Mid-week market update: I am writing the mid-week update a day early for two reasons. First, tomorrow is FOMC day and anything can happen. As well, I am getting on an airplane and I will be in the air when the market closes.

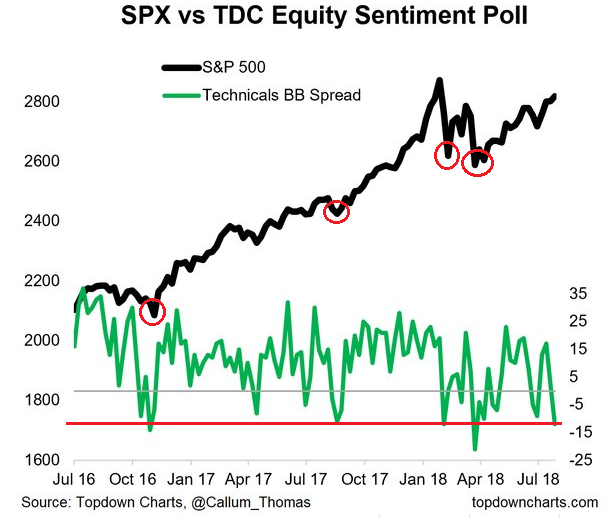

It is astonishing how nervous the market has become after Facebook’s disappointing earnings report. Callum Thomas performs an unscientific Twitter poll on weekends, and the bears have come out of the woodwork. Even if you are bearish, you have to ask yourself how much downside risk could there be at current levels? These conditions are indicative of the jittery nature of this market. A brief and minor pullback was enough to move sentiment to a crowded short reading.

In the short run, the ability of the SPX to hold above its breakout level, and the NDX to hold above its 50 day moving average points to an oversold rally here.

Poised for an oversold rebound

In my last post (see The universe is unfolding as it should), I outlined a number of bearish tripwires, which have not been triggered. SPY/TLT, which measures the stock/bond ratio, recently staged an upside breakout to an all-time high and retreated to test its breakout. Watch for signs of a decisive pullback before turning more bearish. Keep in mind that pullbacks after upside breakouts are normal.

There has also a lot of angst about weakness in FAANG stocks. The following chart shows the relative performance of the Russell 1000 Growth Index against the Russell 1000 Value Index. How worried should you be about that minor blip and pullback?

In short, until these trends are violated in a major fashion, I am inclined to give the intermediate term bull case the benefit of the doubt.

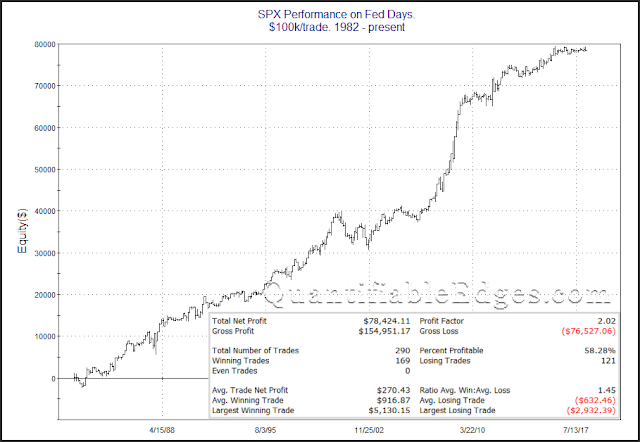

Tomorrow is FOMC day and while anything can happen, the following study from Rob Hanna of Quantifiable Edges shows that FOMC days tend to have a bullish bias. In light of the Powell Fed’s tendency to avoid market surprises, Wednesday’s market action is likely to conform to historical norms.

The real test for the bulls and bears is the market’s behavior on the market bounce. Will it be able to sustain upward momentum, or will it fail and price weaken again? Even if you are bearish, I suggest that you wait for the rally before putting on a short position.

Disclosure: Long SPXL

Tonight is Apple earnings. If they miss, expect another tech/NASDAQ selloff. If they are good and the stock declines anyway (especially a big drop) that would be a very nasty sign that this leading sectors is experiencing a change in trend.

Bulls need good earnings with a nice stock price jump to cool out the investor nervousness.

Ken

Apple earnings were good, especially the “services segment”. I have not had much time to look under the hood of Apple earnings, but S&P futures are down, Nasdaq futures are positive, but well below intraday peak, Russell 2000 (small cap), futures are also down. Oil is down, Gold futures are basing around 1221, give or take and ten year treasury futures are no change to slightly negative. So far, futures are directionless, but we will wait for the average performance of the market of FOMC as outlined by Cam, sans a nasty surprise by the Fed. Good night. 10 PM EST.

Apple was a big win and the stock price reacted accordingly. This takes the heat off for now.

Something is not right; I agree with you on Apple. It is becoming an aspirational brand, pushing pricey products and fat profits for its shareholders. Valuation is not excessive either (not like Amazon). That said, futures are down, we failed at the 2850 level. Let us see if 2800/2750 holds.