Remember the story of the Sorcerer’s Apprentice from Fantasia (click link for YouTube video)? Mickey Mouse played the role of a sorcerer’s apprentice tasked to carry buckets of water. Instead of doing it himself, he stole the sorcerer’s hat and animated a broomstick to carry the buckets for him. To speed up the work, he animated more and more broomsticks, until everything got out of hand.

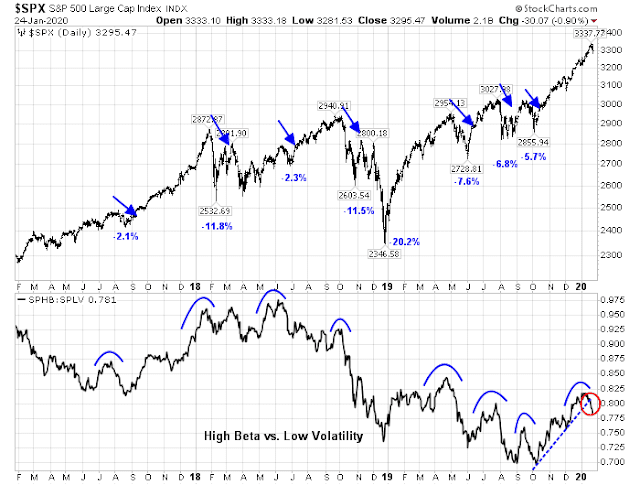

While I don’t claim to be a prescient genius who can see the future of the market, I was fortunate to spot the beta chase early. Bloomberg reported on December 18 that Stanley Druckenmiller had turned bullish, and Druckenmiller would not have gone on television to proclaim his embrace of risk if he hadn’t fully entered into his entire position yet. As Kevin Muir at The Macro Tourist pointed out, “It is also probably safe to say that Druckenmiller, on the whole, is way ahead of most investors.” In other words, the fast money crowd was stampeding into the reflation and cyclical recovery trade.

Nevertheless, the subsequent melt-up does feel a bit like a “sorcerer’s apprentice” rally that got out of hand. Now the equity risk appetite seems to rolling over, and the steady advance seems to pausing on the news of the Wuhan coronavirus, what’s next?

A melt-up recap

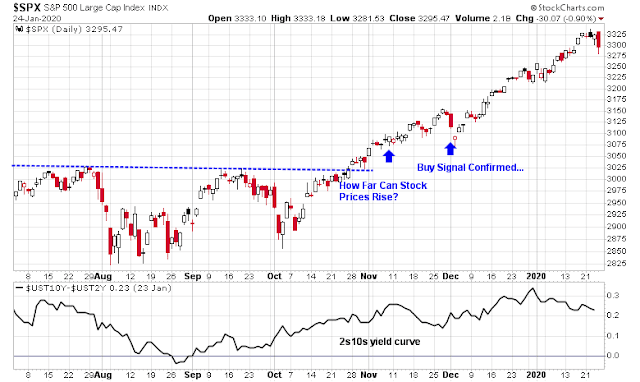

To recap the events of the last few months, let’s go back to last August. The 2s10s yield curve had inverted, and there was widespread concern about a recession. While I was skeptical about the recession narrative, I did expect a deeper valuation reset that did not materialize.

The market eventually recovered and broke out to all-time highs in late October. On November 10 (see How far can stock prices rise), I speculated about the possibility of a market melt-up. The Street had become overly defensive in its positioning, and evidence of a global cyclical recovery was emerging, which would lead to a beta chase stampede to buy stocks.

A more reasonable scenario is a bubbly market melt-up, followed by a downdraft, all in a 2-3 year time frame.

On December 1, I confirmed the melt-up scenario (see Buy signal confirmed: It’s a global bull):

The SPX may be undergoing a melt-up in the manner of late 2017. It is unusual to see the index remain above its weekly BB for more than a week, which it did two weeks ago. The melt-up of late 2017 also saw similar episodes of upper weekly BB rides, punctuated by brief pauses marked by “good overbought” conditions on the weekly stochastic. The technical conditions appear similar today, and I am therefore giving the intermediate term bull case the benefit of the doubt.

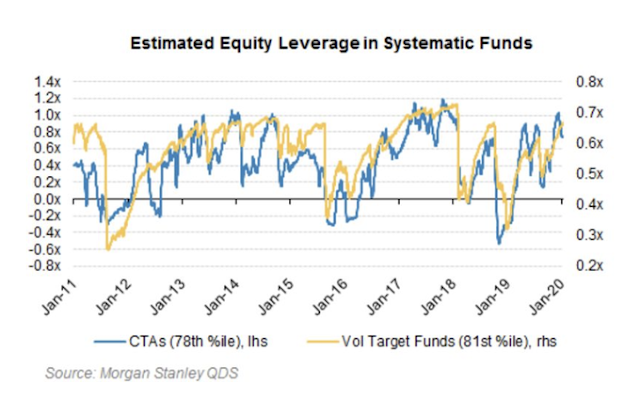

Even though the bullish stampede was in my forecast, its sheer breadth was astonishing. In particular, the fast money crowd had gone all-in, both on risk and leverage. The degree of leverage undertaken by hedge funds was exacerbated by a compression in realized volatility, which was the result of HF steady buying. The compression in implied and realized volatility served as an input to trading desk risk models, which encouraged even more leverage to fund long positions. In other words, the sorcerer’s apprentice was animating more and more broomsticks.

The slower moving institutional investors were also buying into the cyclical recovery trade. The BAML Global Fund Manager Survey showed a spike in global expectations that began late last year.

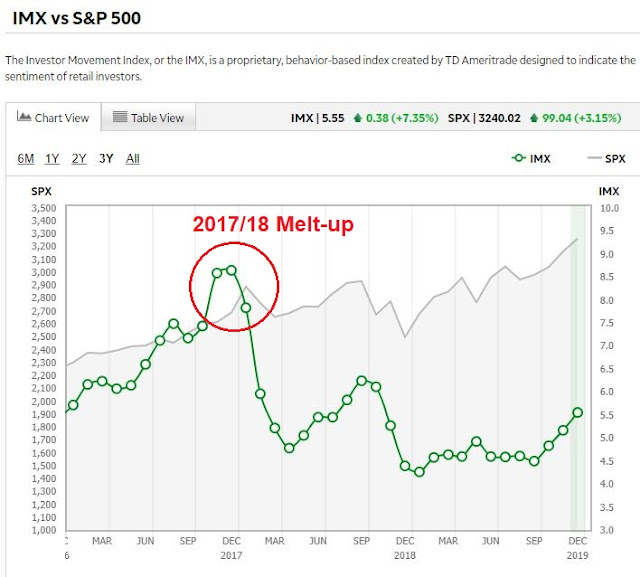

Equity positioning, however, was not as extreme as hedge funds. Readings are only in neutral territory and nowhere near crowded long levels. By contrast, the 2017/18 melt-up episode began with global institutional equity positioning already bullish, and readings then surged to a crowded long.

Another difference between the current melt-up and the 2017/18 experience is the lack of participation by retail investors. The TD-Ameritrade Investor Movement Index, which tracks the custodial position of the firm’s clients, shows that while individual investors did buy into the rally, their level of exuberance was nothing compared to the last melt-up episode.

What next?

So where do we go from here?

The fast money crowd front ran the institutional cyclical recovery trade, and hedge funds are now in a crowded and leveraged long on risk. Market valuation became extended. The stock market is now trading at a forward P/E of 18.6. The Rule of 20, which flashes a warning whenever the sum of forward P/E and inflation rate exceeds 20, is warning of a market pullback.

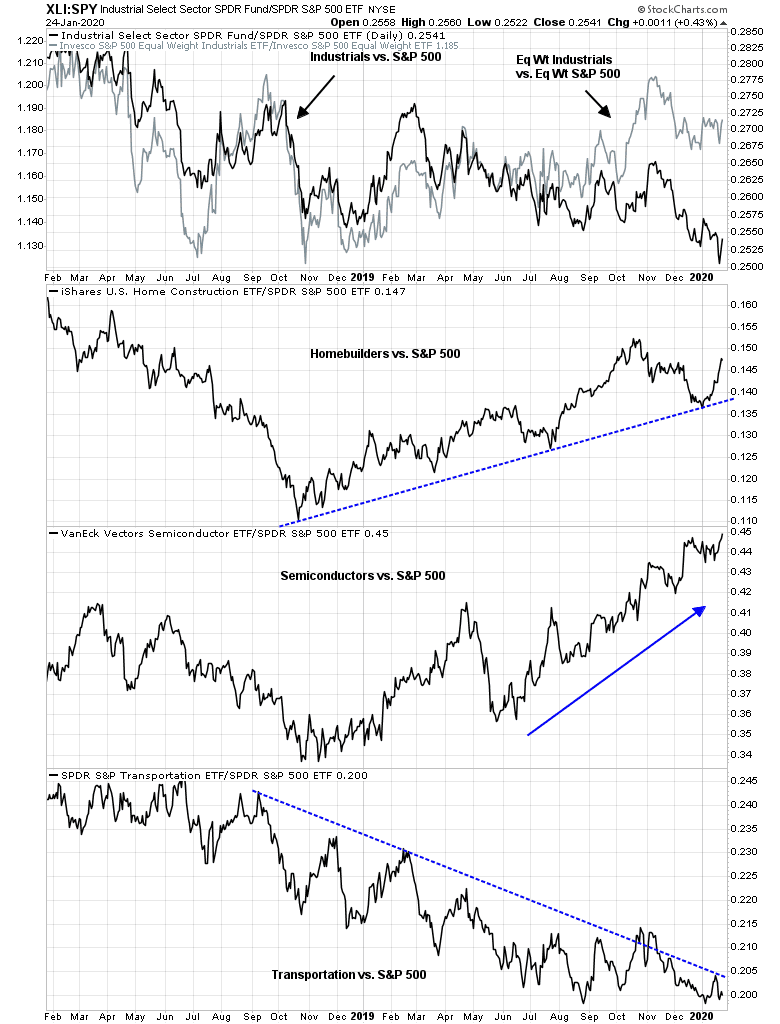

The cyclical recovery narrative is also showing some cracks. In the US, the relative performance of cyclical groups are mixed. Semiconductor stocks are still on fire. Industrial stocks have been soft against the market, but much of the weakness is attributable to the well-publicized problems at heavyweight Boeing. An equal-weighted analysis, which reduces the effects of Boeing, shows that the sector is performing reasonably well. However, homebuilding stocks were underperforming during a period when the cyclical recovery theme was dominant, though they have since begun to rise again and remain in a relative uptrend. Transportation stocks, on the other hand, have done nothing except to lag the market during this entire period.

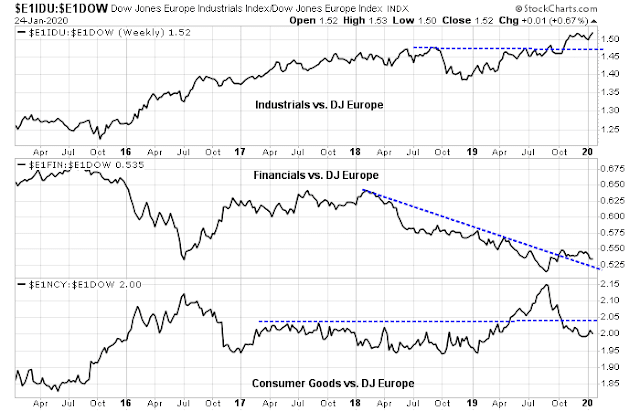

In Europe, the rally of cyclically sensitive have paused. Industrial stocks did stage an upside relative breakout, but they have paused and begun to move sideways. Similarly, the financial sector broke out of a relative downtrend, but they are also consolidating sideways. By contrast, a defensive sector like consumer goods are bottoming on a relative basis, and it is starting to show signs of life.

As the European markets have begun to take on a defensive tone, bond yields have fallen (and bond prices have risen). Falling bond yields are detrimental to European banking profitability, and it is therefore no surprise to see European banks start to underperform. The recent price recovery of the Austrian century bond is an example of the shift in risk appetite.

Normally, at this point I would turn to an analysis of China and Asia’s markets for completeness. However, the recent panic over the Wuhan coronavirus makes analysis difficult. It’s all noise until we get more clarity on the situation.

The cyclical trade still alive and kicking

In summary, the market is tactically poised for a pullback. Valuations are extended, and fast money positioning is too bullish. But that doesn’t mean the bull is dead, once we see a valuation reset. All fundamental and macro signs show that the cyclical recovery trade is still alive.

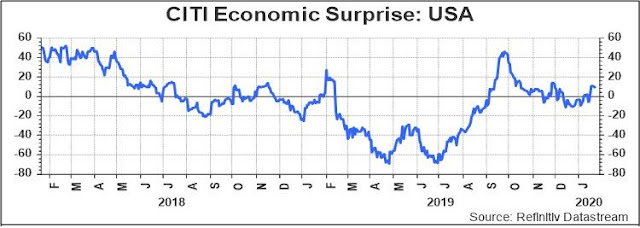

From a top-down perspective, the Citi US Economic Surprise Index (ESI), which measures whether economic releases are beating or missing expectations, is rising and indicating that the cyclical recovery is showing strength.

G10 ESI is also showing a similar pattern of strength.

Calculated Risk reported that the Chemical Activity Barometer, which is a leading indicator of industrial production, is turning up.

Renaissance Macro Research also pointed out that the word count of “weak” and “slow” are falling in the latest Fed Beige Book survey, which is another sign of cyclical strength.

From a bottom-up perspective, consider the latest excerpted comments from The Transcript, which is a summary of company earnings calls:

Business sentiment is improving

“We see some resolution to those issues and that combined with continued consumer strides, leads us to expect to see businesses continue their solid activity and we’re hearing more optimism.” – Bank of America (BAC) CEO Brian Moynihan“There’s no question in the fourth quarter the environment improved. Based on the data or information we can see across activity and dialogue with clients, I would say that it’s improved in the fourth quarter and the trends that we’re seeing early into 2020 are a little bit more positive.” – Goldman Sachs (GS) CEO David Solomon

” the fourth quarter definitely, I would say, stabilized. Things trade certainly stabilized. Things, broadly speaking, stopped getting worse and so, we saw sentiment improve a bit” – JPMorgan Chase (JPM) CFO Jennifer A. Piepszak

Manufacturing seems to be turning a corner

“last year we did see a little bit of weakness in manufacturing, but we’re starting to lap that and we’re starting to see some positive momentum coming out of that sector. So generally, we’re seeing some very good signs from our corporate.” – Delta Air Lines (DAL) President Glen Hauenstein” For most of calendar year 2019, the weakness in global manufacturing was exacerbated by the inevitable inventory destocking that companies undertook in response to the weak demand conditions…As we enter 2020 however, we are seeing signs of an improvement.” – Schnitzer Steel Industries (SCHN) CEO Tamara Lundgren

Significantly, the US consumer is doing fine

“our results continue to reflect the strength of the U.S. consumer in the biggest economy in the world…We also continue to see healthy consumer trends in spending and asset quality. ” – Bank of America (BAC) CEO Brian Moynihan“Our outlook heading into 2020 is constructive, underpinned by the strength of the U.S. Consumer.” – JPMorgan Chase (JPM) CFO Jennifer A. Piepszak

China headwinds are moderating

“In Europe, growth continues to remain relatively low given manufacturing weakness. However in China trade headwinds appear to have moderated with both monetary and fiscal stimulus supporting growth estimates of nearly 6%” – Goldman Sachs (GS) CEO David Solomon

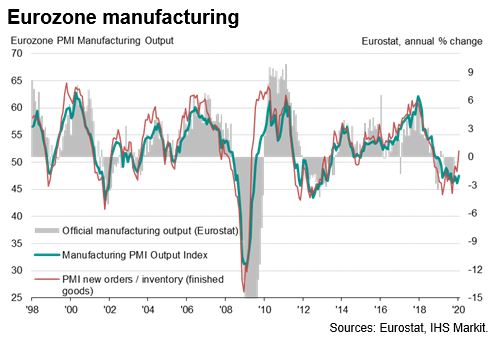

Across the Atlantic, the latest flash PMI release shows signs of green shoots in manufacturing. Manufacturing PMI edged up, and the new orders/inventory ratio rose strongly, indicating that the inventory de-stocking cycle is over.

As well, the latest ZEW survey from Germany rose unexpectedly. While ZEW is a sentiment survey, it has historically led eurozone GDP growth by about 12 months.

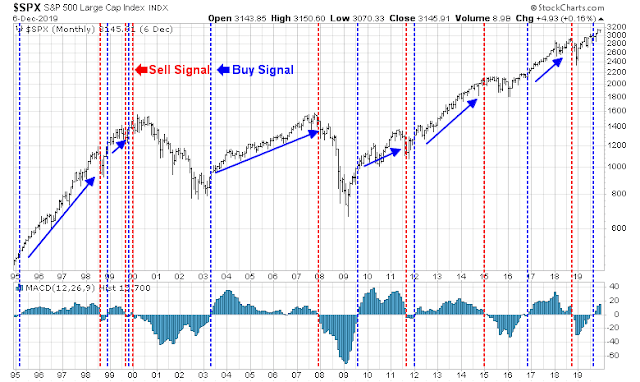

In conclusion, the stock market is tactically poised for a pullback and valuation reset. However, fundamental and macro indicators all point to a continuation of the global cyclical recovery. I have pointed out before that the highly reliable long-term monthly MACD buy signal for US equities remain in play.

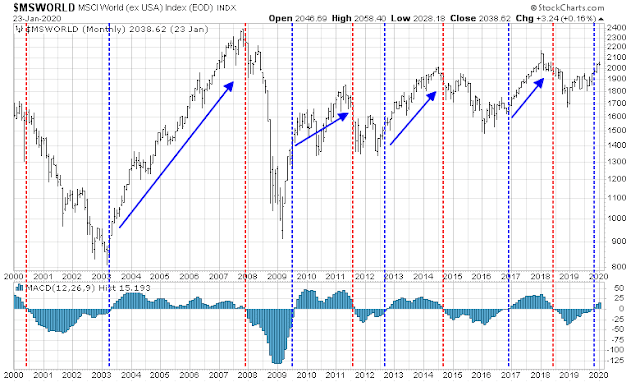

Similarly, the buy signal for non-US markets is also still valid.

Any market weakness should only a hiccup. Investors should be preparing to buy the dip, while traders should position themselves for a correction.

Disclosure: Long SPXU

China news videos show empty malls and few people on the streets, not just in Wuhan but also Beijing. At least four cities are on lock down and intercity transportation has been restricted. This at the time of their annual holiday.

This means current stats are meaningless and we will see a sharp down swing in the numbers soon. This will likely be short lived but a speed bump for global especially non-American markets.

When I look at the charts of the meltup I see it started on October with the start of the massive Q4. We are just three months into this new stimulus. Too early to be overly negative about US equities.

Dr. Eric Feigl-Ding (Harvard epidemiologist) is calling it “thermonuclear pandemic level bad” and Xi just said the country was facing a “grave situation”. Likewise the UK’s Jonathan M. Read.

Exact facts will take time and be messy, but personally it looks to be a very big deal in many ways. Serious headline risk.

In the words of my sober mentor Cam, “stay tuned”.

The Coronavirus is an epidemic in China. There is no way it doesn’t slow (or stop) their economic growth for some time. Although not as deadly it appears to be transmitted human-to-human easier than SARS. So, the Chinese economy slows, but the big question is does it become an epidemic outside of China? It seems to have the potential to go world wide like the Spanish Flu.

Can it be stopped or contained? That is the big question. Reports I’ve read indicate that a face mask is not sufficient to stop infection. It also can infect through the eyes, so eye protection is also required. Few people are wearing eye protection in photos I see near infected people.

So, China will slow. Transportation will slow. If it becomes epidemic outside of China and the epidemic reaches America or Europe, a major recession will ensue. The markets will tell us the extent before we know and the data catches up.

Yes, as Cam would say, “Stay Tuned.”

Anything that results in the lockdown of 48 million people will have a significant economic impact.

Here’s an article that may fuel speculation as to the source of the outbreak:

https://www.dailymail.co.uk/health/article-7922379/Chinas-lab-studying-SARS-Ebola-Wuhan-outbreaks-center.html

Genomic evidence from 24 human samples suggest a single one-time viral mutation of a bat SARS-like coronavirus occurred in November, allowing human infection.

https://www.statnews.com/2020/01/24/dna-sleuths-read-coronavirus-genome-tracing-origins-and-mutations/

“Can it be stopped or contained? That is the big question. ”

Indeed!!! and pretty alarming to hear scientists/virologists openly saying it may be uncontainable and inevitable it will spread world wide.

The virus is now being referred to as WARS (Wuhan Acute Respiratory Syndrome).

Here’s a real time map:

https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6