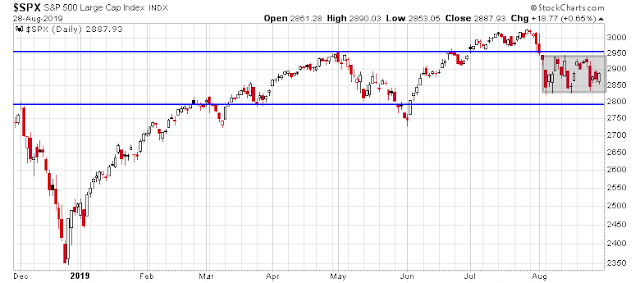

Mid-week market update: The stock market is continuing its pattern of sideways choppiness within a range, bounded by 2825 to 2930, with a possible extended range of 2790 to 2950.

My inner trader continues to advocate for a strategy of buying the dips, and selling the rips. On the other hand, my inner investor is inclined to remain cautious until we can see greater clarity on the technical, macro, and fundamental outlook.

Buy the dips

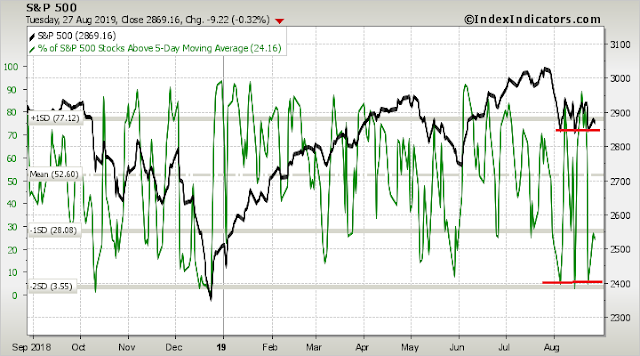

In the short run, breadth is sufficiently oversold that current levels represent decent long side entry point for traders (indicators are as of Tuesday night`s close).

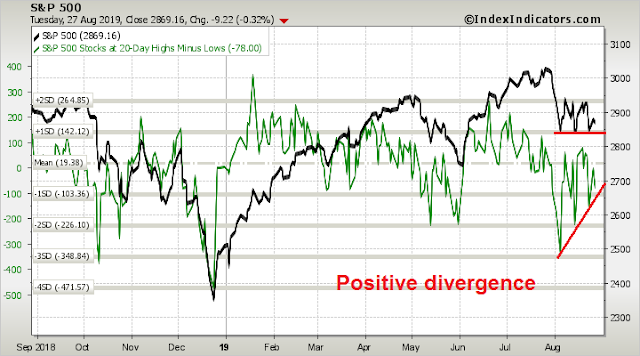

Longer term (1-2 week horizon) indicators are displaying a constructive pattern of higher lows and higher highs.

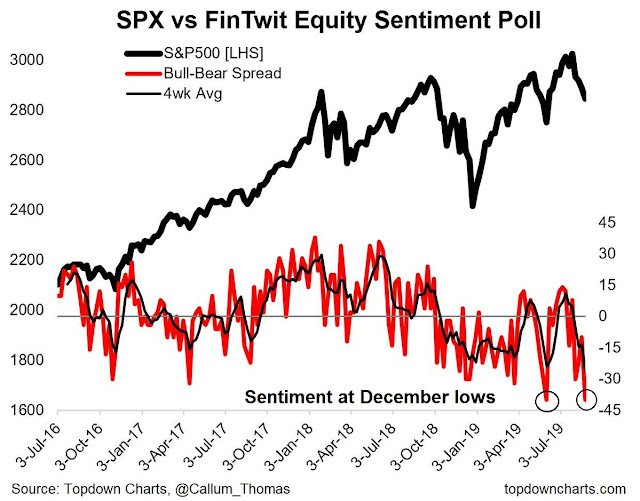

In addition, Callum Thomas` (unscientific) poll of equity sentiment on Twitter, which was conducted on the weekend, shows a bearish extreme, which is contrarian bullish.

Still range-bound

Before the bulls get overly excited, the current up-and-down pattern may not support a sustainable rally. While sentiment and breadth metrics are either oversold, or at bearish extremes, readings are highly fickle, and volatile on a daily basis. We have not seen the kind of consistent selling that usually characterizes a wash-out bottom yet.

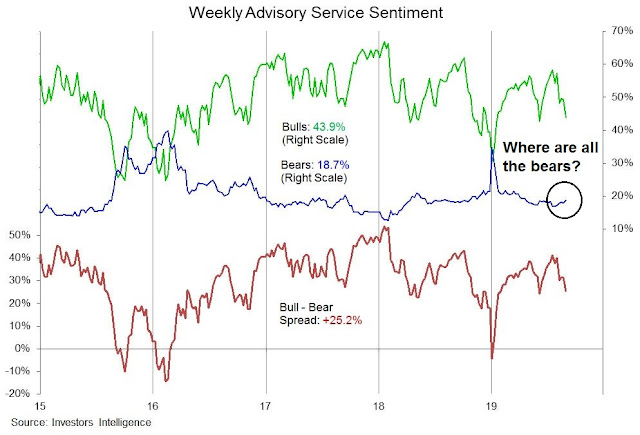

The latest Investors Intelligence sentiment survey tells the story. Bullish sentiment has dropped considerably, which can be a sign of a short-term bottom. On the other hand, bearish sentiment has barely budged. and it has not spiked to signal the panic consistent with a durable intermediate term bottom.

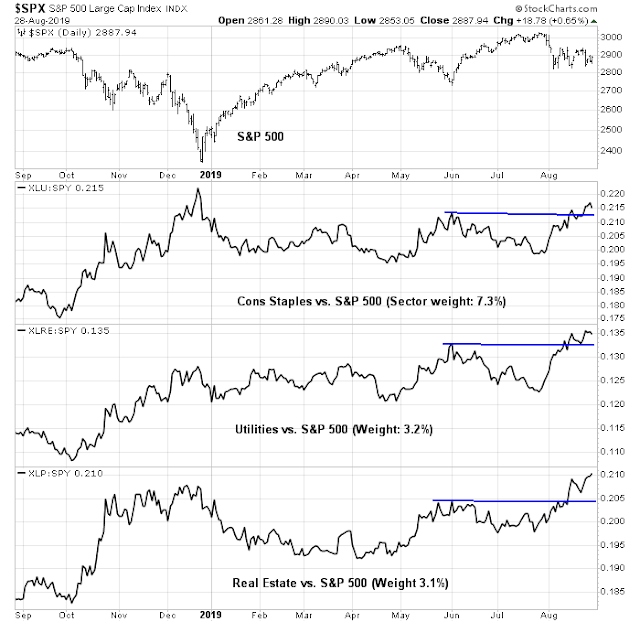

An analysis of sector leadership shows the dominance of defensive sectors, all of which have exhibited recent relative breakouts. This is a signal that the bears remain in control of the tape. The good news is the aggregate weight of the defensive sectors total less than 15% of the index, and no matter how strong they are on a relative basis, they cannot drag the market down very much.

A look at the top five sectors, which comprise nearly 70% of index weight, tells a different story. With the exception of Technology, which is exhibiting a constructive leadership pattern, all of the other sectors are either lagging or range-bound on a relative basis. The stock market cannot rise without the strong participation of these heavyweights, which is more or less nonexistent.

This market structure argues for a continued sideways choppy pattern, and the appropriateness of a buy the dips and sell the rips trading strategy.

My inner investor is cautiously positioned, and he is underweight equities relative to target policy weight. Subscribers received an email alert Tuesday morning that my inner trader had taken profits on his short positions, and he had reversed to the long side. Should the market weaken back to support, he is prepared to buy more.

The trading model is now bullish. However, be aware of the volatile nature of the market, and traders are advised to adjust their position sizes accordingly.

Disclosure: Long SPXL

Nice calls re ST direction the past several days, Cam.

I have a question re Emerging Markets. You weighed in on this topic earlier in the month with the comment ‘the headwinds for the USD is persistent. Unless the fundamentals of the budget deficit changes, or Treasury`s financing schedule changes (not sure how), the USD is going to be well bid over the next few months.’

What might spark a reversal in the USD?

We need a notable change in the tone in risk appetite from risk-off to risk-on. Not sure what triggers that. Taking no-deal Brexit off the board? A friendly trade environment?

SPX 2828 pretty close to top of recent range.

I continue to think (based partly on many of the recent posts here) that emerging markets will be the next big play. Probably a long set-up, but also a long run as in 2016-17.

2928.

Today’s stockcharts message mentioned 3 is the magic number (which I agree). The support has been tested 3 times now and the resistance is (probably) going to be tested the third time. One of them is going to be broken soon.