Mid-week market update: My recent sector review was well received, especially when it was framed in the context of how a market cycle rotation works (see In the 3rd inning of a market cycle advance). As I don’t have much to update about the technical condition of the stock market, especially in light of the non-reaction to the FOMC meeting. The SPX remains in a tight trading range between 2380 and 2400.

Under those circumstancees, I thought that I would focus on a popular topic with a number of readers, gold. In particular, gold is important in a market cycle analytical framework. That’s because inflation hedge leadership tends to mark the terminal phase of equity bull cycle.

The gold outlook

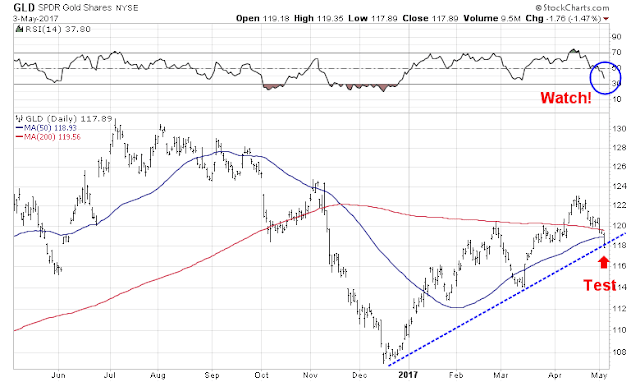

Technically, gold prices may be nearing an inflection point. As the chart below shows, gold violated its 50 and 200 day moving averages (dma) and it is now testing an uptrend line. Further weakness would be bad news for the bulls.

However, keep a close eye on the RSI reading (top panel). Charlie Bilello pointed out that gold is oversold, as defined by its RSI below 30, gold prices has historically performed well.

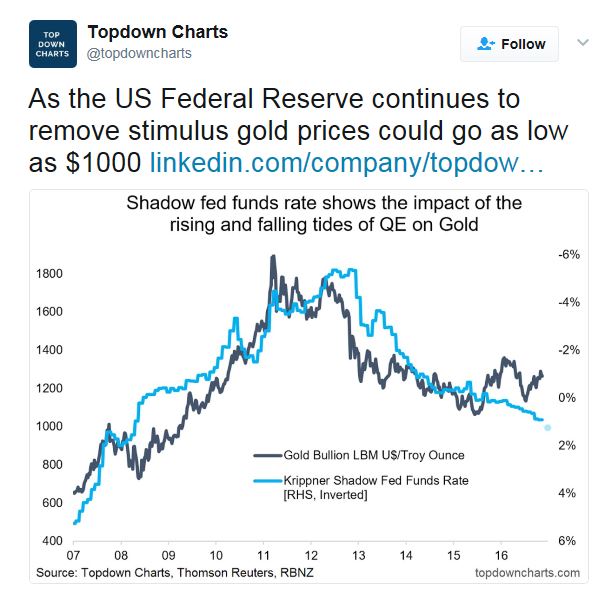

Callum Thomas of Topdown Charts observed that gold prices tend to be inversely correlated with the shadow Fed Funds rate. The Fed continuing tightening cycle should be bearish for gold.

Indeed, the historical record shows that gold prices (blue lines) are inversely correlated with real interest rates (red line, inverted scale). Gold is an inflation hedge, and rising real interest rates would tend to depress the price of gold.

Should investors and traders be bullish or bearish on gold? Rather than try and debate the likely path of inflation and interest rates, an analysis of the technical conditions of other inflation hedge vehicles such as energy and mining represents a more pragmatic approach to the problem.

The message from the markets

The Relative Rotation Graph (RRG, click link for full explanation of RRG) of US sectors depict how sectors rotate in a clockwise fashion in RRG charts. The late cycle inflation hedge groups, namely Energy, Mining, Materials, and Gold, are either in the bottom left or nearing bottom left quadrant, which indicates their lagging status.

As shown in the chart below, the relative performance of Energy and Mining in both the US (in black) and Europe (in green) show the poor relative returns of these groups. The top panel shows the USD Index on an inverted scale. As the USD tends to be inversely correlated with commodity prices, a weakening USD should be bullish for these stocks. The weak relative returns shown by these groups even with a tailwind of a falling USD is testament to the fact that these stocks are not ready for market leadership.

Based on this analysis, I can only conclude that gold and other inflation hedge stocks need time to find a bottom, base, before they can exhibit sustained price strength.

From a big picture viewpoint, this analysis is constructive for equity bulls. If inflation hedge vehicles are still laggards, then that means inflationary expectations remain dormant. The Fed is therefore unlikely to believe that it is behind the inflation fighting curve and will not become overly aggressive in its pace of monetary tightening.

Once inflation hedge stocks start to run, then that will be a signal for the Fed to stomp on the monetary brakes. Such actions would likely lead to a series of staccato rate hikes to cool the economy into a recession, and a bear market.

That day hasn’t arrived yet.

Inflation is no where to be found based on inflation hedges showing no signs of life (see graphs above). This is after 4 Trillion $s of money printing. If there is a tug of war between inflation and deflation, so far, after 4T $ of printing in the US and 50-100 trillion $ printing globally, no inflation on the horizon. Civilized parts of the world is talking about universal pension! Money out of thin air, for doing, well, nothing. It is a topsy turvy world.

As the US fed starts to normalize (?) monetary policy and reduce its balance sheet, one is left wondering whether we get any inflation or another round of deflation.

One is truly left wondering if fiat currency has any real value, if paper assets (e.g. bonds and stocks) have any meaning at these high valuations and finally, if deflation is round the corner.

I am enjoying your analyses of sector performances within the overall background market contexts. There is no point being long the wrong stocks, even if there is a long market signal!

GLD would have to bounce right here to justify any interest, and even if there is a bounce now, there will be plenty of time to be long gold stocks when the time is right. Firstly a GLD breakout above 124 with expanding volume in strong candles would be needed imho. Not long gold stocks atm.

I’m amazed to see the Gold Miners ETF and the leveraged version on the top trading list of the NYSE on a regular basis. In my experience, bottoms happen when there is little or no interest. People are too quick to pounce.

The reason inflation stays low is that the digital revolution is continually putting downward pressure on prices. Online sellers keep prices down. That will continue. Think robotics, AI and driverless trucks etc. etc.

Low interest rates don’t push up goods and services. If you look at the 100 things on the CPI list, only homes and autos respond to lower rates. Check it out. Restaurant meals, would you go more often if the Fed Funds Rate was lower? Lawyers fee, sue more? Entertainment, borrow to go to a movie? Take a stroll down the list. The Central Bankers use QE to lower rates and stand back and wait for the public to borrow and goose up the economy. It’s not happening and won’t.

We in Canada did borrow to buy the two things that respond; homes and cars. We’ve had low inflation but now we have a bubble in real estate, record cars sales and our personal loan to income levels are higher than America before their 2008 GFC.

The Central Bankers and economists live in textbooks not the real world.

For easy money to spur inflation, the cash reserves in the banks has to be borrowed to multiply the monetary base. Worry about inflation only when you see that happening.

Gold is for hot money traders with no logical pattern. Flip a coin every day and take a ticket to ride.

Just a comment on volatility. Here is an excellent study on how we are in a much less volatile stock market environment.

http://advisoranalyst.com/glablog/2017/05/04/have-stocks-become-less-risky.html?hidePD=true

Here is a different reason. As I’ve said, we are in a Moonless World where Central Bankers do not cause synchronized economic recession but rather, industries go through their own cycles. Recessions are what cause severe bear markets when investors get very pessimistic and bail out of stocks. If we have muted economic and stock market downturns, valuation should be higher.