Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

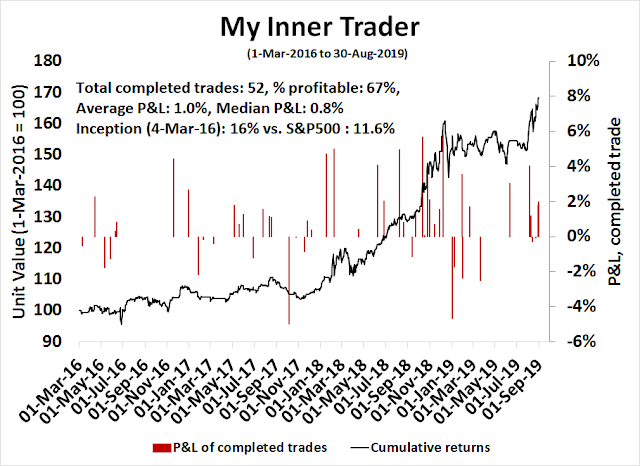

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bearish

- Trading model: Bearish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

The Fear Bubble

Ever since the NASDAQ Bubble burst, investors have been looking for additional bubbles to be wary of. The subsequent housing boom created a subprime bubble, which was facilitated by cheap financing, and wild leverage in the financial system that eventually led to a crisis. Now everyone is a bubble hunter.

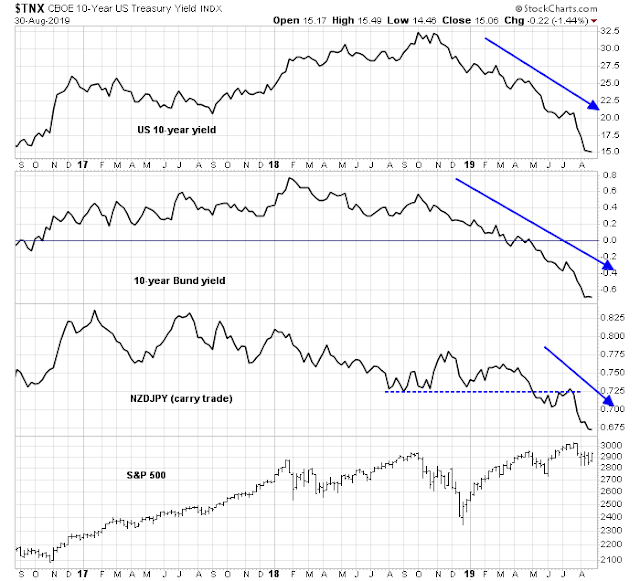

We now have a new bubble, a Fear Bubble. The Fear Bubble can be found across all asset classes, and it can be seen in the diving 10-year Treasury yield; the deeply negative 10-year Bund yield and the growing count of negative yielding European fixed income instruments; and even the forex market, as evidenced by the cratering NZDJPY cross, which is a bellwether of the carry trade. The big surprise is US equities have held up reasonably well in this fearful environment.

The Fear Bubble is creeping into the equity market. Yahoo Finance reported that Goldman analysis found that funds are now increasingly defensive.

The average large-cap mutual fund is Underweight on U.S. firms with the highest sales exposure to China and has been gradually cutting exposure to these stocks during the past 18 months, according to fresh data from Goldman Sachs. Being Underweight is another way of Wall Street saying it expects the U.S. trade war with China to overly hurt companies with outsized exposure to the country and likely, and its stock prices.

Goldman notes that mutual funds are also Underweight semiconductors housed in the S&P 500 , another sector being damaged by the escalating trade war with China and also Huawei.

Meanwhile, hedge funds have also tilted more defensive with their portfolios. Goldman’s research shows hedge funds are Underweight information technology (trade exposed, too) and financials (also trade exposed — worsening trade conditions are causing the Fed to consider lower interest rates, which hurt bank profitability).

Tech overall is the largest net Underweight among hedge funds, Goldman says.

What should investors do, and how should they position themselves in light of this latest bubble?

I conclude that global markets are undergoing a Fear Bubble. This is not the start of a bear market, but the bubble is continuing to inflate. In all likelihood, it should start to deflate at some point in Q4. This argues for a defensive equity posture for the next few months. Suggested pockets of opportunity include the combination of low volatility and high yield, as well as value stocks.

Reasons to be fearful

All bubbles begin with a good reason, they just eventually get out of hand. From a global perspective, the rush towards safety began with China’s deleveraging program, whose deflationary effects were exacerbated by the Sino-American trade war, and the effects washed upon the shores of other countries.

This chart of global exporters tells one story of global contagion, which is being spread through the trade channel. The biggest exporter in the world is China at $2.5 trillion, followed by the US at $1.7 trillion, and Germany at close third at $1.6 trillion. Taken together, the EU dwarfs the rest of the world at $6.5 trillion. As China slowed, the slowdown fed into a European slowdown, as well as China’s major Asian trading partners.

The second deflationary contagion from China has yet to be seen, and that is through the financial transmission channel. This is far more risky, as it involves leverage, which has the potential to topple the global economy in the manner of the Great Financial Crisis.

The Fear Bubble is exacerbating the risk of financial contagion from China. The USD became a safe haven as investors rushed into safe assets. Dollar strength is also helped by the scarcity of investment grade bonds in non-USD currencies, and the debt ceiling deal, whose expected Treasury financing will drain USD liquidity from the banking system, and create a temporary scarcity of USD. As a consequence, the rising USD is putting downward pressure on the yuan.

Bloomberg reported that Chinese companies have significant offshore debt that is maturing fast, and the combination of a strong dollar and weak yuan raises the potential for disorderly defaults and financial contagion.

The foreign debt built up by Chinese companies is about a third bigger than official data show, adding to the pressure on the country’s currency reserves as a wave of repayment obligations approaches in 2020.

On top of the $2 trillion in liabilities to foreigners captured in official data, mainland Chinese firms have around another $650 billion in debts built up by subsidiaries overseas, according to Bloomberg calculations. About 70% of that debt is guaranteed by entities such as onshore parent companies and their subsidiaries, the data show. The amount of maturing debt will rise in coming quarters, with $63 billion due in the first half of 2020 alone.

The prospect of Chinese companies rushing to find dollars to service liabilities comes at a time when authorities have already allowed the currency to sink below 7 per dollar amid a trade war with the U.S. The nation now risks a reprisal of what happened after the yuan’s devaluation in 2015, when foreign-debt servicing contributed to a rapid decline in the country’s foreign-currency reserves.

Not surprisingly, most of the debt is concentrated in the highly leveraged real estate sector, followed by banking.

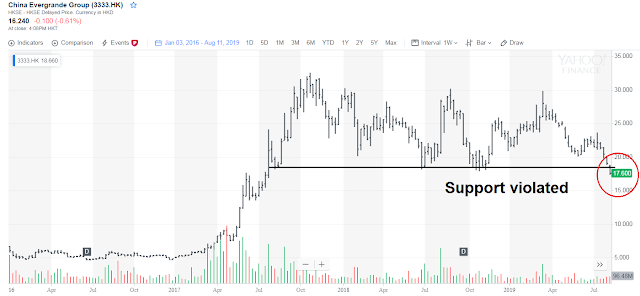

As the Chinese economy slowed, the real estate sector has come under more stress. Our real-time monitor of Chinese property stocks shows that their relative performance is keeling over, The poor market action of these stocks is a signal that the PBOC is standing by and allowing the economy to de-lever while providing limited targeted support. Will these measures be enough? The risk of a PBOC policy error is high.

As well, China Evergrande (3333.HK), which is one of China’s largest and most indebted property developers, experienced a major support violation. According to Bloomberg, 47% of its debt matures and will have to be rolled over this year. Fortunately, the shares of the other major property developers are still holding above key long-term support levels. This is a situation that will have to monitored very carefully, as it has the potential to become China’s Lehman Moment.

The decisions facing investors on the Fear Bubble can be summarized by this chart of the 4-week moving average of AAII Bulls-Bears. Readings are at levels where the stock market has usually undergone a bottoming process, which are marked in grey. The only exception was the 2007 top, when the market continued to fall as from the realization of financial contagion risk, which are marked in yellow.

Is it different this time? Can the deflationary effects from China be contained?

Not out of the woods, but…

Let me first assure US equity investors that the chances of an ugly bear market is unlikely. Recessions are bull market killers, and there is no sign of a US recession in sight. While growth is decelerating, the signposts of a recession are not there. The consumer remains strong, and the Fed has adopted an easy monetary policy. In addition, the risk of financial contagion is low. Beijing has lots of policy levers to avoid a disorderly unwind of China’s imbalances. The more likely resolution is a slow and long glide path of much softer growth than a crash.

The recent inversion of 2s10s yield curve has been interpreted by recessionistas as the sure sign of a slowdown, this time really is different. Past inversions have mostly been caused by overly tight monetary policy, as evidenced by high real rates. This time, the real 10-year yield is low, indicating an easy Fed. It is difficult to see how a recession can happen when the Fed stands vigilant against slowing growth.

Waiting for the Fever of Fear to break

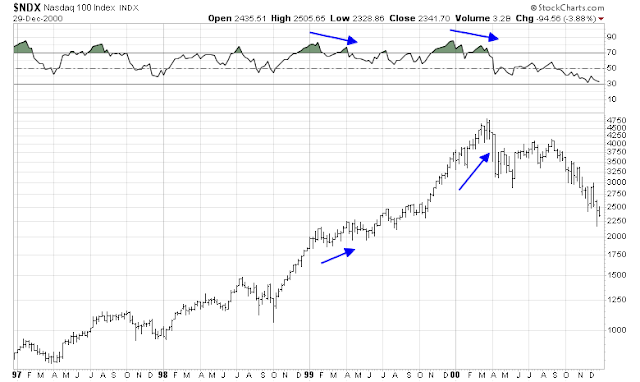

That said, the market is not out of the woods. If we are in a Fear Bubble, the Fever of Fear has not yet broken. Consider the example of the NASDAQ Bubble. the top was marked by negative divergences even as the index made new highs.

By contrast, the chart of the 7-10 year Treasury ETF shows no signs of a negative RSI divergence. The fever has not broken yet.

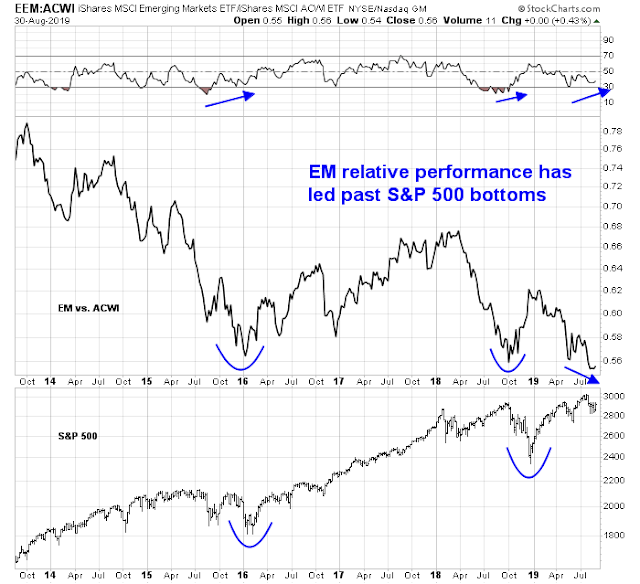

Still there are some hopeful signs. EM equities have been the epicenter of the latest Fear Bubble because of their China exposure. The relative performance of EM stocks to the MSCI All-Country World Index (ACWI) has bottomed ahead of the last two US equity market bottoms. In addition, EM relative bottoms have been marked by positive RSI divergences. We are now seeing the nascent signs of a positive RSI divergence. If history is any guide, we should see the stock market to bottom out and the Fever of Fear to break some time in Q4.

The top-down data tells a similar story. Global growth should resume in early 2020.

New Deal democrat‘s weekly assessment of coincident, short leading, and long leading indicators are also telling a hopeful story:

The nowcast remains positive. The short-term forecast, which has been very volatile recently, turned more positive this week (assisted by the monthly reports, most of which were also positive). The “high frequency” long leading indicators are very positive, buoyed by adjusted NIPA profits as reported in the latest Q2 GDP report.

Investing during a time of Fear

How should US equity investors position their portfolios in this environment? This chart of YTD factor returns tells an interesting story. The leading factor was leading YTD factor was low volatility, as investors who wanted to maintain equity exposure piled into what was perceived to be a defensive factor. This was followed by momentum and growth, as large cap technology and NASDAQ stocks maintained their leadership.

As our analysis indicates that the Fever of Fear has not broken, it pays to be defensive for the next few months. However, defensive sectors are already the leadership, and their prices have already been bid up, as evidenced by the outperformance of the low volatility factor.

Further analysis of the YTD factor performance chart reveals some opportunities that have defensive characteristics. How about the combination of low volatility and high yield (Ticker: SPHD)? While low volatility stocks have recently led the market, and dividend aristocrats, which is a defensive income-oriented factor have matched the market, the combination of low volatility and high yield has lagged. This may be a good place for investors who want to maintain market exposure in a defensive manner could hide out while the Fear Bubble rages.

Another factor that is becoming washed-out and out of favor are value stocks. Bloomberg reported that Michael Burry of The Big Short who called the subprime implosion is pointing to a bubble in indexing, and he is finding opportunity in small cap value:

Now, Burry sees another contrarian opportunity emerging from what he calls the “bubble” in passive investment. As money pours into exchange-traded funds and other index-tracking products that skew toward big companies, Burry says smaller value stocks are being unduly neglected around the world.

In the past three weeks, his Scion Asset Management has disclosed major stakes in at least four small-cap companies in the U.S. and South Korea, taking an activist approach at three of them.

“The bubble in passive investing through ETFs and index funds as well as the trend to very large size among asset managers has orphaned smaller value-type securities globally,” Burry, whose Cupertino, California-based firm oversees about $343 million, wrote in an emailed response to questions from Bloomberg News.

Active money managers have bled assets in recent years as investors rebelled against high fees and disappointing returns — a trend that prompted Moody’s Investors Service to predict that index funds will overtake active management in the U.S. by 2021. The shift has coincided with a multiyear stretch of underperformance by value stocks and, more recently, by small-caps.

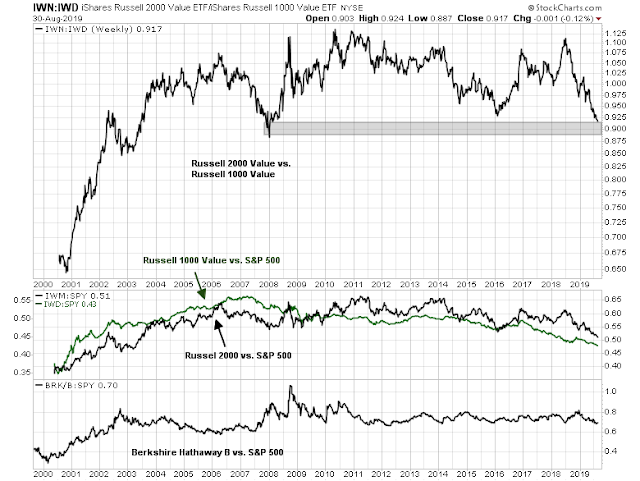

As the chart below shows, even as small cap and value stocks have lagged the market, small cap value has lagged large cap value. The degree of small to large cap value underperformance is nearing the levels last seen at the GFC market bottom.

Equity investors can therefore find pockets of opportunity in value stocks, and small cap value in particular. Be aware, however, that small cap value investing carries liquidity risk, and anecdotal evidence indicate that small cap value managers are experiencing redemption pressures, and they are being force to sell into illiquid no-bid markets. As an alternative, the shares of Berkshire Hathaway has roughly matched the market (bottom panel) despite the struggle of value investing. Giving money to Warren Buffett can also be a reasonable asset allocation option into value investing.

In conclusion, global markets are undergoing a Fear Bubble. This is not the start of a bear market, but the bubble is continuing to inflate. In all likelihood, it should start to deflate at some point in Q4. This argues for a defensive equity posture for the next few months. Suggested pockets of opportunity include the combination of low volatility and high yield, as well as value stocks.

The week ahead

Looking to the week ahead, the stock market remains range-bound. As well, the Sino-American trade war is locked in an escalation and de-escalation cycle.

Make no mistake about it, the Chinese have decided that a trade deal is impossible before the 2020 election because of Trump`s erratic behavior. according to a Bloomberg report:

After a weekend of confusing signals, Trump’s credibility has become a key obstacle for China to reach a lasting deal with the U.S., according to Chinese officials familiar with the talks who asked not to be identified. Only a few negotiators in Beijing see a deal as actually possible ahead of the 2020 U.S. election, they said, in part because it’s dangerous for any official to advise President Xi Jinping to sign a deal that Trump may eventually break.

In off-the-cuff remarks to reporters at the Group of Seven summit in France on Monday, Trump claimed that Chinese officials called “our top trade people” and said “let’s get back to the table.” In subsequent appearances he portrayed the outreach as evidence China was desperate to make a deal: “They’ve been hurt very badly, but they understand this is the right thing to do.”

It all made for splashy headlines and momentarily boosted stocks, but nobody in Beijing officialdom appeared to know what he was talking about. Even worse, his efforts to depict China as caving in negotiations actually confirmed some of their worst fears about Trump: that he can’t be trusted to cut a deal.

“Trump’s flip flop has further enlarged the distrust,” said Tao Dong, vice chairman for Greater China at Credit Suisse Private Banking in Hong Kong. “This makes a quick resolution nearly impossible.”

The editor of Chinese official media Global Times Hu Xijin signaled that China is digging in for a prolonged trade war.

The WSJ reported that China is preparing to decouple from American technology, and it is preparing an “unreliable entity list” of American companies and individuals to sanction in the next round of escalation.

China is studying technology companies’ reliance on American suppliers, according to people familiar with the matter, an apparent attempt to assess their ability to withstand further trade-war shocks, even as Beijing prepares to roll out a retaliatory blacklist of foreign businesses.

The interagency effort, which involves officials canvassing domestic companies, has taken place over the past few months as the trade war has intensified.

A Chinese official last week reiterated plans to release “in the near future” an “unreliable-entity list” of foreign businesses and individuals that would face restrictions in their dealings with Chinese counterparts. The list, which was first floated by Beijing in May, is an apparent planned response to Washington’s attempts to shut out telecommunications giant Huawei Technologies Co.

The performance of my trade war factor (dark line) still shows relative low levels of stress. I have added an additional indicator to the trade war factor analysis. The red line represents the relative performance of Las Vegas Sands to the gaming industry. If Beijing really wanted to get political in their sanctions, they would either hobble or shut down prominent Republican donor and Trump supporter Sheldon Adelson’s Macau casinos run by Las Vegas Sands. As a new round of US tariffs are levied on Chinese imports on September 1, watch for the market’s focus to turn on when next shoe drops.

The market’s internals are still supportive of the sideways consolidation scenario. Breadth indicators are mixed. While the S&P 500 Advance-Decline Line (red line) is nearing all-time highs, the Equal Weighted S&P 500 (green line) is flashing a negative divergence of lower highs and lower lows. The broadly based Value Line Geometric Index (bottom panel) is similarly showing weakness, and a negative divergence.

A comparison of the S&P 500 A-D Line and equal-weighted index reveals an interesting result. First, the underlying stocks are all the same, so the analysis represents an apples-to-apples comparison. However, the A-D Line is a diffusion index, while the equal weighted index is weighted by price change. If a stock rises, the weight in the A-D Line is the same regardless of whether it rose by 0.1% or 1%. By contrast, the equal-weighted index measures the magnitude of the move. The divergence between the two indicates while the breadth of the advance is broad, the magnitude of the advance is weak.

The analysis of market leadership is equally revealing. The market is led by relative uptrend from megacap and NASDAQ stocks, which are just barely hanging on, while mid and small caps are in relative downtrends. This picture of narrow leadership, along with the mixed signals from the equal weighted and A-D Line, suggests that the market is not ready to stage a sustainable rally to new highs. A period of sideways choppiness is the more far more likely outcome.

In the short run, market internals are overbought and rolling over, which also supports the trading range thesis as the market closed near the top of its range Friday.

Longer term horizon models are telling a similar story. Even though the net 20-day highs-lows is at a level where it stalled before, it is showing a more constructive uptrend pattern of higher lows.

From a tactical perspective, the S&P 500 flashed a minor negative 5-hour RSI divergence on the hourly chart when it tested resistance at the open on Friday. Watch for the gap at 2890-2910 to be filled. A bearish impulse will not be confirmed until the rising trend line from last Friday’s low is broken.

My inner investor is defensively positioned and underweight equities. Subscribers received an email alert on Friday morning indicating that my inner trader had taken profits on his long positions, and he had flipped short.

Disclosure: Long SPXU

We are living in a time where there is a Mad King inside the castle and across the land there is fear. Shakespeare’s ghost is sharpening his quill pen to write a great play of human foibles that will come of this. Will it be a tragedy or a comedy?

The emperor has no clothes….funny but I have wondered about how things were with George 3.

One thing that really bothers me about passive investing and choosing stocks that are not in those large ETFs is “the baby and the bathwater”, when all this passive investing cracks and goes “to hell in a handbasket” everything gets tossed. In the GFC gold did not stay up, eventually it went down to around 750.

OK, is vigilance important? yes Is there any role in making careful choices? yes….I am not a fan of passive investing and at some point we are in for a horror show, only I don’t know when, but I also don’t think it is around the corner.

The illusion of liquidity in those ETFs will bite when it disappears.

Times are never the same, they always are different, but not THAT different.

Be happy with a simple life, now that is an investment if you can do it.

I quote you;

“We are now seeing the nascent signs of a positive RSI divergence. If history is any guide, we should see the stock market to bottom out and the Fever of Fear to break some time in Q4”.

I would like to clarify your message in this missive. If I understand you correctly, you expect the fear factor to dissipate around 4th quarter, though expecting further simultaneous downside in equities?

Thanks.

You are correct. Sorry I was unclear.

I am unclear as to why US deficit funding will create a global constraint in dollar liquidity?

It’s a technical issue. When the UST sells securities, it soaks up short-term liquidity in the banking system. So USD liquidity dries up, though it eventually adjusts longer term.

Thanks.

Once again, this newsletter is full of invaluable information. Thanks, Cam!

For instance, I had been wondering why my investment in SPHD had been going so poorly. Now, I won’t be bailing out for sure.

And then the tidbit about Sheldon Adelson’s Macau casinos. That’s an excellent canary in the trade war coalmine.

An excellent analysis of where the market is at, Cam. But, I would like to make a comment on Bloombergs take on Trump’s handling of the Trade War with China.

Bloomberg, as most others, don’t understand that in order to demoralize your opponent you need to keep shifting your position to get them to move off of their objectives. The Chinese do this but Trump does it to perfection. China in the past has made trade deals then proceeded to violate those agreements. Trump is also seeking a punitive measure to make sure they don’t just break every term.

The U.S. just needs to buckle down and accept the pain. (which is offset to a great degree with the devaluation of the Yuan) If we don’t win this fight we will never get out from under the Chinese Trade/tech theft that has been their policy since Nixon opened China and will destroy us if it continues to grow.

Interesting theory.

The ability to endure pain varies greatly among individuals, and probably also among cultures. Whether the Americans or the Chinese exhibit greater endurance during the current trade war remains to be seen, but Xi may have anticipated China’s current move during the Third Plenum via the lifting of term limits.

Imagine you’re on the other side of a negotiation with Trump. It’s a high stake negotiation. If you succeed in reaching an agreement, you are a hero, but if you reach a bad deal where you get blindsided after the fact, not only will you lose your job, you will never work again, other than being a greeter at WalMart.

In the meantime, the other side can’t even seem to articulate what the “ask”, or what want, as the list changes from week to week. You come to a temporary agreement, e.g. post G-20 truce, and the other side rips up the truce a few weeks later.

The head of the other side is a man who boasts that he is out to humiliate your side in making a deal. He also has a history of reneging on his agreements, e.g. not paying building contractors.

What would you do?

Negotiation is not about humiliating the other side, but reaching a deal that both sides can live with, and adhere to.

I don’t quite see it that way, Cam. For instance, it has been the Chinese who have violated every deal we have ever made with them and not just with trade. I remember not long ago that Xi said he would never put weapons on the illegal islands he built in the South China Sea. Guess What!!

There are a hundred instances of that behavior with the Chinese.

Xi also tore up a nearly complete agreement we had with them several months ago. So, who is the mad negotiator? Trump or Xi?

I think certain groups of people are emotional about this trade issue, because they find it a little more difficult to conduct business and make money. For majority of people in US I don’t think they care. But even for businesses a good percentage of them have mitigated the effect. For example, Dollar General, in the most recent earnings report conf call, states that trade issue is only a small factor in their overall business planning. Many other businesses have similar remarks.

This whole thing is not about trade deals. It is to see how China reacts and we adjust next steps. Regardless of your opinions of Trump, current world arrangement is not sustainable. If not Trump, there will be someone in western countries to initiate similar moves. Look at recent history of Europe, Chamberlain style of negotiation always fails. The end result is great calamity.

There is a general consensus in DC that China is becoming a strategic competitor, but there is general disagreement about what to do about it. There have been other strategic competitors, such as Japan in the late 1980’s, that were resolved in a relatively benign manner.

Trump’s framing of the problem is, “There is no way to confront China except my way, and anything else is appeasement” is incorrect.

Consider the example of the Cuban Missile Crisis. There was a general consensus that the missiles in Cuba had to go, and they could not become operational. Hardliners within the JFK administration argued for either air strike, or invasion. Such an outcome would have likely led to all-out nuclear war, and we would not be here today. Kennedy chose a middle path, which was blockade, and he traded off the Jupiter missiles deployed in Turkey for the withdrawal of the missiles in Cuba. It was a middle path that defused the crisis.

Was that the “Chamberlain” solution? Arguably, it was part of the long-term containment strategy that eventually wore down the Soviet Union.

The moral of the story is, even though there is an agreement on the problem, there are many solutions, and confrontation (e.g. invasion) is not the only way.

Don’t confuse appeasement with calculated resolve. Besides, the USSR never came to their knees until Ronald Reagen spent them into self destruction.

I think this tread has gotten off topic.

There may not have been a Reagan presidency had JFK successfully navigated the Cuban Missile Crisis. Should he have invaded Cuban and risked a global thermonuclear war?

@Ingjiunn

you’re giving him an E for effort

Well said, Cam. Fox’s Neil Cavuto did an admirable job calling out Trump’s innumerable

flip flops on Friday: https://www.youtube.com/watch?v=9TKowTztB28

oops … wrong link, here’s the right on: https://www.youtube.com/watch?v=fwc9K5W6fgw

Cavuto? Sorry, I mute the TV when he comes on.

I agree with you.As i have said,China wants Trump to be defeated in the 2020 election & will not make an agreement on trade prior to the election.They understand that they can push us into a severe economic slow down & push Trump out of office.China would rather negotiate with dovish Democrats,who ,by the way will also cut defense spending & allow China to continue consolidate power in the South China Sea. see a weak equity market in the offing.

Alternatively, Xi will force the US to accept a watered-down version of a trade agreement, one which defers decisions on issues that really matter. This may be enough to unwind tariffs and allow China to continue a relationship with the devil they know. Either way, China wins.

During all of these discussions, it is difficult to know what the “ask” from the US side is:

1) Is it just about the trade deficit?

2) Is it about China’s business practices and industrial strategy, such as IP theft and a market structure that favors OSEs?

3) Is it about China’s development and her place in Asia and the world, as viewed through a national security lens?

The members of the US team are divided, and therefore the message is different. So how can the Chinese respond to this?

1) is relatively easy to deal with, as the dispute is viewed through a trade dispute lens.

2) is far more difficult, because you are asking someone to change their industry practices. For example, would the US agree to change their electoral system to a British parliamentary system as part of a trade deal?

If the issue is 3), then should you be using trade dispute tools to address what is in essence a geopolitical conflict?

If the US side changes its focus from week to week from 1), 2) and 3), then is it any wonder that the Chinese side believe that America under Trump is an unreliable negotiating partner?

There is little dispute about some of the problems that the US faces with China. What is in dispute are Trump’s negotiating tactics.

Cam, I only see the US media reporting on the negotiations unlike you. The media reported China renegade when 90% of the deal was agreed back in May this year. Did the US media left material facts out? Thanks.

You haven’t been reading the right reports. Just like Trump, negotiations are never done until they’re finished, and Trump reneged on what he agreed to at the G-20. The Chinese view is everything is up for grabs until a deal is inked.

BTW, I see a lot of discussion about who is right and who is wrong. That is not my focus. My focus is making money.

I recognize that there is a point of view that the tariffs represent short-term pain for long-term gain. It is unclear what the ideal solution is, because Trump keeps undercutting his negotiators and we don`t know what the real “ask”.

We can all live with the idea of short-term pain/long-term gain, but if the market is a reasonably efficient discounting mechanism, then why do stock prices go down every time Trump escalates? Should the market be discounting the long-term gain, or are the gains too difficult to calculate or discount?

Also don’t forget this entire discussion began when I outlined why the Chinese think Trump is an unreliable negotiating partner. Regardless of who the Ds nominate, it sounds like they would even prefer dealing with Pence, whose temperament is less mercurial.

Cam, I am not here to defend Trump’s negotiating tactics by I think the Ask is very clear and has always been clear. It is #1 and #2 with #3 being an underlying motive.

Sure, #2 is going to be hard to negotiate as you pointed out. But having fair trade practices is part of the deal if China wants to join and enrich from the free market system founded by the US and the Western countries.

I also don’t think #3 is the current focus of the on-going negotiations. Unfortunately, the Cold War 2.0 is likely to be around for a while.

Very interesting perspective, thanks!

Tariffs are really beginning to hurt trade and manufacturing

http://scottgrannis.blogspot.com/2019/09/tariffs-are-really-beginning-to-hurt.html

“China’s exports to the US have not been greatly harmed by the imposition of tariffs, most likely because the yuan has fallen almost 13% …”

“US statistics confirm this, showing that June ’19 exports to China were down 17% from a year earlier.”

The +1000-point rally in the Hang Seng may be the shot that signals a reversal in trend for emerging markets – the beginning of the end of a long down trend (which in my opinion began in January 2018).

The extradition bill withdrawal is just 1 of 5 demands by the protestors. Could this rally may be just a one-day wonder?

¯\_(ツ)_/¯

“”This time, the real 10-year yield is low””

How do I think about this?

What is the difference between Real, … and I guess an Unreal yield?

Real = inflation adjusted