-week market update: Numerous signs of a new bullish impulse are appearing.

- The American economy has sidestepped a recession;

- Sentiment is not excessively bullish; and

- Price momentum is strong.

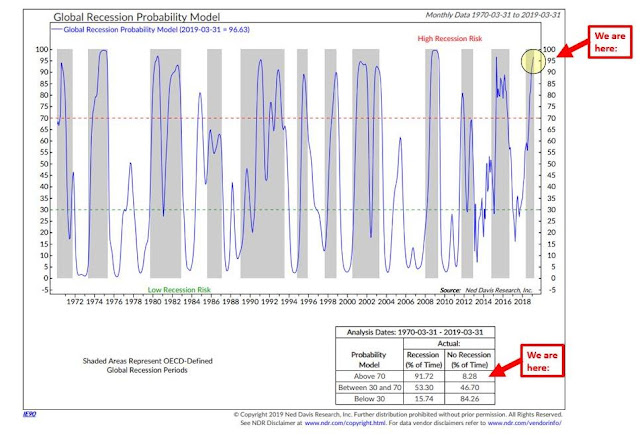

It is a truism in investing that you should buy when blood is running in the streets. The latest update of NDR’s Global Recession Model shows the probability of a global recession, which is defined as sub-3% growth, at 96.63%.

One application of that rule is to buy risky assets when a recession is evident to the public. It seems that we have reached that point, what should we buy?

Dodging the recession

Let’s start with the good news. Greg Ip at the WSJ wrote that “The World Seems to Have Dodged Recession, for Now”:

If the world was at risk of sliding into recession, policy makers appear to have pivoted in time to prevent it.

In the U.S., the slowdown never got started. March capped a quarter in which jobs grew as fast as they did in the fourth quarter. Growth in private hours worked, a better gauge of business labor demand, actually accelerated.

In the rest of the world, a rise in China’s purchasing managers index in March suggests its slowdown may be ending and a modest improvement in German industrial production in February sparked hopes for the same there. In sum, while recession fears haven’t entirely receded, the panic that gripped financial markets last year now looks misplaced.

Josh Brown, otherwise known as The Reformed Broker, thinks that the recession panic was overdone. He stated on CNBC that the US has never imported a recession from abroad:

Recession fears have been reignited amid weakening global conditions, but recessions have never been contagious and the U.S. is doing just fine, according to Josh Brown, CEO of Ritholtz Wealth Management.

“The consumer is on fire. The small business owner is on fire. Financial conditions have not been easier in 13 years. Money is flowing and businesses are growing,” Brown, also a CNBC contributor, told CNBC’s “Halftime Report.”

“Can you think of a recession from anywhere international that we’ve imported over here? It’s never happened. Even in 1998 when every country in Asia melted down, devaluation of the Ruble, complete banking fiasco all over the place in Latin America, we didn’t have a recession as a result to that,” he added.

The economic stresses that have been manifesting in Europe, China, and Japan are worrying many of a global slowdown. Adding to the fears is the deteriorating U.S. data including durable goods, Markit PMI and manufacturing survey, but Brown said the data is skewed by the government shutdown and will soon recover.

“The first quarter is always disappointment,” Brown said, referring to a phenomenon called residual seasonality. “In some years, we had that because of major northeastern snowstorms. In other years, we had that because of the falling price of the oil. It happens every single year.”

“You will see a bounce back in the data when we get deeper into Q2 right on schedule,” he said.

Jurrien Timmer at Fidelity pointed out that US equities is following roughly the same path as the non-recessionary drawdowns of 1994, 1998, and 2011 (via Callum Thomas).

Supporting sentiment

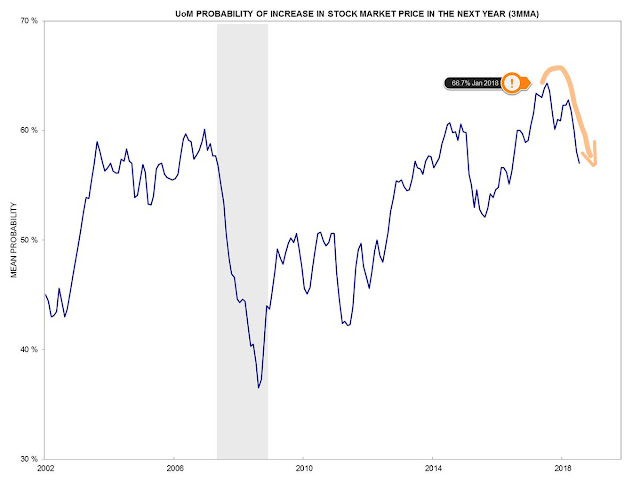

Add to the equation a backdrop of supportive sentiment. The University of Michigan survey of the public’s believe that the stock market will rise has pulled back from a high of 66.7% to 57.1%, While that reading is still a little elevated, there is room for sentiment to become more bullish.

Momentum returns

The turnaround from excessive caution about an economic slowdown is showing up in rising price momentum. Brett Steenbarger at TraderFeed wrote on Monday:

I noticed an interesting event at the Friday close. Over 80% of all SPX stocks closed above their 3, 5, 10, 20, 50, and 100-day moving averages. (Data from the excellent IndexIndicators.com site). That is very broad strength. Going back to 2006, we’ve only seen 23 similar occurrences–and none since 2013! Many of those occurrences were seen in 2009 and 2010 and then again in 2012 and 2013 during protracted rises following market weakness. Indeed, if we examine those 23 occurrences over the next 20 and 50 days, we find 17 occasions up and 6 down for both time frames. The average 20-day gain was about 1.5%.

What this says to me is that we’re seeing significant upside momentum in stocks. Historically, such momentum has led the market higher, though not necessarily at the same rate previously seen. The main takeaway is that we can’t conclude that we’re heading lower simply because we’re “overbought”. Whether we think the valuations are justified or not, whether we like macroeconomic forecasts or not, equities have found meaningful demand. Perhaps that’s not so surprising in a world of low interest rates and tepid growth: U.S. stocks may offer some of the few havens for yield and growth. It may also be the case that the stock market, which has been kindly disposed to the current U.S. administration ever since the 2016 election, could display similar behavior should odds of re-election increase.

In any case, we’re seeing broad strength and few signs of weakness. A normal correction, given low levels of volatility and volume and the fact that stocks making new 52-week highs are not expanding, is clearly a possibility. If the mood of participants that I speak with is indicative of a more general mood, any such pullback may find interest from frustrated traders late to the party.

In other words, get ready for the dip buyers to stop waiting for the dip and pile in on the long side.

What to buy?

If global stock prices are poised for another bull leg, what should you buy? I have a number of suggestions, both in the US and internationally.

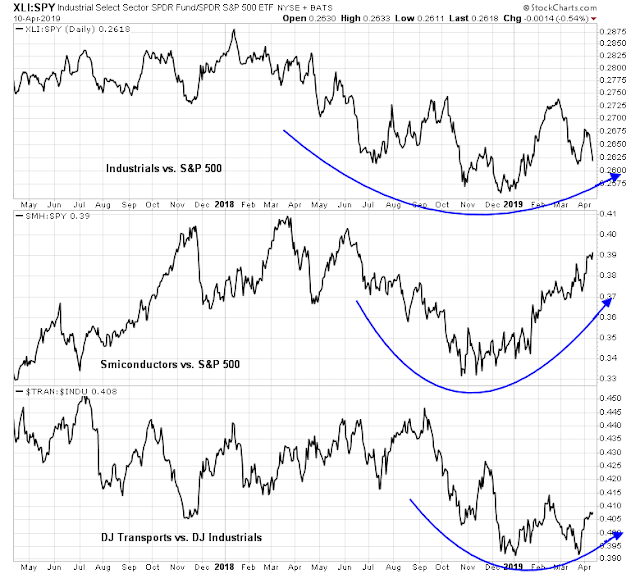

Let’s start in the US. The macro backdrop is a cyclical rebound, and cyclical stocks appear to be the emerging leadership. Industrial stocks (XLI), semiconductors, (SMH) and transportation (IYT) are all turning up relative to the market.

Across the Atlantic, it may be a little too early to be buying cyclicals, especially in light of the latest Trump tariff threat. The following chart shows performance of core and peripheral Europe against the MSCI All-Country World Index (ACWI). Surprisingly, Germany, which is the growth locomotive of the eurozone and its export leader, is underperforming. On the other hand, the pattern is the more “peripheral” the country, the greater the outperformance. The countries exhibiting the broadest based relative bottoms are Italy and Greece.

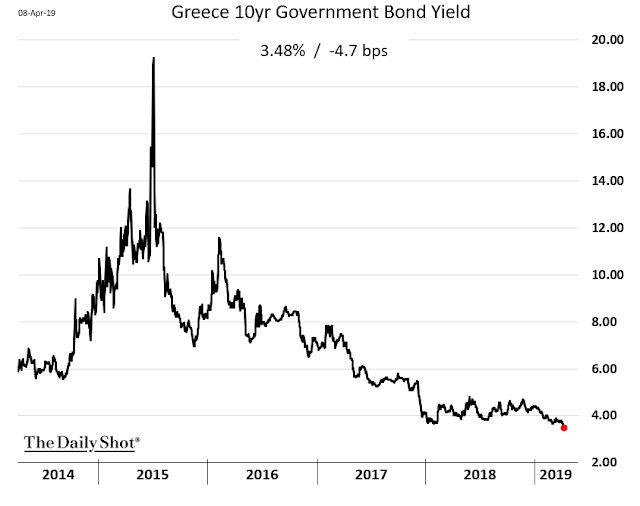

Yes, that Italy. That Greece. For some perspective of how much Greece has recovered, just take a look at this chart of the yield on 10-year Greek debt. In Europe, it seems that the dominant theme is contrarianism and financial healing.

The ACWI relative charts of China and her major Asian trading partners tell another story. The country showing the best momentum is Hong Kong. Despite all the excitement over a US-China trade truce, and China’s stimulus program, the Shanghai market has been range-bound against ACWI for 2019. The other Asian markets are also range-bound relative to ACWI, though two (Singapore and South Korea) are tracing constructive double bottom patterns.

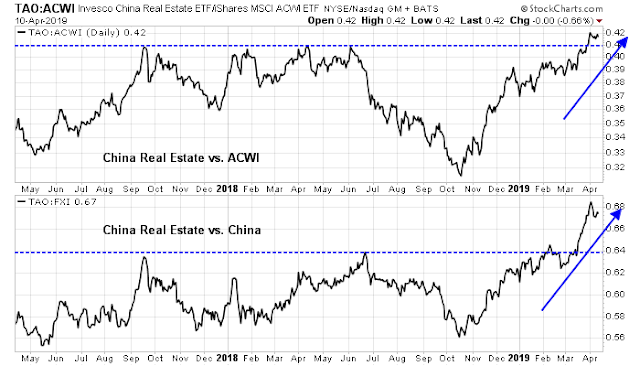

In Asia, you might want to bet on momentum. A really speculative choice might be the Chinese real estate stocks (TAO). I am indebted to my former Merrill Lynch colleague Fred Meissner of The Fred Report for bring this to my attention, though he does not explicitly recommend a position. The relative performance of TAO to both China (FXI) and ACWI has been astounding. Though TAO is a little extended, it is an aggressive way of gaining exposure to Beijing’s stimulus programs, whose effects appear quickly in the highly leveraged real estate sector.

There you have it. Bullish investors can position themselves with a diversified selection of investment themes and factors around the world, with exposure to a cyclical rebound in the US, beaten up contrarian exposure in Europe, and momentum in Asia.

Disclosure: Long EWI

So you’re long Italy ETF ?

Yes long Italy

Cam, if one wants to stick to the US, are there any better choices apart from SMH? How do small-caps (R2K) and technology (XLK ) look compared to S&P500?

Other major semiconductor ETFs to consider are: SOXX and XSD. The semiconductors have been performing roughly in line with the other technology stocks this year.

Thank you.

Are you still long SPXL?

Long SPXL in my trading account, long EWI in my investment account.

Thx. Will you provide a link for your investment account performance returns?

The returns of a portfolio depends on at least three elements:

1) What do you buy and sell

2) How much you buy and sell

3) The timing of the trade(s)

While we discuss (1) a lot on this site, (2) and (3) are not discussed. That’s because my risk and reward preferences are not your risk and reward preferences. My pain threshold is different from your pain threshold, and so on. So publishing the returns of a portfolio is at best meaningless, and at worst deceptive.

You will note that the published results of the trading system is not an actual portfolio, but the returns of a series of out-of-sample signals based on certain assumptions, such as execution at the end of day closing price, no commissions, no dividends or yield on cash, 100% long or 100% short the S&P 500 on a signal, etc. Those returns are shown for illustrative purposes, most traders would not actually construct a portfolio that way.

Possibly you could keep track of the real time results of your Investment Account as well as your Trading System. Thx.

Cam

It would help your readers if you would create three portfolios, one with high, moderate and low risk stock exposure.

Non-stock market reserves could be simply put in cash or money market funds.

My own portfolio has some specific issues, such as some old positions with very low cost bases that would cost a lot of capital gains tax if they were sold.

I also haven’t formulated model “inner investor” portfolios in the manner of the “inner trader” positions. That’s why in this case, I prefer with the approach of giving readers the idea, and let them decide how much they want to buy (if any).

As I keep repeating: I know nothing about you. I know nothing about your return requirements, your income requirements, your risk tolerance, your pain threshold, your tax situation, even your tax jurisdiction, and so on. It’s very, very difficult to formulate a model portfolio under those circumstances.

Hi Cam, what are your thoughts about the market move today that some are attributing to perceived hawkish language coming from some Fed members? Noise?

It looks like Europe and US markets shrugging off the Asian markets move down. US futures pointing up. I guess the Fed is just trying to keep its options open.

So, cyclicals are the ones to buy for the next phase of this but market. What about banks/financilas (XLF and KBE)?

So, cyclicals are the ones to buy for the next phase of this but market. What about banks/financials (XLF and KBE)?

The relative performance of financial stocks have been highly correlated with the 2s10s yield curve. Financials are not going to outperform until the yield curve starts to steepen. I am not sure when that starts to happen.

Thanks.

EWI and TAO already moving in the right direction! Please remember to tell us when the music stops for these…

I tried to buy GREK but it ran away from me. More on TAO in a future post

Thanks. BTW, I really like the international macro analysis!