Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

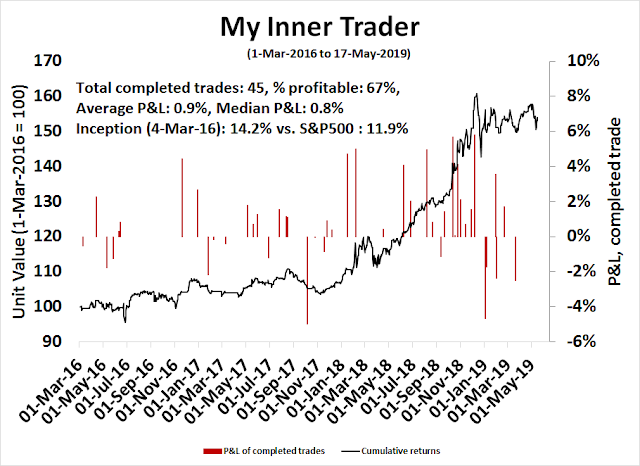

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Neutral (downgrade)

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Trump’s two personas

Trump’s two personas are on a collision course with each other. On one hand, he likes to style himself as Tariff Man, because he believes the US has had a raw deal from its trading partners. The list of offenders starts with China, but it is numerous. Tariffs are the best tool to address that imbalance. On the other hand, Trump the Dow Man loves a booming stock market, which he tracks obsessively, and views it as a form of validation of the success of his administration.

As trade jitters rose, the stock market has become nervous and sold off. Markets hate trade wars, and they hate uncertainty. While Tariff Man and Dow Man can coexist when trade tensions are low, we will reach some tipping point where Trump has to choose.

Jason Furman raised a number of insightful points in a recent Twitter thread.

It would be rational to escalate the trade war with China if the short-run cost for the U.S. economy are outweighed by the long-run benefits of a more favorable trade agreement.

This is not a priori bad economics, it is a numerical cost-benefit question.

I have seen many quantification of the SR [short run] cost (usually something like 0.5pp hit to GDP growth if the tariffs are expanded and sustained).

But I have seen no quantification of the benefit of plausible or best-case Chinese concessions relative to what they have already conceded.

The LR [long run] benefits conditional on a favorable resolution is just one input into a view on the strategy, you would also need to know how the trade war changes the probability of a favorable resolution. But we should be able to take a stab at quantifying the LR benefits.

In theory equity markets are doing this sort of present value calculation—we lose upfront but this strategy raises the chances we get more IP protections, soybean sales, etc. And they seem to be saying that the potential LR benefits don’t outweigh the SR costs.

This is consistent with my hunch that there would be only a very small macro difference for the U.S. economy between China’s last offer and our latest demand. But I wish I had more than a hunch. Anyone seen anything better?

In other words, would the price of a trade war be worthwhile? We have a reasonable idea of what the costs are, but has anyone calculated the net benefits under varying assumptions and scenarios? In particular, has anyone in the Trump administration done a cost-benefit analysis?

If not, will Trump the Tariff Man or Trump the Dow Man gain the upper hand in the crunch? What are the bull and bear cases?

I find that investors should re-orient their portfolios to a neutral risk position, and adjust their asset allocation back to investment policy targets. The heightened level of uncertainty is likely to boost volatility, and investors may want to take advantage of this environment of elevated option premiums by selling covered calls to boost expected returns. It would be a way of getting paid via option premiums while you wait for a resolution of the trade conflict.

The bear case

The bear case is easy to make, and in a multi-dimensional fashion. From a trade negotiation perspective, things don`t look good. The trade talks are already foundering, and Trump’s most recent decision on Huawei could torpedo the talks entirely. The latest initiative will ban Huawei from selling equipment into the US, and forbid US companies from selling to Huawei. The latter move could cripple Huawei and lead to its destruction. In effect, it will be unable to access components as key components of a 5G network, and there is some question as to whether it will be able to service existing installed networks.

China will view this as a grave escalation in the trade conflict. While the initial reason for the conflict was “fair trading” by China, the Huawei decision is a signal that the US intends to keep China down and retarding its ability to develop its economy and innovate into higher value-added products. Bloomberg reported that China’s state media has suggested that there is little interest in continuing talks in the current environment:

China signaled a lack of interest in resuming trade talks with the U.S. under the current threat to escalate tariffs, while the government said stimulus will be stepped up to buttress the domestic economy.

Without new moves that show the U.S. is sincere it is meaningless for its officials to come to China and have trade talks, according to a commentary by the blog Taoran Notes, which was carried by state-run Xinhua News Agency and the People’s Daily, the Communist Party’s mouthpiece.

The National Development and Reform Commission is studying the impact of U.S. tariffs and will ensure growth is kept in a “reasonable range,” spokeswoman Meng Wei said at briefing in Beijing Friday.

The U.S. has been talking about wanting to continue the negotiations, but in the meantime it has been playing “little tricks to disrupt the atmosphere,” according to the commentary on Thursday night, citing Trumps steps this week to curb Chinese telecom giant Huawei Technologies Co.

“We can’t see the U.S. has any substantial sincerity in pushing forward the talks. Rather, it is expanding extreme pressure,” the blog wrote. “If the U.S. ignores the will of the Chinese people, then it probably won’t get an effective response from the Chinese side,” it added.

Jin Canrong of Renmin University wrote a scathing editorial in China`s state controlled media Global Times that outlined possible retaliatory measures:

- China could restrict the sale of rare earths to the US

- China could sell its vast Treasury holdings

- China could punish American companies doing business in China

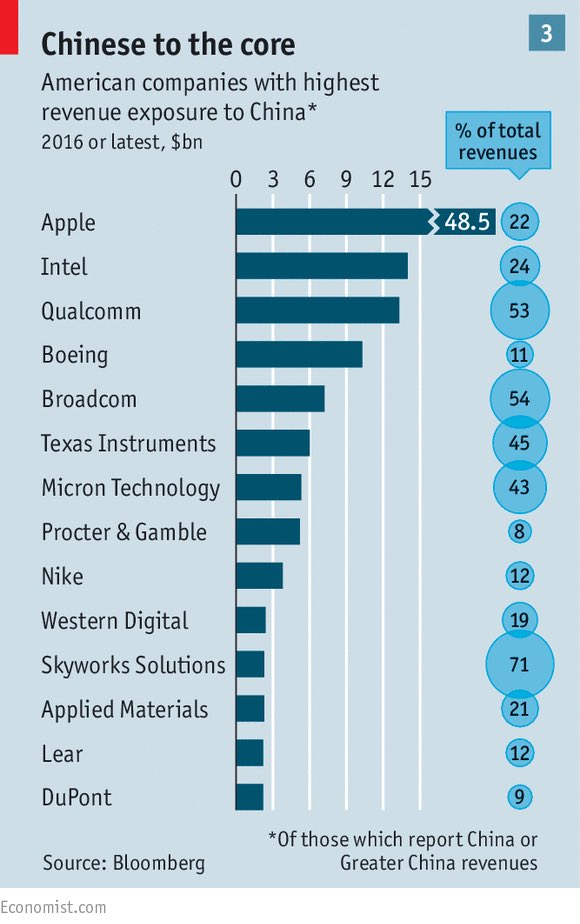

While I would discount threat 2, as the sale of Treasuries would have minimal effect, and would force China to shift assets into another major currency, the other two threats have the potential to seriously damage the global growth outlook and spark a risk-off stampede. The greatest exposure are the technology stocks, which have been the market leaders. A cutoff of rare earth exports would crater the semiconductor industry, and global growth. As well, the list of companies with the highest revenue exposure to China reveals a technology bias.

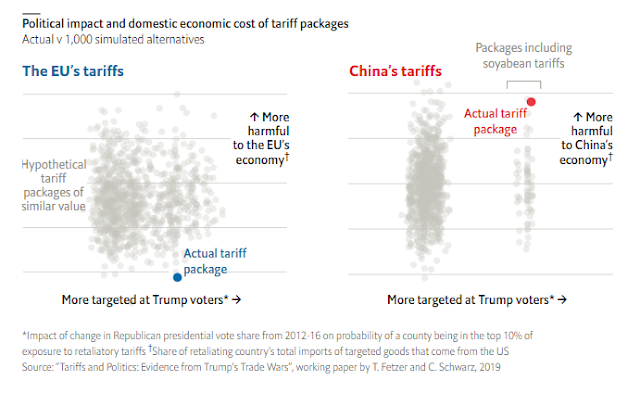

The Economist recently highlighted a study by Thiemo Fetzer and Carlo Schwarz of the University of Warwick. The study measured the trade-offs between the political harm of retaliatory tariffs (horizontal scale) against the economic costs of retaliation (vertical scale). They found that the EU’s retaliatory measures were designed to minimize blowback to European interests, but Beijing’s response was designed to cause maximum political damage to Trump’s base without regard to China’s own cost.

China is an autocracy and it has a much higher pain threshold than conventional Western democracies. Will Dow Man cry uncle?

From a US economic perspective, wobbles are starting to appear. While Trump may view the Q1 GDP print of 3.2% as a triumph, which gives me room to negotiate from a position of strength, final demand after stripping out the effects of exports and inventory buildup was an anemic 1.4%.

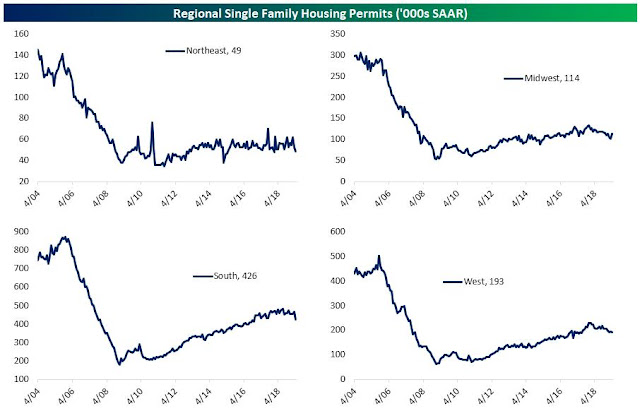

The highly sensitive housing sector is weakening, despite the support from lower mortgage rates. Single family housing permits, which leads housing starts, is weakening across the board. Tariff effects will worsen the situation. A recent CNBC interview with the CEO of Clayton Homes, which builds manufactured housing, revealed that the company’s costs will rise 4-5%, and those increases will eventually have to be passed on to buyers.

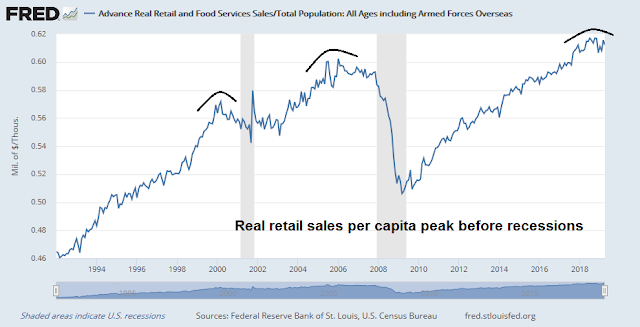

In addition, the latest retail sales figures are weak. In the past, real retail sales has peaked about a year or more before recessions, and the high in this cycle was October 2018.

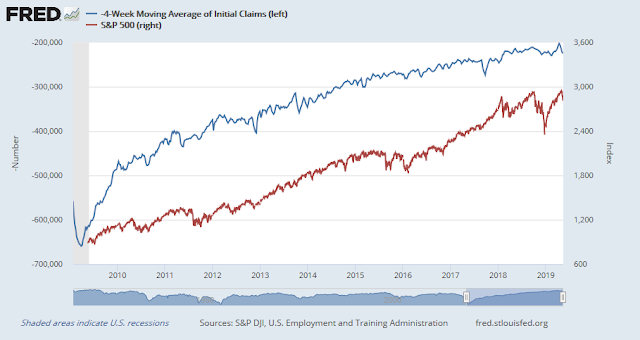

The labor market is also starting to soften. After reaching multi-decade lows, initial jobless claims have begun to rise, and initial claims (inverted scale) have shown a coincidental inverse correlation to stock prices.

New Deal democrat pointed out that initial claims has historically led the unemployment rate by several months, though it has moved coincidentally with unemployment during this expansion cycle. Regardless of whether the relationship is leading or coincident, rising initial claims is likely to put upward pressure on the unemployment rate in the immediate future.

These conditions may put the Sahm Rule into play later this year. The Sahm Rule is designed to spot a recession in real-time, and it was proposed by Federal Reserve economist Claudia Sahm. It formed part of a fiscal policy initiative as part of the Hamilton Project, which called for direct and automatic payments in the event of a recession, but such a program requires a real-time recession rule. The Sahm Rule trigger is: “when the three-month average of the unemployment rate is 0.50 percentage or more above its low during the prior 12 months … that’s in a recession and time to start stimulus payments”. While the trigger rule is only backtested and it is untested in real-time, the Sahm Rule has had not false positives since 1970.

My long tenure as a bottom-up equity quant has taught me how market factors react to unexpected shocks. My models were the typical multi-factor stock selection model, with a combination of value, growth, expectations, and price technical factors. When the market encounters an unexpected macro shock, the first set of factors to react are the price technical models. Top-down strategists then begin to revise their earnings and interest rate outlook, which feed into expectation models. Earnings estimates then change, because while company analysts recognize the direction of the change, they need to see the exact details of the change before they can determine the magnitude. Finally, fundamental factors such as growth and value then work again.

We already saw the initial stage, when price responded to the change in trade tensions. Bloomberg reported that some strategists are now beginning to revise their outlook downwards:

It’s a minority view, to be sure, but for Mike Wilson, Morgan Stanley’s chief equity strategist, the escalation has increased the likelihood for a prolonged economic downturn — the most reliable killer of bull markets. JPMorgan Chase & Co’s head of cross asset fundamental strategy, John Normand, warned that stocks could fall another 10%.

“The risk of an economic downturn has increased substantially,” Wilson said in a note to clients Monday. “While last week’s correction helped move the risk-reward closer to balanced, we think there is likely more downside than upside based on our high conviction view that earnings expectations remain too high by 5-10%.”

When will Dow Man take notice of all of these developments? For some context, the S&P 500 fell -2.4% last Monday. That equates to a market cap loss of $600 billion, which is more than the total value of the annual US imports from China.

The bull case

The intermediate term bull case for equities rests on the combination of a relatively constructive outlook for growth, and excessively defensive positioning.

First, the outlook for the US economy is not exactly dire. While there is some evidence of deceleration, the economy is not about to fall into recession. Sure, retail sales is soft, but University of Michigan Consumer Sentiment printed a 15-year high.

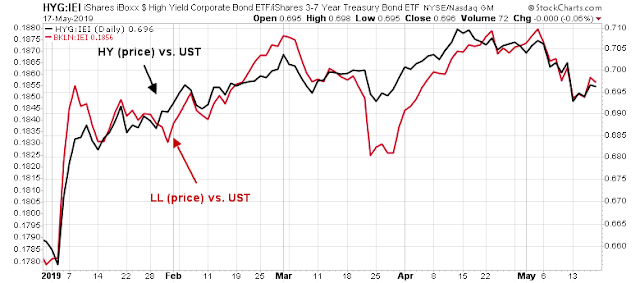

Even if you believe that the economy is showing the warning signs of a recession, not all of the pre-conditions for a recession are present. Monetary policy remains accommodative, and the Fed has signaled that it stands ready to ease in case of weakness. In addition, there are no signs of any credit crunch, which exacerbates the downside path of a downturn. Analysis from UBS reveals that the leveraged loans market is most exposed to tariff effects.

So far, leveraged loans have performed roughly in line with high yield in 2019, though this is an indicator to keep an eye on.

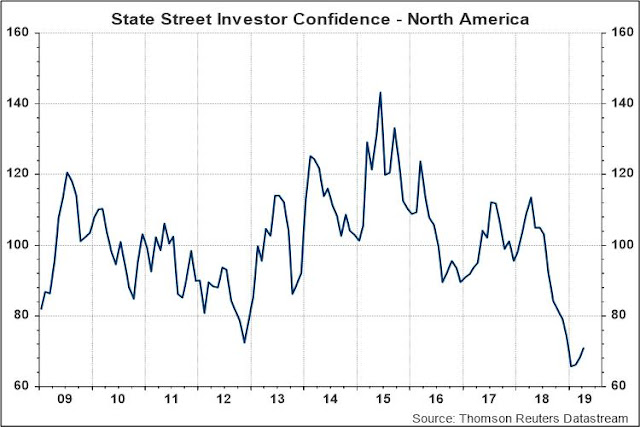

In addition, excessively cautious institutional sentiment is likely to put a floor on any pullback. State Street Confidence is already at historic lows, indicating defensive positioning.

The latest BAML Global Fund Manager Survey reveals that the number of managers that have taken out tail-risk hedges is at all-time highs. Most past spikes in hedging behavior has signaled minimal downside risk, except for the 2008-09 bear, and the downdraft in late 2018.

The Fear and Greed Index is telling a similar story. The index hit a low of 32 last Monday, but it has recovered to 36 on Friday. While readings are not the sub-20 levels seen in past capitulation bottoms, the market has bottomed in the past at similar levels in the past.

Resolving the Tariff Man vs. Dow Man dilemma

After a review of the bull and bear cases, here is how I resolve the Tariff Man and Dow Man dilemma. In the absence of tail-risk, expect Trump to adopt the Tariff Man persona and act tough on China, as well as other trading partners. Should tail-risk appear, either in the form of deteriorating economic conditions, or a market slide, Dow Man will become the dominant persona.

This analysis argues for a choppy range bound market for the next few months, with limited downside risk and restricted upside potential. Trump and Xi are expected to meet in Japan in late June, but there are no further interim talks scheduled. Until Trump’s latest trade tantrum that upside markets, the Trump administration had been telling us that a deal was 90% done, and talks were constructive. It is therefore possible that Trump and Xi could put aside their difference and close the last 10%. That said, even if they were to come to an agreement in principle, negotiators will have to iron out the details, which will take time, and there will be the inevitable ups and downs of bargaining. Hence the choppiness.

Ironically, a significant market rally will exacerbate trade war risk, because Trump will think that he has a cushion to push for more concessions. On the other hand, a market decline will weaken Trump’s hand. But the big and slow institutional money is already defensive, and short market beta, which should limit downside equity risk. The combination of a Fed Put and a Tariff Man Put should also put a floor on stock prices.

Under these conditions, investors should re-orient their portfolios to a neutral risk position, and adjust their asset allocation back to investment policy targets. The heightened level of uncertainty is likely to boost volatility, and investors may want to take advantage of this environment of elevated option premiums by selling covered calls to boost expected returns. It would be a way of getting paid via option premiums while you wait for a resolution of the trade conflict.

The week ahead

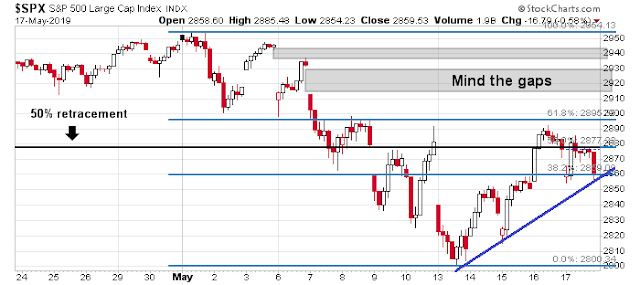

Last week, I made a strong case for a bullish rebound. While stock prices appear to have made a short-term bottom, and I remain tactically bullish, the bull case is less clear-cut as it was last week. The hourly S&P 500 chart shows the index in a short-term uptrend. It rally the 50% retracement level last week, but the advance was halted, with possible gaps to be filled on the upside.

Historical studies are supportive of further market strength. I had highlighted analysis from Rob Hanna of Quantifiable Edges, who flashed a buy signal based on his Capitulative Breadth Index (CBI) on Thursday May 10, 2018 when it reached an oversold value of 10. CBI remained at 10 Friday, and rose to 13 Monday. If we were to set day 0 as Thursday May 10, last Friday would be day 6, and Hanna’s historical study suggests further gains ahead.

Even though the market rebound appears to have begun, Ryan Detrick of LPL Financial observed that the DJIA is down for four consecutive weeks, which is a rare event.

Troy Bombardia pointed out that when the S&P 500 pulls back for two weeks after a prolonged advance, the intermediate term outlook is bullish, though there could be some turbulence in the first week.

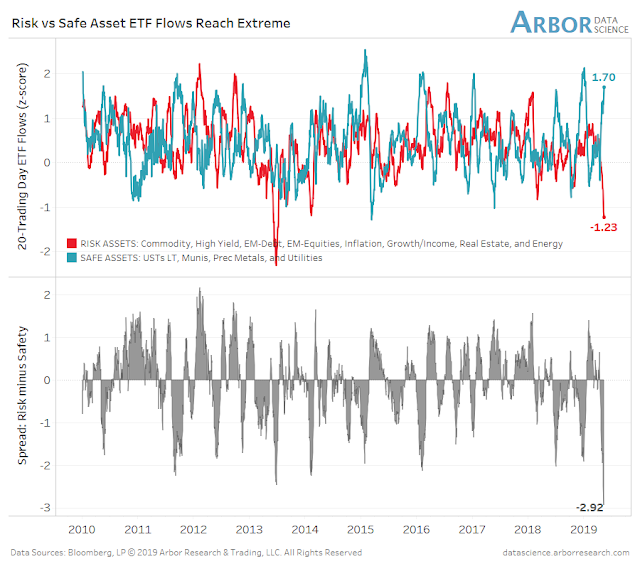

Sentiment readings remain fearful, which is contrarian bullish. ETF fund flows between risky and safe assets are at an extreme.

The 10-day moving average of the CBOE equity-only put/call ratio is showing high levels of fear. Most instances of these extreme readings have been signals of low downside risk.

After Friday’s market close, Reuters reported that the Commerce Department may walk back some of the harsh treatment of Huawei, which could alleviate some of the trade tensions:

The Commerce Department, which had effectively halted Huawei’s ability to buy American-made parts and components, is considering issuing a temporary general license to “prevent the interruption of existing network operations and equipment,” a spokeswoman said.

Potential beneficiaries of the license could, for example, include internet access and mobile phone service providers in thinly populated places such as Wyoming and eastern Oregon that purchased network equipment from Huawei in recent years.

In effect, the Commerce Department would allow Huawei to purchase U.S. goods so it can help existing customers maintain the reliability of networks and equipment, but the Chinese firm still would not be allowed to buy American parts and components to manufacture new products.

Nevertheless, the bulls still face a number of challenges. A review of the relative performance by market cap groupings show that mid and small cap stocks are testing key relative support levels. Decisive downside breaks may be signals that the bears have taken control of the tape.

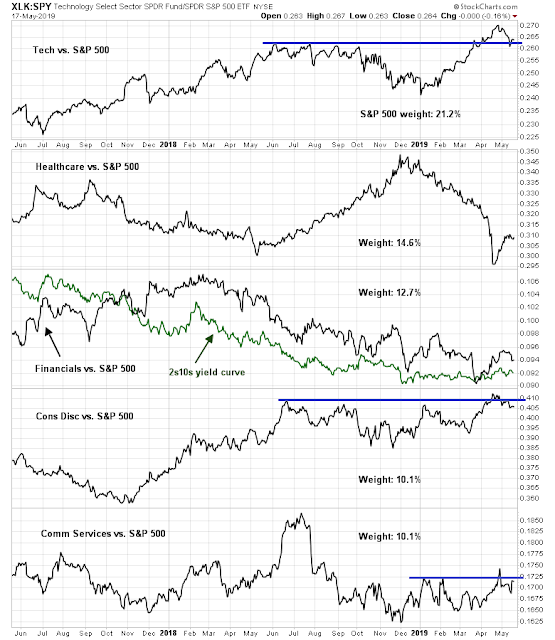

As well, the relative performance of the top five sectors that comprise over two-thirds of index weight indicate that the glamour FAANG sectors, namely Technology, Consumer Discretionary (AMZN), and Communication Services (GOOGL), are struggling. These stocks will have to maintain some semblance of market leadership if the market is to rebound in a sustainable fashion.

In particular, semiconductor stocks, which are growth cyclical stocks within the Technology sector, have decisively broken down on an absolute and relative basis. To be sure, the downward pressure came from the Huawei blacklist news, but this could be a technical warning for the bull camp.

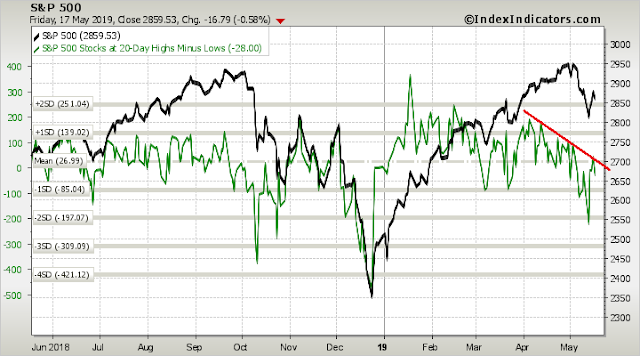

In addition, both short (1 week) and intermediate term (2-3 week) breadth indicators are deteriorating by exhibiting a series of lower highs even as the index rebounded. Unless the bulls can stage upside breakouts through those downtrends, rallies are likely to fail.

Where does that leave us? I am inclined to give the bull case the benefit of the doubt, though my level of conviction is lower than it was last week. The market is nearing a short-term crossroad, and I am maintaining an open mind to all possibilities.

I give the last word to Zero Hedge, which reported Friday morning that Dennis Gartman made a recommendation to short the market. Gartman has long been an uncanny contrarian indicator: “I feel a great Disturbance in the Market, as if millions of bearish voices suddenly cried out in terror and were suddenly silenced. I fear something terrible has happened.”

My inner investor will opportunistically trim his equity position back to investment target weight in the days to come.

While a downgrade of the intermediate term trend model from bullish to neutral would normally translate into a trading sell rating, I am temporarily maintaining the buy rating mainly because of the bullish momentum from the relief rally. My inner trader remains nervously long. He is ready to take profits should the market approach the old highs, or flatten his long positions should it significantly weaken.

Disclosure: Long SPXL, TQQQ

How much of the trade gap between US and China is due to unfair trade practices and how much is due to lower cost of labor in China? If it’s simply a matter of lower labor cost, shouldn’t we focus on intellectual property issues.

The A-D line (!ADLINENYC) suggests an imminent downturn.

My momentum work says the U.S. housing sector will be the leading group going forward and the fundamentals are falling into place to confirm it.

The NAHB Housing Market Index has turned up sharply from its 2018 year end low. The outlook for mortgage rates is now very positive whereas it was hostile for all of 2018.

I check the Fragility of sectors when markets correct. In the Sept to Dec 24 drop, Home Construction ITB was ranked a dismal 57 out of 61 sectors. Since the May 3 peak, it is ranked 12. That tells me something new is happening. Also in the rally from Dec 24 to May 3, it was ranked 6th. That was another sign of new leadership.

The sectors above it were technology oriented and as Cam says, those groups are having headwinds.

They is a possibility of a moonshot over the next couple of years if the populist Left movement for student loan forgiveness is enacted (or even as leading Democrats have it in their policy platforms). First time home buyers are historically 50% of new home buyers but that has fallen to 30% as young people are strapped with high student loan debt, They live with their parents longer and form families less. Student loan forgiveness will reverse that trend and give a huge boost to home sales, This bullish possibility may be bubbling in the background as we move to the 2020 election.

Ken,

I always look forward to your comments. Interesting point of view.

Chris

Ken, I respect your opinion but I wonder if something else is shifting in the US society.

Generally, there is a trend away from owning to renting (subscription economy).

The births in the U.S. have fallen in 10 of the last 11 years since peaking in 2007.

https://www.wsj.com/articles/u-s-births-fall-to-lowest-rates-since-1980s-11557892860

Across the population, men today have less testosterone compared to men of the same age a generation ago.

https://www.forbes.com/sites/neilhowe/2017/10/02/youre-not-the-man-your-father-was/#410d28eb8b7f

Women are financially independent and don’t need to marry for financial reasons.

Millennials are more interested in interacting with smartphones than with each other. On top of it, the Metoo movement has made it harder for men to approach women. At my work location, there are many men and women in 20s and 30s but I rarely see any flirting going on.

Of course, all of this will affect the couple formation and the first home purchase at the margin.

“I feel a great Disturbance in the Market, as if millions of bearish voices suddenly cried out in terror and were suddenly silenced. I fear something terrible has happened.”

Replace Market by Force and you’ll got exactly the Obi-Wan Kenobi replica in the first Star Wars

“I feel a great Disturbance in the Force, as if millions of voices suddenly cried out in terror and were suddenly silenced. I fear something terrible has happened.”

When we replace Market by Force and you’ll got exactly the Obi-Wan Kenobi replica in the first Star Wars

Ken- Appreciate your comments.

Our two older children graduated from college 5-6 years ago, and of course buying a first home in the Bay Area has been out of reach. That’s beginning to change. With rates at one-year lows they’ve both started attending open homes. At some point, Millenials will transition into homeowners.

Most of the newer developments on the Peninsula are necessarily higher-density – there’s little unprotected open space. Many cities are in the process of legislating ADRs (auxiliary dwelling units) – basically, 1-2 BR units constructed in back yards. As the population continues to grow in Silicon Valley/ San Francisco (which is still the base case), we’re likely begin to see high-rises changing the landscapes and skylines.