Mid-week market update: Stock prices have taken a minor and uneven risk-off tone this week. The pullback has been attributable to fears over a Delta variant-related slowdown.

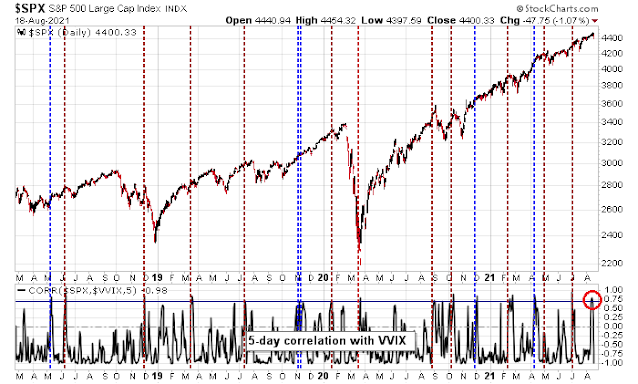

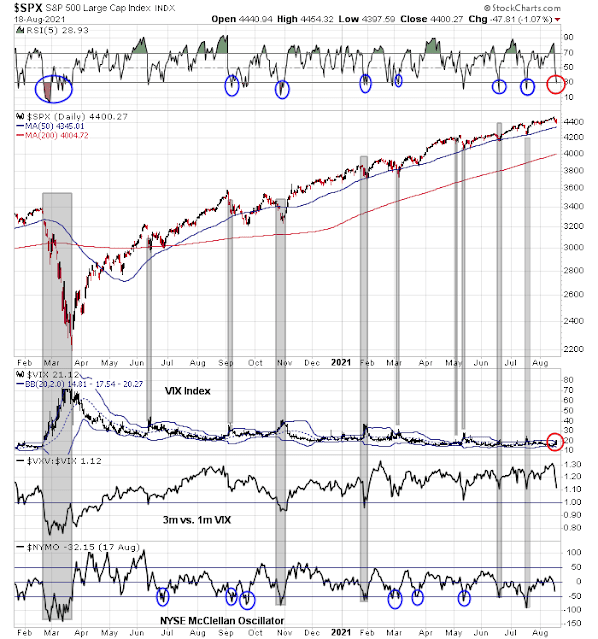

I beg to differ. Instead, the weakness can be better explained by market technical conditions. The 5-day correlation between the S&P 500 and VVIX, or the volatility of the VIX, had spiked recently. Past instances have resolved themselves with minor bearish episodes in the last three years.

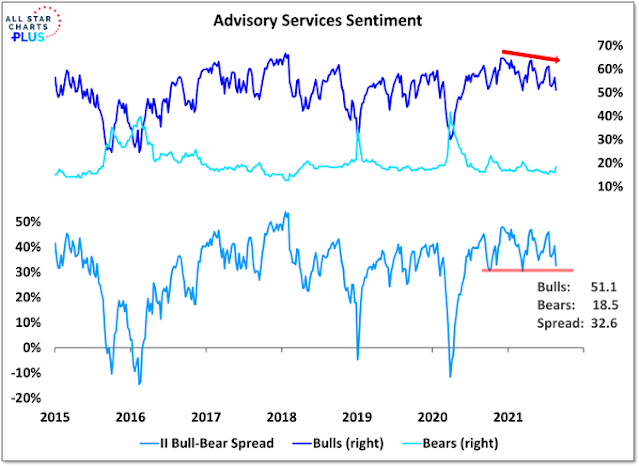

Sentiment readings could put a floor on stock prices. Investors Intelligence %Bulls has retreated and %Bears have edged up. The Bull-Bear spread has fallen to levels consistent with short-term bottoms.

Delta slowdown fears

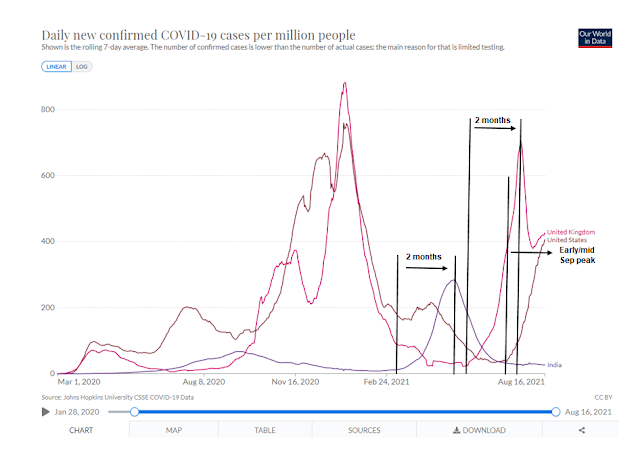

Evidence of a Delta variant surge in cases had been evident for some time. It’s unclear why risk appetite should suddenly take a turn for the worse under these conditions. Using India, where the Delta variant first appeared, and the UK as guides, case spikes have peaked in about two months. Using the same template for the US, this means that cases should peak in early or mid-September and then begin to recede.

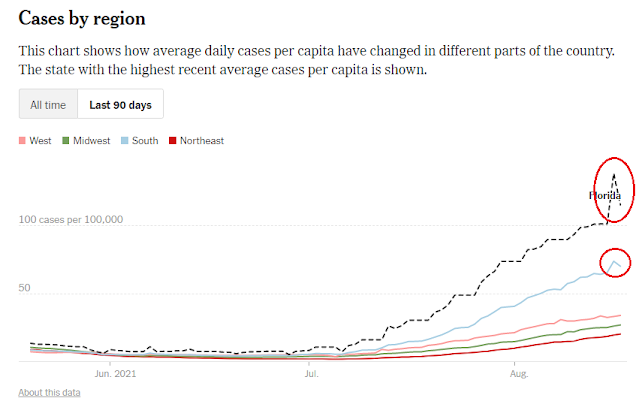

Indeed, data from the NY Times shows that case counts are starting to roll over in some of the more problematical regions, such as Florida and the South.

To be sure, Calculated Risk’s seven high-frequency indicators show that progress in reopening has either flattened out or started to roll over. Here is Apple mobility:

And TSA travel.

However, the plateau in activity has been evident for about a month. If the market narrative is attributing the risk-off tone to slowing growth, then why now instead of one or two weeka ago?

A final flush

My panel of bottoming indicators are nearing a series of buy signals Some of my bottoming indicators are nearing buy signals, while others are in neutral. The 5-day RSI is oversold and The VIX Index has risen above its upper Bollinger Band, indicating an oversold condition. The NYSE McClellan Oscillator (NYMO) is not oversold, though it is getting close. By contrast, the term structure of the VIX has not inverted, indicating fear and panic.

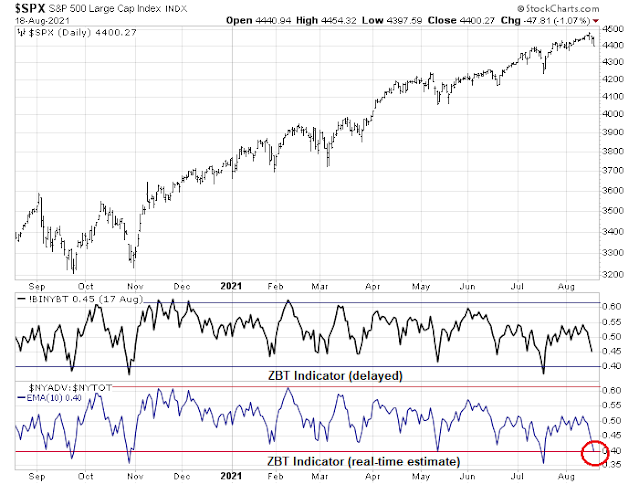

As well, the Zweig Breadth Thrust Indicator is has reached a marginal oversold condition, which has marked short-term bottoms in the past.

In summary, the stock market is undergoing a shallow pullback. A short-term buying opportunity is near. Market psyhology may need just one more flush and panic.

Buy the dip.

Technicals are one thing but I sense there may be a mood of FUBAR around the American experience right now with screw ups in Afghanistan, anti-vaxers, plunging consumer confidence and spending as well as political wrangling in the Democratic party over the infrastructure bill. FUBAR up and down the list.

Sorry should also add droughts and forest fires that experts say are Climate Change related but nothing is being done to address it by government.

There is more to the delta variant than the chart of UK and India experience show. UK has a high level of vaccinations throughout the country. Yet, after peaking, the rate is still elevated and recently turned up. India, testing rate is very low. Mostly when people go to the hospitals that they are tested. People deal with it at home primarily.

The uncertainty and fear in US is still high. CDC is somewhat contributing to those fears. Booster shots, mask mandates do not ease the concerns even though these steps will help in the longer term.

We have altered our plans and activities significantly. So have so many others whom we talk to.

It may peak as forecasted but we are not changing our plans till the threat recedes.

You misunderstand me. Evidence of a delta related slowdown has been around for a while, so why did the market decide to sell off now instead of a week or two ago?

That’s why delta is a red herring.

Sometimes we see a delayed reaction to these things.

The market also has a tendency to frustrate rational minds. It thrives on misdirection.

That said, your indicators have caught most of the major turns.

Why a market sells off or rallies on any given day is somewhat difficult to figure out. Question in my mind is: is it a shallow sell off or somewhat more serious. I am inclined to wait and see.

So, no need to delta hedge.

My guess is that volume was low and someone had an interest in holding prices high to let puts expire. Last opex the move down started on Friday. I’m not sure I want to trust this market before opex.

Why a market sells off or rallies on any given day is somewhat difficult to figure out. Question in my mind is: is it a shallow sell off or somewhat more serious. I am inclined to wait and see.

Regarding Delta, I think the next “does this become something more” moment is what happens in schools, particularly elementary schools where kids can’t get vaccines yet. If there are multiple outbreaks in places where vaccine rates are high, those areas will put restrictions in place IMO. And that would be the right choice.

Schools just started in my area. I have two in elementary. Our school district has great protocols and there is no anti mask push, so we are all hoping for the best.

One other factor regarding restrictions in CA is the recall election which will limit the governors actions, but that wouldn’t stop counties from doing more. Likely this will just crest as before but meantime we hold our breath.

On the flip side I can tell you that once my kids are vaccinated we will be much more active than we have been, even before Delta.