Mid-week market update: Is the market exhibiting signs of froth, or is the economy healing? There are signs of both. As Fed chair Powell indicated, the economy has encountered a health related shock, and the Fed can only do so much to stabilize markets. It cannot provide a cure.

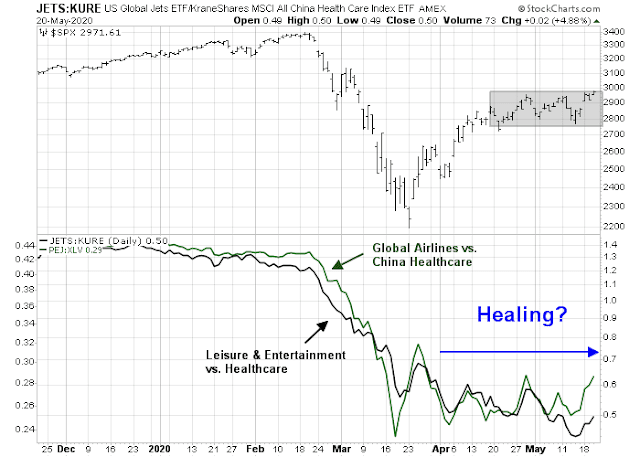

Some of the market based indicators of covid related anxiety are showing signs of healing.

Indeed reported that job postings are stabilizing and starting to improve from their worst levels.

As the northern hemisphere enters spring and approaches summer, a non-peer reviewed Harvard study found a weak effect of temperature and humidity on virus transmission.

We show that the delay between exposure and detection of infection complicates the estimation of weather impact on COVID-19 transmission, potentially explaining significant variability in results to date. Correcting for that distributed delay and offering conservative estimates, we find a negative relationship between temperatures above 25 degrees Celsius and estimated reproduction number (R), with each degree Celsius associated with a 3.1% (95% CI: 1.5-4.8%) reduction in R. Higher levels of relative humidity strengthen the negative effect of temperature above 25 degrees. Moreover, one millibar of additional pressure increases R by approximately 0.8 percent (0.6-1%) at the median pressure (1016 millibars) in our sample. We also find significant positive effects for wind speed, precipitation, and diurnal temperature on R. Sensitivity analysis and simulations show that results are robust to multiple assumptions. Despite conservative estimates, weather effects are associated with a 43% change in Rbetween the 5th and 95th percentile of weather conditions in our sample.

A quick glance of the weekly growth of confirmed deaths shows that a trend of acceleration of fatalities in the southern hemisphere, which is becoming colder, and a deceleration in the northern hemisphere, which is turning warmer.

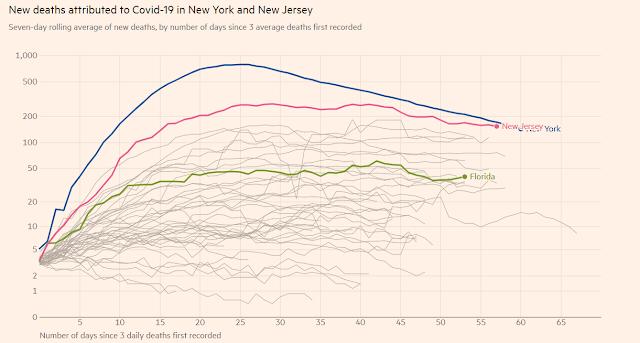

The US trend is less clear. While the hardest hit states of New York and New Jersey have bent the curve, the fatality rates of most other states have been flat, and not falling. Some states, like Florida, have seen death rates edge up, which is a worrisome sign as different jurisdictions relax their stay-at-home edicts.

However, Bloomberg reported a disturbing sign from China that the virus may be mutating, and infections are presenting themselves differently. If this strain were to spread, current lockdown approaches of containment and mitigation may be insufficient to combat its effects.

Chinese doctors are seeing the coronavirus manifest differently among patients in its new cluster of cases in the northeast region compared to the original outbreak in Wuhan, suggesting that the pathogen may be changing in unknown ways and complicating efforts to stamp it out.

Patients found in the northern provinces of Jilin and Heilongjiang appear to carry the virus for a longer period of time and take longer to test negative, Qiu Haibo, one of China’s top critical care doctors, told state television on Tuesday.

Patients in the northeast also appear to be taking longer than the one to two weeks observed in Wuhan to develop symptoms after infection, and this delayed onset is making it harder for authorities to catch cases before they spread, said Qiu, who is now in the northern region treating patients.

What about the Moderna vaccine, which got the market all excited? Stat News criticized the Moderna press release because it didn’t show sufficient details. The study states that 45 volunteers received various doses of the vaccine, and eight developed neutralizing antibodies. So what happened to the other 37?

The company’s statement led with the fact that all 45 subjects (in this analysis) who received doses of 25 micrograms (two doses each), 100 micrograms (two doses each), or a 250 micrograms (one dose) developed binding antibodies.

Later, the statement indicated that eight volunteers — four each from the 25-microgram and 100-microgram arms — developed neutralizing antibodies. Of the two types, these are the ones you’d really want to see.

We don’t know results from the other 37 trial participants. This doesn’t mean that they didn’t develop neutralizing antibodies. Testing for neutralizing antibodies is more time-consuming than other antibody tests and must be done in a biosecurity level 3 laboratory. Moderna disclosed the findings from eight subjects because that’s all it had at that point. Still, it’s a reason for caution.

Something’s isn’t adding up

While many of these signs of healing are constructive, back on Wall Street, the market is getting frothy. In a commentary written on Tuesday, Joe Wiesenthal of Bloomberg thinks that something isn’t adding up.

A thought I keep having throughout this economic crisis is that it’s extremely weird. For example, let’s start with the obvious that it’s weird that the NASDAQ is solidly up on the year, amid one of the worst economic shocks ever. But it’s not just tech stocks doing well. It’s odd, for example, that we’re experiencing a boom in big ticket items like recreational vehicles (just look at shares of Camping World) at a time when so many people are losing their jobs, or their incomes are so uncertain. It’s odd that we’re seeing surging prices for illiquid collectibles, like vintage Jordan’s or old baseball cards. You don’t normally expect to see that when people are anxious about money. The electronic DJ duo The Chainsmokers are raising a venture capital fund. That’s not a typical crisis headline. And then there’s this whole phenomenon of legendary investors like Warren Buffett or Stan Druckenmiller sounding anxious about this market, while retail traders on Robinhood keep taking the opposite sides of the bet. The list goes on and on, but suffice to say there are many things about this crisis that don’t quite add up.

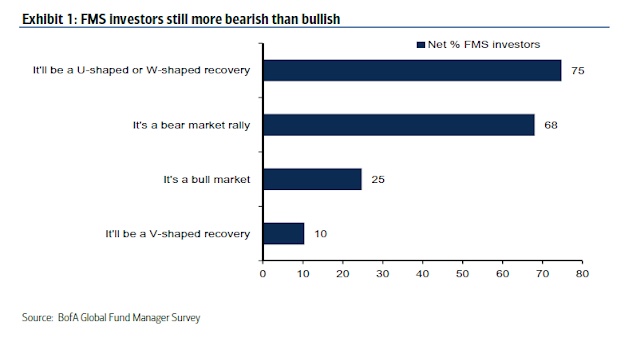

The latest BAML Global Fund Manager Survey shows a cautious view. The consensus calls for a slow recovery, and the current rally is a bear market rally.

While this cautious view might suggest the current market rally is becoming the pain trade, global managers are only slightly underweight equities, and they have all piled into the US as the last refuge of growth.

Something isn’t adding up.

A frothy market

In the meantime, the market is becoming frothy. FT reported that stock trading is now the new sports betting. Three of the top online brokerages had nearly 800K new users in March and April .SentimenTrader observed that small option buyers have been piling into call options, which is contrarian bearish. The adage of “young bears and old bulls” certainly fits the current go-go sentiment climate.

The equity-only put/call ratio hit 0.46 yesterday. In the past, the market has encountered difficulty advancing when it reached these levels in the past.

The credit markets are not entirely impressed with the equity advance. The price of credit protection is not confirming the stock market rally.

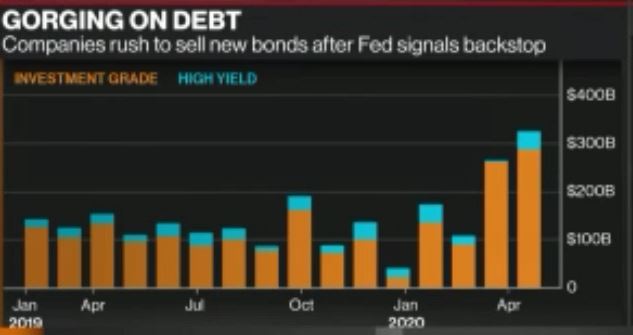

To be sure, the Fed has stepped in to stabilize markets. As a result, companies rushed to raise cash in the bond market to facilitate their liquidity needs.

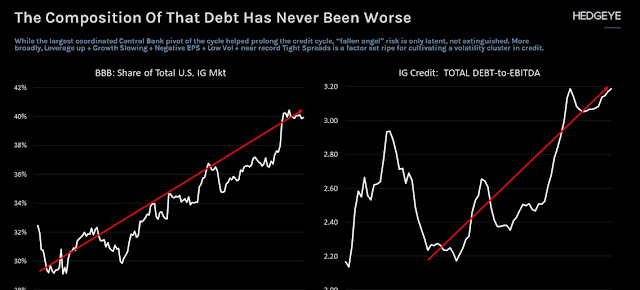

However, the credit risk of outstanding debt is worsening. I don’t want to be Apocalyptic, this just represents a nascent risk should the economy and financial conditions worsen. It does not represent an immediate risk to the markets right now.

Moody’s also estimates that “Investor recoveries upon default will be lower during the current default cycle than they were during the 2008-09 downturn, with recoveries on first-lien debt likely to be worse than they have been in the past.”

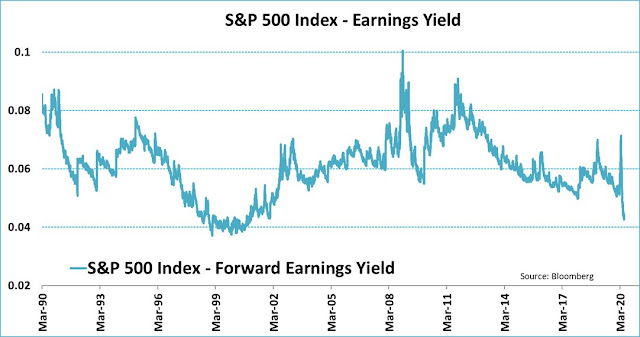

As well, valuations are extended. The forward earnings yield, or the inverse of the forward P/E, has fallen to levels last seen during the dot-com bubble.

Top of the range?

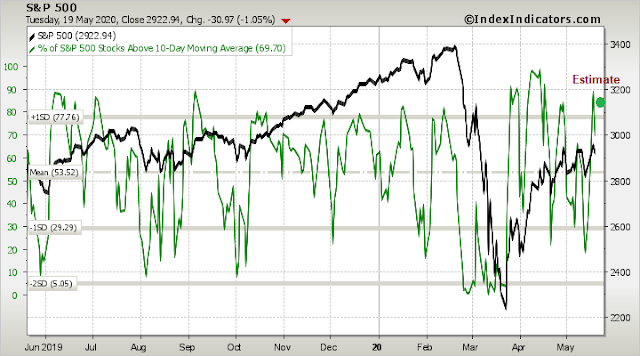

Tactically, the market is highly overbought on a 3-5 day time horizon.

The SPX is testing the 61.8% Fibonacci resistance level while exhibiting a negative 5-day RSI divergence. There is also a minor divergence between the VIX Index and VVIX, which is the volatility of the VIX. The 10-year Treasury yield remains range-bound. This array of market internals suggest that the stock market is also range bound, and at the top of its range. The bull case scenario calls for a test of the 200 dma at about 3000.

My inner investor was underweight equities, and he is slowly and opportunistically unwinding his underweight position to a neutral weight.

My inner trader is short the market, and he has set a stop loss zone of 2970 on a closing basis. I was overly distracted at the close writing this publication that I did not have time to act on that trigger, but if the market were to remain at or above these levels in the at the end of the first hour on Thursday, I will be stopped out.

Disclosure: Long SPXU, TZA

=> My inner investor was underweight equities, and he is slowly and opportunistically unwinding his underweight position to a neutral weight.

Cam,

You said you are unwinding positions. Are you unwinding Shorts? Or, are you adding Longs to get to a neutral position from underweight?

Thanks!

Bad choice of words. Unwinding the underweight position

Hi Cam,

I understand it to mean that your portfolio is getting to your policy allocation of equities from maximum defensive allocation.

I am interpreting it to mean that for the intermediate term the risk of revisiting the lows are off the table. There is a trading range to keep in mind.

The Trend Model is a pure price based trend following model. Based on recent price patterns of global equity and commodity prices, it judges that risk levels are neutral, and therefore a neutral equity and bond positioning is warranted. It does no further analysis.

My other macro and valuation analysis concludes that downside equity risks are still high. A revisit of the March lows is certainly still on the table.

Two models, two conclusions.

Thanks Cam! Appreciate your analysis and insights.

Thanks for the clarification, Cam.

So, which model is your portfolio following? The Trend Model or the other other macro and valuation analysis model?

A bit of both. If I was truly disciplined, I would be at investment policy target allocations. Since I am still somewhat cautious, I am moving towards a neutral allocation in a slower and more opportunistic (buy the dips) way.

Cam,

Two questions:

“The consensus calls for a slow recovery, and the current rally is a bear market rally.”

Isn’t this a classic case of ‘climbing the wall of worry’ and the odds can be equity index keeping grinding higher until the ‘bear rally’ crowd throw in the towel?

Re observation of hyped retail investors and their participation, they cannot move the market. To what extent do you take this data/observation into consideration when formulating the trading and asset allocation decisions?

Hats off to NY for reducing covid19 deaths from 15x FL deaths, to 5x. Probably helped that Cuomo decided to stop waging geronticide by ordering nursing homes to take in infected patients, whereas DeSantis worked to avoid this. Congratulating NY for ‘bending the curve’ is like congratulating someone for how well they applied the turniquet after blowing their foot off with a shotgun. FL, having not failed spectacularly, has deaths per day happening at the same rate as they were six weeks ago. It should also be noted that FL has 35% more people over the age of 65, compared to NY. (And is 10% larger overall.)

Ironically, perhaps the biggest risk to FL is the existence of NY. I reckon there is a fair amount of travel between NY-FL.

ICYMI, here’s a site that computes the covid19 effective reproduction rate (Rt) for each state, and a 7-day moving average of new positive cases.

https://rt.live/

Note that Rt is not R0. I know we are all experienced epidemioligists now, but in case you need further explanation of Rt see:

http://systrom.com/blog/the-metric-we-need-to-manage-covid-19/

There is skepticism about the accuracy of the values shown, but I think the trend is of interest. Note that some places (e.g., NY) are starting to show small upticks.

lol

https://twitter.com/LawrenceBJones3/status/1263177475376513024

https://www.marketwatch.com/story/americans-spent-their-stimulus-checks-on-discretionary-goods-such-as-bikes-video-games-and-clothes-target-and-walmart-ceos-say-2020-05-20?mod=home-page

Rumor had it that America would engage in austerity, soul searching and being more frugal, once all is said and done. Sure enough, something never added up in my mind with this statement. As US government prints and sends helicopter money to Americans, spending rises on non essentials! No wonder, all the metrics shown by Cam are still in party mode.

https://www.cnbc.com/2020/05/21/its-dangerous-to-ignore-the-market-bank-of-america-sees-1-trillion-in-cash-to-fuel-stocks.html

That’s true, D.V. There is too much money chasing too few stocks. And there aren’t many good alternatives to stocks with interest rates at zero.

For those who are individual share buyers and sellers: Is AAPL a sell here? The 399$ price tag on new I phone is likely to squeeze profits, or should one wait for the Apple 5G upgrade cycle?

https://www.marketwatch.com/story/dont-even-think-of-owning-stocks-unless-youre-willing-to-buy-and-hold-for-this-many-years-2020-05-19?siteid=yhoof2&yptr=yahoo

Vegas will reopen June 1:

https://www.venetian.com/resort/about-us/faq/covid-19.html

If SPY holds 292+ today, I would consider reopening a position for a run @ 300.

Cam has the market gods on his side this time.

Unemployment claims : only 2438K

Philly Fed Manufacturing Index : only -43.1

Flash Manufacturing PMI : 39.8

Flash Services PMI : 36.9

The Conference Board Leading Index m/m : -4.4%

What could possibly go wrong?

But their are trillions of dollars chasing yield. (including you) With Fed Funds at zero where is there to go but in dividend yielding stocks? Even Earnings/Share is on the menu. Then throw in the Fed pumping money into the markets and here we are.

Including me, yes, Wally . But at the moment, dividends for many companies are being cut or eliminated, so by and large, I am waiting for things to become more settled. This level of the indices does not seem to be supportive of purchasing dividend stocks. Risk / Reward is quite unfavourable against most paying stocks.

I don’t really want to be tied to a trading state all day – too much garden and dog walking and other things in life for that.

I hear ya, Joyce.

SPY 295 hardly a compelling buy. A pullback into Monday’s gap (below 292) followed by a recovery would be a better setup.

I agree about watching the markets all day. Even with the volatility/ higher trading frequency since March, I generally keep it to the opening and closing 30-60 minutes.

Effects of index tracking ETFs on the markets:

https://globe2go.pressreader.com/@Reader14825538/csb_ZWv7mdtm-gO49m61UhC4pDFXgkn0LG-mSMX-gNbrNHatX-QtDdIwKv3s5W7pzIHK

Essentially it says:

/snip…

“Passive funds have gone from bystanders to crucial influencers, but their ability to distort markets makes them risky

Passive investing strategies are becoming a victim of their own success. In the process, they are shaking the foundations on which they were built, distorting markets and introducing unintended risks.

There is no question that ETF index investing has distortive effects on the market.

To quote John Bogle, the father of passive investing and founder of Vanguard, “If everybody indexed, the only word you could use is chaos, catastrophe …. The markets would fail.””

…end snip/

Are the markets being swayed too much by index fund buyers (and sellers in March) and this might explain the currently difficult to undersatnd markets?

ignore the link, it doesn’t really work.

Better link:

https://www.theglobeandmail.com/investing/markets/etfs/article-theres-a-downside-to-passive-etf-investing/

Cam, did we hit 2990 on SPX or ES today? I don’t believe we did but saw this bullish tweet by Jurien Timmer at Fidelity. https://twitter.com/TimmerFidelity/status/1263569988209836033?s=20

Podcast: The Bull and the Bear Case for the American Economy with Dan McMurtrie

https://open.spotify.com/episode/4AfforwTrX3zk3piK4zvDN?si=D-omAr6OTJOWT_jIDFGFoA

He wrote the bull case article on medium people thought was interesting a while ago.

Interesting observation. Several thoughts come to mind.

1. There is one exception, and it’s a big one. Most would also place the current decline/ retracement in the ‘exceptionAL’ category. Exceptional events will include exceptional price swings.

2. ‘Odds are up’ doesn’t necessarily translate into ‘odds-on’ or even ‘odds are good.’

3. If ‘50% to 62%’ is the expected maximum retracement for a bear market rally, well I think the market is smart enough to print a 66% retracement just to make things interesting – not least in the context of several ‘V’ moves in the past few years.

Sorry – Comments above should appear under Ellen’s post.

Agreed, thanks for your assessment rx!

My take away is that something bad could still happen 3-6 months from here.

Trump and Chip Makers Including Intel Seek Semiconductor Self-Sufficiency

https://www.wsj.com/articles/trump-and-chip-makers-including-intel-seek-semiconductor-self-sufficiency-11589103002?mod=hp_lead_pos6

It is long overdue, and it takes a lot of determination and cooperation among all parties to restore former glory. But at least the future engineers in IC industries need not endure the incredible ordeal of long flights of Asian biz trips. When I was young I used to like it. But it quickly got to me. If we can pull it off it is very helpful to our economy. The whole ecosystem would provide a lot of high-paying jobs and generate tons of knowledge. It would balance the current situation of everything and all-thing software.

China has dropped the GDP growth target for 2020 suggesting no plans for major stimulus. It cannot be good for the world economy.

Moreover, the US Senate passed legislation that would make it difficult for Chinese companies to list or raise money in the US. This will further flare the tensions between the two nations.

https://www.cnbc.com/2020/05/22/stock-market-rising-us-china-tensions-will-hit-financial-markets.html

Look further and farther: India, for next 50 years.

Our political and corporate leaders, starting from Bush Sr., have sold out our nation and profited handsomely themselves. Why China can have special treatment? Our workers need jobs too. Why you can tell Americans to die for the Country and not create something for them?

Starter positions in EWH (Hong Kong) ~19.8x + FXI @ 37.7x. It’s an overreaction, IMO.

US indexes holding up surprisingly well. I was hoping to see SPY ~292 – may get there later in the day.

BABA (Alibaba) looks attractive here.

A strong (and perhaps rising) undercurrent of buyers continues to bid up the market, IMO.

Reopening a position in SPY ~293.5x , with an exit plan if I’m wrong.

The market reaction looks weak. Upside bias for holiday in US (Monday). But … What do you think?

SPX futures pulled back to 2903 overnight, and had every reason to decline further in the regular session. Yet here we are at 2946. It just feels like a persistently strong bid, and the market ‘wants’ to test 3000.

It looks you are right. Aftermarket 2960+ movement – so Tuesday it can be easily 3000+. And I am holding shorts :-(.

It’s funny how the narrative changes week to week, sometimes day to day. Last week we had billionaires like Druckenmiller and Tepper telling us it was the most expensive market they had seen. This week it was positive results from vaccine trials and reopening the economy. We do the best we can ‘to sync up with market rhythm. I’m wrong probably at least half the time – I acknowledge that and will make U-turns immediately when I’m wrong. Right now, SPX 3000 almost feels like destiny – so I’m OK holding through the long weekend. If I’m wrong, then I’ll exit on Tuesday. It’s not about being right or wrong – it comes down to knowing it could go either way and having plans A and B.

Cam

Is the 1600-1800 target on the S&P 500 off?

Based on what Liz Ann Saunders is saying, we may be in for a liquidity driven rally, with poor underlying fundamentals. That said, she is also making a case of strong returns going forward. Take a look:

“Remember, the stock market is a leading indicator—typically starting its move into a bear market in advance of the economy entering a recession; and typically starting its move into a bull market in advance of the economy exiting a recession. Although the latest moves have occurred at warp speed, history shows that the stock market has actually had its best performance in the highest zone of the unemployment rate, the weakest zone of real GDP and the weakest zone of S&P 500 earnings growth.

https://www.schwab.com/resource-center/insights/content/every-picture-tells-story-chartbook-look-economymarket

051820_NDR Triple Tables”

https://www.schwab.com/resource-center/insights/sites/g/files/eyrktu156/files/styles/embedded_700/public/051820_NDR%20Triple%20Tables.png?itok=flQXlKoD

The asterisks in the above table is where we are. This is not the first time she has made this point and she has generally been right over the decade(s). Based on what she says, this market seems like a strong long term buy.

Here is what we know.

1) We are in a recession, and recessions are bull market killers

2) The economy hit a brick walls and fell into a recession without much warning

3) This market has been highly unusual inasmuch as it barely reacted to the recessionary downturn. Blink and you missed it.

Past studies of market history, like the one that Liz Ann Sonders cited, has shown than as soon as you recognize you are in a recession, the bear market is over. But, in the past, the bear market began well before the recession began. Not so this time. In the past, the market reacted to negative recessionary events ahead of time, e.g. Fed tightening, signs of slowing growth, credit market events and rising bankruptcies. None of that has happened this time.

In the past, the market has typically bottomed out at 10-12 times forward earnings. The market is trading at a forward P/E ratio of over 20, but without the aforementioned reaction to slowing growth, etc. These valuation levels are entirely appropriate if you believe that the economy will snap back in a V-shaped recovery and everything will be back to normal by Q3 or Q4 as if nothing happened. Otherwise, I would wait for the second shoe to drop, the signs of a prolonged slowdown, and the subsequent market reaction. In that case, a 10-12x forward P/E would still give us a range of 1300-1700.

Cam,

You mentioned earlier that you are watching small-caps for signs of out-performance. That has been happening recently.

https://twitter.com/ukarlewitz/status/1263929198646685696

Does it change your view of the stock market?

Small/large cap ratio trying to bottom but the turn isn’t definitive yet. Also watching the other big 2 leadership trends. US/global (sideways also not definitive) and growth/value (no).

Thank you, Cam.

Robert Arnott, a noted Value Investor on WealthTrack:

https://tv.youtube.com/watch/8IYxo6BKjBo

Very bearish. Some key points:

• This pandemic is different enough to matter. We did not lock down the economy for polio, WWI, WWII and even in the Great Depression. The biggest disruption to the economy since the Great Disruption. The damage will be lasting and quite serious.

• 30M businesses; 10M businesses may be bust by mid-year.

We will see more bankruptcies. We are in a depression, not a recession.

• High odds we retest the lows, and decent odds we breach them.

On the positive side, fewer businesses means less competition and better pricing power sometime in 2022.

Sentiment round up from Urban Carmel:

https://twitter.com/ukarlewitz/status/1263554090522443776

Smart, very smart.

Cam, Agree with almost everything you wrote except for one point. Camping World was a bad example for what doesn’t make sense. Camping is the one activity that people can do with their families ,while social distancing. They are not getting on planes to go to Europe or Disney world etc; you can rent a camper for $169 a month. This is not a high ticket item. Camp grounds across the country are sold out.