I recently wrote about my scenario for a market top in 2016 (see My roadmap for 2016 and beyond), which goes something like this:

- Unemployment is now at 5.0%, which is a point at which the economy historically started to experience cost-push inflation.

- Inflation edges up, which is already being seen in commodity prices.

- Initially, the Fed is content to let inflation run a little “hot” because of what it perceives to be slack in the labor market, but as inflation and inflationary expectations tick up…

- The Fed finds that it is behind the curve and responds with a series of rapid rate hikes.

- The economy slows and goes into recession.

- Stock prices fall as the probability of a recession spikes and a bear market begins.

It’s not oil, it’s the Fed

This is a case of correlation does not equal causation. The framework of that question is actually incorrect. It isn’t rising oil prices that cause recessions, it’s the Fed’s response to rising oil and other commodity prices that slow the economy.

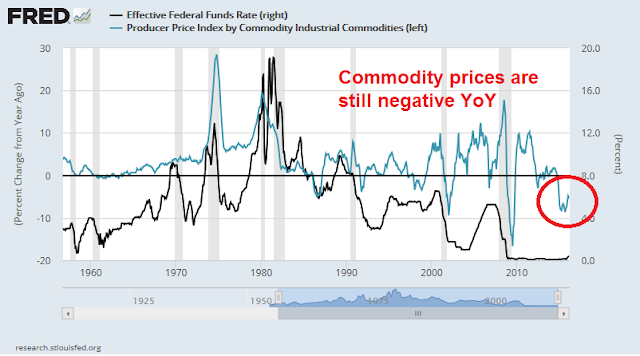

The chart below shows the relationship between industrial commodity prices (blue line) and the Fed Funds rate (black line). In each of the recessionary episodes, we have seen Fed Funds rise in response to signals of rising inflationary pressures from higher commodity prices.

Consider the chart of the CRB Index below. Assuming that commodity prices rise modestly by Q4, the CRB will be positive on a YoY basis by then. How far does it have to rise before the Fed turns decidedly hawkish?

Monitoring Fedspeak for clues

We return to the key question of Fed interest rate policy. I interpreted the April FOMC statement as the Fed’s attempt to tell the market that the June meeting is “live”, though data dependent. But the Yellen Fed’s communication policy is to avoid surprising the markets and the markets shrugged off the April statement and the market implied probability of a June hike barely budged.

Tim Duy thinks that the Fed is about to become more hawkish:

They can change their story within the scope of six weeks. Just like they did from the December to January meetings. And they have the one good reason to change the story: The dramatically change in financial market conditions.

The tightening in financial markets during the winter was the proximate cause of a more cautious Fed. The data didn’t help, to be sure, but more on that later. The combination of a surging dollar, collapsing oil, and a stock market headed only south signaled that the Fed’s policy stance has turned too hawkish, too fast. The Fed relented and heeded the market’s warnings.

But things are different now. US stock market rebounded. The dollar is languishing. And oil is holding its gains, despite disappointment with the lack of an output agreement.

This improvement will not go unnoticed on Constitution Ave. Even among the doves.

We shall see. I will be waiting and watching the tone of the Fedspeak in the days and weeks to come, starting with the Atlanta Fed conference on market liquidity this week.

My base case scenario calls for the Fed to get serious about tightening monetary policy late this year as the commodity prices start to pressure monetary policy. At that point, watch for the narrative to change to “the Fed is behind the curve”.

On the other hand, the turning point could come soon, or later. My inner investor is watching developments and keeping an open mind.

6 thoughts on “Will an oil spike kill the market bull?”

Comments are closed.

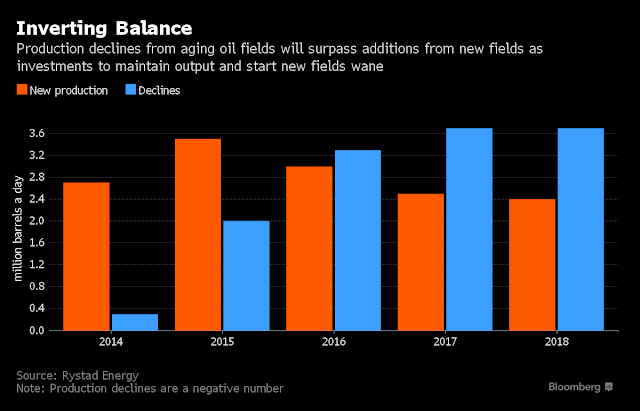

Rystad’s assessment is correct, in addition growing demand (1.2 % for 2016) will cause balancing faster. BUT the world has 400 Million bbls of excess supply in storage which will dampen price increases beyond 60 to 70 $ a bbl. BUT by 2020 the industry will have had 5+ years of under investment, large Middle East fields will have started their decline and tight oil plays will have had the sweet spots drilled up – that’s when the price cycle will start to seriously escalate once again .

Is focussing on commodity prices the right inflation series? I thought core PCE might be closer to the Fed’s thinking. Though I suppose commodity prices might be a precursor to PCE moves. I also wonder that since the oil price drop hasn’t started an economic (consumer spending) boom, a reversion to higher oil prices might not work the other way either.

You are correct that the Fed focuses on PCE ex-food and energy, but when you get cost-push inflation, everything is linked. Commodities are just the proverbial canaries in the coalmine – and focusing on core might just mean that the Fed allows inflation to get out of hand and get behind the curve that much more.

The trick is to get the timing right.

The most common mistake I have seen about this stock market and Fed watching since the GFC is assuming that previous history pre-GFC will be repeated. From a Central Banker’s viewpoint, they narrowly missed a Minsky Moment total meltdown of the financial system by a hair. Now a downhill Olympic skier after a fall breaking his legs might get back to being a fast, danger seeking winner. But any head of any Central Bank is not going to be THE single person to let the financial system fail after it has healed so nicely since the dark days of 2008-9. They don’t want to go down in history as an academic stupid enough to kill it. Look at the old chart above of previous cycles where rates were ramped up before every recession. Forget it. We will not see any ramping up of rates. That was then, this is now. They will be a slow as the sloth in Zootopia.

Inflation used to ramp up every business cycle before the GFC but not since. We have seen persistent deflation pressure. This has nothing to do with Central bank policy. We are in a technology revolution that is upping supply faster than demand is rising. Witness oil technology. Old theories about deflation always being caused by a drop in demand in the general economy are still held by Central Bankers when they are obviously wrong. Demand keeps rising and prices of goods keep falling. Surprising (to them) low inflation with keep Central Bankers slothful and give them the excuse they need to move ultra-cautiously. It will also prove wrong the bears who think Central Bankers will get behind the inflation curve and need to raise rates sharply when inflation subsequently soars, hence killing the highly indebted world.

I expect Cam’s late 2016 finish line to keep on moving further into the future as we move through the year. I also expect him to shift it forward as we go and keep us on the winning track.

I always said that the wildcard is the Fed’s reaction function. It is always possible that the timing of an aggressive rate hike cycle gets pushed forward into the future, or pulled forward.

I see that we have Fedspeak today (Atlanta & SF Fed presidents) warning that June is “live”, not that the market really believes it right now:

http://www.bloomberg.com/news/articles/2016-05-03/fed-s-lockhart-calls-june-rate-increase-a-real-possibility

Ken,

You remind me of a famous bet James Altucher once wrote about in his blog, except I think you are forseeing technology and commodity prices to advance?

In 1980, Julian Simon bet the economist Paul Ehrlich that no matter what basket of commodities Ehrlich picked, prices would be lower ten years later. Ehrlich, a decently smart guy, laughed at how easy it would be to win this bet. Ehrlich picked nickel, copper, chromium, tin, and tungsten.

Julian Simon won the bet.

Why did he win? Because he knew that no matter what materials the US economy depended on, we would innovate faster than the costs would rise.New inventions and technologies would outpace the demand for those commodities so that as we needed their functionality more, the prices would fall.”