I am somewhat at a loss of why Trump is putting so much pressure on the Federal Reserve. In a recent CNBC interview, CEA chair Kevin Hassett projected that growth would rise again to 3% later this year. “Everything we see right now is teeing us up to have a year like last year – Q1 around 1.5% or 2%, then Q2 goes way north, carries you into a 3% year.”

After the BLS reported a strong than expected March Jobs Report last Friday, Donald Trump repeated his assertion that the Fed should shift to an easier monetary policy (via CNBC):

President Donald Trump said Friday the U.S. economy would climb like “a rocket ship” if the Federal Reserve cut interest rates.

Commenting after a strong jobs report for March, Trump said the Fed “really slowed us down” in terms of economic growth, and that “there’s no inflation.”

“I think they should drop rates and get rid of quantitative tightening,” Trump told reporters, referring to the Fed’s policy of selling securities to unwind its balance sheet, a stimulus put in place during the financial crisis. “You would see a rocket ship. Despite that we’re doing very well.”

A “hot” economy

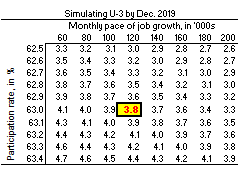

Robin Brooks of the Institute of International Finance believes that if economic growth remains on the current trajectory, the unemployment rate is destined to fall a lot lower.

With unemployment at 3.8% (yellow) and participation at 63.0% (vertical), break-even jobs growth – the monthly pace needed to keep unemployment at 3.8% for participation at 63.0% – is only 120k (horizontal). We’re averaging 200k, so U-3 unemployment is likely headed a lot lower.

Do a 3% growth rate and a strong jobs market constitute good reasons for the Fed needs to ease in a dramatic fashion?

Counterweights to Powell

In addition, Trump announced that he is nominating economic commentator Stephen Moore and former pizza chain executive Herman Cain as governors of the Federal Reserve. The White House hopes that the additions would act as counterweights to the perceived hawkishness of Fed chair Jerome Powell.

While many market participants and economists are in an uproar over the nomination of Moore and Cain (see the CNBC Wall Street survey which showed that 60% of respondents were against Moore’s confirmation, and 53% against Cain’s confirmation), their confirmation in the Senate is no slam dunk. The current verdict on PredictIt for both Moore and Cain’s confirmations are highly unfavorable.

As well, the WSJ reported that Cain cast doubt as to whether he would actually be confirmed by the Senate:

Herman Cain, President Trump’s latest choice for the Federal Reserve Board, expressed caution about his chances of making it through the vetting process that precedes a formal nomination.

In a video posted Friday evening to Facebook , Mr. Cain dwelled on the arduous nature of the background check conducted before the White House submits nominations to the Senate for confirmation.

“They have to collect an inordinate amount of information on you, your background, your family, your friends, your animals, your pets, for the last 50 years,” Mr. Cain said. He added that the endeavor would likely be “more cumbersome” in his case because he has held a large number of roles throughout his career.

“Whether or not I make it through this process, time will tell,” Mr. Cain said. “Would I be disappointed if I don’t make it through this process? No. Would I be thrilled and honored if I do make it through this process? Yes.”

Why is Trump putting so much pressure on the Fed?

Trump’s economic report card

Soon after Trump’s inauguration, I laid out a series of criteria for the economic success of Trump’s presidency (see Forget politics! Here are 5 key macro indicators of Trump’s political fortunes). By those yardsticks, Trump is performing quite well.

The economic success of the Trump presidency is based on the criteria as outlined by Newt Gingrich in a New York Times interview:

“Ultimately this is about governing,” said former House Speaker Newt Gingrich, who has advised Mr. Trump. “There are two things he’s got to do between now and 2020: He has to keep America safe and create a lot of jobs. That’s what he promised in his speech. If he does those two things, everything else is noise.”

“The average American isn’t paying attention to this stuff,” he added. “They are going to look around in late 2019 and early 2020 and ask themselves if they are doing better. If the answer’s yes, they are going to say, ‘Cool, give me some more.’”

Trump has performed reasonably well based on the Gingrich criteria. First, there have been no major incidents of terrorism within US borders, at least the ones that matter in a political sense. As an example, the casualty count of the mass shooting in Las Vegas was much higher than that of the Boston Marathon bombing, but the prevailing political view is the latter poses a much bigger than to the safety of Americans.

I had created five economic yardsticks for the Trump administration based on the Bloomberg Intelligence economic criteria. Here is how he is performing a little over two years later.

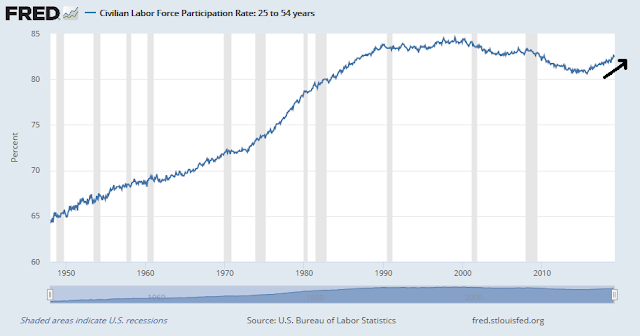

The prime age labor force participation rate has been improving steadily.

Trump promised good jobs. That means full-time jobs. Full time workers as a % of the labor force has been trending upwards.

What about manufacturing? The intent of Trump’s trade policy is to bring back manufacturing jobs. The bad news is manufacturing jobs as a % of the economy has been flat. The good news is the multi-decade declining trade trend has been arrested.

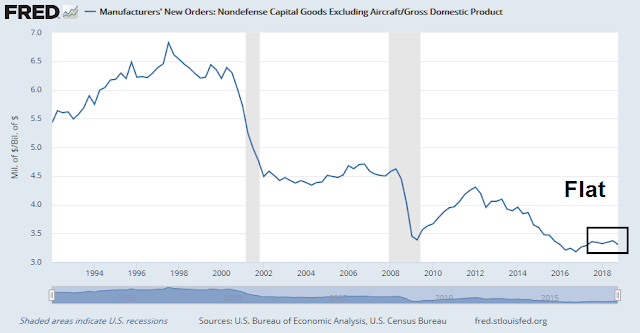

Trump promised a program of tax cut and deregulation would revitalize the economy and induce companies to repatriate offshore profits, and raise capital expenditures. Did it? Not really. The capex to GDP ratio has been flat.

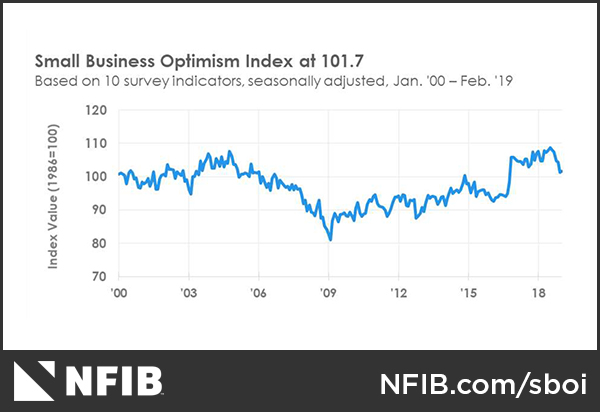

Finally, Bloomberg Intelligence suggested net business births as another economic criteria of Trump’s success. While there is no timely way of measuring net business births, I did turn to NFIB small business confidence as a proxy. Small business confidence did surge after Trump’s election, but they have fallen in the last few months.

We saw a similar pattern in small business sales and expectations.

While I recognize that Donald Trump is a highly polarizing figure. In an alternate universe, if this was the record of any other Republican occupant of the White House, such as Marco Rubio, Jeb Bush, Mitt Romney, just to name a few, the administration’s economic record would be judged to be a success. While there are some inevitable hits and misses, the grade would be, at a minimum, a solid B.

Political insurance?

It is with that report card in mind that I pose the following puzzle. The jobs are coming back. The economy is growing at a reasonable pace. Why is Trump squeezing the Fed so hard?

He is already winning on the economy. Stock prices are up about 33% on an un-annualized total return basis since his inauguration.

Is he just trying to run up the score as a form of insurance?

If so, the insurance will costing him a lot of political capital.

The answer to what you have asked here is simple. It is politicization of the Fed, or at least an attempt.

The good news is they are having trouble with the nominations. Mitch McConnell cast doubt as to whether they can get the two candidates confirmed. If you’ve lost the GOP leader of the Senate…