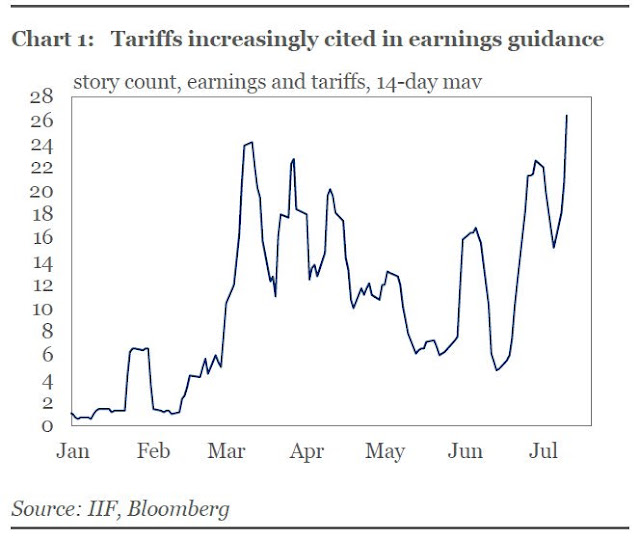

The news about the Sino-American trade war seems to get worse every day. Callum Thomas pointed out that corporate managements are increasingly raising concerns about rising tariffs.

Chinese stocks have cratered, along with the stock indices of China’s largest Asian trading partners. However, a couple of contrarian buy signals are appearing. First, trade tensions are now showing up in the one place that you might expect, FX volatility.

As well, Chinese and other Asian markets are washed-out and poised for relief rallies, which would also be supportive of higher global equity prices.

Poised for an oversold rally

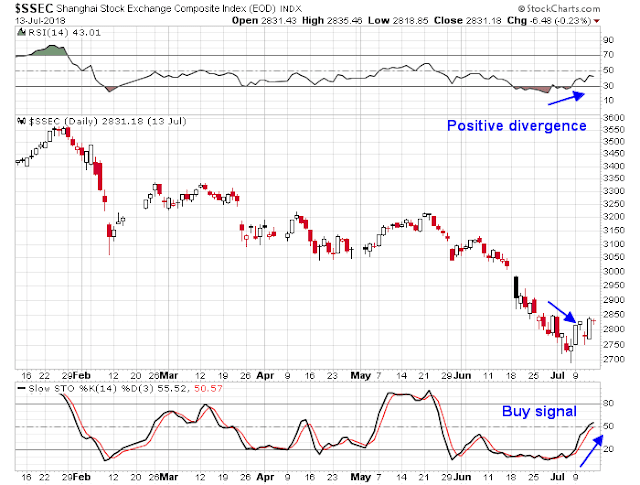

From a technical perspective, Chinese and Asian markets are showing signs of a turnaround. The Shanghai Index recently flashed a buy signal when the stochastic recovered from an oversold condition, which was supported by a positive RSI divergence. Chinese share prices fell Monday because of softer than expected economic data, but such conditions may present as an ideal entry point.

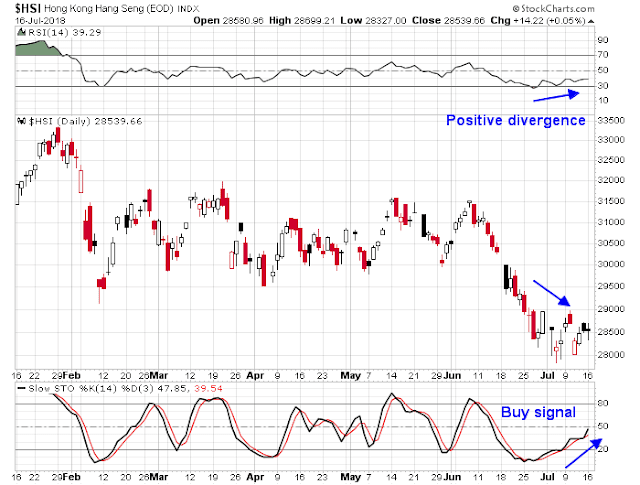

The Hang Seng Index in Hong Kong also exhibit a similar pattern of positive RSI divergence and stochastic buy signal.

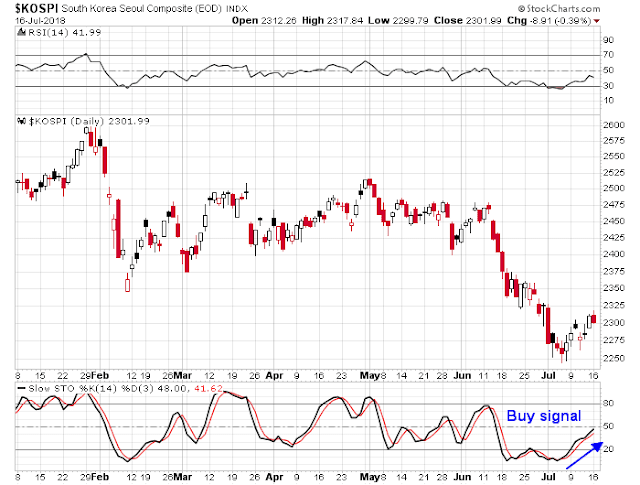

The South Korean KOSPI also flashed a stochastic buy signal.

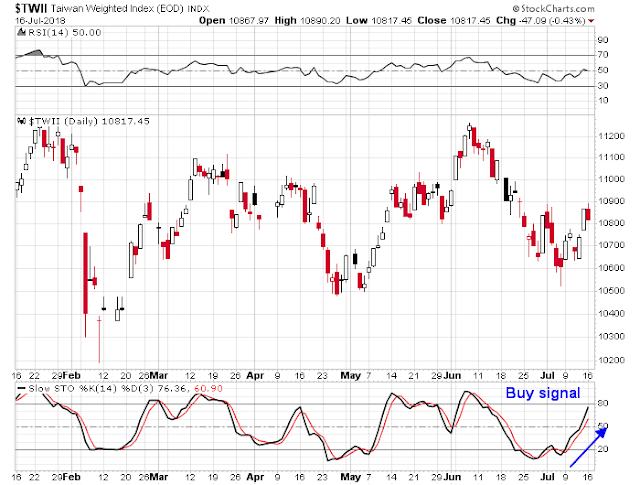

The same goes for the Taiwan market, which is important as it is a bellwether for the semiconductor industry.

I could go on, but you get the idea. In short, the stars are lining up for an oversold rally in China-related plays. After all, how can you not buy when pictures like this one goes viral?

LOL, I’m the guy in the picture!!

F

Long $YINN last week.

Thank you for this post.

Hdeel Abdelhady at Masspoint PLLC has written several articles about the Trump Administration’s use of U.S. sanctions, anti-corruption and anti-money laundering laws against economic rivals such as China. There was a denial order on ZTE which was only recently been lifted after a relatively heavy fine of over $1b. I wonder how this is going to unfold over the coming quarters and years, and its impact on Chinese growth.

https://masspointpllc.com/zte-sanctions-trade-war-law-weapon/

If you are a betting (wo)man, nothing is going to come out. See Cam’s trades on Mexican, Canadian ETFs from last month, and todays trades on China, Hong Kong. South Korea and Taiwan (no India, Singapore nor Japan).

Also see his oil trade from about two years ago (? early 2016; “generational bottom in oil”).

Cam, a sell signal on these trades would be much appreciated. Mexican ETF has worked out well; waiting it to top out in the low to mid 60s. Canadian ETF has not worked out as well, so far. Thanks, Cam.

New to the site. Where does he list trades? Are they just reflected in these market notes? Thanks!

Trades are listed in his market notes. See todays missive.

Is this post his market notes? Just asking as I don’t see a link with that title.

Thanks!

The “trend model” long/short signals are updated on weekends. Subscribers receive email alerts of signal changes as they occur. As well, a hypothetical returns of that model is updated weekly here: https://humblestudentofthemarkets.com/trading-track-record/

Other ideas, e.g. buy China plays, are shown on an ad hoc basis in individual posts and there is no systematic way to track them because of their irregular nature.