Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading component of the Trend Model to look for changes in the direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bearish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. The turnover rate of the trading model is high, and it has varied between 150% to 200% per month.

Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Neutral

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Trade chaos, or buying opportunity?

Trump’s tariff announcements in steel and aluminum last week were certainly a shock to the market, though they were not totally unexpected. I had written about this in early January when the market was melting up and suggested that 2018 would be the year of “full Trump” and a dramatic change in policy tone after the tax cut victory (see Could a Trump trade war spark a bear market?)

Trump went on to double down on his steel and aluminum tariff announcements with a “trade wars are good, and easy to win” tweet.

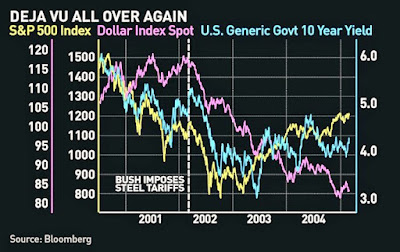

In the wake of the announcements, the charts of the market reactions to past major trade actions began circulating on the internet. Here is what happened when George W. Bush imposed tariffs on steel in 2002.

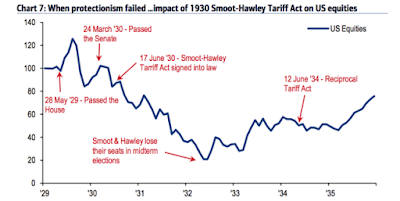

This chart shows the effects of the Smoot-Hawley tariffs during the 1930`s.

Is this fear mongering? It depends on your perspective. Trade wars had a major dampening effect on global growth, but the American economy were either in recession (2002) or in a Depression (1930’s) during these two episodes.

Is this a Tariff Tantrum that should be bought, or a Trade War Apocalypse that should be sold?

A trade policy analytical framework

For a better perspective, Tim Duy outlined a useful analytical framework as trade policy is just one of several moving parts to Trump’s initiatives. Investors should view the latest development by the Trump administration in a broader context in the form of:

- Fiscal policy

- Trade policy

- Monetary policy

According to Duy, a good starting point is the tax cuts as the main element of fiscal policy. Despite concerns about fiscal overheating, the tax cuts might actually work to boost productivity and fuel non-inflationary growth:

Tax cuts and spending increases are projected to fuel an ill-advised federal budget deficit for 2019 in excess of $1 trillion. With the economy operating near full employment, the extra impetus from deficit spending could cause inflation to overheat. The Federal Reserve would respond with a rapid increase in interest rates that triggers a recession. The fiscal stimulus thus shortens the expansion.

There are good reasons to engage in this experiment. First, we don’t know the extent of any excess slack that might remain in the labor market. Low wage growth and inflation, despite a drop in the jobless rate, encouraged the Fed to reduce its estimate of longer-run employment in recent years. Perhaps further declines are possible, or there might be an opportunity for pro-cyclical growth in labor force participation. Moreover, tight labor markets might induce firms to invest in more labor-saving capital, boosting productivity. Running the economy hot might trigger a supply-side boom.

On the other hand, the contractionary effects of tariffs work against the expansionary effects of fiscal stimulus:

America’s trading partners serve as a pressure relief valve for the U.S. economy if the demand boost stretches beyond domestic capacity. Excess domestic demand may be “offshored” in the form of increased imports, which increase the trade deficit. The trade deficit thus provides room for a margin of error by limiting excess strain on domestic resources. This will limit inflationary pressures and reduce the risk of an aggressive monetary policy…

The Trump administration, however, could easily shift the odds against this outcome. President Donald Trump is reportedly considering imposing steep tariffs on steel and aluminum imports of 24 percent and 10 percent, respectively. It is difficult to overstate the destructiveness of such a policy. In recent years, imported steel has accounted for more than 30 percent of U.S. consumption. A steep tariff will undoubtedly impose higher costs on a large swath of the U.S. economy.

While steel companies will benefit from higher prices, manufacturing more generally will suffer. Manufacturers of goods from automobiles to washing machines will feel the pain — in the latter case, offsetting the benefit of recent tariff increases. The new tariffs might backfire in other ways as well. Manufacturers would have an incentive to offshore their production to take advantage of lower prices of materials in other countries. The construction industry, also a heavy user of steel, would be under pressure to push through higher costs to consumers. Our global trading partners may retaliate, limiting opportunities for U.S. exports. With this administration, there is a good chance that any retaliation would be met with fresh trade restrictions.

For newbies, it’s important to expand on Duy’s comments about “America’s trading partners serve as a pressure relief valve for the U.S. economy if the demand boost stretches beyond domestic capacity”. I had written about this point before (see How to lose a trade war before even it begins):

The deeper problem stems from the propensity of Americans to spend and their lack of willingness to save. This creates a current account deficit, which manifests itself in large imports of foreign goods. In other words, as long as Americans keep on spending and don’t save, the trade deficit will migrate to other countries if the US imposes tariffs on China.

Trade deficits are only the symptom of a different malaise. As long as Americans spend beyond their means, the USA will run a current account deficit. If it’s not with China, it will be with another country. No amount of tariffs can solve that problem.

The third element, according to Tim Duy, is the Fed. What does the Fed do in the face of fiscal stimulus in a late cycle expansion and the supply shock of protectionist measures? The Trump tax cuts are highly unusual in the current phase of the expansion. In the past, federal deficits have been correlated with the unemployment rate, but the current round of fiscal stimulus is occurring when unemployment is falling. Cutting taxes during the late stages of an expansion when there is little economic slack would only fuel inflation.

Duy rhetorically asked if the Fed would stand idly by and allow the economy to “run hot”, or does it preemptively act to choke off those inflationary pressures by stepping on the monetary brakes?

Trump ran on a promise to reduce the trade deficit. Following through on this promise in the face of a stimulus-induced economic boom will only reduce the prospects for U.S. growth by aggravating the supply-side constraints on the economy, forcing inflation rates higher and putting the Fed in the position of choking off growth or letting inflationary pressures build. Both outcomes would render the great fiscal policy experiment a failure.

All are unenviable choices for Fed policy makers. In addition, this abrupt shift in trade policy will make it more difficult to fill Fed positions. It is unclear who Trump could find to fill the post of Fed vice chair, as well as other governor positions, who are supportive of trade protection measures.

Policy pushback

Despite all of the protectionist fears, not all is lost for the bulls. First of all, NBC News reported that the tariff announcements last Thursday was impromptu and unplanned as Trump met steel and aluminum industry executives. This decision is reminiscent of the travel ban fiasco during the early days of Trump`s tenure. The travel bans had to be revised and reversed because of a lack of coordination between departments, and implementation difficulties.

There were no prepared, approved remarks for the president to give at the planned meeting, there was no diplomatic strategy for how to alert foreign trade partners, there was no legislative strategy in place for informing Congress and no agreed upon communications plan beyond an email cobbled together by Ross’s team at the Commerce Department late Wednesday that had not been approved by the White House.

No one at the State Department, the Treasury Department or the Defense Department had been told that a new policy was about to be announced or given an opportunity to weigh in in advance.

Secondly, the steel tariffs are not hitting their Chinese targets. The biggest exporter of steel to the United States is Canada, followed by Brazil, South Korea, and Mexico. China isn’t even in the top 10.

The presence of Canada and Mexico as sources of steel brings up the issue of NAFTA negotiations. As the chart below shows, the Republican leaning farm states would bear the brunt of the trade losses if NAFTA were to collapse. The political blowback to the Republican Party would be enormous. Count on a major loss in the midterm elections (see Relax! NAFTA isn’t going to collapse).

As the details of the tariffs are not fully written yet, one mitigating factor could see the trade protection measures become targeted tariffs instead of the much feared broad based ones. Exemptions for American allies and trading partners like Europe and NAFTA partners could be carved out. Moreover, what types and grades of steel and aluminum are included in the trade action? The tariff battle isn’t lost yet, and the possibility of damage containment hasn’t been discounted by the market.

Another encouraging sign is China’s muted reaction. CNBC reported that Chinese officials have urged restraint, and Bloomberg reported that Liu He, who is Xi Jinping`s top economic advisor, is still in fact finding mode. In other words, figure out who we should be talking to, what you want, and then tell us:

Liu said that he had three requests for the Trump administration: Establish a new economic dialogue, name a point person on China issues and hand over a specific list of demands, the person said. Liu pointed out that different U.S. administrations have wanted various things, the person said, with George W. Bush focused on monetary policy and Barack Obama emphasizing investment.

By contrast, the response from major allies has been far more belligerent. Bloomberg reported that Canada has vowed to retaliate, and the EU has unveiled 25% tariffs on $3.5 billion of American goods in a highly targeted retaliatory measure. Harley-Davidson is based in House Speaker Paul Ryan’s home state of Wisconsin. Bourbon whiskey is made in Senate Majority Leader Mitch McConnell’s home state. Levi Strauss is headquartered San Francisco, which is House Minority Leader’s Nancy Pelosi’s district.

The latest announcements on trade policy finally made the WSJ editorial team turn on Donald Trump:

Mr. Trump seems not to understand that steel-using industries in the U.S. employ some 6.5 million Americans, while steel makers employ about 140,000.

The political pressure from Republicans will be unrelenting in the next few days. Don’t be surprised if the White House either backtracks or waters down the effects of the tariffs.

Not enough panic

Back on Wall Street, there are insufficient signs of market panic, which could suggest that the selling is incomplete. When equity futures were deeply in the red in the pre-open Friday, I sent an email alerting subscribers to a possible Trifecta Bottom Spotting Model buy signal. When the market turned around and closed on Friday, the signal had evaporated like the morning mist. The term structure of the VIX, which had been inverted indicating a high level of fear, had eased. Moreover, the OBOS Model had neared an oversold signal, but readings turned up with the late day market rally.

The “buy the dip” crowd had won the day, but it is less clear if they had won the war. If this was the second bottom of a W-formation, it seemed a little too easy. The second leg of W-shaped pullbacks do not just occur because traders will it to happen, but because of some OMG-we-have-to-sell-everything event or news.

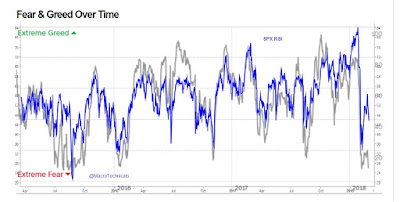

Many indicators are bothering me. The Fear and Greed Index may be setting up for a bearish negative divergence. Past instances of W-shaped bottoms had seen positive divergences in the index, but this index bottomed last week at 8, which equaled the low set in the initial sell-off, though the SPX had yet to test its February lows yet.

A comparison of the Fear and Greed Index and the RSI of the SPX tells a similar story. We probably haven’t seen the bottom yet.

The Citigroup US Economic Surprise Index (ESI), which measures whether high frequency economic data is beating or missing expectations, has experienced a series of Q1 negative seasonality. The downturn in ESI is showing up right on cue this year, which could lead to growth disappointments.

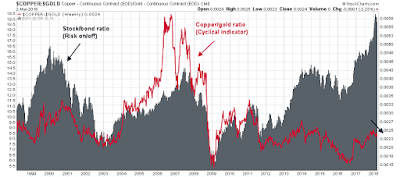

The deterioration in ESI is consistent with the signal from the cyclically sensitive copper/gold ratio, which has historically been correlated with the stock/bold ratio, which measures risk appetite.

Another cautionary signal comes from weekly report of insider activity from Barron`s. Even though this data series is noisy and volatile, the latest readings indicate that while insiders did buy the first dip, they are not showing a high degree of enthusiasm at current levels.

Then there’s the Fed. The Fed has not been standing idly during this period of market volatility. It has responded by altering its messaging. Ann Saphir of Reuters reported that the title of Fed governor Lael Brainard’s speech in the coming week has been changed from “Navigating Monetary Policy as Headwinds Shift to Tailwinds” to a more neutral “Economic and Monetary Policy Outlook”. This may be a subtle signal that the Fed is expressing its concerns about the offsetting effects of trade policy over the stimulative effects of tax cuts.

The bulls can call it a wall of worry, but I interpret these risks as a possible minefield that traders will have to traverse in the weeks ahead. For the last word, I refer readers to Jeff Hirsch of Trader’s Almanac, who found that the seasonal pattern in March tends to see choppiness early in the month, followed by a late month rally.

In a separate post, he found that March returns tend to be positive when January is up and February is down.

My inner investor remains constructive on stocks. Barring an unexpected recession or massive all-out trade war, equity prices should be able to strengthen to further highs in 2018.

My inner trader is braced for more choppiness. While he still has a small long position, he is getting ready to buy more should prices weaken and test the lows set in early February.

Disclosure: Long SPXL

I’m not sure I agree wholeheartedly with this analysis. There are bigger problems at stake here. Below are my words to some friends.

Since World War II the U.S. has helped rebuild the world’s economies by allowing other countries to dump products in the U.S. while simultaneously putting tariffs on our products to those countries. As a result, we currently run about an $850 Billion annual trade deficit with the world. In other words, we subsidize the rest of the world to the tune of almost a Trillion Dollars a year plus our foreign aid outflows. We can’t afford this any longer. We need to level the playing field so trade if fair to us.

Of course, the rest of the world doesn’t want to play fair with the U.S. They enjoy the benefits of exporting their goods to us while blocking the free trade of many of our goods to their countries. For some products, like steel, a country will subsidize the manufacture of the product so it can be exported below actual cost to the U.S. The result is that industry in the U.S. has collapsed and we are now dependent upon other countries to supply basic materials to us.

President Trump is the first President since Bush who is going to try to level the world trade playing field for the U.S. Can he succeed? That depends upon how far he is able to go and how much pain politicians and the public will tolerate. President Bush folded like a deck of cards and our trade deficits have gotten much worse. This just can’t be done without withstanding some heave headwinds.

You see, in order for the U.S. to rebuild strategic and other industries, there is going to need to be some price pain for the public. Either other countries are going to reduce their tariffs on our goods or we are going to place tariffs on their goods. Unfortunately, the latter will need to be done before the former will even be considered by those countries. What this means is that import prices and many domestic goods are going to become more expensive. We need to bite the bullet and accept this as a short term solution to our trade deficit if we are to survive. Can we do it? Can President Trump get it done in spite of the resistance from lawmakers, other countries and the public? We’ll just have to wait and see how far he can take us.

However, this may prove to be a very difficult time for the stock market. In the short term (a couple years or longer) these developments could keep stock prices in check or worse, cause a bear market. But, the coming elections in the fall may slow these developments as politicians up for re-election scream bloody murder. Regardless, I think Trump will continue with his campaign promise and market upside is now limited and the downside is huge. Bond prices may benefit, though, as interest rates start to fall again at some point.

Imagine that AMZN announced that it is locating its second HQ to Pittsburgh, based a series of tax breaks for AMZN. Consider the following commentary:

Should CA, WA, and the losing bidder states impose tariffs on PA because of “unfair trading practices” and subsidization?

Discuss.

Good points Cam> I am usually not a relativist. Equality, fair play /fair trade sound terrific. But nations, their economies, values, stages of development, demographics are far too “unequal” to be readily equalized. I think it has been greatly to the advantage of America on the whole that we can buy so much low priced aluminum, solar panels, etc of China. And frankly for China up to a point. Both nations benefitted far more than they were harmed if the “prices were fair”. Fair trade and economic equality may be worthy ideals/goals. But demanding it at a given time and trying to force it via tarrifs seems both foolish and counter productive. Bob Millman

The overriding situation is that American consumers save a little and spend a lot. Developing world consumers spend a little and save a lot.

There is some substance to the idea of trade barriers being erected by our trading partners against America. Here are examples: Google and Facebook (and many other companies) are banned in China. On the other hand, Alibaba operates in an unfettered manner in the US.

Canadian farmland cannot be purchased by Americans, however, Canadians can purchase American farmland without issues. Canadian physicians can work in the US, without licensing exams, but not the other way around.

Harley Davidson motorcycles, attracts 100% or more duties when imported into India. India has sought 50% of Apple content be sourced from India, if Apple wants to manufacture Apple products in India.

As societies develop and become wealthier, they create rules and systems that increase cost of doing business. Such rules in many cases are not applicable to many Emerging Nations, reducing their cost of doing business. Yes, it is true that cost of doing business is only one aspect that governs competitiveness, however, if such rules were to be applied to EM companies, the field could become level. Furthermore, what is private enterprise and what is not remains disputed. An example of this is Canadian timber that is owned supposedly by Canada. In the US, these timber tracks are owned privately. Mills that process American timber are at a disadvantage relative to Canadian timber mills, as a result. This was shown to be the case last year in WSJ, attracting tariffs against Canadian timber. Similar situation can be shown for many Chinese and Japanese business practices. Another example is Boeing versus Airbus Industrie. Airbus is a government consortium, for what I know, Boeing is a public listed company.

My neighbor now works for a Chinese auto company, after his original American company was bought out. He tells me that Chinese operate with the basic idea that capital should never leave China.

The ideas being discussed here fall under globalization. Alan Greenspan was a major proponent of this idea. Though the idea was good, it also caused a one way transfer of wealth from Western countries to developing countries. This has not been talked about that much in the lay public. However, there is only so much wealth transfer that could be sustained by Western Countries. Unless bilateral wealth circulation can take place, the idea of Globalization would become unsustainable. Wealth that is taken out of circulation (as shown by policies of China as an example), ceases to become productive. Of course, such wealth can be put to productive use by owners of such wealth in their own countries (read China), provided there is a level playing field for foreign companies. Ban on Google and Facebook by China shows a clear case of protectionism, doesn’t it?

D.V.

Good discussion. I agree with your points and I believe the wealth transfer needs to slow down so that Americans can get a reprieve from all the carnage that is going on. India has the same basic idea, as China, that capital cannot leave India. I know it from personal experience. I think Trump’s blustering is going to wake these countries up to the fact that the field cannot be tilted in their favor forever. Time to pay the piper. You can’t kill the host, if as a virus you want to survive, which seems like the way things are going right now with the transfer of intellectual property and wealth.

Here is a graph of raw US steel production from St. Louis Fed. It has remained stable in the US since 1985, after falling by a 2/3rds since 1975. So, why the bluster now, after 1975?

https://fred.stlouisfed.org/series/IPN3311A2RN

Here is Alumina and Aluminum production:

https://fred.stlouisfed.org/series/IPG3313SQ

The Art of the Deal. I think a lot of Trump’s bluster is about getting people to the table. We’ve been easy marks for decades, and Trump is threatening and people must believe the threat is credible, or they won’t deal seriously. You start with an extreme position and work your way to the middle. IMHO.

Diana

After the initial stock market pull back, the market has started to stabilize. There has been muted reaction from China and other European trading nations to political bluster. All in all, Stock market is simply so far ignoring the presidential banter, as just a rhetoric. Next few weeks are important (See Jeff Hersch’s Almanac trader in this respect).