Rydex funds (now Guggenheim) were early pioneers in offering bull and bear funds, as well as to encouraging switching between bull and bear funds. This innovation attracted short-term traders who had previously been shunned by other mutual fund families. Consequently, Rydex fund assets became an important measure of short-term trader sentiment.

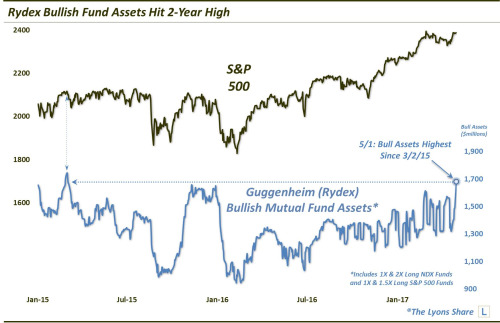

Over the years, I have seen numerous analysts using Rydex data to support their investment conclusions. Most of it has been wrong. The latest came from Dana Lyons, whose conclusion I support, but it was based on the wrong methodology.

Measure cash flow, not assets!

Many analysts use Rydex asset levels as gauges of sentiment. That approach is problematical for a couple of reasons. As the stock market rises, bull asset levels rise and bear asset levels fall. Using asset levels to measure Rydex investor sentiment does not correct for this effect. I have made a number of studies that adjust Rydex funds assets for the rise and fall of market prices, but their results have been less than satisfying.

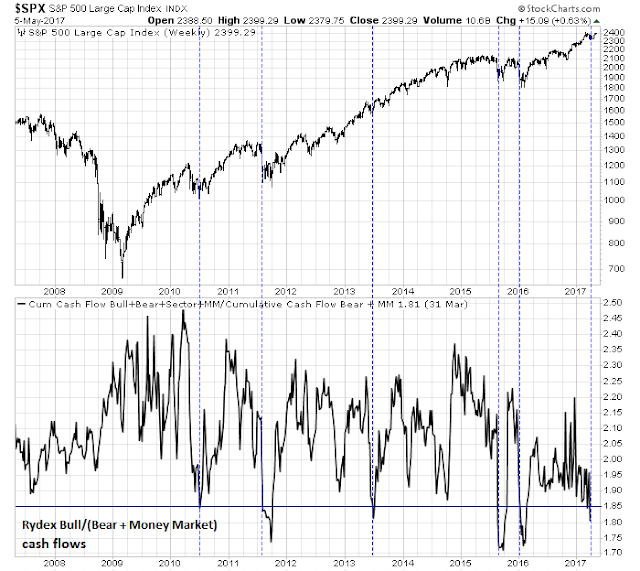

What matters more is cash flow. What matters the most in sentiment studies is not how much you hold, but what you are buying and selling. Stockcharts used have a have series showing cash flows into Rydex bull, bear, and money market funds, whose bull/bear ratio is shown in the bottom panel of the chart below. As the chart shows, this measure has been very good at flashing buy signals at bearish sentiment extremes (vertical blue lines). By contrast, sell signals using the same metric has been less effective.

Despite the minor market pullback, it was these off-the-charts model readings that contributed to my tactical buy signal on April 9, 2017 (see Buy the dip!).

A new Rydex sentiment model

Unfortunately, Stockcharts discontinued the Rydex cash flow data series as of March 31, 2017. However, they continue to report Rydex asset levels. I was able to reconstruct a Rydex sentiment model using asset level data. The trick is to watch for large spikes and drops in the bull/bear asset ratio data, which are reflective of either euphoria or panic, as a contrarian signal. The chart below shows the buy (in blue) and sell (in red) signals when the bull/bear asset ratio has either risen or fallen dramatically.

I conducted a study of the bull and bear asset data. Buy or sell signals were triggered if there was a two standard deviation move in the bull/bear asset ratio within a month. As the table below shows, returns were good, though the sample sizes were not that high for such a long backtest period (N=26 for buy signals, N=25 for sell signals). I would further observe that the signal peaks out after about 2-4 weeks.

I was also pleasantly surprised to see that this model worked well both on contrarian buy and sell signals. As the above Stockcharts chart based on Rydex cash flow measure showed, sell signals did not work well.

What does the model say now?

The chart below shows the record of this Rydex sentiment model in the past year. This model flashed a buy signal on March 29, which has worked out well. This was followed by a sell signal on May 1, 2017.

On the weekend, I had called for a period of market consolidation, or shallow pullback as the major stock indices are likely to encounter a bout of round number-itis, where their advance stalls out at round numbers (see Are the Fed and PBoC taking away the punch bowl?). These latest readings from the Rydex sentiment model are supportive of that view.

Disclosure: Long SPXU, TZA

hi Cam interesting view. But per the chart….seems earlier Sells had the Rydex Bull/Bear+Money mkt asset ratio spike higher than the S&P curve. for some reason that does not seem to confirm on this sell signal. Does that matter…or we in a sell zone for 21 days. Thoughts please.

thnx

Strictly by the numbers, I would consider the sell signal to be in force until one of the following conditions occur:

1) A buy signal (which hasn’t happened)

2) The time period expires, which is 2-4 weeks

In addition, please see the comments from Bruce about the insights from Jason Goepfert at Sentiment Trader.

Jason Goepfert at Sentimentrader has designed models based on the Rydex funds and has followed Rydex closely for years. On April 7th Jason wrote that it appears that since the beginning of 2016 there has been one trader (or multiple traders following the same signal) who trades any where from about $40 million to $200 million in the Rydex Nova Fund (1.5x the S&P500). That trader is short-term in nature, leaving the assets in for no more than two weeks. The trader’s record is pretty good in going long. When he/she liquidates the long position has not carried much informational value.

Cam

Thanks for sharing a neat set of observations based on Rydex asset levels. There are many sentiment levels that seem to be around, but actions speak louder than words. Rydex asset levels are a better indicator of where investors are putting their cash to work rather than sentiment indictors, as you have shown here.

There may be a lag (time) between peaks/bottoms and buy/sell “signals” but that is not really relevant.