Mid-week market update: As regular readers are aware, I have been increasingly cautious about the equity outlook for the past few weeks as the market advanced. This has become the Energizer Bunny rally that keeps going beyond expectations.

Where will it stop? One of the indicators that I have been keeping an eye on is the NYSE McClellan Summation Index (NYSI). In the past, whenever the NYSI has fallen to an oversold extreme of -1000 or less, the indicator has rebounded so that the weekly stochastic bounced from an oversold to an overbought level. We are now overbought on the weekly stochastic.

To be sure, past rebounds have seen the weekly stochastic become even more overbought. These conditions suggests that there may be one or two weeks of more upside on NYSI, this relief rally is running on borrowed time.

The bull case

Here is the bull case for more upside, either on a tactical or sustained basis. First, equity risk appetite continues to be positive. The ratio of high beta to low volatility stocks is rising in the context of a relative uptrend.

Price momentum has been impressive. Ryan Detrick of LPL Financial observed that this is the greatest 50-day equity market rally, and similar strong rallies have led to further strength in the past. The market recently staged upside breakouts through its 200 dma, and the strength may be indicative of a FOMO stampede.

Even as the FANG+ and NASDAQ stocks lose their momentum, market leadership has broadened to cyclical sectors and industries, indicating the expectation of an economic rebound.

Small and microcaps have also been turning up in relative performance.

The bear case

Here is the bear case. First, it seems that analysts are turning bullish to catch up with price. Helene Meisler has a pinned tweet that may fit the current environment well.

As an example, John Authers documented Goldman’s sanguine outlook, though admittedly the market is priced for perfection.

If next year’s earnings turn out to be in line with Goldman’s baseline forecasts, then the market is trading at a high but reasonable 18 times 2021 earnings. It is higher than that if the more bearish estimates from buy-side firms are right; and at an all-time high of 26, significantly above even the worst excesses of 2000, if the worst-case scenario is correct. So the market is plainly working on the assumption that things will turn out about as well as can reasonably be expected:

If any of the risks that I outlined in the past (see Brace for the second waves) were to appear, then it’s game over for the rosy outlook. These kinds of justifications seem to be a case of grasping at bullish straws.

John Authers also pointed out an anomaly in the cyclical and small cap rebound bullish thesis. If the market truly believes that the economic is turning up, then why are the stocks with good balance sheets beating the stocks with poor balance sheets? In a cyclical rebound, highly levered companies, some with zombie-like characteristics, should skyrocket because they behave like out the money call options on the economy.

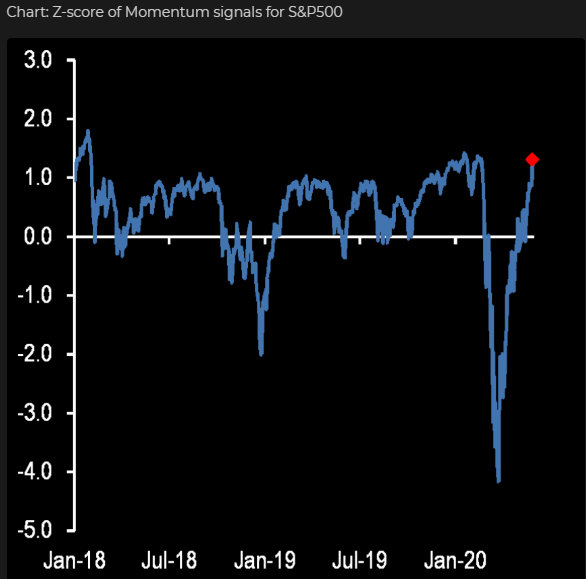

Price momentum effects may be starting to peter out. I had pointed out that the rally off the March bottom was mainly attributable to short covering (see A bull market with bearish characteristics), it was unclear what kind of market players are willing and able to take up the baton. Fast money and trend following Commodity Trading Advisers (CTAs) are now at their maximum long positioning in stocks.

Who will buy next?

When do retail investors pull back?

We have all heard about the frenzied trading of naive retail traders entering the market. Jim Cramer observed that even small trader sentiment is becoming very frothy, which is a cautionary signal.

One clue came from a historian who studied how the rich reacted to the Black Death. So far, the main job losses have come from lower paying service jobs. Better educated workers have been largely insulated because they can work from home.

The coronavirus can infect anyone, but recent reporting has shown your socioeconomic status can play a big role, with a combination of job security, access to health care and mobility widening the gap in infection and mortality rates between rich and poor.

The wealthy work remotely and flee to resorts or pastoral second homes, while the urban poor are packed into small apartments and compelled to keep showing up to work.

Social reaction to the Black Death provides a rough model of what may happen today.

One key issue in “The Decameron” is how wealth and advantage can impair people’s abilities to empathize with the hardships of others. Boccaccio begins the forward with the proverb, “It is inherently human to show pity to those who are afflicted.” Yet in many of the tales he goes on to present characters who are sharply indifferent to the pain of others, blinded by their own drives and ambition.

People with sufficient savings to play the stock market today belong mainly to the class of educated workers. In this case, the adage that it’s a recession if your neighbor loses his job and a depression if you lose yours may ring especially true for the investor class. Sentiment may not break until we start to see widespread white collar job losses and salary cuts. Bloomberg Economics’ estimates of second wave job losses shows management jobs rank second in layoff potential. That may provide the catalyst for individual investors to de-risk because of their own employment conditions.

Leuthold Group: Still a bear market

Analysis from the Leuthold Group provides some context as to why this is still a bear market. Leuthold had set out a criteria of five conditions for a cyclical market low, and the March 23 low met none of those conditions.

The Leuthold Group went on to observe that “the 30% surge off the low met 0-of-3 dynamics that usually accompany the first leg of a bull market”. In total, 0 for 8 is not exactly comforting for the bull case.

I interpret these conditions as a bear market rally, though short-term momentum may carry the market somewhat higher in the next one or two weeks. My base case scenario calls for a short-term peak, but investors should be prepared for rising downside risk afterwards. I have no idea how far the current FOMO rally can run, but my inner trader is standing aside because the intermediate term risk/reward is tilted bearishly.

Thanks! A lot of discussion around OpEx June 19 as potential catalyst… how does this factor in?

Quantifiable Edges shows that June OpEx week is mixed. Average returns are slightly negative, though the success rate is positive.

Not an actionable edge either way.

Cam, I would like to note that your chart comparing the S&P with the HiBeta/LowVolitility ratio is no longer showing a lead time to the S&P. Actually the last arrow showing the ratio dip leading the S&P is relating to the wrong ratio dip. The dips and peaks of the ratio are now directly under the corresponding dips and peaks of the S&P 500 index and offer no predictive advantage.

I agree. Not all indicators work all the time.

Mark Zandi of Moody’s Analytics said this morning that the COVID-19 steep recession is likely over, barring a second wave, and job growth should resume in June. The recovery will be a slog until there is a vaccine or therapeutic.

http://video.cnbc.com/gallery/?video=7000138580

The second wave timing estimates vary widely. (The later the better).

Jeremy Siegel said ‘Rally has further to go’ this afternoon.

http://video.cnbc.com/gallery/?video=7000139061

The recession is bottoming out, but no one can really tell you how quick the recovery is. Don’t expect it to bounce back to December 2019 like conditions too quickly, though.

There are two starkly opposite narratives. A bear rally that can end any time and take the market to previous lows or worse vs. a new bull market with it’s pullbacks and corrections along the way. Two different investment and trading strategies. The odds laid out in an earlier post was 20% up vs. 40% down to old lows. Market is focused on the upside.

A factor review and/or rotation analysis would be very helpful.

Walter Deemer: the market generated a breakaway momentum today.

Supposed to get it near the beginning of a powerful move, not after a 42% advance (altho did have late signals Jul 12 2016 and Nov 20 1950). Definitely not its finest moment…

https://twitter.com/WalterDeemer/status/1268278703395659784

Reply

I saw that. I’ve known Wally Deemer since the 90s. Not sure what to make of that.

I am following him for two years now. His model was spot on when it generated a breakaway momentum signal in Jan 2019. I don’t know what to make of this either.

As many have said on this forum, the Fed has been driving this market up by providing liquidity, cutting risk-free rates to almost zero and lowering the risk premium with an implicit Fed Put. The discount rate to calculate the future cash flows is much lower now than it was back in Feb 2020. That alone can raise the valuation by a significant factor.

The Fed purchase of corporate bonds is also lowering the interest expense and strengthening balance sheets. Investors also know the Fed will come to their rescue unshackling them to purchase riskier assets.

Moreover, it seems investors have written off 2Q 2020 and even the entire 2020 earnings postponing the day of reckoning to produce earnings to late 2020.

The whole tilt to technology companies is beneficial for the overall earnings as tech (software) businesses have tremendous operating leverage. An extra dollar in revenue may add 40-80c to the bottom-line magnifying earnings growth and business valuation.

Furthermore, there is no alternative (TINA). Where will you put your money to even earn some modest returns?

I also don’t expect a major second wave or state-wide shutdowns in either summer or winter. Sweden has likely brought forward the number of deaths due to coronavirus. People all over the world are a lot more vigilant now than they were 3-4 months ago. In NYC, almost everyone is wearing a mask and keeping social distance. Many can and will continue to work from home. On top of it, at least in some states, they have started building decent testing and contact tracing capabilities which will bring some confidence back among the people. With people being careful, I also expect the regular flu season in the fall/winter will be less severe. Just like flying, driving or seasonal flu, coronavirus becomes another risk to assume as part of living your life. This is already happening.

Fundamentals don’t matter in near-term. They will at some point but the market may be significant higher before they begin to matter, IMHO.

I wouldn’t use the discredited Swedish Model as evidence for anything, except how to allow thousands of unnecessary deaths while you’re still crashing your economy.

Some more data on this signal:

https://twitter.com/TPMacroResearch/status/1268506491037855744

The Leuthold Group asks:

“Is this a 1st leg of new bull market or 2nd-largest bear rally of 125 yrs?”

That’s exactly what Tom Lee brought up a couple of days ago-> What if 2191 was THE low?

What was his answer?

It was a rhetorical question. However, given his bullish bias, and the fact that he graphed the current rally against the backdrop of past rallies from durable lows…he’s probably leaning toward no retest of 2191.

Wondering if dollar weakness could propel the market higher… https://twitter.com/MacroCharts/status/1268135341526937601?s=20

The German stock index DAX is valued at a P/E of 20, highest level since the dot-com bubble.

https://twitter.com/Schuldensuehner/status/1268047448045490176

As for short term signals, interesting observation re Bollingers and overbought condition… https://twitter.com/MoMoBagholder/status/1268369947253780483?s=20

This from Sentimentrader on Nasdaq https://twitter.com/sentimentrader/status/1268250530817740800?s=20

https://www.reuters.com/video/watch/idRCV008ANM

Nick Colas from Datatrek research. He is dialing in a ten percent upside from here.

UAL off premarket for a +9.4% gain (despite buying into a +5% gap up yesterday). That to me is a pretty good ‘tell’ re the bid under this market.

Added SPY back ~310.5x.

It’s good to see a little consolidation in the overnight futures, which should extend into the regular session.

Re UAL – Left half of potential gains on the table! Stocks left for dead can move faster/ further than we think when they come back to life.

By definition, retail investors cannot move the market.

Question to me is what institution is going to do with side-line money if there is much left at all. Cam, you mentioned that the ‘Fast Money’ is fully invested. What about traditional money managers (long only or hedge fund)?

Also at market inflection point, it needs a trigger to push it lower before it sets off the cascade. What are the possible triggers that is unknown or little known to the market?

Notice that few of the protestors are wearing masks or keeping a 6 ft. distance between them. If there is a sudden breakout of new Covid infections in about 10 days, that could be the catalyst for a decline.

Wally, I don’t think you are in close proximity for long enough with other people to transmit “enough virus particle load.” Most of the virus particles will blow away in the wind and dilute the concentration to reduce the risk of infection. All bets are off if a person directly sneezes on someone’s face.

Of course, just a guess/observation.

There was a study that showed that in a large crowd that the virus could linger in the air all around people for quite a while. I guess it would depend if there was any wind. Nights are usually pretty still.

I will agree with you if the crowd is stationary and indoors (indoor swimming pools, any event indoor, etc.).

Would love a link to that study!

‘Retail investors cannot move the market.’

There are all kinds of ways to move the market. It might have been one guy eating in a Wuhan market that brought the entire global economy to its knees.

QCOM off for a +3% gain. Flipping into EWZ.

What time does the market start worrying about tomorrow’s Unemployment Report?

Maybe 11 AM EST?

To be honest, Wally – it’s much easier to trade the markets without watching the news. Every time I read the headlines or listen to the radio I get the urge to sell – not helpful when markets are trending up.

RX, I like to see how the market is reacting to important news or economic data. It tells me how resilient a trend may be.

Is the Fed going to institute Yield Curve Control in the fall?

https://www.marketwatch.com/story/get-ready-for-the-fed-to-start-targeting-bond-yields-outright-in-september-says-baml-analyst-2020-06-04

So, what would be the unforeseen consequences of such a move?

It seems it would be a replacement for the non-QE they are doing now that raises the Fed balance sheet. I’m hoping Cam picks up on this story and offers some insight.

Yield curve control is a form of financial repression, which is not good for banking profitability

Thanks, Cam. Does it mean that the Fed continues to buy bonds?

Any opinions about Nasdaq 100?

Made a new all time high. I don’t really follow that index.

Something different is a foot:

+ dollar has dropped like a stone for 8 days

+ 30yr Treasury is at its highest yield since March 19th

Ideal consolidation pattern in the SPX today – a late day selloff that threatened to break support at 3090 before buyers chased it back above the opening print.

Good call, Rxchen2.

So, Texas just collected 19% less sales tax for this month, over last year this month (NPR).

My friend just came from The Outlet stores and bought name branded sports gear for 40% less. He tells me they are looking to liquidate the store. My secretary just called and told me that this was the first time since age of 14 that she had no job. She said the PPP money helped and unemployment checks would not have been adequate.

If Texas is having a hard time, other states are on the hook too. Munis may come under pressure though there is a bid from the Fed under the Muni market.

With stores looking to close, malls and Reits are going to be under pressure.

State after state is reporting increasing number of cases. It looks as though we may be in for more pain, more economic malaise. I am watching these from a distance as a lot of this news is quite scary.

Texas is also getting hurt because of shellacking the oil price has taken.

Is Texas as dependent on oil as it historically was?

Yeah, shale oil contributes significant revenue to the economy.

About 30% of Houston’s economy is oil and gas.

D.V., there was a RE fund on the radio this morning advertising their track record of 10% income and 18% annual growth. I think you are right that such an investment would be HIGH RISK in today’s environment and would have no liquidity to boot when it turns south.

Wally

Real estate prices are not coming down as much as expected. There are many reasons for this. That said, it is safer to hold real estate than buy paper (REITs).

The ECB is also adding a lot of liquidity in the system. I wonder if some of that will flow to our shores.

“The ECB is very well known to be behind the curve, only acting at five minutes to midnight, but now they are ahead of the curve.”

European Central Bank Ramps Up Stimulus Program Beyond $1.5 Trillion

https://www.wsj.com/articles/european-central-bank-ramps-up-stimulus-program-11591271440

Not sure what to make of this… https://twitter.com/hmeisler/status/1268666860851134467?s=20

Tom McClellan suggests uptrend still intact https://twitter.com/McClellanOsc/status/1268720764963807232?s=20

Cam, have you seen this (link below)? It compares the 2020 fiscal and monetary response to the 2008/09 response as a percent of GDP. The U.S. spent about 6% of GDP in 08/09 and spent 11% of GDP this time.

https://www.atlanticcouncil.org/blogs/econographics/how-does-the-g20-covid-19-fiscal-response-compare-to-the-global-financial-crisis/

I agree the economy is questionable, we probably aren’t out of the woods in terms of Covid 19, and the market’s valuation is high. But, if you adjust valuation for the fiscal/monetary response, I wonder what the adjusted level shows. It’s difficult to translate 11% of GDP into an equivalent (and theoretical) interest rate cut, but maybe that “cut” should be incorporated into the rule of 20.

By some metrics, the stimulus so far is 25% of GDP (see Liz Ann Saunders at Schwab commentary).

https://www.economist.com/finance-and-economics/2012/07/14/qe-or-not-qe

Found this Economist article from 2012 saying that findings by the Federal Reserve Bank of SF indicated that $600billion of asset purchases could be equivalent to a 75-basis-point cut in fed funds.

Interest rates levels now differ compared to then and the fed’s balance sheet differs as well (in addition to other reasons, I’m sure, why one can’t draw an apples-to-apples comparison), but it’s a starting point to ponder.

UAL up another +10% premarket. This is a +50% move in less than three days.

Whereas gaps up on Wednesday and Thursday were an indication of an all-out rally – seeing a third gap up today seems to be a different kind of ‘tell.’

It’s no longer a wall of worry-> now it’s flat-out greed, and I would be looking to take profits. Which is not the same as saying I’m bearish -the market just needs a breather.

Comments above refer to the global markets, and not to UAL in particular. I could just as easily have used BA as an example. I don’t mind chasing on Day 1 of a breakout, but Day 3 – that takes more guts than I have!

Nonfarm payrolls +2.5 million versus an expected -7.5 million.

Awesome.

Hope you stayed in. Futures are way up – but who knows. I bought in long to some stocks yesterday – probably see a pop today. One small finger on the sell button – very cautious about this narket – even (especially) now.

Yes. I plan to sell into what now feels like irrational exuberance. A +10 million ‘beat’ on unemployment is still a bad picture.

Glad to hear you waded in!

Can’t believe I let UAL go ~35. And I was the guy pointing out that buying @ 32 was OK if we’re able to ‘see’ prices on their way to 47+.

I was think about airlines too. Up 30% in less than a week. I still don’t understand, but maybe I should stop trying. Where’s my time machine?

Banks + tanks, EWZ, and SPY off here.

A little early, perhaps – but I don’t want to be watching the markets all day long.

A great report. Feels good. But…NY Times captures well:

“ The report noted that “employment rose sharply in leisure and hospitality, construction, education and health services, and retail trade,” even as jobs in the government continued their decline.

Specifically, the leisure and hospitality sector hired about 1.2 million workers, after declining by 7.5 million in April and 743,000 in March. Restaurant and bar jobs alone rose by 1.4 million, counting for about half of the total gain in employment, the Labor Department said.

“What this is telling us is that at least part of the pain in April was due to people being laid off or furloughed who still had very strong connections to their employers,” Ernie Tedeschi, an economist at Evercore ISI in Washington said. “As good and surprising as this report was, this may just be the low-hanging fruit. These may have been the easiest workers to bring back.””

I’m guessing that hotels, restaurants and casinos started to sort things out – how to reopen in a relatively safe manner – and then proceeded to call a percentage of employees back to work.

Well, is everybody in now? Safe to go short? LOL

Just kidding. The Unemployment report will probably put a floor under the market for a while.

Only in for 30%. “Safe” dividends (renewable energy, preferreds, etc.) One finger on the sell button. Still crazy out there.

Just history of shorting this market has not gone well!!

True enough, Joyce. Even sitting in cash has been a big opportunity lost.

Wally – Rather than go short, you might consider ST positions in TLT or GDX?

Can you please describe what is an ST position? Thanks.

Short-term

Joyce, I think he means ST = Short Term.

What I need, RX, is for Cam to get a handle on this market and make some of his incredible calls.

Thanks. I thought it might be some magic options set up that I did not know about.

Retail sentiment is about as bullish as it can get.

I think institutions are sitting on a lot of cash. And, we have the end of quarter coming up at the end of June. Any dip is most likely going to be met by heavy institutional buying to get into stocks for the end of quarter. I would love to see a dip back to around 3000 but that might be asking a lot to happen in June.

Mutual funds are very long positionally.

This action comes pretty close to 1999. I can guarantee it won’t last.

The high volume during this morning’s open? Probably due to one of the most unanticipated/unexpected surprises I can recall (jobs report) – I’m sure a ton of traders/ investors were caught positioned the wrong way and needed to quickly reorient/ correct.

I’m already ticked off at closing SPY ~318.

ukarlewitz

@ukarlewitz

Today’s NFP data was less about “reopenings”. ‘That will be more of a June story. Instead it was likely due to companies rehiring because they let too many people go in April, and because some companies needed to rehire to qualify for PPP forgiveness.’

Thanks for that!

Irrational exuberance?

https://www.barrons.com/articles/stocks-are-headed-to-new-highs-says-former-janus-ceo-51591370809

http://macrocharts.blog/2020/06/05/speculation-mode-on/

‘Flash Recession?’ That’s the kind of headline that’s driving this morning’s buying. That’s the last thing anyone who’s leaning short or under-invested would have even thought possible to see in print (other than as satire) until today.

“In plain English, this means the May unemployment rate is actually 16.3%, not 13.3%, because 4.7 million workers were misclassified as employed, but are really unemployed.”

https://twitter.com/hedgeyefig/status/1268896012204212225?s=12