For the crypto folks who embrace the libertarian philosophy of using a medium of exchange not issued by any national government, here are a couple of reminders of what the USD “exorbitant privilege” means in real life.

First, the Canadian extradition hearing for Huawei CFO Meng Wanzhou finally ended yesterday after nearly three years of drama. Huawei was accused of violating America’s sanctions on Iran, and Meng was arrested at the Vancouver airport based on an American extradition request. In the last three years, she had been battling extradition while under house arrest in a multi-million mansion.

All of this wouldn’t have been possible if the USD wasn’t the dominant currency of global commerce. The US has weaponized the global banking system as a foreign policy tool.

Where’s Afghanistan’s money?

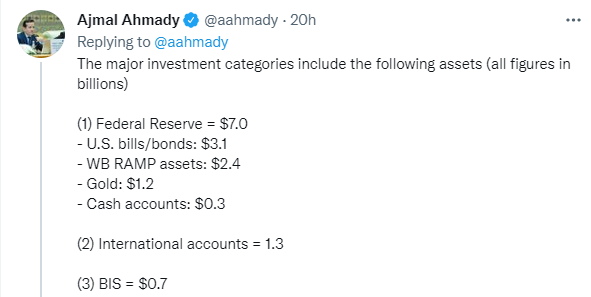

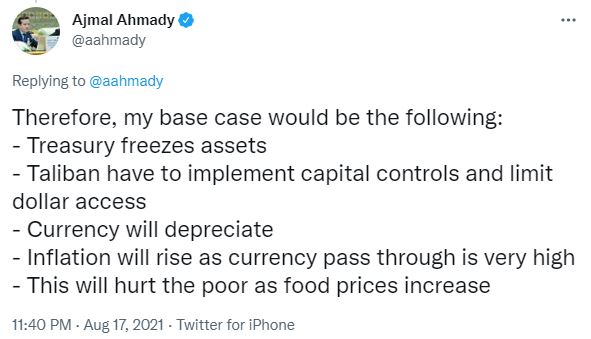

The second is a less-noticed effect of the Taliban takeover of Afghanistan. Ajmal Ahmady, the former governor of the Afghan central bank, the DAB, tweeted that the DAB holds about $9 billion in foreign exchange reserves. However, most of the assets are being held either at the Fed or within the US banking system.

As the Taliban is under international sanctions, little of those reserves are available to the new government. Ahmady states, “We can say the accessible funds to the Taliban are perhaps 0.1-0.2% of Afghanistan’s total international reserves. Not much.”

The BBC reported that the IMF has acted to cut off Afghanistan.

The International Monetary Fund (IMF) has said Afghanistan will no longer be able to access the lender’s resources…

An IMF spokesperson said it was due to “lack of clarity within the international community” over recognising a government in Afghanistan.

Resources of over $370m (£268m) from the IMF had been set to arrive on 23 August.

These funds were part of a global IMF response to the economic crisis.

The Taliban is coming to realize that its banking system exists mainly in a digital world and there is little or no money it DAB’s vaults. Ahmady concluded.

Keep the case of the USD’s exorbitant privilege in mind as you watch the chaotic evacuation scenes from Kabul’s airport. Washington has a powerful weapon at its fingertips, well beyond Predator drones and boots on the ground.

BABA approaching the 160 target – a 50% decline from the 52-wk high.

KWEB bidding 44, which is below the 52-wk low. I don’t really have a price target for a LT entry, but I wouldn’t hesitate to buy ~40. Which probably means it won’t get there.

China here reminds me of the SPX ~2100, when we all thought it would head lower…

I added to the small position in KWEB started recently. I know I will not hit the bottom but I think there has been sufficient damage to these technology giants in the second largest economy in the world. I just hope they don’t become long term loosing investments.

I would agree with Jan re Opex, at least in terms of ST trades. My plan is to sit out today’s action and begin repositioning Friday and/or Monday.

The one exception might be a starter position in BABA around the 160 area.

Lots of dip-buyers into the opening gap down. This time around it may be a mistake.

Targeting the July 19 low for EWC – still a ways to go.

Damn. Should have bought the open.

Reopening BABA @ a 161 handle.

Reopening a day trade in KWEB.

Here’s a thought. Wall Street takes the indexes down hard in an attempt to end the Fed nonsense about a taper 😉

Taking a little FXI as well.

Decimation in Chinese stocks today.

Beginning to see a little of the divergence I’m looking for->China ETFs/stocks moving higher as ex-China ETFs/stocks begin trending back down.

Is there evidence of rotation into value/cyclicals today? Objectively, I’m seeing rotation away from cyclicals and into growth.

Material stocks were down. Not entirely sure why.

What is exorbitant is the privilege of living in a first world country. There is a mind boggling suffering going on. Not only women, but those who are not steadfast Taliban.

Not seeing what I need to see this morning – FXI/ KWEB positions moving against me. A positive divergence is a +0.6% move in BABA.

As I’ve often pointed out – making immediate adjustments when my view is wrong is key to staying in the game. I will be taking losses in FXI/ KWEB, somewhat offset by the minor gain in BABA.

I remain bearish on the market/ bullish on China. Mostly, I’m intent on capital preservation.

All positions off in the premarket session. Back to 100% cash.

Futures reverse as Fed’s Kaplan ‘rethinks’ tapering due to the Delta variant.

Which entirely unravels my premarket strategy. It happens.

Definitely not chasing anything this morning. If a buying opp materializes, I’ll take it. If not, it’s been an OK week.

Nice call by Cam re the SPX.

Reopening positions in BABA/ KWEB/ FXI + a new position in ASHR here.

Adding a position in EWZ.

I’m just not seeing a rotation into cyclicals.

Will attempt to scale back into a full position in BABA as (and if) prices retrace.

Ditto for KWEB.

Retest of Thursday’s lows has allowed a decent reentry into BABA.

And it appears I could have waited for even better reentries into BABA/ KWEB.

In any case, I’m closing KWEB for a minor loss and holding the first of what will I hope will be a LT position in BABA.

No interest whatsoever in holding any ex-China positions for more than day trades right now. I like the perspective that Kass recently provided in one of his tweets. Earning +0.01% in ST Treasuries while waiting for a -20% pullback in equities is not unlike earning 20% on your funds. Not an exact analogy perhaps, but close enough. We’ve all made decent double-digit returns over the past year – is there any reason to continue chasing performance at this point?

Buying the dip seems to still work atm. Noticed there’s still bearish sentiment on twitter.

That is true, but the bearishness is also reflected in detereorating breadth numbers. However it may be reasonable to assume that as long as rates stay low (be it because of QE or supply and demand) US indices will continue to at least stay at those levels. Japan, Hongkong and China look far less rosy.

For now it looks like the usual kind of hiccup we are getting before important economic data releases, like Flash PMIs on Monday. Usually the selling is done 2-4 days before the release and well behind us once the numbers are out.

I wonder when a case could be made for buying Japan. According to Google data more than 50% have now received their first vaccine dose there and while the rest of Asia (primarily China) is dragging them down, many Nikkei stocks have already derated quite a bit. I’m still in the camp of investors who expect higher rates (and a corresponding US stock market top maybe in November) For now I’m not brave enough to buy the dip in cyclicals (many auto stocks for instance have just entered correction territory)