We are continuing our coverage of earnings season during these turbulent times. With 90% of the index having reported, this will be the final earnings monitor of the Q1 earnings season. This week, we are seeing greater additional signs of stabilization, but companies are digging for the long haul.

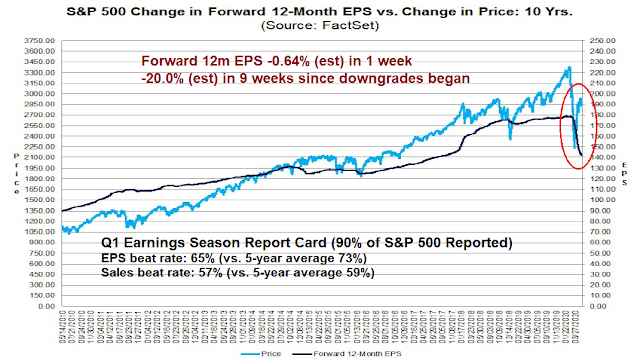

Let’s begin with the big picture. FactSet reported that the bottom-up consensus forward 12-month estimate fell -0.64% last week (vs. -1.4% the previous week), and -20.0% since downgrades began nine weeks ago. The EPS and sales beat rates were both below their 5-year historical averages.

Good news and bad news

There was more good news, and bad news the FactSet summary of Q1 earnings reports. Let’s start with the good news. The speed of earnings downgrades is decelerating. Forward 12-month EPS fell -0.64% last week, compared to -1.4% the previous week. This is a marked improvement from the experience of the past several weeks, when estimates fell consistently by -1% or more. Estimate revision deceleration can be attributed to the fact that bottom-up EPS estimates are starting to converge to top-down estimates. The 2020 bottom-up consensus estimate of $129.16 is within striking distance of the top-down estimate of $120-$125. However, the bottom-up 2021 estimate of $164.68 is still a little elevated compared to the top-down consensus of $150.

As well, the market is becoming immune to bad news. Stocks were reacting positively to earnings beats, and negatively to misses. However, it did not punish earnings misses as badly as it has historically.

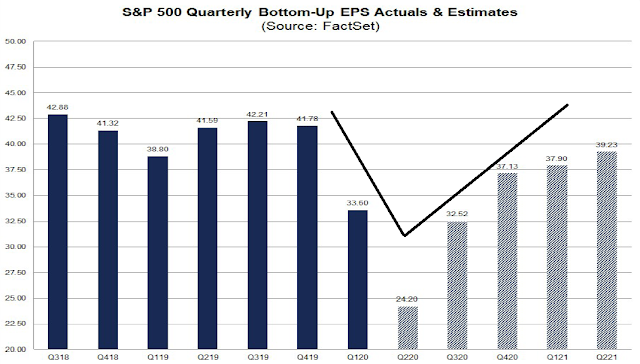

However, expectations are high. The Street is expecting a V-shaped recovery in earnings.

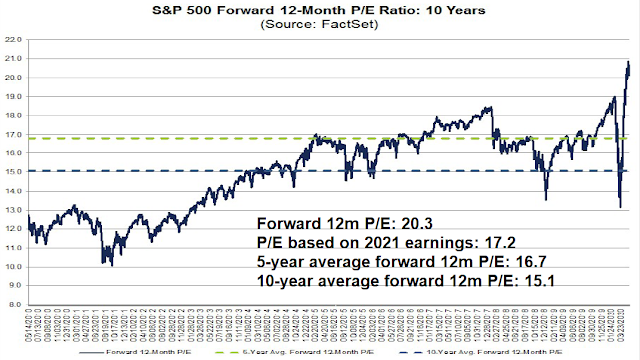

The market is priced for perfection. Forward 12-month P/E is a nosebleed 20.3. Even if you are willing to look over the 2020 valley, the bottom-up derived 2021 P/E ratio is 17.2, and 19.7 on a top-down basis. All of those measures are well above the 5 and 10 year forward 12-month P/E averages.

Voices from the trenches

What are companies saying? Here is the summary from The Transcript, which summarizes company earnings calls. The decline in sales has stabilized, but a full recovery is going to take a long time. These comments cast doubt on the strong V-shaped earnings recovery forecast by the Street.

Economic activity is trending positively as shelter in place orders are slowly lifted around the economy. The data is better than it was but still very bad for any other environment. Markets have discounted a quick return to normalcy, but this week’s comments suggest that business leaders expect the recovery to take longer. For the hardest-hit industries, it could be years before they are operating at peak levels again. And even if demand snapped back today it could take months for the supply side of the economy to rev back up. Importantly, employment will likely rebound slower than the rest of the economy, which is a big deal for the demand side of the economy given how high unemployment numbers are.

Even Jay Powell hedged when asked about his expectations for a recovery in his weekend 60 Minutes interview. Much depends on the fight against the virus. While he is forecasting a bounce back in the second half of 2020, everything has to go right, and the recovery will take a long time [emphasis added].

The big thing we have to avoid during that period is a second wave of the virus. But if we do, then the economy can continue to recover. We’ll see GDP move back up after the very low numbers of this quarter. We’ll see unemployment come down. But I think though it’ll be a while before we really feel, well recovered.

Much depends on the absence of a second wave of infections.

Well, I think you’ll see, again assuming there’s not a second wave of the coronavirus, I think you’ll see the economy recover steadily through the second half of this year. I do think that people will be careful about resuming their typical spending behavior. So certain parts of the economy will recover much more slowly.

Powell did sound the obligatory optimistic long-term tone (as did Warren Buffett):

In the long run, and even in the medium run, you wouldn’t want to bet against the American economy. This economy will recover. And that means people will go back to work. Unemployment will get back down. We’ll get through this. It may take a while. It may take a period of time. It could stretch through the end of next year. We really don’t know. We hope that it will be shorter than that, but no one really knows. What we can do is the part of it that we can control — is to be careful as businesses go back to work. And each of us individually and as a group, you know, take those measures that will protect ourselves and each other from the further spread of the virus.

Here are the key risks:

There’s a real risk that if people are out of work for long periods of time, that their skills atrophy a little bit and they lose contact with the workforce. This is something that shows up in the data — that longer and deeper recessions tend to leave behind damage to people’s careers. And that weighs on the economy going forward.

You could say the same thing about businesses. The small and medium size businesses that are so important to this country, if they have to go through a wave of avoidable insolvencies, you’ve lost something there that’s more than just a few businesses.

You know, it’s really the job creation machine. And if that happens, it will take some time to recover from it.

Former Fed economist Claudia Sahm had a far darker take of the Powell interview in a Twitter thread, She believes that Powell put too much emphasis on the best case scenario, and she was shocked that he said “recession” and even “depression” on national TV. Federal reserve staff were not even allowed to utter the “recession” word in the building.

absolutely no surprise @federalreserve Chair Powell lays it down, we ain’t bouncing back … I learned real world macro and top notch forecasting at @federalreserve, you know I’m deeply pessimistic, his staff must be running through worst scenarios https://economics.cmail19.com/t/ViewEmail/d/64D116D8576D38CF2540EF23F30FEDED/54DDC383BBB39FD140EE66FE10287772

I know nothing about current staff forecast … even so, I could write a close copy from my 12 years at @federalreserve, I wrote Tealbook twice and know the tools deeply, what Powell’s saying out loud is the most optimistic read on the economy , he’s getting sent to him

when I heard Powell say “ recession” at an emergency presser in March, almost fell over … staff were not allowed to say that word in the building when we put recession call in our forecast in March 2008 … my god, Powell said “depression” on national TV last night

they must be doing Great Depression alt sim for the Federal Reserve officials now … me too, except I’m moving fast toward depression it as my baseline

I feel some comfort knowing that Administration and @WhiteHouseCEA always get the Fed staff forecast (including alt aims) and write up in Tealbook .. Kevin Hassett began on

@federalreserve staff, I’m sure he’s reading it, he better be! and sharing its analysis with the PresidentNEVER in 2008 recession when it was clearly severe did staff have as baseline a v-shaped recovery NEVER … clearly it 90% forecast of Powell and staff

I can’t imagine ANYONE at @federalreserve in DC saying Cape-Cod in the winter was like our coronavirus crisis … I blew my top when I first saw @LHSummers argue it in

@washingtonpost op ed … no regretsreally lost it as April data came rolling in

so tired of being angry at the world and at macro men who are mentors PS Cape-Cod man is not one .. talked to @DianeSwonk on my show. asked her if I’m being too pessimistic, no, I’m not. macro women have been tragically right again and again http://macromomblog.com/sahmpodcast/ listen to them

lastly I am SO PROUD of @federalreserve staff and leadership .. . blessed that I left in November (was so hard) and can now share the wisdom in that building with the world. they cannot, I can and am … doubly blessed many people have given me a platform I never expected

Bloomberg reported that even Reinhart and Rogoff thinks that this time is indeed different. Forget the V, the pace of recovery is likely to be very slow.

I don’t know how long it’s going to take us to get back to the 2019 per capita GDP. I would say, looking at it now, five years would seem like a good outcome.

What about the vaccine?

The market rallied on a promising Phase 1 trial of a Moderna vaccine (see CNBC story). Before everyone gets too excited, consider the following:

- It’s only a Phase 1 trial, drug trials often fizzle out in Phase 2 and 3 trials. Possible safety or efficacy problems could arise as the the sample size rises.

- Even if the vaccine proves to be effective, the first doses won’t be available until Q1 2021 at the earliest. Widespread availability might not be until Q2 or Q3.

- There will be production issues. As an example, the vaccine involves two doses. Bill Gates has raised the simple problem of the sufficient availability of glass vials.

- Also consider the possible economic effects. If individuals expect that a vaccine is available early next year, behavior could change as people hunker down and the economy goes into a deep freeze. No one will wants to be the last casualty just before a vaccine saves the day.

In the meantime, the market is priced for perfection. Forward 12-month P/E is over 20, and 2021 P/E is 17.2. The key risks are:

- A second wave of infection (see the new lockdowns in China, rising new cases in Texas, plateaus in new cases in Sweden and UK).

- A second wave of layoffs.

- Avoiding the debilitating effects on individuals and businesses of an extended shutdown (Powell’s comments).

- Don’t forget the risks of a renewed trade war as the November election approaches.

Best case, we won’t start to see a return to normalcy until Q2 2021. In the interim, the risks of significant damage to the economy are high.

Disclosure: Long SPXU, TZA

Texas is probably not going to fair out well in a few months. Over the weekend, any restaurants or bars that opened were fairly packed.

Alex1, what are the guidelines for opening restaurants in TX? Max capacity? Seating / social distancing? Masks?

Thank you.

Official guidelines is to open bars at 25% and restaurants at 50% seating capacity, but they are just guidelines – not enforced regulations. Quite a few more businesses are set to reopen this week.

https://www.statesman.com/news/20200518/abbott-gives-green-light-to-day-care-bars-bowling-youth-sports-and-summer-camp

I live in Austin, TX, so it may not be representative of the other metro areas. As for the mask wearing, most people wear masks while shopping, but its harder to keep a mask on while eating at a restaurant.

I think the correct protocol is:

Remove mask to take a bite, then pull it back on to continue a conversation.

I wouldn’t bother dining in at a restaurant under those conditions.

Thanks, Alex1.

I think the 2nd wave is coming but the impact of that is not yet known.

I think we will learn to live with coronavirus. More and more people are realizing that the cost of the cure is worse than the disease. Most people will take extra precautions and the most at risk will self-isolate. The society will bear the risk of infections and deaths like we do for many other day-to-day activities (driving, alcohol). May be with the exception of watching sports or concerts live in stadiums, flying or even taking public transportation, the rest of the economy will gradually return to normalcy by the end of the summer.

Outside large metropolitan areas dependent upon public transportation, I doubt if we will see city- or state-wide lock downs at least through Sep.

Fall? All bets are off. I do think that though with the healthier habits we are forming now (social distancing, cleaning hands, masks), the regular flu should be much less severe in the fall/winter.

The 90% recovery? That sounds pretty close to the right take:

https://www.advisorperspectives.com/articles/2020/05/18/jim-bianco-a-90-recovery-will-be-a-disaster?topic=real-estate

I have been trying to find some material that uncovers the transmission mechanism of the Fed’s QE policy to risk markets. Here is a helpful Stanford study:

https://siepr.stanford.edu/research/publications/how-did-quantitative-easing-really-work-new-methodology-measuring-fed-s-impact

I just browsed thru Sec 5 (related to risk assets).

Key points:

If central bank actions positively shock expectations for future economic prospects, that may directly shift the willingness of businesses and households to invest and consume. Success in breaking deflationary expectations can catalyze increased consumption and investment.

Not only do investors seek to anticipate potential policy actions in advance, they also digest the full consequences of announced policy actions for an extended period after the fact.

Moreover, sustained moves in markets reflect allocation decisions by large pools of capital, not traders reacting to news on the fly. These pools include pension funds, endowments, sovereign wealth funds, institutional asset managers, and others.

Half of the 10 largest quarterly rallies and sell-offs in equity markets between 2010 and 2018 began within one week of a major balance sheet announcement. Three of the five largest sell-offs in credit markets during the same period started within one week of the ends of QE1, QE2, and QE3.

The interest of investors in new policy announcements was not limited to the technical dimensions of particular initiative. Rather, market participants were looking for what these announcements revealed about the character of the central bank. Was the Federal Reserve willing to do “whatever it takes” to secure a recovery and clip the tail risk of a deflation scenario? If so, portfolio managers would have a “green light” for investing in riskier assets that would benefit from a reflationary scenario.

Bottom line: Don’t fight the Fed if the Fed is willing to do “whatever it takes.”

What the long and winding Stanford study says is about psychology, not transmission mechanism. We should all learn from Einstein and make it simple enough. The math is very simple. QE drives balance sheet expansion and drives IR lower. Lower IR drives up equity market valuation. The reverse (QT) has the opposite effect.

A similar story about one of my friends who got a PhD in mechanics (from a reputable graduate program) by studying cantilever beam thru perturbation method, basically long and winding equations. His dissertation is 400+ pages long ( I have seen it). You can easily look up the equations governing cantilever beams in any mechanics of materials textbook.

Ingjiunn, you are totally correct. There is no direct transmission mechanism. The effect is primarily through 2nd and 3rd effects (e.g. via its impact on the investor psychology).

Cam – were you stopped out of your short positions today?

No. Tomorrow is another day.

Thanks

UCSF virologist discusses Moderna Phase I vaccine clinical trial https://www.youtube.com/watch?v=SmzR1D_KUvE

Thanks, Ellen.

Np!

Capitalism has gone awry in the age of the millennial. Take a look at this Doordash foolishness.

https://www.theverge.com/2020/5/18/21262316/doordash-pizza-profits-venture-capital-the-margins-ranjan-roy

Nice one Wally – I wish we can find a few of those “risk-less arbitrage” in the equity mkt these days. Real econ is plunging at the speed of light but the mkt is not… this makes complete sense when the Fed says they got us (US) covered.

https://www.washingtonpost.com/business/on-small-business/powell-says-fed-has-americas-back-with-congress-arguing-over-aid/2020/05/19/777e4348-99df-11ea-ad79-eef7cd734641_story.html

Good equity arbs are tough to find. A few years ago I was able to arb some bitcoin. I made thousands a month but I had to use Paypal to make it work safely. But Paypal didn’t like me making money so they started closing my accounts and locking up my capital for 6 months before they would give it back. No explanation or recourse. Seems what they were doing was illegal but I wrote my Congressman and Senators to enact legislation but they wouldn’t do anything about it. Paypal must have an effective lobby.

BAML Fund Managers Survey:

https://twitter.com/ukarlewitz/status/1262750898800881667

Still very defensively positioned.

https://twitter.com/WalterDeemer/status/1262797936834088962

Looks like Walter and his buddies are trying to convince us that we are in a bull market. Unless we aren’t. LOL

Wally, you’re right. Like all of us here, Walter is just trying to be on the right side of the market.

Scaling back into SPY ~293 for a ST swing long.

Piecing together a few tweets/observations that crossed my feed today – there seems to be strong undercurrent of buyers, perhaps enough to make a run at SPX 3000 before this rally is over. I also agree with Tony Dwyer’s rebalancing thesis re ‘banks and tanks,’ and added starter positions in XLI + XLE + XLF at the close.

It’s working for you this morning, RX.

If the rotation into value is real, then we should see JPM/ BAC/ WFC back at the late April highs soon.

BA looks good. The high-volume spike on Monday should hold.

Airlines? Buffett sold, but Bill Miller’s buying. There are two sides to every trade.

Wow. Todays market action is really beyond belief.

The Potemkin market. It’s not real, just for show.

So much winning.

I’ve trimmed a few positions, and will continue to hold others. Mix includes XLI (industrials), XLE (energy), BAC (BofA), JPM, WFC (Wells Fargo), UAL (United)/ JETS (airlines), and BA (Boeing). All stuff recently viewed as toxic waste.

Will probably take most of my position in SPY/ RYSPX off at the close. I think another broad market pullback may be necessary to successfully launch an assault on SPX 3000.

Cam, did you exit your short? 5 day RSI SPX divergence, narrow leader ship continues.

Watching the close

This feels like we are on an ark looking for land – we keep hoping but no land in sight yet. I may just stay pretty much in cash until things become clearer.

We were all worried before covid that the stock market was over extended. I think this is the source of my anxiety. Markets looked dodgy, and now the economy has become even dodgier, the stock market has become, seemingly, even more over extended. Cognitive dissonance for me. Go long? Go short? Yes!! Both at the same time!!

Yes, that’s about right. A professional value investor I’ve long followed, posted he’s confused in the current environment: http://yetanothervalueblog.com/2020/05/confused.html (and another “part deux”).

It looks to me like Fed actions have so undermined market functioning we’re in “uncharted territory”. The past is no guide. It adds to the already extreme uncertainty of the virus and economy instead of lessening it. Sentiment seems very divided for example, in odd ways. The market’s disconnected from the economy.

Money and interest rates have been around since before Biblical times and if you could solve problems by creating a flood of newly created money, you’d think people would’ve figured that out. What ever results, I don’t think we’re going to like it.

I like to watch CNBC once a while to get the alternative points of view, and I just happen to catch Tom Lee on Fast Money. He is uber-bull and is expecting S&P500 to make new highs this year. Very gutsy call to make!

I didn’t catch the whole discussion but some points are worth mentioning.

• The number of jobs lost are very large but the loss of national income is just 5%.

• He also thinks the economy affected due to the social distancing just represents ~$700b out of a total economy of $17 trn. If half of that economy comes back, we’d have lost $350b which can be made by the rest of the economy.

• He is rotating from the Staples sector to the beaten-down Energy sector (just 3% of the weighting now, vs. 12% several years ago).

Risks:

The virus re-emerges (of course, that’s a big one).

Another point is that the earnings are driven by the operating leverage, and the tech companies have a lot of leverage. Every $1 in rev can probably ad $0.90 to the earnings. The question is whether they can compensate the loss of earnings in non-Tech and non-Communications Services sectors.

Sanjay, I think there is a real risk of a second shutdown coming. Two churches here in Texas had to reclose after the congregations started getting sick and one of the pastors died of covid. We are close to finding out if this is going to happen or not nation wide.

Wally, we definitely need to closely watch on the data for the emergence of the 2nd wave. The places or events for congregation – weddings, parties, churches, synagogues – have accelerated the spread of the virus.

I think we may NOT see state-wide or nation-wide shutdowns if the new cases remain “manageable” over the next few months. I feel we are gradually and reluctantly accepting the cost of living.

The shelter-in-place could remain confined to communities or areas affected. In NY State, the authorities quarantines communities and towns when the virus initially emerged. That’ll have limited effect on the economy.

Also, people are a lot more vigilant now than they were 2-3 months ago. In NYC, almost everyone is wearing a mask and keeping social distance. Many can and will continue to work from home. On top of it, at least in some states, they have started building decent testing and contact tracing capabilities which will bring some confidence back among the people. I think we won’t see the whole state shutdown over the summer.

With people being careful, I also expect the regular flu season in the fall/winter will be less severe.

Btw, I’m not buying Tom Lee’s or anyone else’s bullish arguments but just listening to the alternative viewpoints, and keeping an eye on the market. How the market behaves around 3,000 is critical.

The Fed has been driving this market up. At minimum, the prices won’t pull back very deeply over the short-term.

This is not good news. Bloomberg reports:

Chinese doctors are seeing the coronavirus manifest differently among patients in its new cluster of cases in the northeast region compared to the original outbreak in Wuhan, suggesting that the pathogen may be changing in unknown ways and complicating efforts to stamp it out.

Patients found in the northern provinces of Jilin and Heilongjiang appear to carry the virus for a longer period of time and take longer to test negative, Qiu Haibo, one of China’s top critical care doctors, told state television on Tuesday.

Patients in the northeast also appear to be taking longer than the one to two weeks observed in Wuhan to develop symptoms after infection, and this delayed onset is making it harder for authorities to catch cases before they spread, said Qiu, who is now in the northern region treating patients.

https://www.bloomberg.com/news/articles/2020-05-20/china-sees-signs-new-cluster-carries-virus-longer-than-in-wuhan

Surprisingly truthy… “They cannot admit that we’ve given up on beating the coronovirus, and that herd immunity is now the objective”

https://www.marketwatch.com/story/why-governments-cant-tell-the-truth-about-opening-up-2020-05-18?mod=article_inline

SPX now less than 1% away from the 200-day. Given the always perverse nature of the market – the index will probably sell off for a few days before breaking above.

And probably via overnight futures while we’re all sleeping.