. (By the way, if anyone wants to dive into the Hertz financials to figure out their capital structure, please let me know the results of your analysis.)

It seems that bankruptcy is now the new buy signal. While sardine traders don’t care about intrinsic value, sardine eaters have to be concerned about the sentiment implications of this development.

As another example of the retail frenzy, this tweet from Jesse Felder requires no further explanation.

The action of small option traders are also raising red flags about market frothiness. Remember back in February, small traders were actively plotting bull raids on stocks using call options on Reddit (via Bloomberg):

When shares keep rising, managing the hedge entails buying more stock. That’s where the Reddit set perceives a weakness. A favorite tactic on r/WSB is to swamp the market with call purchases early in the morning in an attempt to force dealers to keep buying stock. Up and up everything goes—supposedly. As the stock price rises, so does the value of the calls, often by far more.

In this worldview, the only constraint on success is the force of one’s own conviction and willingness to act upon it. An added attraction: It’s all relatively cheap in terms of an option’s simple dollar cost. For the price of one share of Amazon.com Inc.—about $1,965 on Feb. 25—a decent-size campaign can be waged in long-shot options trading for pennies. That matters nowadays, when the rise of exchange-traded funds and mutual funds has convinced U.S. companies that they no longer need to split their stocks to keep the share price manageable for retail investors. Many companies now trade for three or four figures a share.

SentimenTrader pointed out last Friday that small traders are back to their old tricks.

At the peak of speculative fervor in February, small traders bought to open 7.5 million call contracts.

This week, they bought 12.1 million.

Watch what people do, not what they say. They’re full-bore bullish, on steroids.

As well, the Market Ear pointed out that long/short equity betas are also showing a crowded long positioning.

These kinds of sentiment excesses have to be concerning, even for sardine traders who are purely focused on price momentum.

Resolving the bull and bear cases

Here is how I resolve the short-term bull and bear cases. The signs of excessively bullish sentiment is a warning, or a bearish trade setup, but it’s too early to go short just yet.

The equity-only put/call ratio reach a low of 0.37 on Monday, and its 10 dma reached 0.44 on Tuesday. In the past, such readings have signaled limited upside potential, but the market did not retreat until either RSI recycled below an overbought level, or flash negative divergences with the price action.

Should RSI flash “sell”, the next question is whether the signal is calling for a minor correction, or a deeper pullback. From a technical perspective, I would be inclined to give the bull case the benefit of the doubt until the rising trend line on the ratio of high beta to low volatility are violated. It is difficult to judge the strength of a trend until it pulls back, and you can gauge its strength by the scale of its short-term weakness.

My inner trader is in cash, but he is watching for the setup to jump in on the short side for a scalp. It is always difficult to discern a viable signal on an FOMC day, but if the market were to weaken tomorrow, my trading account would enter a small initial short position in the market.

Spot on Cam, there is a bubble forming – but my instinct is to jump in and ride it for a while. I still have plenty of cash, and I know I’m not the only one in the market. Only buying Nasdaq 100 though.

The FOMC call was very good today. Jay Powell is definitely in “whatever it takes” state. The Fed will keep the interest rates near-zero for 2-3 years, and is targeting $80 billion a month in Treasurys and $40 billion in mortgage-backed securities.

I don’t know for how long can this Fed-provided liquidity sustain the market. For now, onwards and upwards, I guess.

Sorry, meant to include this link:

https://www.cnbc.com/2020/06/10/fed-meeting-decision-interest-rates.html

The Bloomberg article re r/WSB traders is more than a little troubling. How much influence do these traders have on price action? The implication seems to ‘substantial.’

Apple, for example, has 4.3 billion shares outstanding as of last quarter end. Average 10 day trading volume ~ 28.5 million. Cap change in those 10 days > 100 billion. I find it hard to accept that this is ‘Robinhood’ activity. More likely overseas liquidity flooding into US markets. IMO.

So what does this all mean?

The market has been rigged by wild call option reddit people and the recent run up is all hot air manipulation?

Or is this the mythical bear inflection point to revisit the last low or just a bull breather space?

I would have thought the FED said all the happy words for the market.

Yes, the Fed said all the happy words. Therefore, market must sell off. Futures are down 220 points.

Looks more like -330 points. Is that a buying opp, a selling opp, or noise? Personally, I don’t know.

I’m unable to answer any of your questions, Joyce. The market has succeeded in surprising/ perplexing just about everyone at this point.

Since I have no edge, the best I can do is try to avoid being whipsawed. Moving to cash is one option, but I then run the risk of never getting back in – or being forced to chase a +4% gap-up that closes +7% and never looks back (I didn’t make that up – it actually happened in April, and as far as I can tell the market has yet to revisit those levels).

It makes perfect sense to short/ cash out at this point. I would even say it ‘feels’ right.

Here’s the thing. How many of you who sidestepped the downdraft in March actually bought back in on the retrace rallly? And if you bought back in, how far did you ride the uptrend?

What happened to “train left the station”? is it coming back around the loop?

Maybe it is. And if that’s the case, are you planning to climb aboard – or decide it’s actually headed back down?

Oh, I am on board, just wondering if it is time to leave and wait for a better time. i am so excellent at timing the market I should start my own web site.

Whatever I do, do the opposite and you will make a fortune :).

The market will do its best to convince us it’s headed down…right before gapping up the following day.

The market will do its best to convince us it’s headed up…right before gapping down the following day.

That’s the market I know.

This is why I don’t like trading. Too much whipsaw – and often during the hours of darkness.

https://awealthofcommonsense.com/2020/06/5-signs-this-might-be-a-new-bull-market/

Cam, Comments please, Lee

Very interesting: Google search trends for “call options” and “day trading”

https://twitter.com/jessefelder/status/1270776064198021120/photo/1

Any average Joe who happens on this thread would probably shake his head and wonder if all traders have OCD. He probably checks his account balance(s) – most likely without the (s) – once a year if that and couldn’s care less if he outperforms anyone else (but probably does outperform the vast majority of active funds).

How’s that for a conversation killer 😉

Taiwan and South Korea headed for 9 or10 consecutive days of higher closes. Just saying.

If this is a (global) bear market, it’s doing a damned good job of disguising itself.

Here’s a great chart that highlights exactly how I view the past twenty years -> the SPX (I don’t know if the chart includes dividends or not) treaded water for 14 years, broke out in 2014 – taken two body blows in the past two years – and may now be ready to resume its climb.

https://twitter.com/saxena_puru/status/1270883796859056129

Not to mention a devastating bear in emerging markets and commodities in 2015-16.

I would agree with that assessment. Remember I wrote that the downside potential is 1300-1700 on the S&P 500, which would still be above the breakout levels shown in the chart.

The divergence between the US and the rest of the world (VTI vs ACWX)

https://tinyurl.com/y9xkm4fq [Link shortened, Cam]

Maybe this just means there’s more upside available in the rest of the world, maybe the rest of the world will now join the party, maybe all will live happily ever after. Maybe.

Here’s hoping it’s a new era of permanently high US stock prices.

My original SPY target of 313 has just been hit in overnight futures. In terms of ST direction I had it wrong.

It’s been a while since I’ve taken a portfolio approach (as opposed to a tactical approach). Sitting through drawdowns requires an entirely different mindset (almost a different skill set!). Each approach comes with its own form of market pain!

You know how sometimes we return to an old neighborhood or an old work site (or even an old relationship!) and initially excited. At some point the irritating aspects show up and suddenly we realize – we’re really back!

Red sky in the morning, sailors take warning. We’ll be opening deep in the hole.

I’m up later in the day now, as trading the premarket is no longer necessary. First impressions:

(a) To be honest, my first reaction is that I’ve let Joyce down – in the sense that I worked hard to counter her second-guesses ~a better entry point with my own ‘breakaway/ won’t look back’ scenario. I was wrong – I sincerely feel bad.

(b) The pullback is not entirely unexpected. Rereading Cam’s arguments for exactly this still makes perfect sense. In this case, the market did indeed do its best to convince us it was headed higher before a gap down. It happens all the time.

(c) How the market handles the pullback will tell us a great deal about the staying power of the current rally.

(d) I knew what I was getting into with a portfolio approach. One ADVANTAGE of a buy-and-hold approach – perhaps its greatest advantage on days like this – is knowing ahead of time what my response will be to any market move. Stay the course. There’s no need to run through a dozen different approaches to mitigate/ reverse the damage, no need to make the difficult choices that ultimately determine Plans A and B. All I need to do right now is take the dog out for a walk.

Keeping my powder dry, RX. But there have been several indications the advance was unraveling. 10 year rates falling, Transportations falling, vix climbing, high betas falling, etc.

🙁

Joyce, Wally, please let us know when you decide to go long, Lol. That said, yes, last night, I did lose capital being on the long and wrong side of ticker tape!! I got long at 3187 and had to close 20 points lower, if that is any solace. Furthermore, my buy at 3040 also hit middle of the night, that I closed out very quickly for rick control.

More seriously, Rxchen2, I am watching VIX index now, to estimate trading bands. The trading band has suddenly widened. So today, I do have a long order at 3050, which seems like a support (awaiting a whip saw here to 3050, as the market trades at 3100). Let us see if 3020 holds here.

I will likely wait for price to come to me around 3020-3050, depending on how this market behaves.

2. Yes, Chen, Thanks for reminding all of us of sticking to long term portfolio management.

3. I would have thought gold would have rallied sharply here, but it is not. What do you make out of it, Cam?

len-g, Ravindra, Mohit, Sanjay, and all others, thanks for making this board lively. Special thanks to my fellow Rhum drinkers!! Lol.

Cheers, gals and guys.

My buy at “3140” that I closed out for “risk” control.

D.V., we closed a gap and made a new one. I feel like an “eating sardine” in a trading world.

Yes, I was the sardine last night that got eaten, if it is any solace!!

That said, I am also trying to buy a gift for a buddy of mine (my gift buying skills are as bad as my trading skills, as I have no idea about cigars), and here is what I am looking to gift;

https://us.davidoffgeneva.com/davidoff-winston-churchill-robusto/

To each her or his own. My poison may be trading (apart from a few others!). That said, someone reading this may have some insights into buying a (wo)manly gift for my friend before I drop a pretty penny and lose even more in the deal than what I did last night, trading. Lol.

Investment and trading aside, let us also focus on what brings us gratification. Life is too short otherwise!

D.V., If he smokes cigars you can’t go wrong with a box of good cigars. Go by the rating number and strength. Prices can vary widely by website. When I have a cigar it is usually something cheap! LOL I like the Havana Honey coronas in Rum. But with the wife working at home online I haven’t had a cigar for months.

Yes, well it happens and I think we’ve all learned to manage the inevitable setbacks in this game.

I took the dog along the shoreline, where we watched three planes take off from SFO within five minutes. On the way back, we drove by the new Facebook/ Oculus campus, which appears ready to open (maybe it’s already open), and past the express lane construction work being done on 101. The narrative this morning seems to be the coming second wave. Look ahead a few months, and I hope to be booking flights to HK/ Taiwan/ Japan/ Vancouver.

The long-term approach comes down to this-> very good odds that it outperforms the majority of active funds over 1/5/10-year periods. Days like this are the price we pay. No free lunch in the markets, or in life for that matter.

D.V. – Why not hedge your bets and begin scaling in @ 3094? How do you know it pulls back to 3050?

I do not know if 3050 is hit or not today, but I am just going by the break out from 3020-3050 in October 2019, as support. See numerous graphs that show this on Cam’s website.

If 3050 is hit today, it would be a steep 150 point fall from yesterday. This would increase probability of at least a short term countertrend rally. I have no way to quantify the odds of such a move as I have described here.

Reduced buy limit to 3040; watching the market, may bring it down further.

There is minor support right here at 3075 fwiw.

Right. Since it’s impossible to predict the exact turn, scaling in can make the buy decision a little easier. Otherwise, we often fail to pull the trigger at all.

rxchen2, I have used the the scaling approach you refer to for investment capital. Trading IMHO is a different beast. I have lowered the buy limit to 3020 now. So far, there has been an orderly sell off, almost too orderly. Every 5-15 points on the ES has been sold (stair step, down pattern). That is not what I am looking for, at least not in this environment. In this environment, I need a scary, waterfall decline of say 50 points in a few minutes on the S&P 500, to buy a trading (futures) position. A huge gap down like this (see Wally and Cam’s comments), makes shorting risky.

rxchen2, I have used the the scaling approach you refer to for investment capital. Trading IMHO is a different beast. I have lowered the buy limit to 3020 now. So far, there has been an orderly sell off, almost too orderly. Every 5-15 points on the ES has been sold (stair step, down pattern). That is not what I am looking for, at least not in this environment. In this environment, I need a scary, waterfall decline of say 50 points in a few minutes on the S&P 500, to buy a trading (futures) position. A huge gap down like this (see Wally and Cam’s comments), makes shorting risky (unless I see a break down of 3020; that would be a different matter all together). Comments from other traders and technicians are welcome. Thanks.

DV, why not buy some Calls if S&P500 hits 3020?

OK! Nice call, D.V.

Sanjay, the “time” component of the Black and Scholes formula is something I do not fully understand. I like the linearity of the futures market. I need to study the options markets more in order to be comfortable and hence stay away from what I do not completely understand.

That makes sense.

Great call, btw. I think it may even head lower (3,000?).

” if the market were to weaken tomorrow, my trading account would enter a small initial short position in the market.”

I take it, you are short a bit here Cam?

Had I gone short, you would have received a trade alert email.

I would have shorted the market today had it been down -0.5% or so, but I couldn’t bring myself to short it when it gapped down like that.

We are oversold here and I am waiting for the reaction rally before going short.

Cam, do you plan to go long for the reaction rally?

You can try if you want to, but don’t expect the bounce to be more than a day or so.

A lot of price action is occurring in the AH futures. You don’t invest there, so perhaps you don’t care to comment, but I’m trying to understand that.

fwiw, had I closed positions on Monday, I would have bought back in this morning – probably averaging ~ SPY 311. I don’t think we’re looking at a protracted decline.

R2, what ETFs would you buy today? XLI, XLF or XLE?

My portfolio is 78% VT + 5.5% aliquots in XLI/ XLE/ XLF/ EEM. So if I were to buy today, that’s what I would be buying.

The beauty of buy-and-hold is not needing to respond to short-term volatility.

The difficult part of buy-and-hold is reminding myself to ignore short-term volatility.

Scanning through the headlines on Marketwatch – today is a perfect example of how the media can induce investors to sell.

Sell and do what?

If you sell on the way down without a reentry plan, what often happens is that you’ll be buying higher on the way back up.

Cam has a flight plan. Most investors don’t.

And in reference to Allan’s point above – I believe that studies have shown that most of the gains in the SPX occur overnight. In other words, trying to buy back in during the regular session will be a tough decision.

Someone else recently made the point that being sidelined on the ten best days of each year pretty much guarantees that you’ll be capturing very little of each year’s gains.

Put these points together, and hey – that’s why there are so many diehard Bogleheads.

I’m neither a Boglehead nor a fervent market timer. I do my best to alternate approaches. Obviously, making the latest transition on Monday wasn’t timed well. But let’s see how things play out over the next few weeks/ months. It may turn out not to have been such a bad move.

The selling pressure is intense.

I think we all knew it had to happen at some point. That point is today. (If not today, then when – personally, I can’t come up with a ‘better’ time.) In order to have a sustainable rally, we need days like today. Embrace it, the way you tell your kids to embrace any setback in life – it paves the way for future gains/ successes.

For a buy-and-hold investor, you spend quite some time analyzing the market.

It’s early days on the buy-and-hold, and recent habits can be hard to break. Although most of my comments are actually directed towards managing today’s selloff from a buy-and-hold perspective.

Curious, what triggered the sell-off today? I dont think it wasn’t the modest resurgence of virus as that was expected. Jay Powell may have been less sanguine on the economy than the market expected.

The street is saying a combination of an increase in virus cases and Powell’s statement that it will take years (at least to 2022) to see meaningful recovery.

My read is Powell’s statement about the time left in this thing took air out of the V shaped recovery. Suddenly the accommodative Fed turned into a bad thing.

We haven’t seen a selling day like this since the original Covid selloff. I’ve decided the 3000 area is still too high to start nibbling at long term positions. I’ll wait until I see constructive days or we get in the 2800 area. Catching falling knives is too stressful for me.

Cancelling long order at 3020, for now. Ticker tape is too weak here. Zero long side action, too close to end of the day, volume usually dries up after 4 pm and tomorrow is Friday. Sanjay is right.

At this point in time of the day, we could be in for a much bigger and rapid sell off.

We didn’t see a noon counter rally today so you are probably right. The market seems to be abandoned by the Robinhood traders today.

That’s the problem – they have no problem stealing from the rich, but are then nowhere to be found when it’s time to give to the poor…

They are probably watching their call options and account values drop to zero today.

BTW, we are sitting on the S&P 50 day moving average at around 3015. The 100 day is just under 2900.

Thanks Wally, yes, 3020 was my line in the sand, or 3015. We are looking to break below that, as I write this. Not wanting to become a sardine twice in a row!

Good job managing your trades, D.V. Cutting losses quickly after opening positions @ 3187 and 3140 + pulling late-day bid @ 3020.

Good call by Wally as well.

I was (of course) not sure what direction we would go in the near term, so did not want to mention this– but the comments here have been way more bullish and FOMO oriented recently, a reflection of sentiment that had gotten too frothy . Robin Hood has been humbled in the short term for sure.

Cam picked a great name for his site – the market humbles us all.

To your point re market direction – that’s the underlying reason for my decision to transition into a portfolio approach. The market rallied way beyond anyone’s targets, and I began to sense we (or at least I) had no edge in predicting the next move(s). You could say the same about 1999.

A day like this hurts – no doubt. But it hurts in the sense of ‘this is what I signed up for.’ And as I mentioned previously, in order to capture any gains in the market, I need to be IN the market. As an example that isn’t going to happen anytime soon – what if China announces the discovery of a safe and effective vaccine on a Saturday? What if Trump releases a (positive) surprise statement on a Friday afternoon? What if you’re not holding?

For now, I’ll stand by my earlier belief that it’s a bull market. It’s difficult today to remember the recent breadth thrusts, but they did take place. The market was extremely extended – against that backdrop, was today’s selloff really unexpected? I don’t think so. It was good to get it out of the way.

As always, there are two sides to every take.

I’m still unclear as to whether it is bull or bear but the fact that you are flexible will of course serve you well in this environment!

Is it time to go short?

By the way – with more time on my hands these days I’ve spent the past few days catching up on binge video via couple of British TV dramas – ‘Unforgotten Season 3’ and ‘Manhunt’ (the 2019 production based on a true story) are both highly recommended. I don’t know how the Brits do it, but most of their productions seem two steps above any American series in terms of screenplay and acting.

Sorry, Alex – didn’t mean to post the above comment underneath yours.

Only Kroger was green today among S&P500 constituents.

98.4% downside day. Most-lopsided in March was 97.6% on the 9th.

https://twitter.com/WalterDeemer/status/1271177353201418240

Thanks Sanjay. Such days usually mark market bottoms, That said, I feel this time is different with Covid19, we are likely to have more work to do here. March has an uncanny ability to create bottoms (2009 and 2003). So let us see if March 2021 marks a bottom.

DV, I agree. I don’t think this bull run is over yet. The decline was very orderly, across the board and without any panic. The market just used the dovish Fed speak and the prospect of a 2nd wave of the virus as an excuse to take some hefty profits. Com’on! We all know there will be a 2nd wave but hopefully no major lock downs. No one was expecting a V-shaped recovery.

The market should be happy at the prospect of continuation of easy money through 2022. Powell tried to tighten the monetary policy once with unpleasant results. Once burnt, I think he will be more careful.

I think we are already letting our guard down when it comes to Covid-19. Even in NYC, I am seeing people more relaxed (may be it’s weather). Life goes on. Another risk to living your life.

Having said that, we need to remain watchful. The futures are up modestly.

https://www.marketwatch.com/story/gun-stocks-rally-as-continued-surge-in-background-checks-street-violence-stoke-demand-2020-06-02

Sturm Ruger, Smith and Wesson, Vista Outdoors: Is it too late to buy this group?

Would the recent increase in positive cases lead to economy shutting down similar to March-May? I believe people are not going to go through it again unless it’s back to early days. It will impact stocks related to ‘opening’ more than ‘work from home’ stocks. A bar-bell strategy is another way.

Options, used prudently, provide a defined risk way to trade.

Hey, let me be the nasty guy to point out the obvious. This blog has become like Reddit, a stream of consciousness for minute by minute commentary from intelligent amateurs.

I like to come to the blog for gems of insight by all us committed investors. It has become a chore to sift through all the thought-streaming posts including what TV shows traders are relaxing with when taking a trading break.

We are seeing here the phenomena we read about with new day traders gambling because they are bored when locked down. Maybe Cam should have a side blog for active day traders to share their ongoing trading strategies throughout the day and into the overnight futures markets.

Are other Humble Students seeing this or am I the Grinch that is out of line? I’ll shut up about this now.

Agreed

No worries, Ken.

Personally, I think a community is built on active interaction – off-topic exchanges absolutely included. I enjoy hearing from different personalities and listening to the experiences/ stories behind their investing decisions.

I am kind of a stream-of-consciousness guy – if I were on a trading floor with colleagues, we’d be bantering all day. It’s all about enjoying the camaraderie – it’s part of what makes life fun!

You’ve been a participant far longer than I have, and compared to the past few years, I can understand how this comment section may be taking on the character of a virtual trading floor. Is that good or bad? And is it really that hard to sift through the comments? There were many posts in the (distant) past with 1-2 comments that offered little insight beyond a ‘thank you.’ I’m not sure that’s the intent of the comment section. I think Cam encourages discourse that includes different viewpoints, even (perhaps especially) ones that challenge his own – and he doesn’t appear averse to light banter and humor.

In any case, I’ve moved this morning’s comments to the ‘Discussion’ section of the website. That works for me.

I agree with Ken. It’s become something like Facebook, only without the Likes and the multimedia. Too much noise for me.

That said, as long as this market remains a crazy place I’ll be checking these pages compulsively, seeking some kind of indication of logic.

I sort of agree with rxchen2. You can’t encourage people to participate and then tell them to post only insightful comments. It’s the nature of the beast to interact. It’s not that hard to scan the daily posts. Just start at the current date. Avoiding long drawn out posts would help though.

RX, if you start posting on the discussion forum, I’ll never see your posts. I don’t go there.

Thanks, Wally. I’ll continue posting here until Cam indicates otherwise.

I put on a short trad with Cam. A little late though. Now to see if I can keep from analyzing myself out of it.

So far, so good! You have the island reversal pattern at your back – the bullish island reversal ~SPX 2500 signaled the start of a rally that took the SPX above 3200. May work as well in reverse – although I’m certainly not hoping that will be the case!

I appreciate that this board has come to life. Been subscribed for several years and for a long time there would be no comments at all, this is better. What I see here isn’t like reddit, it’s our Humblestudent community, a group of people who care enough about what they are doing to be subscribers to Cam’s service. I assume everyone here has enough at stake to justify the fee, as opposed to reddit where I have no idea if it’s a 15 year old yolo’ing their lunch money on Boeing calls, so there alone the comments here have more weight for me. It has been my hope that Rx was trailblazing a more active forum which would encourage others to start posting as well (without me posting myself ha). I think everyone here is able decide what is useful and what isn’t. Especially since this is emailed, users do not even have to come to the site to read comments, only reason I’m logged in is to see what you all are thinking.

The one thing I’ve cringed at is seeing marketing for other services creep into the board. Since I’m commenting I’ll take the opportunity to say I don’t like being sold to, even if indirectly, and I hope if anything could be quashed it would be that. That makes me feel like I can’t trust what is being said because I have to question what is real and what is marketing. I would not come to the boards if they were reserved for guerilla marketing campaigns and ‘thank you’ comments.

I have always looked forward to reading Kens and others more detailed and thoughtful takes, but also appreciate everyone’s else’s comments as well. I weight my attention based on the relative effort and usefulness of each users post.

Last comment before fading back to obscurity is that I would encourage others to start posting if there are other silent, but devoted students out there, I for one appreciate your commentary!

Thanks for your support, Jarad. I appreciate it.

I think a forum that restricts comments to what ‘professionals’ consider insightful has the potential to essentially ban/censor all input from ‘intelligent amateurs.’ The market is a playing field that does not distinguish between two. How many actively-managed funds outperform their benchmarks? I’ll leave it at that.

Kudlow says health experts are telling him there is no Covid 2nd spike of infections. I assume they are attributing it to increased testing produces more discovered infections. Hence, the market rally off yesterday’s bottom.

From SentimenTrader:

‘Corporate insiders like S&P 500 stocks a lot more than Nasdaq 100 ones

‘As stocks climbed incessantly higher to start the year, corporate insiders became hesitant. Among S&P 500 companies, there was a multi-year low in the number of insiders buying their firm’s shares on the open market.

‘Insider buying in S&P 500 stocks is now the highest since at least 2010 RELATIVE to buying in Nasdaq 100 stocks.

‘Other times when insiders in S&P stocks were much more aggressive buyers than insiders of Nasdaq 100 stocks, the ratio between SPY and QQQ showed a modest tendency to rebound in the months ahead.

‘The pandemic changed all that. As other investors panicked, insiders picked up shares on the cheap. They’re still going. The number of insiders that have bought shares in S&P 500 companies within the past six months has soared to a decade high.

‘They’re maybe not seeing quite the same values in big tech stocks. Insider buying among Nasdaq 100 companies has been tepid.’

Ignore the previous comment. Go with this one instead. (I inadvertently copied/pasted one paragraph out of sequence, which may affect your interpretation of the post.)

Corporate insiders like S&P 500 stocks a lot more than Nasdaq 100 ones

As stocks climbed incessantly higher to start the year, corporate insiders became hesitant. Among S&P 500 companies, there was a multi-year low in the number of insiders buying their firm’s shares on the open market.

The pandemic changed all that. As other investors panicked, insiders picked up shares on the cheap. They’re still going. The number of insiders that have bought shares in S&P 500 companies within the past six months has soared to a decade high.

They’re maybe not seeing quite the same values in big tech stocks. Insider buying among Nasdaq 100 companies has been tepid.

Insider buying in S&P 500 stocks is now the highest since at least 2010 relative to buying in Nasdaq 100 stocks.

Other times when insiders in S&P stocks were much more aggressive buyers than insiders of Nasdaq 100 stocks, the ratio between SPY and QQQ showed a modest tendency to rebound in the months ahead.

Volume came in when yesterday’s lows were broken. I covered my short trade and added some investment cash into stocks. I’m counting on Fed support if we should break lower in which case I will probably add more investment cash to the market.

Kudos for a nicely-executed trade, Wally.

Not that great, RX. I must have had “analysis paralysis.”

Interesting that you used volume as the indicator. Which source do you use? Thanks

actually I watch the 5 minute bar volume on the SPXL and SPXU at inflection points. Unfortunately I didn’t trade at that spot and was a bit late.

Thanks I’ll need to try that.

Hulbert back to betting bearish (at least based on his newsletter sentiment readings):

https://www.marketwatch.com/story/the-real-reason-for-the-stock-markets-7-plunge-shouldnt-surprise-you-and-it-happens-every-time-2020-06-11?mod=home-page

Although useful, it would be hard to make that into a short term timing indicator on its own.

https://in.finance.yahoo.com/news/robinhood-is-not-behind-the-rally-barclays-says-as-retail-demand-surges-220519362.html

Sorry guys, seems like I started the trading comments. Yes, I did trade last night, and today, several times in the Futures markets (ES). I sometimes have time to trade actively. That said, this is a very erratic market that I do not like to trade. Just too erratic even for someone who has done this for good part of this decade.

Ken, you have been a valuable part of this community and many of us including me, look forward to your moonless and full moon nights. Please keep them coming. Many of us are amateurs, who look to learn from you and Cam, with humility in our hearts and minds, knowing fully well that we are not the Cat’s whiskers. Please continue to participate. We like your comments.

Thanks Cam, for making this platform available, and please keep doing the good work you do and be the guiding hand and master, that we all learn from.

No need to apologize, D.V. I’ve enjoyed reading all of your comments (you’ve made more than a few that I found helpful at pivotal points in the markets), and hope you continue to do so.

You are very kind. Thanks.

RX is right, D.V. Nothing to apologize for. I enjoy your posts.

Wally, you are a gentleman. Thanks.

DV, I enjoy your posts. Please do not stop sharing your thoughts and experience with the rest of us.

Thanks, the sentiment is reciprocated.