Mid-week market update: There doesn’t seem to be much of a point in writing about the technical condition of the market when its likely path is dominated by a binary event like the FOMC meeting this week. So I thought that I would write about how to interpret and react to the FOMC statement instead.

Much of investing is about setting a course of action and assessing risks under different scenarios. A key assumptions of my equity bull case that I made on the weekend is a relatively equity friendly Federal Reserve (see How the SP 500 can get to 2400 this year). As we approach another FOMC meeting, a key question is, “How do we react if the Fed gets more hawkish?”

Poised for a hawkish rebound?

Despite the dovish tilt of the Yellen Fed, BCA Research pointed out that the Fed seems to go through a stop-start hawk-dove policy loop – and we are currently nearing a dovish extreme.A reversion to a more hawkish tone in its communications would therefore be no big surprise.

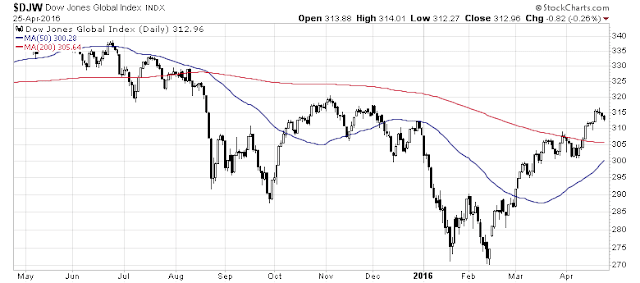

From a technical perspective, the markets are also ripe for a reversal. The USD Index, which is a key indicator of monetary policy divergence and driver of US corporate earnings growth, is currently testing an important support level.

Hedge funds have reversed out of their crowded long in the USD and they are now slightly short.

The flip side of the USD weakness coin is commodity strength. The post child of commodity strength are the precious metals and Tiho Brkan pointed out that gold miners are now highly overbought:

…while hedge funds are in a crowded long position in silver:

A less dovish message from the Fed this week has the potential to embolden dollar bulls and panic commodity bears.

How the FOMC works

When I talk to investors and traders, there seems to be a great deal of misconception about how FOMC meetings work. They think that the Fed governors and regional presidents all show up, talk about the economy and then decide on what to do.

An FOMC meeting is like an international summit of leaders and the Federal Reserve is a bureaucracy. Before the summit occurs, staff all talk to each other well before hand and craft a rough outline of the final communique. It is at the meeting of the leaders (or Fed governors and presidents) where the final language of the statement is tweaked. Everyone more or less already knows what will be said and the main focus of the statement has already been decided several weeks ahead of time, barring any last minute earth shattering changes in conditions.

Moreover, the members of the FOMC are all academics by training. Fed governors and presidents don’t just stand up and say, “I think ____”. Statements and conclusions need to be backed up by evidence and theory. When Janet Yellen pivoted to a more dovish view, she still has to justify it in academic terms. As an example, note how Yellen shifted her focus to how inflationary expectations are falling and at risk of becoming unanchored to the downside in a speech made on March 29, 2016:

Lately, however, there have been signs that inflation expectations may have drifted down. Market-based measures of longer-run inflation compensation have fallen markedly over the past year and half, although they have recently moved up modestly from their all-time lows. Similarly, the measure of longer-run inflation expectations reported in the University of Michigan Survey of Consumers has drifted down somewhat over the past few years and now stands at the lower end of the narrow range in which it has fluctuated since the late 1990s.

There is also a subtle imbalance of power at the FOMC that many observers are not aware of. A regional president can voice his opinion, but if he takes a “brave” contrarian stand, he needs staff to do the studies for him to make his case. But the Fed chair will have far more resources available in the than any regional Fed president. That`s why, in the long run, what the Fed chair wants, the Fed chair gets.

What`s in Janet Yellen`s head?

Ultimately, much of the direction of Fed policy depends on how Janet Yellen thinks. We do have some clues about her general approach from a recent round table discussion with Yellen and past Fed chairs Bernanke, Greenspan and Volcker in which she made the following points:

- On one hand: “We remain on a reasonable path and I don’t think December [rate hike] was a mistake”

- On the other hand, She seems to be terrified of global financial instability. “Yellen says she also is watching international developments and meets regularly with international central bankers.”

Marc Chandler gave a rather dovish interpretation of global events by stating that current global conditions are as good as it gets. He cites a number of sources of near-term uncertainty:

- The UK Brexit referendum, which will occur just after the June FOMC meeting;

- Tensions between Turkey and the EU over refugees;

- Debt relief for Greece; and

- The June OPEC meeting.

I have no idea what the Fed will do, but here is what I am watching.

Reading the market reaction

What’s yours?

Great work. Thanks

Hello Cam, when you say “then my original thesis is correct and it’s up, up and away for the hard asset and resource extraction stock market sectors.” you mean the USD will be up as the stock market but commodities will sell off ? and short and long term should we go out of the commodities ? Thanks for your answer.

Original thesis:

Rally led by resource extraction stocks (hard asset plays) as inflation ticks up. Under that scenario, USD weakens.

If the Fed tightens early to fight inflation, then USD strengthens and commodities weaken.

Note in the roundtable of four Fed chairs, Yellen said that while Volcker and Greenspan had to fight inflation, she is trying to get inflation up.

very sound strategy with simplicity of indicators that will signal. with the fed being unanchored it makes our financial markets so vulnerable to the back and forth fed leans. it appears the markets are already priced for a dovish fed so it is difficult to see much upside fuel given the upcoming June events.

For more novice investors can you explain what are resource extraction stocks?

Mining and energy stocks

Tightening soon is bad for stock markets outside the USA in general, EM stocks in particular. Big sell off here in the stocks that have gone up so much since Mid February. Money will flow into long dated treasuries. As you rightly suggest, it is both the tone and direction of Yellen’s remarks. She wants to tighten 25bps again. The Fed always want to show the markets who is the boss. My guess, not in June. But an inclination to do so by the fall.

What I’m trying to wrap my head around is how will mining and energy stocks (maybe leave energy out of it for the time being for political reasons) continue to climb should we be in a “moonless world” as Ken calls it. One where the FED is very dovish and reticent to discourage any nascent signs of inflation. What continues to propel them upwards if giants like China aren’t purchasing minerals as they once were and continue to (try to) reform away from building bridges to nowhere?

I can’t speak for Ken’s moonless world thesis as that’s not my investment case.

You might want to re-read this: https://humblestudentofthemarkets.com/2016/04/17/my-roadmap-for-2016-and-beyond/

To summarize:

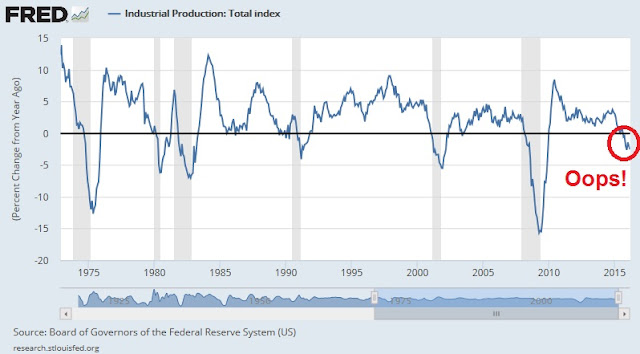

1) We are at a point in the economy where inflationary pressures start to show up, particularly when unemployment is 5% or less

2) When inflationary pressures show up, hard assets perform better, whether it`s gold, oil, copper, nickel, etc.

3) …until the Fed decides that enough is enough and steps on the brakes

The big question is the timing of (3).

Hello Cam, my strategy since August 2015 is to go short (buy SPXU) every time market reaches its 2015-2016 technical ceiling (SP500 around 2100). The reason for is that I see very limited risks (only 5-7%) in case market goes up. And this expected to happen very slowly, giving me enough time to re-think and react. Whereas, downside potential (reward) is very high. (As high as 40% in terms of SPXU).

You mentioned that on a long side capital goods and resource extraction are expected to perform well in late cycle economy. Would you be so kind to recommend sectors and ETFs which might work better for my short-strategy compared to SPXU?

Here’s a useful list of region, country and sector ETFs, which include both long and short as well as leveraged ETFs:

http://etfdb.com/etf-trading-strategies/ultimate-etf-trading-cheat-sheet/

Thank you.

In case USA approaches and touches recession, which sectors are expectet to fall first and in the most painful way?