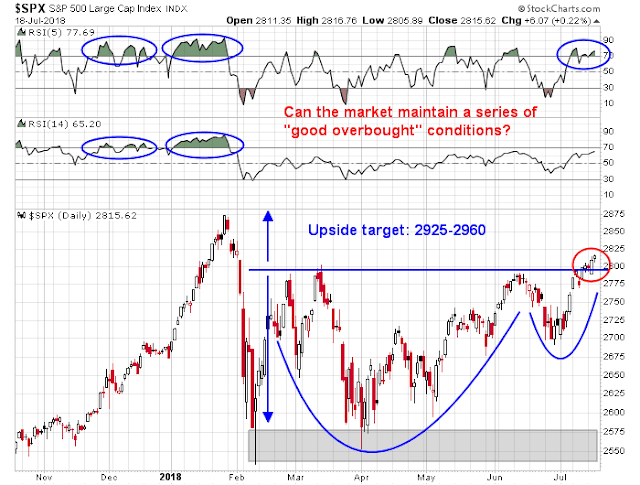

Mid-week market update: It’s finally happened. The SPX staged a convincing upside breakout from its cup and handle formation. Depending on how you draw the lower line, the upside target is in the 2925-2960 range. The first test will be resistance of the January highs.

Upside breakouts are bullish. What more do you need to know?

Bullish confirmation

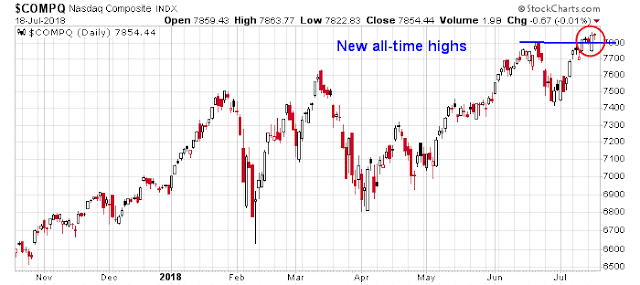

The upside breakout has been confirmed by the bullish market action in other US and non-US indices. The NASDAQ Composite has already made an all-time high.

The broadly based Wilshire 5000 has made a similar upside breakout of a cup and handle formation.

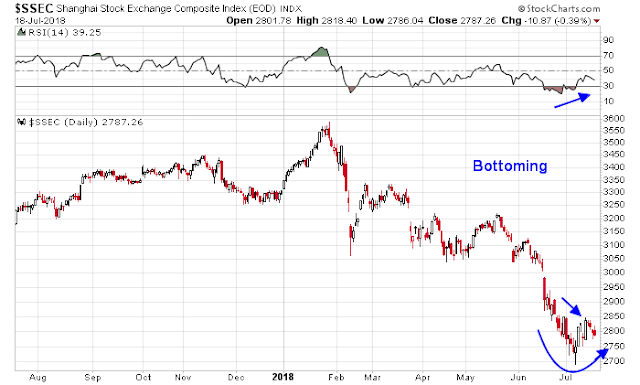

I wrote earlier in the week that China related plays were wash-out and poised for relief rallies (see Tariffs to the left, tariffs to the right…Contrarians buy China!).

European markets have also turned up. The Euro STOXX 50 has rallied and violated a downtrend, which is bullish.

In short, the upside breakout in the SPX is supported by both US and non-US indices. The next challenge for the bulls is to maintain momentum with a series of “good overbought” conditions. Should that happen, it could form the backdrop for a FOMO (Fear of Missing Out) bullish stampede in the manner of the late 2017 market melt-up.

Disclosure: Long SPXL

nice post

The upside action seems rather tentative to me — when moves to the upside are not more pronounced than this latest one, I get anxious that a correction/drop is coming. Also, many commodities seem to be under pressure.

Question: During this most recent move off the last pullback, how many times has the market closed at the high for the day?

6-15 AM EST. S&P futures are down by 7.50 points and Dow futures by 56 points, which is not much. In the background, ten year treasury is selling off and the $ is still rallying trying to break above the 95$. Hoping this modest pull back in futures is contained and markets turn around later intraday. That said, second half of June is not a very strong part of the month.