Mid-week market update: What’s going on with the VIX Index? The VIX, which measures implied option volatility and a useful measure of “fear”, spiked dramatically on Monday. While SPX did fall, the magnitude of the decline didn’t match past VIX spikes. It prompted this tweet from Ryan Detrick:

Rob Hanna at Quantifiable Edges also observed that the combination of a VIX spike of this magnitude is unmatched by the shallowness of the fall in stock prices.

As you can see from the chart below, the VIX Index spent the second day above its Bollinger Band (BB), which has marked regions of limited downside risk in the past. On the other hand, the bottom panel shows the 10-day rate of change of the VIX Index, and such events have often foreshadowed further SPX weakness (see vertical lines).

What’s going on? My analysis suggests that we are seeing the case of the VIX tail wagging the SPX dog.

Unusual levels of fear

These levels of fear shown by the VIX Index is unusual in many ways as the VIX spike has been unconfirmed by other metrics. The Fear and Greed Index has retreated from an overbought, or “greedy”, reading to neutral. Normally, these kinds of VIX moves have tended to correspond to oversold levels, which are not in evidence.

Macro Man recently suggested that Brexit referendum anxiety has spilled over from the currency option market to the more liquid VIX Index. While that explanation undoubtedly has some elements of truth, it remains unsatisfactory.

If the market is indeed trying to hedge against Brexit event risk, then we should expect that the VIX term structure to have become inverted at some point. If you are trying to hedge event risk, then you hedge the event. In that case, the demand for near-term protection (VIX) should be higher than the demand for longer term protection (3-month VIX, or VXV). As the chart below shows, while the VIX/VXV ratio has risen, it hasn’t inverted in the last few weeks nor is it anywhere near an inverted state.

Historical studies

In more practical terms, how can someone trade this anomaly in the VIX?

One way of addressing this puzzle is to examine the historical precedence. An alert reader highlighted analysis from Rob Hanna at Quantifiable Edges showing what the market has done after a sharp drop from an intermediate term high. The results look bullish out to a five-day time horizon.

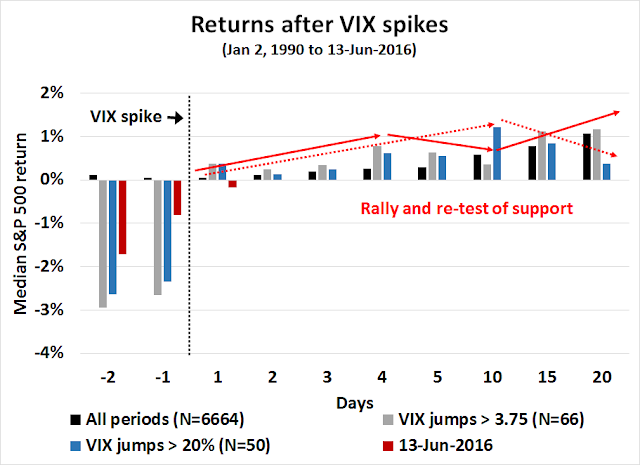

Separately, I went back to 1990 and looked at what happened after sharp VIX spikes. The VIX spike on Monday was 3.9 points, or 23%. The chart below depicts the median market action before and after the VIX spike, which shows that the study found sufficient number of instances to denote statistical significance. As the chart shows, the magnitude of SPX weakness one and two days before the VIX spike was nearly half of past episodes. Depending on how we defined the VIX spike, either by the absolute point rise or in percentage terms, the market tended to rally after the spike and then fall back. This suggests a scenario of a rally, followed by a decline to test either the previous lows or find some support level before rising again.

If history is any guide, then expect some market supportive noises out of the FOMC tomorrow, especially during the post-meeting press conference. The market would then rally into Friday and then fall into the Brexit referendum next week.

That’s when event risk comes into play. If the UK votes to stay in the EU, then the bears can expect a rip-your-face-off relief rally. If, on the other hand, the Leave forces prevail, then the bottom could be much lower than anyone expects.

For now, my inner is inclined to step aside in light of the FOMC wildcard, but if events unfold as planned, then he plans on entering a modest short SPX position near the close on Friday in anticipation of further angst about the Brexit vote. Anyone who plans on trading this event will need the discipline to pre-define his risk and pain threshold. And he have to be prepared to be nimble.

Good luck.

If betting markets are to be believed, then the odds are against Brexit. Anybody around who has made investment decisions based on Ladbrokes?

If Brexit happens will it be that bad. Norway and Switzerland seem to be doing okay. Is this over done???

If UK exit, Europe Union will be in deep trouble. to say the least, Italian bonds will tank big time.

“In more practical terms, how can someone trade this anomaly in the VIX?” Trade the volatility directly. Thinking that what spikes above normal range often (always?) falls back into normal range I bought some XIV (a day too early evidently) and hoping it works out by Friday.

If you are in the Canadian market you can trade the HVI in $CDN. It performs just like the XIV and is based on the same premise of exploiting the normal state of contango between the current month and next month of the VIX futures. I have used it successfully several times over the past three years but I usually tend to jump in too soon and then have to dollar cost average 5 – 10 days later. I use plots of VIX:VXV to try and time my entry but it is imperfect because the VXV is two months out and not one month which is the trade that HVI and XIV are exploiting.

I use Elder impulse charts (on stockcharts.com) of VIX:VXV and wait for inversion followed by a decline back below 0.9 which usually entails a solid series of a half dozen or so red bars on an Elder plot. Judging on past behavior it will probably take at least another 8-10 days for the XIV and HVI to bottom followed by a relief rally which might or might not be followed by an even bigger decline (i.e. a second VIX peak and time to consider cost-averaging). The nice thing about XIV and HVI is that it pays to be patient because contango is working for you, not against, thus the inherent long-term trend should always be up.

Real money does attempt to hedge using a process called “dynamic hedging”. Essentially, as VIX increases you sell more of your risk assets (equities). Keep in mind that most of these processes are based on historical movements of VIX, with 2008 being the elephant in the room and incorporated in the back tests. I find it more of chasing your tail, selling as VIX goes up to avoid another 2008 type occurrence. Instead, incorporate other indicators, such as sentiment, to better refine entry points once VIX spikes.

Cam,

Is there a reason why your inner trader and investor are focused on the S&P? And not, say a European Index that is now down further off its highs?

Thanks

The vast majority of the readership is American and the US market is the biggest and most liquid stock market in the world. I recognize that there are other markets, but not everyone can trade those as easily.