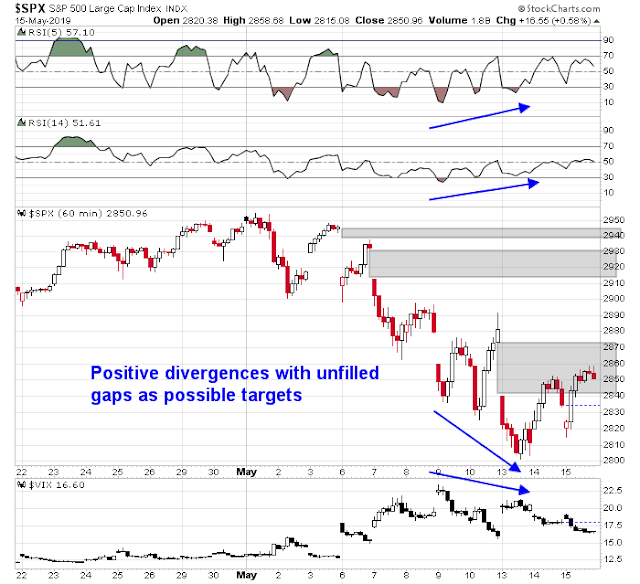

Mid-week market update: There are numerous signs that the US equity market is making a short-term tradable bottom. Firstly, the market is washed out and oversold. While oversold markets can become more oversold, we saw some bullish triggers in the form of positive divergences on the hourly SPX chart.

Even as the index fell, both the 5 and 14 hour RSI made higher lows and higher highs. In addition, the VIX Index failed to make a higher high even as prices declined. Possible upside targets are the three gaps left open in the last few days.

Bullish setups everywhere

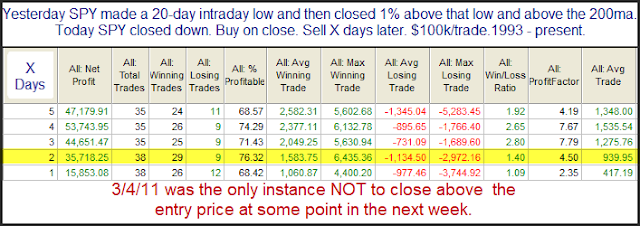

There were many bullish setups in the last few trading days. Rob Hanna at Quantifiable Edges pointed out last Friday that his Capitulative Breadth Index (CBI) hit 10 last Thursday. Historical studies show a definite bullish edge on a three-week horizon when CBI rises to 10 or more.

To be sure, a CBI reading of 10 does not necessarily mark the exact bottom. Hanna went on to report that CBI remained at 10 on Friday, and rose to 13 on Monday. He followed up with a post on Monday explaining why a failed bounce is not a sell signal.

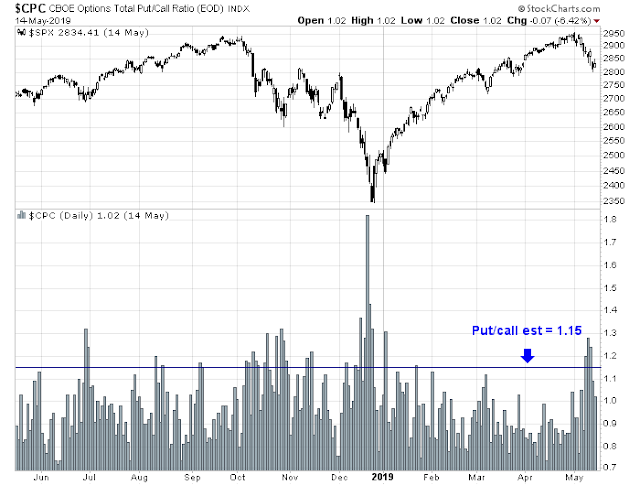

In addition, Schaeffers Research observed that the 5-day equity put/call ratio had spike to levels seen at previous panic bottoms.

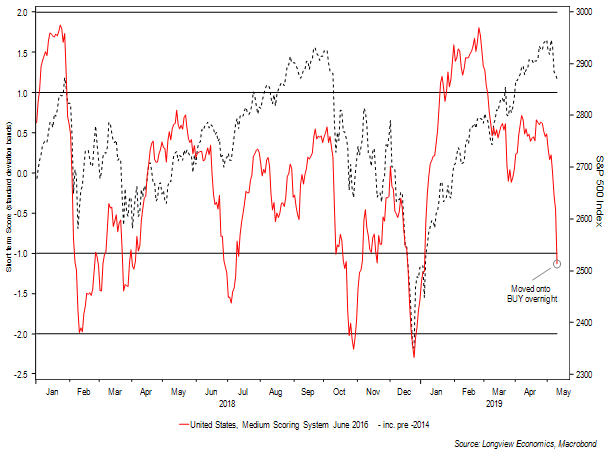

John Authers, writing at Bloomberg, pointed to the sentiment index produced by Longview Economics, which was published Friday morning. All of these readings, from Quantifiable Edges, Schaeffers, and Longview, are screaming “short-term market bottom”.

Authers went on to attribute the oversold rally to a lack of bad news. I interpret these conditions as seller exhaustion.

The sky didn’t fall. Risk assets enjoyed a slight rebound Tuesday after the big selloff sparked by the U.S.’s decision to impose additional tariffs on China and that country’s decision to respond in kind. The relief rally can be justified by the likely absence of pressing reasons to sell for the next few weeks. The current target appears to be for the U.S. and China to strike some kind of deal at the Group of 20 summit in Osaka late next month. That gives time for both sides to try to find a way to avoid any further escalation. Meanwhile, the tariffs announced in the last few days will not take effect until the end of this month.

How durable is the rally?

The next question for investors and traders is, “How durable is this rally?”

Rob Hanna’s analysis suggests that his CBI buy signals have a positive risk/reward of at least three weeks. In the very short-term, the market is climbing the proverbial wall of worry. Despite today’s advance, the CBOE put/call ratio end-of-day estimate stands at 1.15, indicating some degree of residual fear and skepticism about the rally.

My inner trader remains long this market, and he is hanging on for this rally. In a future post, I will discuss the intermediate term outlook for stocks after the relief rally peters out.

Disclosure: Long SPXL, TQQQ

Cam, why is R2K is under-performing for a while now? With so much uncertainty around trade, strong US economy and strong USD, shouldn’t US domestic businesses outperform the businesses exposed to international and China trade?

¯\_(ツ)_/¯

Your guess is as good as mine.

Why would domestic small-caps outperform?

Small-caps almost always under-perform when economic conditions deteriorate (which is the most likely outcome of higher tariffs).

Large companies are generally better capitalized and more able to withstand a downturn in the economy. Even with significant exposure to international trade, they’re able to absorb the impact of tariffs in ways inaccessible to smaller companies (shifting resources or spreading the impact across multiple product lines/sectors, for instance).

Many small-caps are simply suppliers to large-caps, and may be pressured on pricing. Even those who sell directly to consumers will come under pressure – an uncertain economic outlook will lead most consumers to cut back.

Finally, given a choice, I would imagine that fund managers who anticipate having to navigate through a rough patch are currently unloading positions in relatively illiquid R2K holdings in favor of large-caps.

Just my opinion.