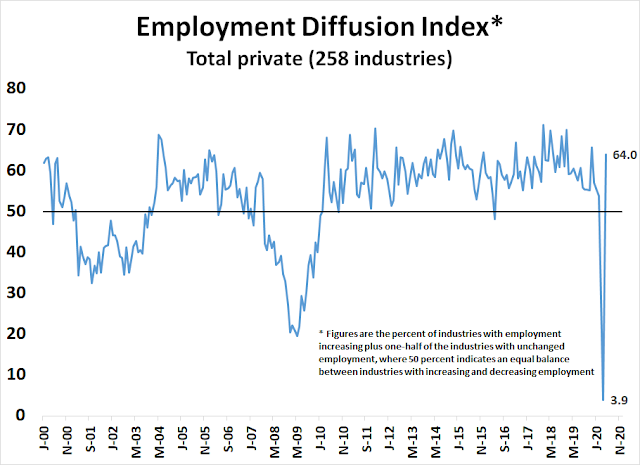

I don’t usually offer instant reactions to economic news, but the May Jobs Report was a shocker. Non-Farm Payroll gained 2.5 million jobs, compared to an expected loss of -8 million. The Diffusion Index bounced back strongly, indicating breadth in job gains.

This was a positive and highly constructive report for the economy. Before everyone gets overly giddy, the report also highlighted some key risks to the outlook.

Where the jobs came from

Nearly all of the 2.5 million in job gains came from the “private services providing” sector. Half of that was attributable to “leisure and hospitality”, with additional major gains from “retail trade” and “health care and social assistance”. Equally constructive was the 39.1K increase in temporary employment, which is a leading indicator of employment and shows rising labor market tightness. As well, average weekly hours and overtime hours rose across the board, which is another sign of a healing economy.

The unemployment rate was consistent with the direction, though not the magnitude, of the continuing jobless claims data. In the past, the red line (unemployment rate) was above the blue line (continuing claims). While the unemployment rate fell in a direction that was consistent with continuing claims, there is a discrepancy in magnitude.

Companies are calling furloughed employees back, mainly in the hospitality and retail industries. Another interpretation of this report is the Paycheck Protection Program (PPP) worked to encourage employers to keep paying workers, and returned many back onto the payroll.

Key risks

Here are some of the key risks. First, the unemployment rate for Blacks and Asians rose, which is not helpful in light of the latest round of protests.

One of the key questions is how the Fed reacts to this report. There is an FOMC meeting next week. Will they start to change their body language and hint at taking their foot off the QE accelerator? Watch the USD and interest rates. The USD Index is nearing a key support zone, and yields are rising. Rising yields and a bullish reversal in the USD could be a headwind for equity prices.

The callback of workers is a good news, bad news story. The good news is many workers are closely linked to their employers, and the callback in hospitality and retail industries is encouraging. The risk is the emergence of a second pandemic wave that prompts another shutdown. The daily graph of new confirmed cases have been edging up in a number of states, such as California, Florida, Louisiana, Washington State, Arizona, Tennessee, and Vermont, just to name a few. As different jurisdictions have reopened their economies, the revival in case count might be enough to prompt re-impositions of stay-at-home orders again, which would shut down the local economies. This has the potential to batter an already fragile small business sector, and prompt a second wave of layoffs and unemployment.

Finally, how will Congress react? The strong May Jobs Report could prompt lawmakers to drag their feet on another stimulus package. The U6 unemployment rate, which includes discouraged workers, did not show as much improvement. It fell from 22.8% to 21.2%, which is still very high. PPP payments expire at the end of July. If the program is not renewed, the economy is likely to face significant headwinds to a sustained recovery.

The stock market is roaring ahead today on the good employment news, but investors should keep in mind the key risks facing the growth outlook.

Hard to ‘Curb My Enthusiasm’ today with Nasdaq hitting all time high. If that is not a bull market, I do not know what is. As always, need to keep a lookout for the clouds that might rain on the parade. But not today.

I think today’s action in UAL is instructive. Not saying this is how it will play out in the broader market, but the underlying psychology may be similar.

(a) UAL gapped up this morning for the third consecutive day. Pre-market action saw it jump from 43->44->45->47->49.7x. Very, very difficult to contain one’s enthusiasm as you put it. Thus traders were strung along thinking any price below let’s say 48 would be a decent fill.

The first 15 minutes of the regular session played out that theme pretty convincingly – and buyers were pulled in ~47 and 48. Since then it’s been a steady slide back toward the first premarket print of 43.

Obviously, the SPX isn’t UAL. But what if it plays out the same way over a longer time frame? Premarket indications started ~+0.65% = ~313.xx. Opening trades were in the +1.7% to +2% range. Prices then spiked to >+2.25% and haven’t looked back. Traders waiting for an entry will view anything <319 as a decent fill. Any buy stop between 319 and let's say 317 will be hit…with last-minute buying likely to lift the closing print to ~319. Then a gap down on Monday to revisit the lower range of today's premarket prices and close the bull trap.

JMO.

Dipping below 319 @ 1245 pm. Odds are it tries for an undercut of the intraday low of 317.17…

Now at my early morning exit ~318.39. There will be many others who exited at the same point considering at least a partial reentry.

I would consider a reentry on Monday ~313. But the market probably knows that and thus unlikely to offer that kind of setup.

My trading mentor always said that it’s hard to make Trading money on big opening gap days unless you are long coming into it. In other words, the risk is rewarded in a trending market. The music will stop one day but it’s hard to leave the party just yet.

I have given up on being pessimistic, and am now opportunistic. Bought TNA with a 10% trailing stop. That means the market will probably crash soon.

2020 Covid19 infections = 1982 M1 money supply.

Thoughts on this? https://twitter.com/martin_pring/status/1268969118860009475?s=20

I like Ryan Detrick’s numbers in the chart embedded inside this tweet:

https://twitter.com/RyanDetrick/status/1268558741839982598

It makes perfect sense (common sense if you will) to expect a pullback over the next 30 days, perhaps a significant pullback. Far more attractive entry/ reentry than buying today.

Not sure if you can use TA on economic indicators.

thanks both!

Cam, how do you feel about European financials here? EUFN has had an incredible run recently.

This tweet shows just how ridiculous this market has been:

Helene Meisler:

I went out for a bike ride and come back to discover the economy is fixed.

I know, I know. Sold everything again today, including what I bought yesterday. To make my monthly target income in one day is a bit scary, but I can live with it.

Roll om Monday 🙂

Nice!

I have a theory re taking the hard trades (assuming, of course, that I already have other reasons to enter a position):

(a) If opening the position is dfficult, I’m probably not the only guy who feels that way.

(b) Which means the crowded trade has to be either [i] taking the other side, or [ii] sitting in cash.

(c) The harder it is to pull the trigger, the less likely it is that I’ll have any competition.

Under the above conditions, the payoff for being right will be larger than average. And feeling a little ‘scared’ is often a sign that you’ve made the right move.

Thanks, rx.

Shrug, if holding longs, I would hedge at these levels.

https://twitter.com/WalterDeemer/status/1269002166989185025?s=20

Not surprised. The after-hours ask on SPY is lower than the closing print, so anyone who wants to open/reopen/ add to a position can easily do so. The catch is that its just seems too easy. Today’s buyers are likely to be tested next week (ie, hard to believe they’ll be immediately rewarded for chasing the third gap-up in three days). I agree with Alex1 – if you’re still holding, consider a hedge (options don’t trade after hours, but there’s still time to pare back on position size and/or open a small inverse fund).

I often have to remind myself to resist recency bias – (i) it’s unlikely we’ll experience another move like this immediately, and (ii) rather than continue playing, it may be prudent to wait out the next day or two.

‘small *position* in an inverse fund’

Yes– agree. And I’ve been observing the DIX (dark pool) recently– just pared back from a bullish 47-50+ readings to neutral reading of 45. I think the speculative bid will slow down, does not mean a precipitous drop but perhaps some balance in the market.

Good site for anyone who has not seen it https://themarketear.com/