I have heard comments from veteran technical analysts who have become bewildered by the market’s action. The word “unprecedented” is often used.

I beg to differ. The violence of the sell-off, and subsequent rebound is not an unprecedented event. Recall the NASDAQ top of 2000. The NASDAQ 100 fell -39.8% from its March 2000 high, and rebounded 40.1% to its 61.8% Fibonacci retracement level in just four months. The index proceeded to lose -49.7% in that year, and ultimately -80.8% at the 2002 bottom, all from the July reaction high.

I am not implying that the NASDAQ pattern in 2000 represents any market analog to today’s action. Barring some other unforeseen catastrophe, such as the Big One taking down California and decimating Silicon Valley, the market is not going to fall -80% from the reaction high.

In the past, I outlined my concerns about the stock market (see The 4 reasons why the market hasn’t seen its final lows). This week, I register additional concerns, mainly from a technical analysis perspective.

Repairing technical damage

My first concern is the level of technical damage in the March downdraft. Even if you are bullish, it is difficult to believe a market could rally back and shrug off that level of damage without at least some period of consolidation.

Technical analyst J.C. Parets recently showed numerous examples of technical patterns that needed repair. He compared the price of Carnival Cruise Lines (CCL)

…to Citigroup before and after the GFC.

He also highlighted the relative price action of technology stocks after the NASDAQ top.

There were other examples, but you get the idea. Even if you are bullish, the market needs time to heal. Stock prices were so stretched to the upside that technician Peter L.Brandt, another grizzled veteran, declared that he had sold all his equity holdings.

Frothy sentiment

Another concern I have is the frothy nature of sentiment. Greg Ip wrote a WSJ opinion piece which highlighted the lack of perception of the difference between lower tail-risk and the odds of a sustainable recovery:

There is another, less reassuring, explanation for the market’s rally: Investors are translating less-bad incremental news into a much faster economic rebound later this year, perhaps prematurely.

The lockdowns and the fiscal and monetary backstops have eliminated the worst-case scenarios “for hospitalizations, mortalities, and bankruptcy filings,” but not the baseline scenario “which involves a massive negative shock to national income,” said Mr. Thomas. This doesn’t seem consistent with S&P 500 index hovering just 15% below its pre-pandemic high.

Mark Hulbert also issued a similar warning when Goldman Sachs made a public U-Turn and turned bullish.

Consider the average recommended stock market exposure level among several dozen short-term stock market timers I monitor (as measured by the Hulbert Stock Newsletter Sentiment Index, or HSNSI). This average currently stands at 13.7%, which is more than 40 percentage points higher than where it stood just a few days ago, as you can see from the chart below.

That represents an unusually quick jumping onto the bullish bandwagon. The typical contrarian pattern at market bottoms is for rallies to be greeted by widespread skepticism. That’s not what we’re seeing now.

Incidentally, Mark Hulbert issued a second warning based on market seasonality. Historically, the six months beginning in May has been historically weak, and Hulbert observed that it is especially weak if the stock market in the previous six months was down.

Selling in May and going away is starting to sound good in 2020.

Waiting for the credit event

The Economist pointed out how fraud and credit event blow-ups occur in the wake of recessions:

Booms help fraudsters paper over cracks in their accounts, from fictitious investment returns to exaggerated sales. Slowdowns rip the covering off. As Baruch Lev, an accounting professor at New York University, puts it, “In good times everyone looks good, and the market punishes you harshly for not keeping up.” Many big book-cooking scandals of the past 20 years emerged in downturns. A decade before the crisis of 2007-09 the dotcom crash exposed accounting sins at Enron and WorldCom perpetrated in the go-go late 1990s. Both firms went bust soon after. As Warren Buffett, a revered investor, once put it: “You only find out who is swimming naked when the tide goes out.” This time, thanks to a pandemic, the water has whooshed away at record speed.

Setting aside any fraudulent activity, every recession has been followed by a credit event that has disrupted markets. The GFC was sparked by the failure of Bear Stearns, followed by Lehman Brothers. Investors were left holding the bag after the 2000 bear market when Enron, Worldcom, Adelphia, and others blew up. Regulators had to clean up the Savings & Loans crisis after the 1990 recession.

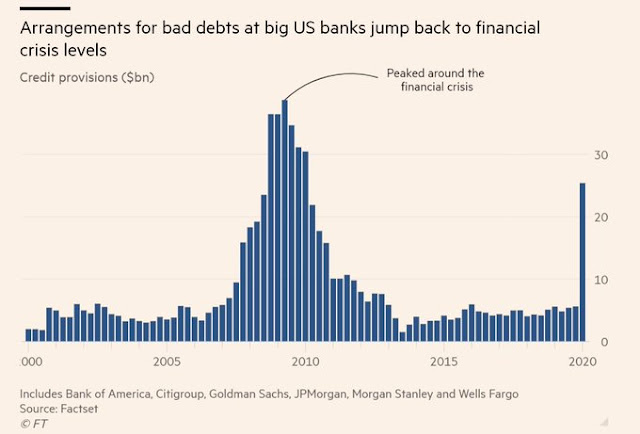

What credit event are we likely to see in 2020-2021? Bad debt provisions are already rising at the major US banks, but we haven’t seen any credit blowups yet. You know that things are bad when Verizon, a phone company, announced that it raised its Q1 bad debt expenses by $228 million.

What about the carnage in the oil market? Remember Amareth, the hedge fund that imploded when it tried to buy the front month in natural gas but couldn’t take delivery because of the lack of storage? Reuters reported that Singapore oil trader Hin Leong Trading owes $3.85 billion to banks after incurring $800 million in undisclosed losses. This blowup occurred before the front month WTI price fell into negative territory early last week.

Last week’s crash in oil prices may have created some financial damage. Interactive Brokers reported that it is making provisions for losses of $88 million from bad debt stemming from client accounts who were long the crude oil contract that crashed. Bloomberg reported that the Bank of China took a huge hit from a Chinese WTI ETF that it manages, It rolled its May positions forward on the Monday when the price went negative, which created large losses. How large? The market went into the open on Monday with an open interest of about 108,000 contracts, and Tuesday morning’s open interest was about 16,000. The market skidded by $50 per barrel on Monday, which translates to a loss of $4.6 billion for the closed contracts, not all of which are attributable to BoC. BoC has asked ETF holders to make good on the losses which drove the ETF’s NAV into negative territory. Given the highly leveraged and opaque nature of China’s financial system, we will never know the exact details of the losses, the risk is financial instability first shows up in China, and not within America’s shores.

Notwithstanding any oil related blowups, Mohamed El-Erian fretted in a CNBC interview about corporate and sovereign defaults. JC Penney and Neiman Marcus are already on the verge of seeking bankruptcy protection. The Gap announced last week that it was running low on cash, and it had stopped paying rent on stores it has shuttered. If the lockdown were to last until the end of May, other major retailers may have to follow suit. In that case, El-Erian worried that the government will have to make a major decision. Will it bail out all retailers, or will it have to pick winners and losers?

The signals from the credit market indicate a loss of risk appetite. High yield (junk) bonds have underperformed in the last two weeks despite the Fed’s intervention in the credit markets. The Fed can supply liquidity to the market to stabilize spreads and ensure the solvency of the financial system, but it cannot supply equity that was lost because of the crisis. In light of the well publicized difficulty of state finances, municipals have sagged as well.

So much for the bullish narrative of “the Fed is buying HYG”.

Stresses are also showing up in the offshore dollar market. The Fed has opened up USD swap lines with numerous new countries, in addition to supplying dollars through their existing swap agreements. This flood of dollar liquidity has been unable to stem greenback strength, and EM currency and bond market weakness. In particular, EM currency weakness will pressure countries with weak external balances, especially in the current precarious environment.

When does the next shoe in the credit drop in this recession, and is the market prepared for that event?

Narrow leadership

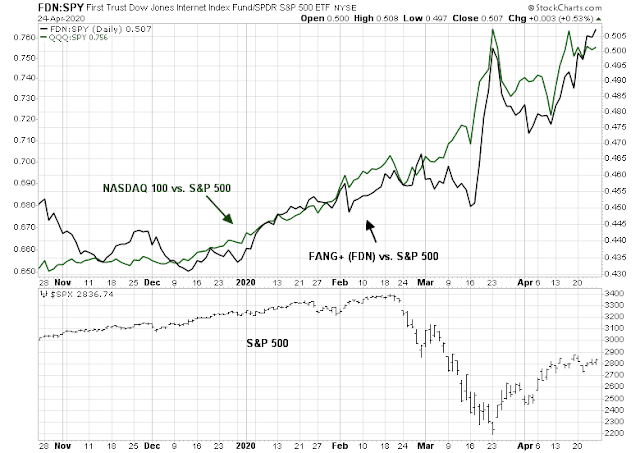

Another worrisome aspect of the market rebound is the narrowness of the market leadership. Remember Bob Farrell’s Rule #7: “Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names”.

The FANG+ and NASDAQ 100 stocks have been on a tear relative to the rest of the market this year.

SentimenTrader observed that growth stocks are becoming an extremely crowded trade, which usually does not resolve in a benign manner.

Here is what might derail the momentum of the FANG+ names. In particular, I am watching the Amazon, Google, and Microsoft earnings reports on their cloud services. While many investors have been focused on Amazon’s retail delivery services, which is a beneficiary of the work from home trend ruing the pandemic, their Amazon Web Service (AWS) is the company’s far higher margin business and AMZN’s jewel in the crown. The Information reported that cloud customers were asking for financial relief on their bills:

Public cloud providers like Amazon Web Services, Microsoft Azure and Google Cloud have had to cope with a surge in demand in recent weeks as huge numbers of people work from home. But the cloud providers are also facing requests from many customers for financial relief, while others are cutting their cloud spending.

So far, AWS has been the least willing to offer flexible terms on customer bills, according to numerous customers. That stands in contrast to Microsoft and Google which have shown some flexibility, partners say. How each of the cloud providers responds to customers asking for help has big implications, for both their near-term revenue and their long-term relationships with customers.

AWS has shown itself to be the least willing to give their customers breaks. (Reading between the lines, Lyft is the probably the reference ride sharing customer as it has guaranteed $80 million in payments to AWS.)

Inside AWS, salespeople have been asking managers how they shoudl best respond to requests for a break on payment from customers in travel, retail, real estate and ride ailing. A person who works at one of AWS’ largest customers said the company recently asked AWS for a financial break on its agreement, but AWS declined. An executive at an online real estate company said AWS pushed back on his company’s request for a break while another executive at a different company told The Infomation planned to ask AWS for a price reduction. The latter executive isn’t hopeful that AWS will grant the request, however, as it isn’t known for making pricing concessions.

By contrast, Microsoft has shown greater flexibility. While it is difficult to switch cloud providers during a period of stress as customers’ IT departments faces layoffs and staff reductions, AWS’ recalcitrant behavior risks alienating its client base and long-term relationships once the pandemic ends.

Microsoft has indicated to customers that it is willing to be flexible on pricing and contract terms if the Covid-19 crisis continues to keep the economy on hold, according to Adam Mansfield, director of services at UpperEdge, a firm that helps large companies negotiate contracts with cloud providers.

Customers in a wide range of industry segments have asked Microsoft for financial help since the beginning of March, including companies in consumer packaged goods, oil and gas, and retail, said Mansfield. Some have asked to defer payments for software they’ve used; others are asking for annual price reductions for software they’re planning to use in the future; and still others are asking to reduce the volume of users in agreements without a corresponding rise in per-user pricing.

Already, we are seeing how cloud services are evolving in the current environment from the IBM earnings report. While IBM is reporting strong cloud revenues, customers are delaying major development projects to conserve cash. Existing cloud revenue streams are likely to be untouched, but don’t expect much growth, and don’t be surprised at either delayed revenue recognition, or rising bad debts.

Amazon is scheduled to report earnings Thursday.

How a bear market bottoms

In conclusion, this is a recession. Recessionary bear markets take a long time to resolve, largely because of the technical and financial damage suffered in the downturn. As the macro and fundamental problems and uncertainties resolve themselves over the course of the downturn, that’s the mechanism how the stock market returns to retest its initial lows after the first reflex rally.

Consider the problem of reopening the economy. Selected European countries and US states have begun to relax their stay-at-home edicts and reopen their economies. Based on the first in, first out principle, we can see how the Chinese economy has fared in their efforts to reopen. Manufacturing and industrial activity is almost fully back to normal, though the sector is burdened with a lack of foreign demand. However, the consumer and services sector has recovered far more slowly.

Let us assume for the moment that the efforts to reopen the US economy is successful. The American economy is mainly consumption and services driven. If the consumer is still weak in China, how weak will it be in America, and what will be the effects on economic growth?

Now consider all these markets from a technical perspective. The S&P 500 and DJIA have violated uptrend lines, indicating bullish exhaustion as they approached their 50 dma.

Similar technical patterns can be seen in the Shanghai Composite, and the stock indices of China’s major Asian trading partners.

Don’t forget the DAX. Germany is taking small steps to reopening its economy.

Are the global markets trying to tell us something? I interpret these technical patterns as a setup for a retest of the March lows at some point in the future. Depending on the nature of the fundamental and financial damage, the retest of the lows may not necessarily be successful.

This is the process of how a bear market bottoms. We have only undergone the first stage of the decline.

Stay tuned.

Cam – if I’m not willing to predict when a retest will occur do you think a small position in deep out of the money SPY puts expiring at year end is the best way to hedge?

Volatility is rather high, and puts are going to be expensive. If you want to do that, you might want to consider a collar, where you sell a call and buy a put. How you adjust the strike prices is up to you and your level of risk appetite.

With regard to the SPY, the uptrend line that was violated represents a 30% rally in 20 days. The fact that this rate of ascent was unsustainable is indisputable, but I don’t think it says much about the likelihood of a retest of the lows. Such a retest is certainly possible, perhaps even probable, but I’m not convinced that the violation itself is prema facie evidence.

Cam, even though we see a certain break down of the recent recovery rally trend, so far prices are still kind of stabilizing below the 50% retracement levels or near to resistances levels (2´800 for SPX). How do we explain this resilience, knowing that we get only negative news (retail sales, industrial production, jobless claims, oil collapse)… I mean, what do we need more than what we had in order to get a second down wave. I find this resilience surprising personally.

Talking about Sentiment indicators… I see divergences between 2 indicators that I follow. Put/Call ratios are kind of normal (or at least not very high to justify a bottom of market), which means positioning of the market looks quite neutral here… but if we look at Bull/Bear sentiments, surprisingly we are at extreme pessimism levels, even after the recent rally. This doesn’t really fit with a contrarian top process or top of trend. Any input on that ?

There are different sentiment indicators that measure different things. “Sentiment” is not monolithic.

1) Retail investor sentiment (AAII asset allocation survey, done monthly, BAML)

2) Retail swing/day trader sentiment (AAII weekly survey)

3) Advisor sentiment (II, NAAIM)

3) Global institutional (BAML Fund Manager Survey, monthly)

4) US institutional (Barron’s Big Money)

5) Institutional positioning (State Street)

6) Hedge fund, which can be further broken down into different groups, e.g. market neutral, long short, global macro, etc. (JPM, COT, option data)

They don’t all move together.. Much depends on how they interact with each other, and which group’s positioning is likely to move the market.

The other risk is a 2nd wave of infections once the first attempt to reopen is underway.

If stay at home orders are issued again, its questionable if companies have enough resources to get through another quarter of lost revenue.

Cam- Here’s another comparison by Helene Meisler – March/April 2020 versus late 2008.

I’m unable to post her charts, but I’ll reprint her comments below:

‘Two charts of SPX. Chart 1 is from now.

Big fast down (25-30%).

Big rally in one week.

Quick correction (A)

Rally to higher high (B)

Sideways for 2 weeks, then higher high.

Chart 2 is late 2008.’

‘Since I shouldn’t assume the rest of you have no life as I do, after that January high it was nothing but down til the March low.

Just thought it was interesting.’

Here is the tweet along with the charts:

https://twitter.com/hmeisler/status/1254079942121402370

Thanks – the similarities are striking. And of course we all know that chart similarities reflect predictable emotional responses by investors to similar events.

I have appreciated and respected her analysis, but what is missing from that chart is the action from about 6 weeks before that time frame.

The market fell and made an initial low, bounced and then retested that low. The retest was unsuccessful and it made a second lower low.

In other words, the pattern Helene cites occurred after the retest, which was unsuccessful. We haven’t seen the retest yet.

That’s the problem with analogs. they are highly open to interpretattion.

Good point.

Everyone’s probably looking for patterns wherever they can find them due to the lack of historical precedents (although, as you point out, that’s not necessarily the case).

Current expectations that the recession will be compressed ‘because it’s a virus and not a financial crisis’ – I’m not so sure about that either. The more pessimistic scenarios are being unfairly dismissed, IMO.

Helen also has a hashtag named “#helenesgreenshoots” going on. She may be pre-disposed to feeling bullish coloring the way she interprets charts.

Icahn was a buyer (1-2 million barrels) last Monday at negative prices-

https://www.bloomberg.com/news/articles/2020-04-25/icahn-says-stocks-are-overvalued-virus-may-cause-downdrafts?utm_content=business&utm_medium=social&utm_source=twitter&cmpid=socialflow-twitter-business&utm_campaign=socialflow-organic

Interesting back story related to the Stanford study.

https://www.sfgate.com/bayarea/article/Wife-s-email-may-have-tainted-Stanford-15225414.php

https://www.sfgate.com/news/article/Healthy-people-in-their-30s-and-40s-barely-sick-15224874.php#photo-19277632

Strokes and COVID-19? There’s a lot we have yet to learn about the virus.

I’m leaning toward a successful or unsuccessful re-test scenario so looking for some data where I could be wrong. Cam has outlined a strong case for the re-test but I think we have not explored the bullish (in short-term) scenario in some depth. I think the Fed and the Congress may keep the market floating in the short-term but the weight of a sinking economy will weigh on the stock market in intermediate and long-term.

However, the bullish scenario I am concerned about is the re-opening of the economy. I am seeing more and more experts come out and weigh on the pros and cons of doing that. The WSJ carries an article or two, and editorial here and there arguing for gradual and thoughtful re-opening the economy. Many are arguing the mortality rate is nowhere 1%-2% but is more likely to be around 0.1%-0.2%. The demographics at risk is agreed upon since we have enough data on it now. The weather is getting warmer even in the north. Not many people use public transportation extensively in the US outside of the Metro-NY. In NYC-metro, one needs to manage the re-opening very carefully.

https://www.wsj.com/articles/reopening-the-u-s-economy-even-if-the-pandemic-endures-11587740529

But outside that (and some other regions), why can’t we gradually re-open the economy with stricter rules for social distancing, wearing of masks, staggered work hours (to reduce the number of people out low), and expanded if not extensive testing (at work places)? Most of us now know the precautions we need to do to protect ourselves and others.

The quarantine of the vulnerable population should carry on until we have a vaccine or a therapeutic drug available.

We can’t get back to pre-CV economy but bring maybe 90% of it back to normalcy.

I think people are getting restive. I don’t think shelter-in-place can continue for months, let alone for quarters.

There is no credible data that suggests mortality is 0.1%, which is the mortality rate of the flu. Look at South Korea, Germany, and New Zealand to consider what is needed to reopen. Georgia will very likely see an outbreak about 3 weeks after reopening. That is what happens when they cut corners and fail to use public health approaches that work.

Simple math:

NYC has reported about 15K deaths from COVID-19. At a fatality rate of 0.1%, that implies an infected population of 15 million.

NYC’s population is 8.55 million. Even if you include the population of the outlying areas in that figure, that makes no sense.

Agreed Cam. South Korea has the best testing data, and in SK the only population with mortality .1-.2 is children up to age 10. I’m thrilled about that, but every other age group has much higher mortality.

Here is an individual risk calculator, which will evolve as data becomes available. Readers should try to plug in their own stats to estimate their own mortality. https://covid19riskcalc.com/?fbclid=IwAR1xuoz3h11LUPZLtB32MZgKgPvEGNhCUo_Od_p3z8r8BYCw-9HHEm2gVGk

Cam, I think the problem comes from who they include dying from Covid. Some places they include everyone who has Covid symptoms regardless of what killed them. That obviously raises the death rate. I don’t think we have a good handle yet on who is dying because of Covid.

There is plenty of credible data from multiple large serology studies including la county, Santa Clara, Denmark, New York, etc. which all point to fatality anywhere from 0.1% to 0.5%. People need to look objectively at the data and not cherry pick to support their thesis.

The Santa Clara study has numerous flaws and has not yet been peer reviewed.

Somewhere, somehow someone has to take the bold and calculated steps to try and open the economy gradually but surely, willing to learn and make changes quickly and show the way. Risks are better understood now. That is the course of human history, human progress and it’s the American way. I say kudos to Georgia for taking this step. Godspeed to them. In broader context, this may be how we avoid doomsday outcomes.

I posted this thread in response to another article on this form. These are the steps needed. GA is not doing any of them. Look at WA and CA for the most successful reopenings. https://twitter.com/propublica/status/1253351877787467779?s=20

So, the government provides the environment. It is the people’s behavior that matters most. If initial effort is not going well, make quick changes and adapt. I have faith.

Have to work with public health agencies or it will fail badly. Testing, contact tracing, gradual opening of essential services. You do not start with gyms and movie theaters like GA.

1. What’s truly bold may be to stand firm on stay-at-home orders until we have more clarity on infection/transmission rates.

2. Not sure I would describe the current scenario as one where ‘risks are better understood.’ More towards ‘just beginning to appreciate the risks.’

3. Calculated – agree. But it sounds as if most of Georgia was caught off guard by Governor Kemp’s announcement (and mostly disagree with his decision).

4. I have to disagree with the statement ‘this may be how we avoid doomsday outcomes-‘ almost to the point where I would say ‘this may be how we end up with doomsday outcomes.’

Yep. Fauci and others have warned that returning to work too soon is going to backfire with more outbreaks and make everything take even longer.

So, seventeen states have opened or have announced plans to open with Georgia probably being most aggressive. New York has talked about opening parts of the state. No one expected this just a month ago. I also trust the people to act responsibly by and large. Yes, it can all come crashing down but I am with people moving forward slowly but surely. Those who choose otherwise, I say take your time but the inclinations are to open.

California, Texas, Florida, Georgia, Ohio are opening. My physician friends tell me that some of them are opening their (outpatients) centers. Mountain and upper midwest, non-Seattle Washington, North East, outside NYC, appear to be relatively lower intensity areas. Barring significant increase in Covid cases, shouldn’t this be seen as a positive for the economy?

So, Denver extends lock down, but Colorado opens. Please list other states I have left out. Thanks.

Texas is slowly opening starting today. I haven’t kept up on the rules that much since the only place I might be going to the Costco parmacy and the cleaners to get my shirts. LOL

First step to normalization, if you can call that, is for vix spot-F1 to go contango. After a big drop for vix on Fri, it happened. The futures term structure has much smaller backwardation now. Let’s hope spot vix continues downward move and causes much flatter term structure, eventually into full contango. A lot of implication here. Chief among them is the correlation of movement rapidly decreasing. This will gradually reduces the chances of retest. Translation into stock markets is range bound with small upward slope overall, and into real life economy a slow gradual pickup overall and small setbacks here and there but together not enough to derail the recovery. As we move along we become more experienced and adapt better and push the recovery faster.

This time there is no “If” in the story:

Japanese magazine Shukan Gendai reported that Kim collapsed during a visit to a rural area in April. Kim reportedly required a stent procedure following the incident. Shukan Gendai subsequently detailed how the surgeon in charge of Kim’s operation was not used to dealing with obese patients and was too nervous during the operation, leading to delays that left Kim in a “vegetative state.”

“North Korea’s Kim Jong Un is either dead, brain dead or just fine, depending on which Asian media report you believe.”

As we debate the pandemic, the key to investing is the absolute fact that the stock market is just 15% from its all time high when the world economy is head into a storm of unknown depth and length.

The financial world returning to normalcy even with the best virus outcome is more unlikely than a given in the opinion of gurus like Ray Dalio and Mohamed El-Erian.

I’m buying some sectors that I think will outperform and simultaneously buying an equal amount of a market index inverse ETF. It’s low risk with a decent return potential while waiting.

Interesting commentary on volume here: https://twitter.com/WalterDeemer/status/1254418759282036738?s=20

May say more about short-term market direction, not sure– maybe someone savvier on technical analysis than I can figure out what it is saying.

It is stating the obvious. Basically what Keller says is: if spx drops on a big volume then all hell breaks loose, because volume will break out of down trend and it will be ominous. Currently spx is supported by 10ema and 50ma and sitting right above biggest volume-by-price block of 2800-2775. Everyone is watching and plotting how to react either way. So I add nothing valuable since everyone knows this info. I tend to be more optimistic and not fighting the Fed. Occasional setbacks but more wins. I watch Fed bond buying program more closely. This is what I learned after GFC. If you align with Fed activities, your chances are much higher in making money.