Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading component of the Trend Model to look for changes in the direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bearish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. Past trading of the trading model has shown turnover rates of about 200% per month.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Risk-on

- Trading model: Bearish (downgrade)

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers will also receive email notices of any changes in my trading portfolio.

Tightening into an approaching storm?

William McChesney Martin Jr., who was the longest serving Fed chair, famously said that the job of the Federal Reserve was to take away the punch bowl just as the party gets going. In the past week, there has been rising angst over two separate central bank actions that may indicate that the “punch bowl” is leaving the global party.

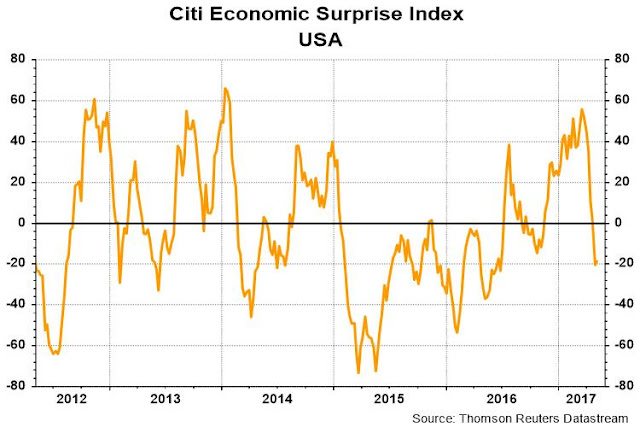

The first set of actions belong to the Federal Reserve. The tone of the May FOMC statement and the strength of the April Employment Report makes a June rate hike a virtual certainty. Barring further “data sensitivity”, the Fed is well on its way to raise rates three times in 2017, and to begin reducing its balance sheet either late this year or early next year. At the same time, the Citigroup US Economic Surprise Index, which measures whether macro releases are beating or missing expectations, has been tanking. These readings, along with the weak Q1 GDP growth figures, raise the risk of a Fed policy error as it tightens into a weakening economy.

At about the same time, Beijing has been taking dramatic steps to contain credit growth and reduce leverage in China’s shadow financial system. These liquidity tightening measures have caused commodity prices to collapse and create heightened market anxiety.

The combination of a newly hawkish Federal Reserve and a PBoC intent on reining in excesses in the Chinese financial system have raised fears that the global economy may come crashing down as a result. Ambrose Evans-Pritchard summarized these fears in a recent Telegraph article:

Equity investors across the world are positioned for the nirvana of synchronised and accelerating global expansion led by China and the US.

What they may instead get is a synchronised Sino-American slap in the face. Analysts at UBS say the international credit impulse has already “collapsed”. The two interlocking economic superpowers are both tightening policy into an approaching storm.

The US bond market has been signalling for two months that the US economy remains uncomfortably close to a deflationary relapse, an implicit judgment that the US Federal Reserve is about to commit a policy error…

Meanwhile, the Fed is in “another galaxy”, to borrow an expression in vogue this week.

It shrugged off signs of weakness as “transitory” at this week’s meeting and seems determined to pack in a clutch of interest rate rises while the coast looks clear…

There must be a risk that they will do exactly what they did at the tail end of the pre-Lehman boom, when monetary indicators had already turned down. Bureaucratic over-tightening caused a manageable downturn to morph into a banking crash.

In addition, China is raising the risk of a global crash with its shift in with a credit restrictive policy:

Beijing began stealth tightening six months ago. This is turning into a full-fledged effort to rein in the $US8 trillion shadow banking nexus.

“The Chinese economy peaked in the first quarter and is set to lose steam for the rest of 2017,” said Danske Bank. Caixin’s manufacturing index is the weakest in seven months. Steel output has dropped to 2015 levels. Planned investment is even lower. Housing curbs are biting with a delay. China’s credit impulse has turned negative.

Saxo Bank says the contractionary forces are so powerful that the Chinese economy may slide towards a “full stop” later this year, with tremors through the commodity nexus and with risk of outright falls in world GDP.

“The markets are pricing in a 20 per cent chance of a recession, but after returning from China, we think it is more like 60 per cent,” said Saxo’s Steen Jakobsen.

Are the US and China tightening into a synchronized global recession? Let’s examine the bull and bear cases.

The bear case

The key underpinnings of the bear case is the fragility of both the American economy. Indeed, three of my seven recession indicators are starting look a little wobbly.

Corporate bond yields tend to bottom out before recessions. Even though this indicator tends to be very early, they made a cycle low in August 2016.

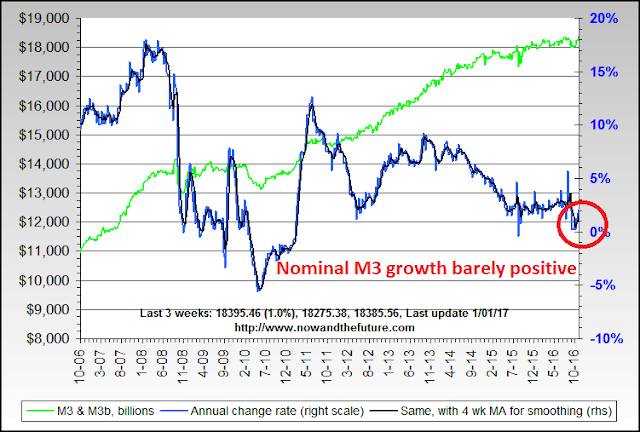

Real money supply growth has also turned negative before recessions. While real M1 and M2 growth have not turned negative just yet, they are showing signs of deceleration, which are signs of a late cycle expansion.

While real M1 and M2 growth have been less reliable recession indicators, real M3 growth has turned negative just before, or coincidentally with past recessions.

The Federal Reserve stopped publishing an M3 money supply series in 2006. However, Now and Futures has reconstructed an M3 estimate. The latest reading of nominal M3 growth as of January 1, 2017 shows YoY M3 growth to be barely positive. Once we subtract an inflation adjustment, real M3 growth would be either negative or very close to negative – which is a recessionary red flag.

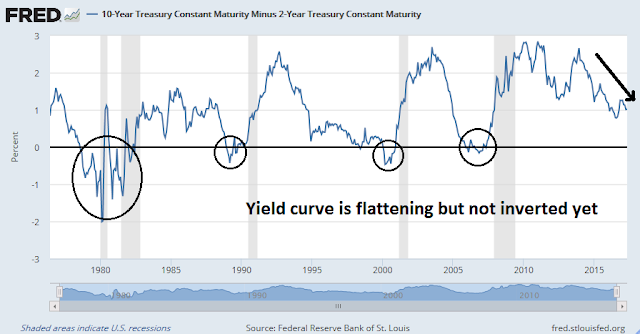

The yield curve has been an uncanny recession indicator. The 2/10 Treasury spread has turned negative, or inverted, ahead of every recession. Today, the yield curve is flattening, indicating slowing economic growth expectations, and has been bouncing around between 100bp and 105bp for the past few weeks.

While UST 2/10 yield curve is not in the danger zone, the Chinese yield curve is plunging, indicating market fears of an economic slowdown.

These concerns about the reversal of the global reflation trade are not new. The latest BAML Fund Manager Survey, which was done about a month ago, reveals that institutional managers were already concerned about a global growth slowdown.

While many Chinese economic statistics cannot be fully trusted, we can rely on market prices as real-time proxies of Chinese growth expectations. One of the most commonly used indicators are commodity prices because China has been such a voracious consumer of raw materials. As the chart below shows, the CRB Index has been falling for most of 2017 and it is now testing a key support zone.

The cyclically sensitive industrial metals are faring better than the CRB Index, which is heavily weighted in the energy complex. Even then, industrial metals have weakened this year to test a key uptrend line, which is raising doubts about the global reflation scenario.

Even if you think that the Fed is charting the right course on monetary policy, there is a significant risk that Fed policy could become even more hawkish next year. The terms of Fed chair Janet Yellen and vice chair Stanley Fischer expire in 2018, and the Trump administration has not indicated whether they would be replaced. Most Republican candidates for the Fed chair are said to favor rules based approaches to monetary policy, where interest rates targets are higher than they are today. Chances are, any replacement to Janet Yellen will steer the Fed on a more hawkish course.

In addition, vice chair Fischer did not endear himself with the Trump White House when he rebuked them for their intention to “do a number” on Dodd-Frank in a CNBC interview:

“We seem to have forgotten that we had a financial crisis which was caused by behavior in the banking and other parts of the financial system and it did enormous damage to this economy,” Fischer told CNBC in a live interview. “Millions of people lost their jobs, millions of people lost their houses.”

“The strength of the financial system is absolutely essential to the ability of the economy to continue to grow at a reasonable rate, and taking actions which remove the changes that were made to strengthen the structure of the financial system is very dangerous,” he added.

In summary, there is merit to the concerns that the tightening efforts by the Fed and the PBoC risks policy errors of tightening even as their respective economies are showing increasing signs of fragility. These actions could then plunge the world into a global recession.

The bull case

By contrast, the bull case consist of, “What economic weakness?”

Sure, long leading indicators of the American economy, which are designed to spot recessions a year in advance, are starting to turn down. On the other hand, other long leading indicators show that the US economy is nowhere near the recessionary danger zone.

As an example, housing and construction is one of the most cyclically sensitive sectors of the US economy. If the economy is starting to weaken, then housing would be rolling over. As the chart below shows, there are no signs of a peak in housing starts.

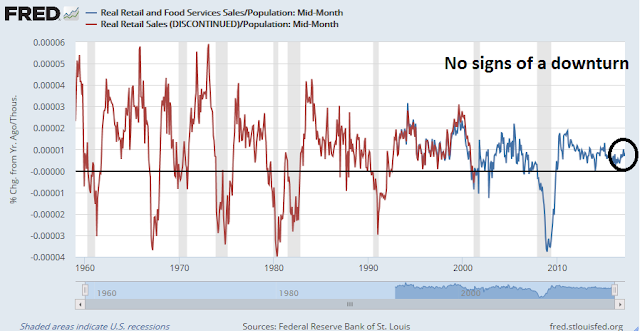

In addition, recessions are characterized by a slowdown in consumer spending. American consumer spending continues to be healthy.

Employment is also a key factor in driving consumer spending. As the April Employment Report shows, the jobs market remains strong. In addition, leading indicators of employment, such as temp jobs, are not peaking.

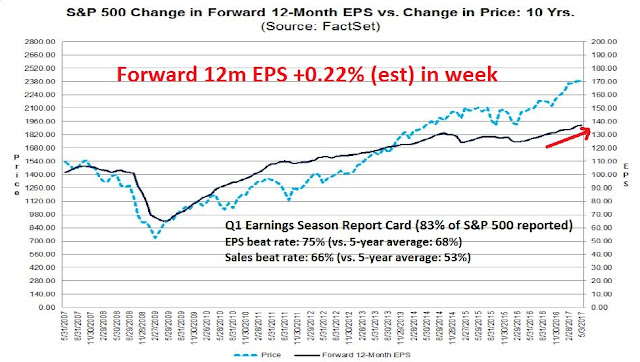

There is also lots of good news from Wall Street. The latest report card from Q1 Earnings Season remains a solid one The latest update from Factset shows that both the EPS and sales beat rates are above average. Forward 12-month EPS estimates are continuing to rise.

Barron’s report of insider activity shows that insiders are back buying again.

In short, these are not the kind of readings normally found when the US economy is at high risk of recession.

China concerns overblown

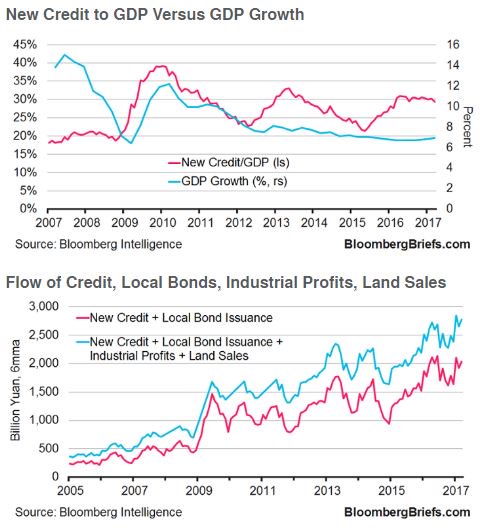

As for China, Bloomberg’s Asian economist Tom Orlik thinks that fears over a China credit crunch are overblown, “Credit is down but land sales and profits are up – businesses and local governments still have funds to work with.”

If the market is worried about the contagion effects from a Chinese credit slowdown, then the first place these concerns should show up is in the markets of China’s major Asian trading partners. As the chart below shows, the Shanghai Composite has declined dramatically and violated its 200 dma. On the other hand, the stock indices of other major Asian markets remain healthy. All are above their 50 dma, and several, such as South Korea and Singapore, have rallied to new recovery highs. Chinese induced global slowdowns don’t look like this.

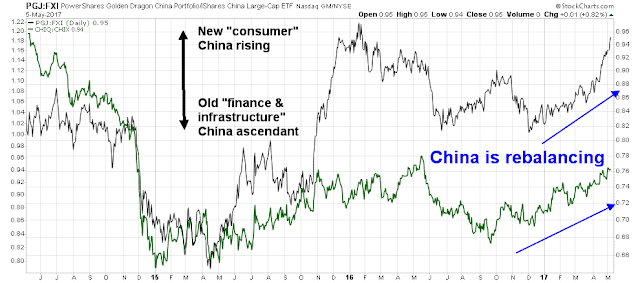

In addition, my monitor of two New (consumer) China vs. Old (finance and infrastructure) China pairs trades shows the ascendancy of consumer sensitive industries in China. Beijing’s policies of credit controls while targeting consumer oriented growth seems to be working. Isn’t economic balancing supposed to look like this?

Finally, Beijing still has lots of tools available should the latest round of credit controls tank the economy. Overshadowing these policies is the 19th Party Congress in the fall, where Xi Jinping is expected to consolidate power. Any government official who get overzealous in curbing growth and embarrasses Xi by tanking the economy as the Party Congress opens can expect a detailed corruption investigation into his affairs, as well as those of his extended family and close associates.

Investment implications

When I put it all together, resolving the bull and bear cases is a matter of differing time horizons. Current conditions are nowhere near recessionary levels and fears of an imminent downturn are overblown. Still there are a number of longer term concerns that investors should be aware of.

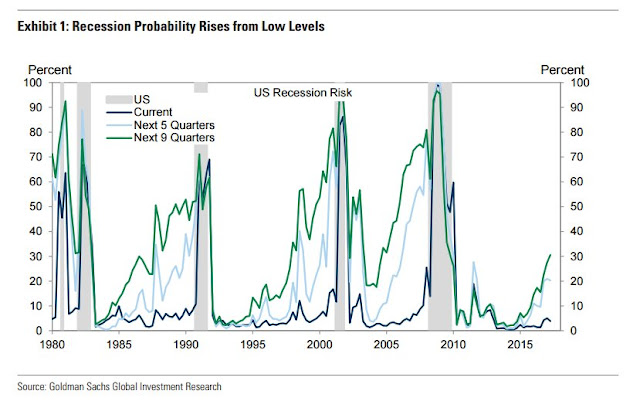

Jan Hatzius at Goldman Sachs recently indicated that their models show US recession risk is rising, but readings are not at danger levels. That sounds about right. My own Recession Watch indicators show that risk is rising, but there is no slowdown in sight. Should the Fed continue on its tightening path, however, it would be no surprise to see risk levels significantly higher six months from now. The economic outlook would further deteriorate should Yellen and Fischer be replaced by Trump nominees, who are likely to be even more hawkish.

Looking into 2018, both corporate and household balance sheets will come under great stress as rates rise. While the megacaps are in strong financial shape, smaller companies face far more financial pressures. What happens when rates are 50bp to 100bp than they are today?

In addition, analysis from Pimco shows that credit leads industrial production by about six months. The current round of credit tightening suggests that manufacturing could be peaking soon. If so, then watch for weakness in the stock indices of major Asian partners, which hasn’t occurred yet.

At a tactical level, Sentiment Trader observed that the market flashed a dual Hindenburg Omen for both the NYSE and NASDAQ on Thursday, which is a short-term cautionary signal for the stock market.

I interpret these conditions as the intermediate term bull trend remains intact. Don’t expect a Fed or China induced downturn to be realized between now and year-end. However, those concerns are not without merit and could materialize in 2018, but those are problem for next year, not now.

The week ahead: Round number-itis?

Looking to the week ahead, the stock market may be subject to a case of round number-itis, where stock indices pause or pull back as they rally to round numbers. The major US indices all closed at or around round numbers on Friday: Dow (21,006.94), SPX (2,399.29) and NASDAQ (6,100.76).

Round number-itis can be a contributing factor to a market pause as short-term worries over policy induced slowdowns to play themselves out. The SPX could either consolidate while remaining overbought on RSI-5, as it did last July, or pull back and test initial support at its 50 dma.

As well, data-mined fears are coming out of the woodwork. While the analysis below looks like a spurious correlation from torturing the data until it talks, sentiment readings are at neutral levels and have room to get more bearish. Tactically, the bears may need to take temporary control of the tape and spike fear levels before an uptrend can resume.

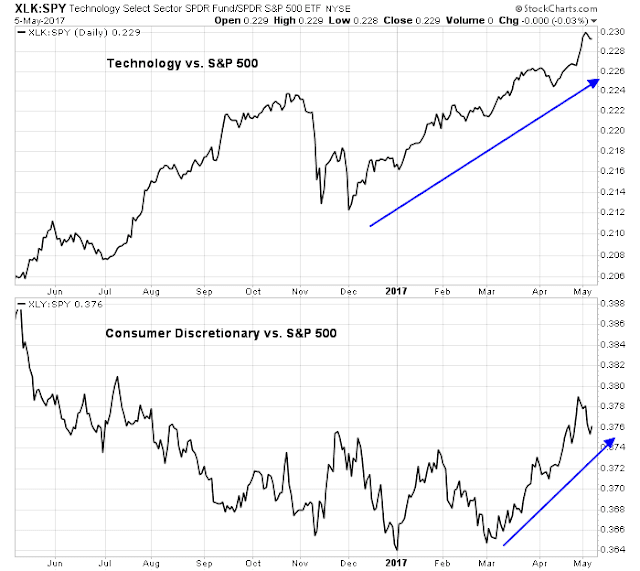

Under the current circumstances, long-term investors may be best served by holding sectors that exhibit market leadership, such as Technology and Consumer Discretionary stocks.

In the short term, I will be watching the market reaction to electoral results on Monday as a test of market psychology. Emmanuel Macron is likely to win the French Presidency on Sunday, which is positive news but largely discounted by the market. As well, I will be also watching the Schleswig-Holstein state election in Germany, where Angela Merkel’s CDU is leading Martin Schulz’s SPD in the polls. A CDU win would therefore be an expected result and solidify Merkel’s campaign for another term as chancellor. Will the market rally on the electoral news from Europe, or will traders sell the news?

My inner investor is constructive on stocks and he remains overweight equities. My inner trader took profits on his long positions on Friday. Even though the trading model flashed a sell signal, he did not go short. He preferred to adopt a wait and see attitude and wait for a break of the SPX trading range before making a commitment.

Here is the latest comment from RecessionAlert, an expensive newsletter I subscribe to. They have an amazing number of recession indicators that they summarize in an overall indicator that is at zero in a range of zero to five, implying the least possibility of a recession in the U.S. Here’s what they say now;

“All SuperIndex components are registering negligible odds of recession. Since none of the Leading SuperIndex, co-incident

SuperIndex, Diffusion Index, Syndrome Diffusion Index, Headwinds Index nor Anxiety Index are flagging reccession, the

Recession Forecasting Ensemble (RFE) remains at 0 (DEFCON-5) implying a 100% equity allocation.”

I’ve been around a long time and must say that tightening of a quarter point here and another quarter six months or a year later in prior days was not a big deal. In 1987, rates were ramped up two percent or more in six months before the stock market cracked and even then no recession occurred. Is it more media nowadays around these tiny moves, that make the situation seem precarious today? Or maybe, the financial system is more indebted and I should be more fearful of these quarter point hikes. I’m willing to go either way.

The system is significantly leveraged with debt and GDP growth and inflation are running low (unlike in the 1980s). It is a different time now. See the 2-10 year graph which is now approaching zero. All told, systemic fragility is much greater than in 1987 and one should be concerned, going forward. Chinese slowing is another issue that is different than in the 1980s.

The 2/10 current stands at 103bp, which is far from inverted. It was at about 70bp last fall before it steepened.

However, the yield curve may not work this time as a recession indicator as the Fed is likely to reduce its balance sheet late this year or early next year. It’s unclear what that will do to belly or long end of the curve.

Thanks for the article , it was a very helpful analysis.

Maybe commodity prices are not such a strong forward indicator with the rebalancing in China.

Note also that the Australian ASX is starting to show a bit of weakness due to the higher commodity component to the index (i.e. BHP etc) and the fact that is approaching 6000 which I think is a high resistance level.