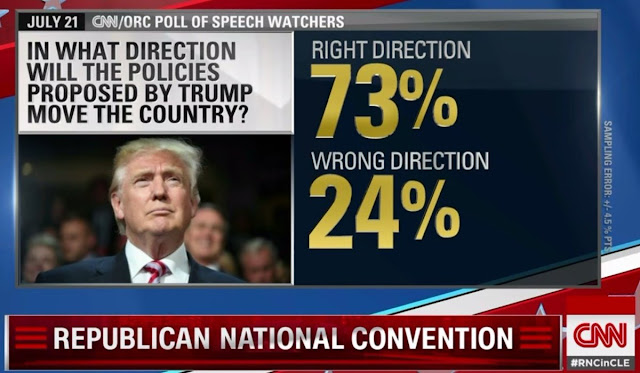

The reaction to Donald Trump`s speech to the Republican convention has been highly bifurcated. Mainstream media and analysts mostly reacted with horror and raised cautionary notes about his campaign of fear (see The New York Times and The Economist), while social media lit up with “I would totally vote for this guy” messages.

To be sure, Trump’s speech was extremely dark in tone for the presidential candidate of any major party. Here are some key excerpts that painted a picture of a failing America:

Homicides last year increased by 17% in America’s fifty largest cities. That’s the largest increase in 25 years. In our nation’s capital, killings have risen by 50 percent. They are up nearly 60% in nearby Baltimore…

The number of police officers killed in the line of duty has risen by almost 50% compared to this point last year. Nearly 180,000 illegal immigrants with criminal records, ordered deported from our country, are tonight roaming free to threaten peaceful citizens.

The number of new illegal immigrant families who have crossed the border so far this year already exceeds the entire total from 2015. They are being released by the tens of thousands into our communities with no regard for the impact on public safety or resources…

Household incomes are down more than $4,000 since the year 2000. Our manufacturing trade deficit has reached an all-time high – nearly $800 billion in a single year. The budget is no better.

President Obama has doubled our national debt to more than $19 trillion, and growing. Yet, what do we have to show for it? Our roads and bridges are falling apart, our airports are in Third World condition, and forty-three million Americans are on food stamps…

Not only have our citizens endured domestic disaster, but they have lived through one international humiliation after another. We all remember the images of our sailors being forced to their knees by their Iranian captors at gunpoint…

In Libya, our consulate – the symbol of American prestige around the globe – was brought down in flames. America is far less safe – and the world is far less stable – than when Obama made the decision to put Hillary Clinton in charge of America’s foreign policy.

Never mind the pundits who fact checked Trump and pointed out the distortions. If you are a believer in the Trump message and you weren’t sure if he will win, what would you do with your portfolio?

The answer is to buy gold. That viewpoint sets up the Trump Arbitrage: If you believe in Trump’s assessment of America, you would buy gold. If you thought that things aren’t as bad as the Trump view, you would buy stocks. You would buy hope – and innovation.

The Trump Arbitrage trade is either gold, or stocks. Here is the gold vs. equities pair trade, which remains largely range-bound for most of this year.

Here is how I would evaluate the Trump Arbitrage Trade.

Evaluating the Trump Arbitrage Trade

I could tell you that you would be late to the party in “buying” Trump, as COT data shows that hedge funds are in a crowded long in gold futures (via Hedgopia).

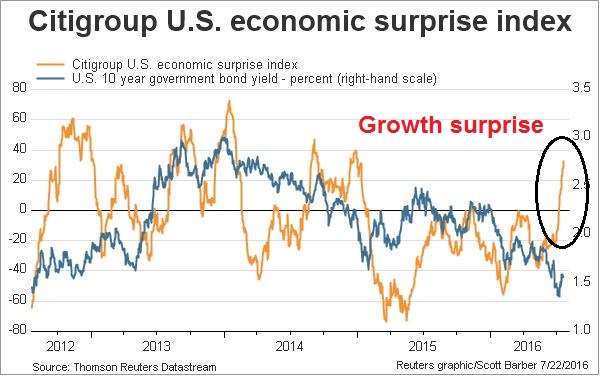

I could also tell you that while the recent past (Q1 growth) has been subpar, the American economy is undergoing a growth rebound. The Citigroup Economic Surprise Index, which measures whether macro-economic releases are beating or missing expectations, has been surging. That’s an indication of a growth surprise that’s probably not priced in by the equity market yet.

I could also tell you that the stock market has hit all-time highs and the US Dollar is rallying again. Does this look like the picture of a weak America?

You may choose to support Donald Trump and express your support at the ballot box, but a bet on his vision of a failing America would likely hit you in the wallet.

Could you please elaborate the cause and effect connection you see that leads you to conclude that if one thinks Trump is going to win, one should buy gold?

I don’t see any connection whatsoever. I would say if one thinks Janet Yellen is going to stay in charge of the Fed, or be replaced by some other clown who thinks that keeping interest rates near 0% forever is a good idea, then one should buy gold. If Clinton wins, then Yellen likely keeps her job, or gets replaced by an equivalent clueless academic. It is possible that, to satisfy the Bernie/Warren wing, Clinton might even push for more helicopter money printing–hey, free money for everyone, not just banks!–which would be as bullish as possible for gold.

True, Trump is a complete economics ignoramus, but it is conceivable that if elected, just randomly (not because he would understand what he is doing) he might replace Yellen with someone else who doesn’t think that destroying the value of one’s currency is the way to make the country great again. That would be bearish for gold.

Gold is nothing more, or less, than an alternative currency, which has been valued by all humans for many thousands of years. The more a central bank conjures new fiat money into existence, the more people want to trade that money in to get a currency that can’t be created in infinite size by a few keystrokes on a central bank’s computer. I would say that Clinton is bullish for gold, Trump could do any crazy thing that comes into his head one morning, so that may be bullish or bearish for gold, but more likely the latter compared to Clinton.

A few other comments: Bears on gold have been touting the seemingly excessively bullish COT numbers, but if you look back to the last bull market in gold, the COT numbers previously hit a similar peak in I believe 2009 (don’t have a chart in front of me at the moment) and gold proceeded to double in the next year and a half.

The growth surprise index merely measures economic statistics (that are often later revised) versus the guesses of economists, who are notoriously terrible forecasters. Beating their bad estimates doesn’t mean that things are actually getting much better. This recent essay puts the alleged strong growth story in perspective: http://www.alhambrapartners.com/2016/07/20/examining-the-abundance-of-strong-data-from-a-realistic-perspective/

To argue that America is strong because the dollar is strong, when the dollar is measured against currencies run by people even dumber than Yellen, is a bad argument. Europe’s financial system is in dire trouble, the pound’s weakness reflects the temporary confusion around Brexit. China’s debt situation is among the worst in the world, along with Japan’s, and these are the currencies that the dollar is strong against. Look, if you were to line me up against a bunch of 5 year olds, at my height of 5 foot 8 inches I would tower above them, but that doesn’t mean I am a fabulous basketball player.

The case is really simple. If you buy Trump’s thesis that America is falling apart and going down the drain, you buy gold as a hedge against tail-risk.

Cam: Trump doesn’t have any “thesis.” What he has is a collection of words coming out of his mouth that he thinks will get him more votes. That covers most politicians most of the time. Do you think Hillary actually believes anything she says in her speeches? She says what she think will get votes, and is happy to switch to saying the exact opposite if she thinks that will be more effective.

Still, if Hillary is elected you can count on more dissolute behavior by the Fed. She is bullish for gold. With Trump, it could go either way, since he is so ignorant, but he is more likely than she is to appoint people to the Fed who want to return its policies to something approaching sanity. That would be bearish for gold, if it happens.

I like the last line; but lets face it. Even though what you wrote is true you would run up the score in a big way. Investment returns can be the same way; at least until the NBA substitutes hit the court 🙂

Paul: You’ve obviously never seen me try to play basketball. Even one 5 year old would kill me.

And you would make more shots than the five-year-olds.LOL

Here is the latest Purchasing Managers Index PMI for manufacturing. It is surging strongly. That is not just a difference between previous economists’ estimates and actual announcements. It’s what’s happening on the ground in almost real time.

https://product.datastream.com/dscharting/gateway.aspx?guid=2c833d67-09f5-403e-9649-2d36a2204d24&action=REFRESH

I also include the New Orders sub-index on the chart. This is showing that good PMI news will continue.

Also new housing starts surged 4.8% month over month. These ridiculously low interest rates that Rick mentioned will likely lead to a surge in U.S. new home building. Look at what’s happening up here in Canada with super low mortgage rates. Once real estate starts to get momentum, it keeps going. I have read recently that the big problem in new U.S. home sales is a lack of inventory not demand. Home building can give a big boost to the economy.

Here is one of momentum charts I construct. It is for the iShares Home Construction ETF (ITB). Very interesting things are happening.

https://product.datastream.com/dscharting/gateway.aspx?guid=73c4b5b0-95b0-497e-bf6a-a4844081613f&action=REFRESH

The bottom chart show the ITB performance along side the S&P 500 ETF (SPY) rebased to the February 11th last market intermediate sentiment low. ITB is clearly leading from the recent low.

The top chart tracks relative performance to the S&P 500. ITB is close to outperforming on this longer term relative strength as well. Momentum theory says buy when a given investment starts outperforming the general index. Academic studies prove trends of outperformance persist. I use 9 month percentage change as my performance measure. Recent momentum studies use a combination of one year and six month performance. For example, the Momentum ETF MTUM uses one year and six months.

I don’t just follow momentum slavishly. I need to to see reasonable logic behind the outperformance and why it might persist. Here with home builders, it fits perfectly with my ‘lower for longer’ interest rate outlook. Last December when the Fed raised rates the first time, everyone assumed we would see rates ramping up sharply to old ‘norms’. That would of killed the home builders since mortgage rates would have ramped up too, making housing less affordable. That is likely why stocks of the group were doing badly. That outlook is changing dramatically from bad to great as the ‘lower for longer’ message starts percolating in investors brains.

I don’t like to buy something that is up 35% from a recent low when it starts outperforming so I will wait for an opportunity to buy this new leading group for my client portfolios.

By the way, if you cut and paste any of the chart links I post to an email to yourself, a word document or excel sheet and save it, you can click on the links in future and see an up-to-date chart. You will have a growing library of nice interactive charts.

We are in this together to earn a decent rate of return in a crazy world!

All the best!

KEN,

thanks for being a great contributor to the comment section on the site. I enjoy reading your comments. And yes, “we are in this together… in a CRAZY world” Keep up the good work and thanks again for your contributions.

“The answer is to buy gold”. I quote you.

Cam, I am listening to Hillary Clinton as I write this. Physical bullion, would be a hedge against not just Trump, but Hillary also. Let us get real. Coin clipping started with Romans, and continues today Physical bullion (gold, silver, platinum and palladium) would be a good antidote to ALL politicians.