As the infrastructure and budget bills make their way through Congress, I was surprised to see that the latest BoA Global Fund Manager Survey did not mention a corporate tax increase as a key risk to the S&P 500.

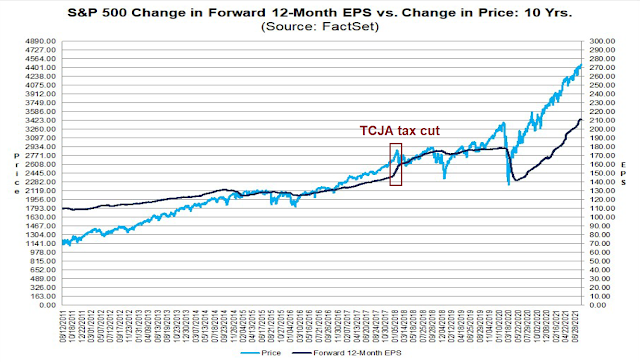

The Biden tax proposals have been well telegraphed and most of the details have been known to the public since March. They call for a partial reversal of the Tax Cuts and Jobs Act (TCJA) corporate tax cuts from the Trump era and the imposition of a corporate minimum tax. An analysis of bottom-up 12-month EPS estimates shows that they have been rising steadily for 2021, which is understandable because individual company analysts won’t cut estimates until they see the exact details of the legislation. However, strategists have penciled in top-down earnings cuts based on different tax regimes.

For investors, a corporate tax increase represents the greatest risk to US stock prices that’s hiding in plain sight.

The Biden tax proposals

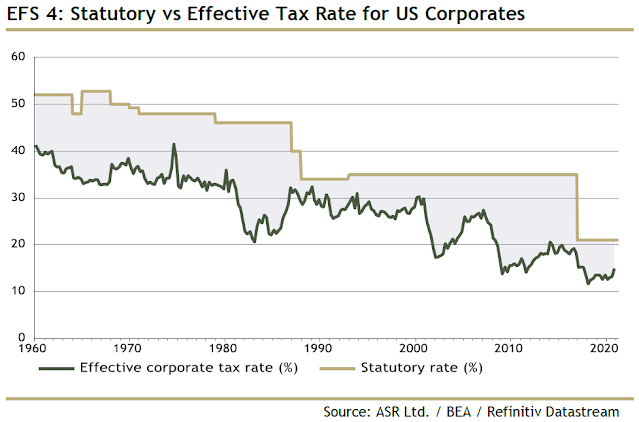

The Biden corporate tax proposals have been known since Q1. They initially called for an increase in the statutory tax rate from 21% to 28% and the imposition of a 15% minimum tax on the book income of large corporations. Further discussions with Democratic Senators indicated there was little support for a 28% tax rate and the consensus expectation is the increase will be scaled back to 25%.

The White House believes these proposals are justified for a number of reasons. The TCJA cuts were advertised as a way to spur investment and create jobs. Bloomberg reported that lower corporate taxes were ineffective at raising investment.

Government data showw that, outside of housing, private-sector investment averaged 4% annualized growth over the eight quarters of 2018 and 2019 – while the Trump tax regime was in place but before COVID-19. That’s little different from the 3.8% average of the previous five years, and well below the 6.8% pace of the 1990s – when tax rates were higher.

For policymakers, what matters isn’t the statutory rate, but the effective rate, which has been falling for decades.

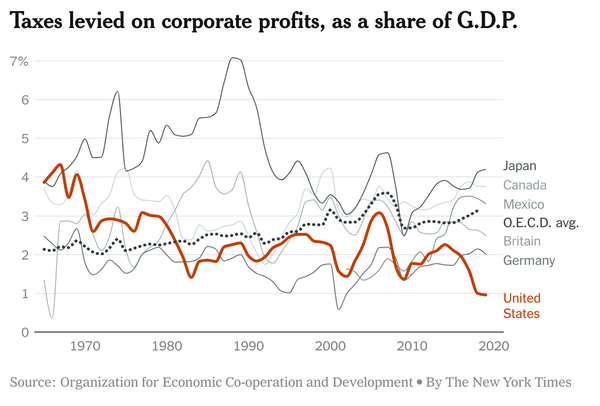

In addition, US corporations have the lowest tax burden as a percentage of GDP compared to other major OECD countries. If other major industrialized countries can be persuaded to sign on to a minimum corporate tax, a corporate tax increase should not overly detract from competitiveness.

Winners and losers

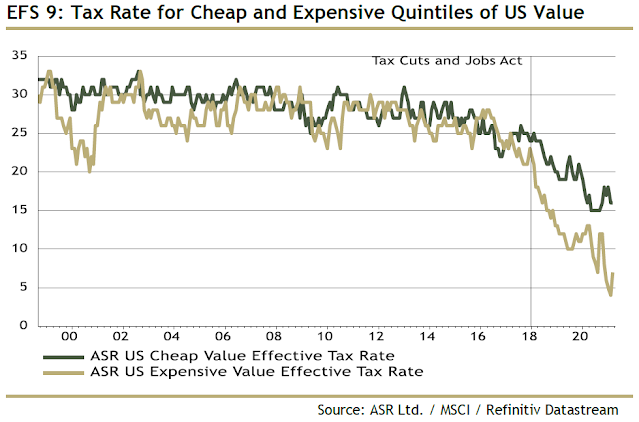

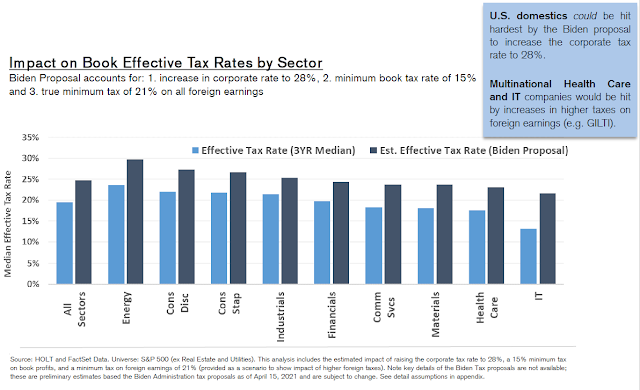

While virtually all US companies will be negatively affected by higher corporate tax rates, a more detailed analysis reveals the relative winners and losers. From a factor perspective, the TCJA lowered the tax rate of expensive stocks by valuation far more than the cheapest stocks. In other words, growth stocks benefited from the Trump tax cuts more than value stocks. Expect that to reverse itself under the Biden proposals.

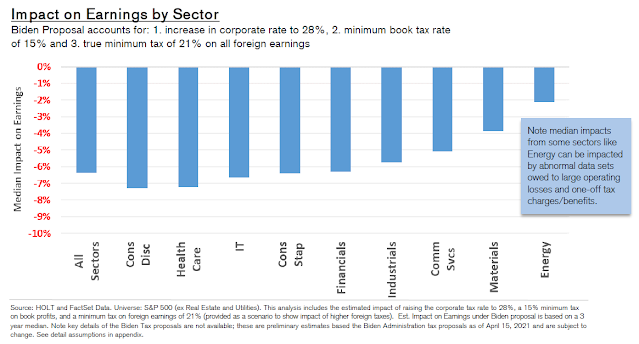

Credit Suisse also modeled the effects of a corporate tax increase to 28%. The three sectors with above-average hits to earnings are consumer discretionary, healthcare, and technology.

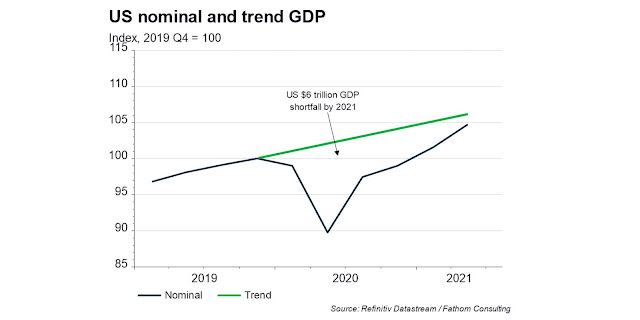

However, I expect the net effects on the consumer discretionary sector to be slightly better than this model. The extraordinary level of fiscal support in response to the COVID shock allowed GDP to return to trend growth at a much faster pace than the GFC recovery. Biden’s redistribution policies are designed to put more money in the hands of the poorest Americans, who have a higher propensity to spend extra income, and will disproportionately boost the sales of consumer-oriented businesses.

On the other hand, drug and technology companies that hide their IP in low-tax jurisdictions will be the worst affected under the Biden tax proposals. The Credit Suisse analysis found that technology stocks will still have the lowest tax rate under a 28% rate regime, but will endure the largest tax increase.

Pricing the pain

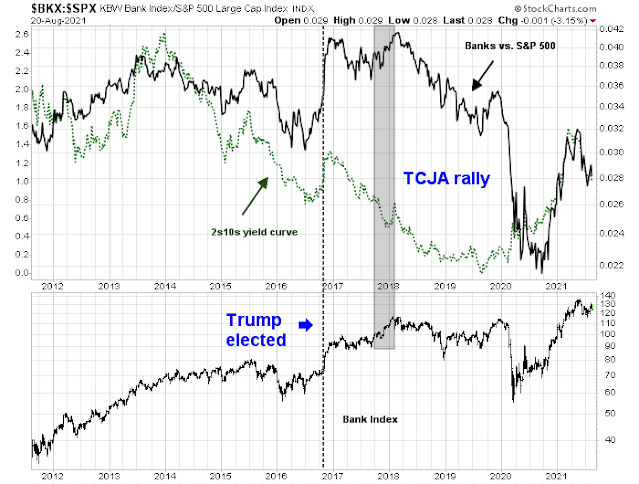

An examination of the most popular market narrative indicates that the effects of a corporate tax increase have not been fully discounted. Sometimes, the anticipation effect is higher than the actual event. Consider the market relative performance of banks stocks as an example. The relative performance of banks has long been correlated to the shape of the yield curve. Since banks borrow short and lend long, a steepening yield curve is favorable to banking profitability. The banks to S&P 500 ratio diverged from the 2s10s yield curve in November 2016 in anticipation that a Trump victory would be positive for the sector. When the market finally rallied in response to the passage of TCJA in late 2017, the magnitude of the TCJA rally was dwarfed by the post-election surge.

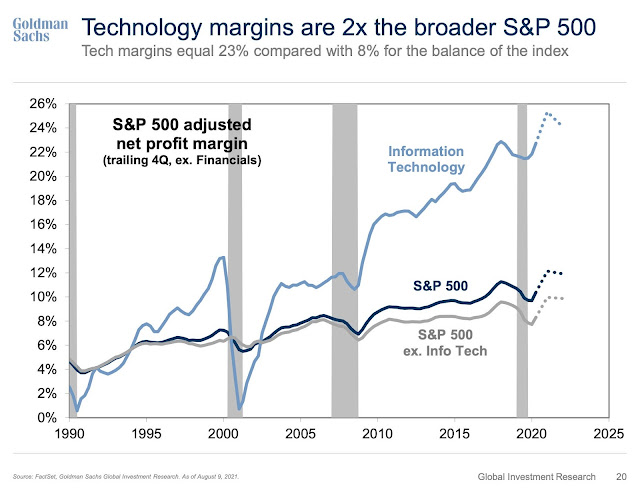

This brings us to the biggest loser under the Biden tax proposals, namely technology companies. The net margins of the tech sector is 23% compared to 8% for the rest of the S&P 500. A higher corporate tax rate has the potential to be an enormous negative surprise.

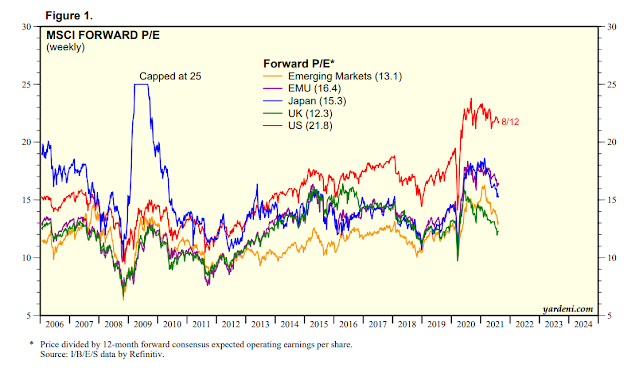

In conclusion, the market does not appear to have fully discounted the effects of a corporate tax increase. While all US equities will suffer from lower earnings, relative winners under the current proposals are value stocks and relative losers are growth stocks. Investors with a global focus should consider tilting their equity weight away from the US, which is not exposed to changes in US corporate taxes and exhibit lower forward P/E valuations.

Publication note: I am taking a week off next week. Barring any episodes of market volatility, there will be no mid-week market comment on Wednesday. Regular service will resume next weekend.

I’ve noticed pricing slowly creeping up in consumer and business products, but can’t tell if its due to scarcity or due to low interest rates, maybe both?

Business at my job continues to be strong on paper. We have had strong sales this quarter with a positive outlook into end of fiscal year. However, delivery times for product are almost at a year at this point. Pre-pandemic, normal delivery times was within 3-10 days. Competitors are reporting the same thing, significant demand with little supply.

Cam, nice call in initiating a long position Thursday morning!

Cam, Do foreign policy setbacks, a la Afghanistan, have any lasting impacts on domestic policy? IMO, hopefully the situation is resolved in the next few weeks without affecting the domestic agenda.

If so, would 4.5 Trillion dollars of stimulus not offset partially the tax impact?

Rough week for metals/ mining/ industrials/ financials. Now that I’m older and approach trading with an emphasis on capital preservation, I have less tolerance for drawdowns. If valuations were lower I would have more patience – with every valuation measure at historic highs, if a trade isn’t working, I’m out. The current back-and-forth action actually works well for day trading.