Mid-week market update: It was the best of times, it was the worst of times. Stock prices continue to surge ahead, while the bond market *ahem* is having its difficulties.

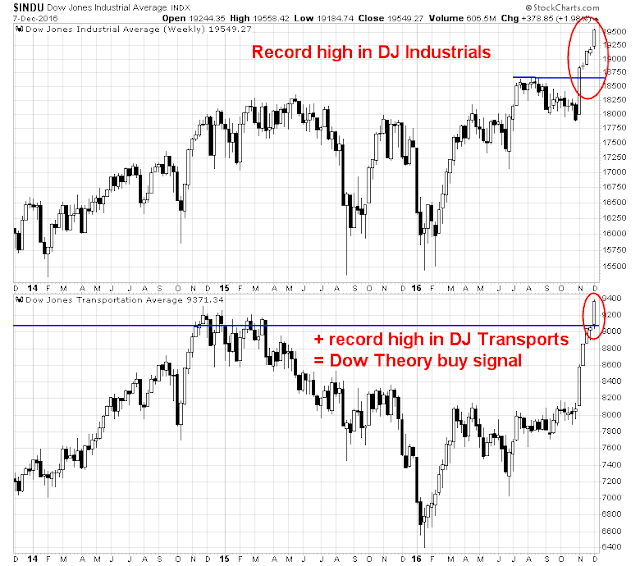

The Dow Jones Industrials Average made another record high, followed by the Transportation Average. The combination of the dual all-time highs constitutes a Dow Theory buy signal.

By contrast, investors are fleeing the bond market. Moreover, the yield curve is steepening, which means two things. First, long dated yields are rising higher than short yields, which means that investors at the long end of the maturity curve got hurt more. In addition, a steepening yield curve has historically been the bond market’s signal of better growth expectations.

How are we to interpret these differing patterns in stocks and bonds? Have stocks gone too far? Are bonds ready for a comeback?

Stocks: A “good” overbought reading

You can tell a lot about the character of a market when you watch how it responds to news. On the weekend, Italy overwhelming voted “no” to change its constitution. That outcome caused prime minister Matteo Renzi to resign, which raised the risk of more instability in the eurozone.

So what happened next? Stocks rallied. What’s more, the yield spread between Italian BTPs and German Bunds narrowed.

Stock prices continue to grind upwards. As the chart below shows, the SPX has flashed a series of overbought readings on RSI-5, only to pull back when RSI-14 hit 70, which is an overbought level. These is a classic example of what my former Merrill Lynch colleague Walter Murphy called a series of “good overbought” readings.

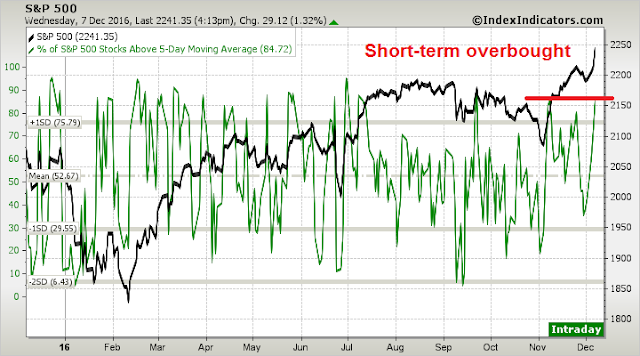

In the short-term, equities prices may pause and pull back a little here. Short-term breadth metrics are not at extreme levels. As this chart from IndexIndicators shows, % of stocks above their 5 dma is getting a little stretched.

However, these timing models tend to have a very short-term (1-2 day) time horizon and any pullback is likely to be shallow given the powerful momentum that underlies this rally.

Bonds: A “bad”oversold condition?

By contrast, consider this chart of TLT, which is the long Treasury ETF. Prices appear to be trying to find a bottom. It is experiencing a series of positive divergences on RSI-5 and RSI-14 even as it sees a number of “bad oversold” RSI readings, indicating negative price momentum.

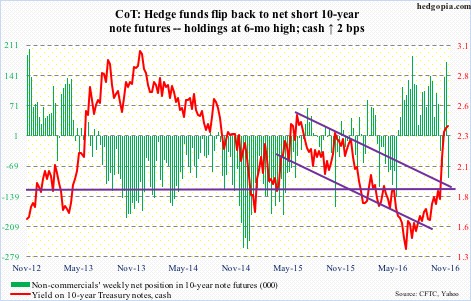

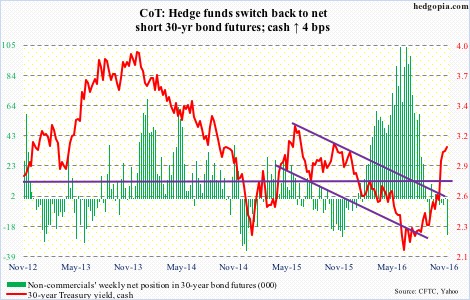

The latest Commitment of Traders data shows that large speculators, or hedge funds, have moved to a short position in the 10-year note (charts via Hedgopia):

…and in the long Treasury bond. These readings are indicative of crowded short positions.

Is the bond market flashing a series of “bad oversold” conditions? Should you try to catch falling knives?

To be sure, a longer term perspective of the 10-year Treasury yield shows that the downtrend is still intact.

Bond bulls shouldn’t worry – just yet.

The inter-market analysis interpretation

Have stock prices risen too far, too fast? Are bond prices poised to bounce? Here is my interpretation based on inter-market, or cross-asset, analysis.

The relative performance of SPY to TLT just staged an upside breakout from multi-year resistance level stretching back to 2007. While the price break is not definitive, it potentially signals a sea-change in risk appetite and the relative performance of stocks vs. bonds.

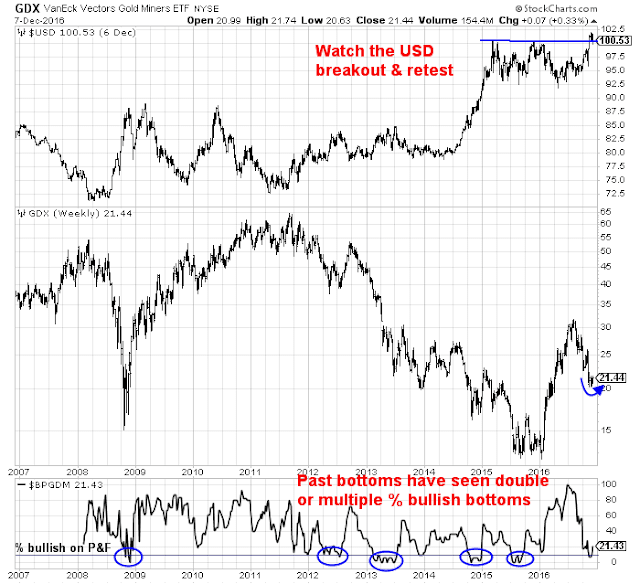

We can get more clues form other underperforming assets, such as gold and gold stocks. As the chart below shows, gold stocks (GDX) are showing a similar bottoming technical pattern as bond prices. As I indicated before, the % bullish metric (bottom panel, also see Why it’s too early to buy gold and gold stocks) tend to form double or multiple bottoms before a sustainable bottom is made. Gold and bond prices could bounce here, but any strength is likely to be short-lived.

One clue to the timing of any turnaround in stock, bond, and gold prices is the US Dollar (top panel). The USD Index has pulled back to test support at its last breakout. The success of any bounce in gold and bonds, as well as a pullback in stock prices, can be found in the behavior of the greenback.

In conclusion, the stock market is experiencing strong price momentum from a FOMO (Fear Of Missing Out) risk-on stampede in the wake of the election. Expect stock prices to pause or pull back for 1-2 days, but continue advancing for the remainder of December as underperforming managers pile into the career risk trade in order to chase returns. Any pullbacks should be regarded as buying opportunities. Conversely, any turnarounds in gold or bond prices in the month of December will probably be fleeting. Better opportunities in those asset classes are likely to emerge in 2017.

Disclosure: Long SPXL

A thought experiment on when a big new event occurs like the Trump victory (or Apple inventing the iPhone) and a trend starts that last for years. Human emotional biases slow down the price movement to the future eventual value price. This sets up a momentum phenomena.

Think of Mr. Spock of Star Trek fame. He was from the planet Vulcan where people had no emotions. If the iPhone was invented and announced on the Planet Vulcan, the Apple stock on the Vulcan Exchange would have gone up from the previous $25 close to open at $600 the next day. Nobody would think that strange. The logic of consumer appeal and advanced technology would have been calculated and forecast. Humans on the other hand take seven years to get to $600 and then overshoot in a speculative ‘herding’ frenzy to an extreme peak and then crash. Trends happen because it’s so easy to sell a stock that’s up and hard to buy. We anchor on past prices. We use ‘confirmation bias’ to justify why we don’t buy an obvious winner or sell an obvious loser like Blackberry when Apple is crushing it.

So when a huge new event like the Trump victory occurs, I try to think of what would happen on planet Vulcan to a stock like Goldman Sachs or the banking industry in general. My guess is a double or a triple overnight. They would calculate that profits would soar more than humans expect because the U.S. economy would boom as workers consumer confidence and hence spending shoots up, interest rate increases would help margins, the PE would go from a 20% discount to the market to a 40% premium, foreign banks would become noncompetitive, deregulation would lead to huge trading profits, soaring stock markets fueled by investor confidence and a drop to 15% corporate tax rate from 35% would boost earnings of banks wealth management business,etc, etc, etc.

On planet earth, the double or triple in bank stocks will take four years not overnight. Then if Donald looks like a victor for a second term, the bank stocks will soar pre-election to bubble valuations and crash in the year following his re-election.

Just a thought experiment on behavioral economics on planet Earth.

The underlying message is, bank stocks are still cheap relative to where the new Trump stock market will take them. Don’t be like selling Apple at $50 or avoiding buying it when it has doubled from its $25.low heading for $700.

Extremely good thoughts Ken and very much appreciated. Momentum strategy has a place in selecting what is “hot” as opposed to value investing. They have been many practitioners of this strategy. Bill O’Neil of CANSLIM fame comes to mind. In fact, he started a mutual fund that unfortunately did not do to well. The difficulty is deciding when to sell. As you know a herd mentality has taken over the market. Witness the last few weeks in the Russell 2000. Also, see what happened to the bio-stocks (symbol BLUE) today. So, any thoughts on when to sell to beat the herd or be the last person on the Titanic will be appreciated.

Rajiv, this Trump market is young, very young. Renew your subscription every year and in future I will be there to let you know when the iceberg is ahead. Right now, the Titanic passengers can still see the dock where their families and friends are waving them off.

Good sense of humor. Do we need life jackets? I guess valuations etc.. don’t have any meaning. We have gone through these cycles before. I might be showing my age. There was a time when we were told toinvest in the nifty fifty and forget about it. Kodak, Gulf and Western. Recently, the internet stocks. I guess this time around somebody is going to blow a whistle. Ken lets all wait till the fat lady sings.

Thanks for the update 🙂

Ken, you raise an interesting point: how does Mr. Market recognize the fundamentals of a business or broadly a sector and close the gap between the current price and the fair (or intrinsic) value. Specifically, with the election of Trump, why didn’t the utilities and REITs got cut in half, and financials, materials and industrials doubled on Nov 9th? I think that part of the explanation lies in uncertainty surrounding Trump’s policies and the extent to which they will be clarified and implemented. For example, corporate taxes may be reduced from 35% to 15% or to 22% – a big difference. Even a Republican Congress may want to close the loopholes in the tax code partly neutralizing the benefit of tax cuts. Anyway, there is a good likelihood the corporate tax will be lower by at least 10%. The impact of a cut in corporate tax on corporate profits is relatively easy to quantify. However, you cannot say the same thing about the impact of deregulation. The impact of latter on banks’ profitability is much harder to assess – both qualitatively and quantitatively – at this stage.

On top of it, if you consider the impact of trade barriers on the US and world economy, the rise of USD, the possibility of retaliation by our trade partners and the rising geopolitical tensions everywhere, may be it is prudent for investors to dip their toes gingerly in the water.

I appreciate your comments and agree that psychology (anchoring, confirmation bias, recency bias, love for stocks we own, etc.) definitely plays a part but so does the uncertainty about the future. There is so much we don’t know about the new regime.

Cam, would love to hear your thoughts as well.

Ken,

I’ll be astounded if you’re correct. This bull market was floated on excess money supply. Now it’s negative for the first time in more than 7 years. Money is tight for the first time since 07. Median debt to equity ratios for companies (ex energy and financial) are at 1999 levels.

Good luck with your trip on the Titanic.

Wes

Market valuation (P:E) in 1999, was much higher than today. So, if debt to equity ratio is similar today, it would appear that the today’s debt to equity ratio may be more sustainable than in 1999. That said, GDP growth rate was higher in 1999, than today and so perhaps a higher debt could be sustained. Looking at it in a reverse manner, today’s debt level to GDP growth may be as much as the economy could sustain in a low growth low inflation environment. That said, companies are holding significant cash on their books as well that is being used for higher dividends and share buybacks causing the market to go higher. If Trump delivers on his promises, good chance that this market goes higher. That said, the Fed also needs to be considered here. Profligate increase in fed funds rate have usually been market killers. We shall see. There is a see saw here between the fed and Trump tax cuts.

D.V.

I follow about a score of monetary metrics, and since 1970 these parameters have been more favorable to market growth 87% of the time than they are today. Of course, the Fed, and markets can possibly make many of them more favorable in the future.

I’m not so much suggesting a bear market as I am my disinterest in trying to achieve the next 5% return in a market that could well have a 30% standard deviation.

What I am seeing is that historically successful investors were great backward looking analysts of value. These folks are doing poorly today, especially the hedge fund crowd. When you are dealt circumstances that have no president, history is not a guide, it’s a trap.

The digital revolution, globalization,rise of China,negative interest rates, QE, rise of nationalism, robotics, social unrest, on and on. Investors that try to use previously successful rules from 1999 or any time in the past are simply trying to hold on to a shaky support in a cyclone of change.

One must look ahead not back. Give up the notion that we are in the eighth year of a bull market that is needing a bear market like the old days. No, we are weeks into a new market cycle that could go on for years. I argued back in February that the world had started a new bull market after EVERY country in the world had finished a 20% down bear market. But investors who were fixated with a need to see a bear market play out with its normal general economic recession could not see that we were started a fresh new bull market with only recessions in a few industries ending. They have been nervous and underinvested.

So one must look ahead and envision the investment landscape of the future. Step one is to realize that investors especially institutions must put their money somewhere. Basically that means stocks or bonds or alternatives. Here is my take;

Alternatives like hedge funds have been performing badly since old investment strategies aren’t working and client’s object to high fees. This will not be a place for big dollars. For individuals, homes used to be a big area if investment. After the housing crash this is now suspect and hence not an area for big dollars.

Next bonds. Globalization is under attack and government spending with lower taxes is a strong global political trend. This is obviously inflationary. This will likely have bond interest rates rising. Individual investors in their lifetime have not experienced a secular rising interest rate environment. It will make bond mutual funds do very poorly, often falling year over year. Balanced mutual funds and portfolios will do poorly as the bond portion pulls down returns. I envision a revulsion towards bonds developing. The swing from the current love-fest for bonds is a huge change. Massive monies will shift in future.

Now stocks. Other homes for money outlined above look poor. Stock would win by default but they have a number of strong attributes. Corporate taxes will be cut. Business friendly policies will be championed. America centric policies will be uppermost. Consumer confidence will rise. Business confidence will rise. Trump administration will highlight every small victory, drowning out opposition. He will do deals or bully to get economic growth.

So stocks become the best home for investment dollars. As money shifts out if bonds to stocks and new money avoids bonds in favor of stocks, you set up a virtuous circle of stocks rising and investor confidence rising with it.

This new dynamic is not short term. Just ask yourself, if you were not allowed to trade for the next four years, would you lock up your money in a ten year bond or the stock market index?

Ken

I love reading your posts. Thanks for these comments also. Everything you said here appears on the dot. One thing that seems a little leap of faith is that money will, like a knee jerk reaction flow into stocks. Stocks are expensive by historic multiples (a premise you would discount based on what you have written here). Buying at this juncture is contrarian at best, but as you say, the buying public seems to buy into the idea. Yes, we could have significant inflation down the pipeline, as oil cracks higher. Most stocks tend to well in inflationary periods and we could have further rise in the indices based on notional appeal than real substance.

Ken, do you not fear that government spending in this late economic phase will be quite inflationary, thus causing rising interest rates, thus causing a recession, thus causing a bear market in 2018 at the latest? How does your ‘four upcoming bull years’ thesis square with the economic cycle?

Wes

Your 30% SD is well taken. Thanks.