Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

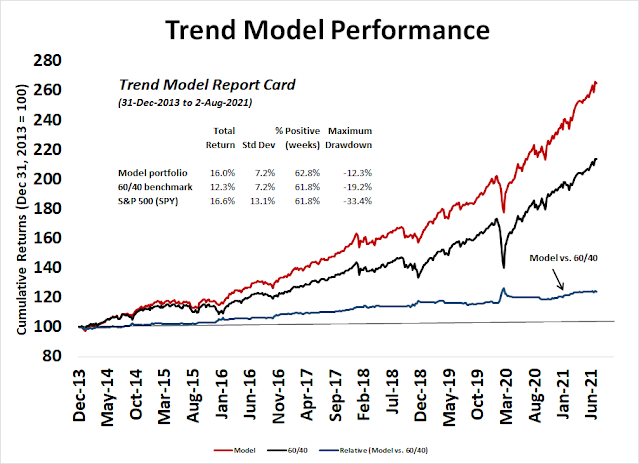

Trend Asset Allocation Model is an asset allocation model that applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

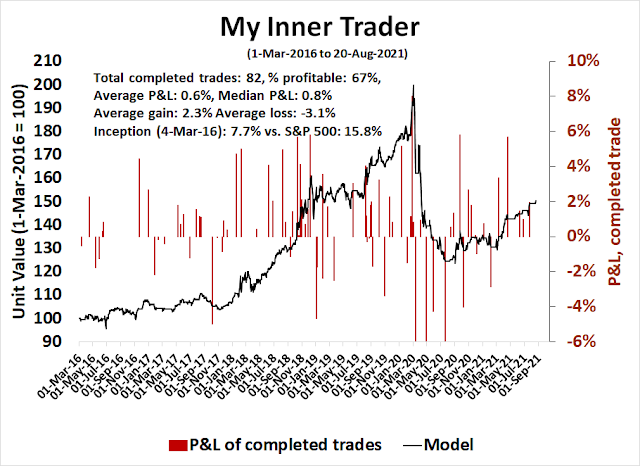

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

A risk-off episode

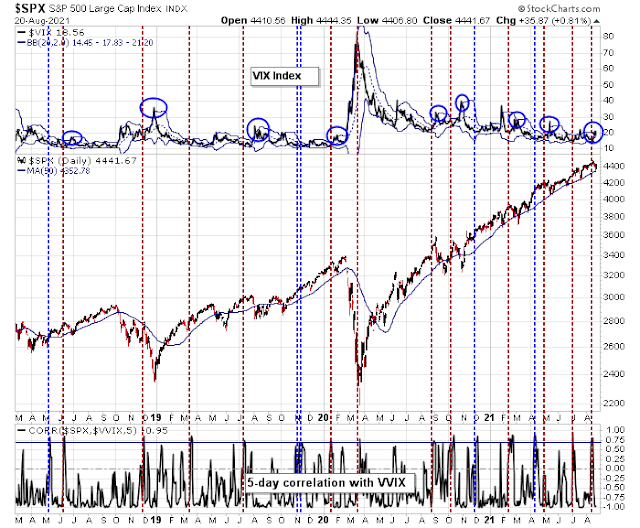

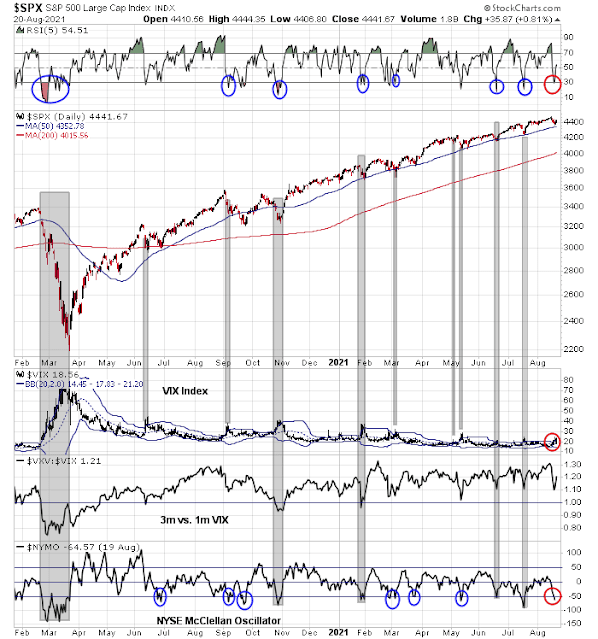

A week ago, I highlighted the risk of stock market weakness because the correlation between the S&P 500 and VVIX, or the volatility of the VIX, had spiked. The pullback duly arrived and the S&P 500 briefly tested its 50 dma.

In the past, S&P 500 and VVIX correlation spike sell signal sell-offs have bottomed when the VIX Index spiked above its upper Bollinger Band. Barring a new and unexpected shock, market internals have sufficiently deteriorated that a short-term bottom is near.

If I am right in my tactical assessment, the minor panic last week was just a brief summer squall.

An oversold market

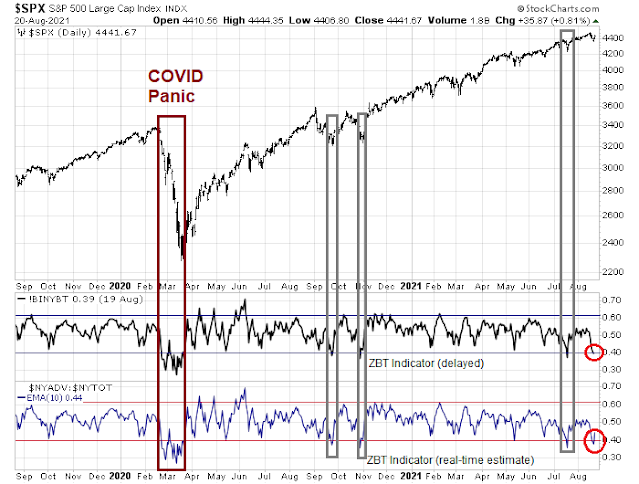

The Zweig Breadth Thrust buy signal is a rare momentum-based buy signal that occurs only once every few years and almost never fails. It requires the market to move from an oversold condition to an overbought reading within 10 trading days. The ZBT Indicator went oversold last Thursday, indicating an oversold condition. While I am not holding my breath for a ZBT buy signal, technical conditions are stretched enough to be consistent with a technically driven market bottom. The only recent exception was the COVID panic of March 2020.

As well, three of my four trading bottom indicators are flashing buy signals. The 5-day RSI became oversold; the VIX Index rose above its upper Bollinger Band; and the NYSE McClellan Oscillator (NYMO) reached an oversold reading.

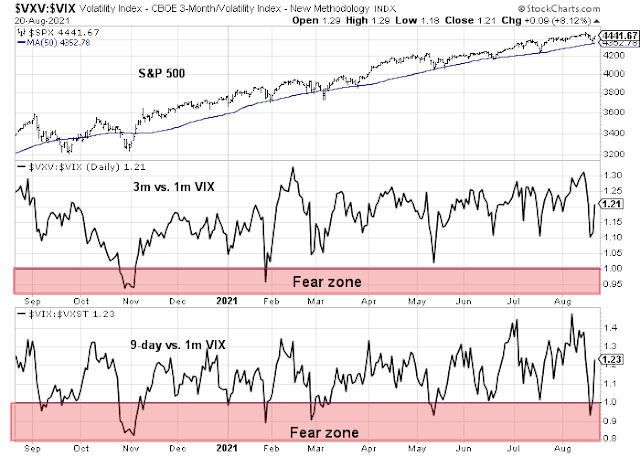

The only exception is the term structure of the VIX, which did not invert to indicate panic. To be sure, while my main indicator of the 1-month to 3-month VIX futures did not invert, the 9-day to 1-month VIX briefly did.

A sentiment extreme

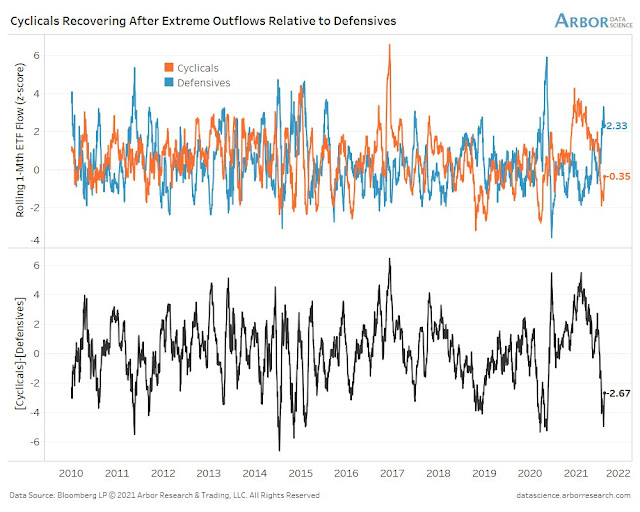

I also believe the cyclical and reflation trade is due for a rebound. Defensive sentiment is becoming overly stretched.

Ben Breitholtz at Arbor Capital recently observed, “The gap between cyclical vs defensive ETF flows rebounding from an extreme. Cyclical IG credits tend to outperform after these extremes.”

Sector internals favors cyclicals over growth

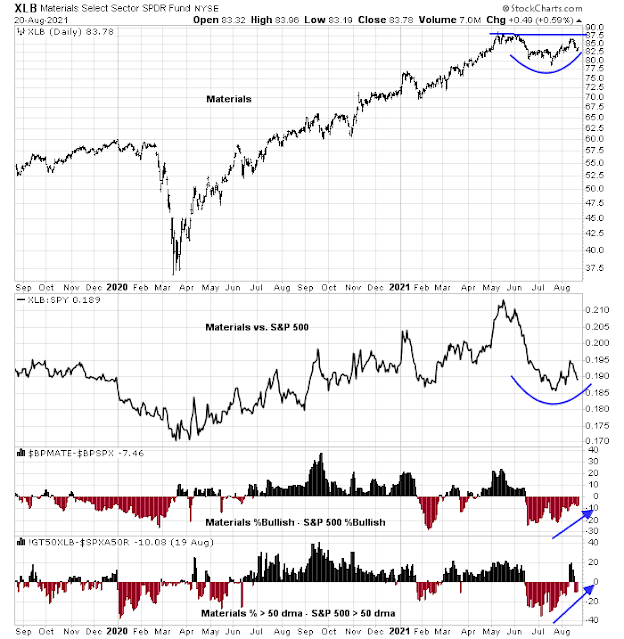

A brief survey of the market internals of cyclical and growth sectors tells the story. Consider, for example, the performance of material stocks, which is an important cyclical sector. The sector is making saucer-shaped bottoms on both an absolute and market relative basis. In addition, the relative breadth internals has been improving in the past month.

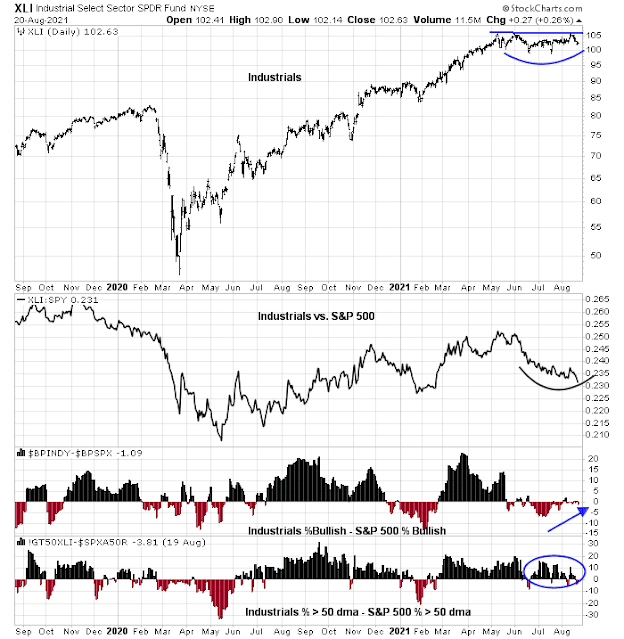

Industrials stocks is another cyclical sector exhibiting a similar pattern of saucer-shaped absolute and relative bottoms and strong relative breadth internals.

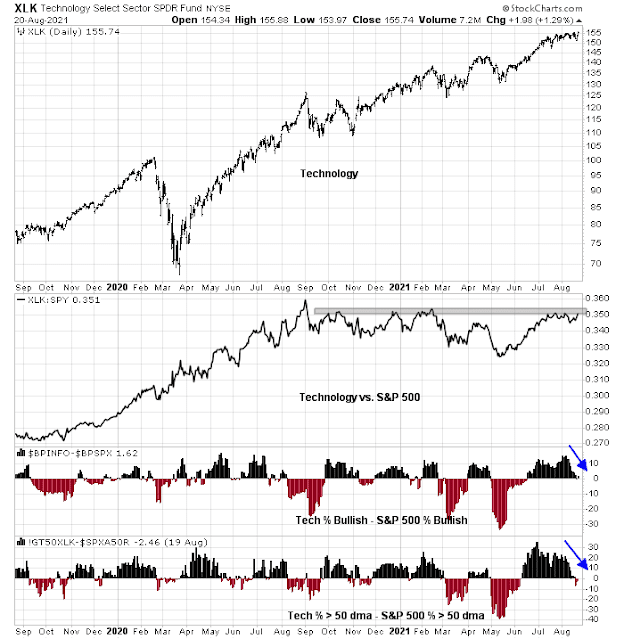

By contrast, the technology sector, which is the largest growth stock sector in the S&P 500, is testing both absolute and market relative resistance levels while relative breadth internals deteriorate.

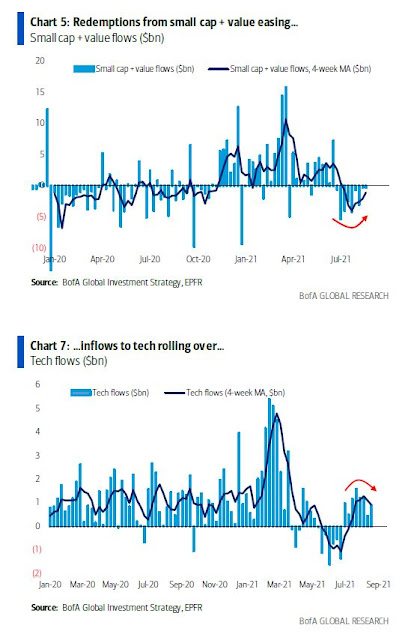

These relative breadth conditions are consistent with the analysis of fund flow data indicating an easing of small cap and value fund redemptions and a rollover of inflows into tech.

Finally, I offer the cover of Barron’s as a contrarian magazine cover indicator.

In conclusion, short-term market conditions have become sufficiently oversold that, barring an unexpected negative shock, the stock market should rebound. Based on my analysis of market internals, cyclical and reflation sectors are poised to be the next leadership, and growth stocks have become increasingly vulnerable.

Disclosure: Long SPXL

Publication note: I am taking a week off next week. Barring any episodes of market volatility, there will be no mid-week market comment on Wednesday. Regular service will resume next weekend.

nice work

‘unexpected’ negative shock can be raising tax rates. A bit surprised to see given it is not news.

What are the timeline to watch with respect to corporate tax increases?

Good work calling the bottom Cam. Helped me make bank. Cheers.

Adding a bit to BABA this morning. No other trades.

Yes, great call by Cam!

BABA reversed from red to green on high volume. Not saying it necessarily printed a durable low, but I have a fair degree of conviction that current levels represent a decent entry point.

Last Monday’s rally was a bull trap (in the very short term)

Making partial sales on BABA after hours ~163.xx. For the simple reason that a +6.5% intraday gain (opened ~153.xx) makes sense. Trading around a core position works well once a durable low is in place. We won’t know if it’s a durable low until later, but that’s my take right now.

SPX breaking out to new all-time highs before Powell has even spoken and before we are getting a decision on the infrastructure spending bill and possible corporate tax increase? Again, feels “disconnected” – now add in that the most bearish Wall Street analyst just raised his SPX year-end target by almost 1000 points. Does anyone need more warning signs?

Feels like maybe your asset allocation is too aggressive? I know I’ve felt like you at times, and it was always a signal that I needed to trim back a bit, to put some of my chips in my pocket.

I’m currently positioned in at an average AA for my range, which is making it easier to keep those “diamond hands” Ken wrote about.

I’m still bullish on European and Japanese stocks here, but I’m a non-believer in super-low treasury yields forever. US growth stocks are sending warning signals as outlined by Cam above. Higher yields and potentially higher taxes are a double whammy that few seem to be positioned for.

Trimming back further on BABA in hopes of repositioning lower. (Looks like I basically gave away shares of KWEB/ FXI last week.)

Reopening MRNA here.

Closing MRNA.

We got the short-covering and/or oversold bounce in China. Won’t be as easy going forward.

Feels like another summer squall has started…

Added back the trading positions in BABA that were closed yesterday. Restarted a position in FXI. No other trades.

FXI + all trading positions in BABA off here in the premarket session. I was wrong about an overnight recovery in Asia and wasting no time taking the hit.

I sometimes compare being wrong about market direction to heading in the wrong direction while driving. As soon as either becomes apparent, what’s the right move?

Good way to think about it. Turn around and go the other way. =)

Right, well the key to staying in the market is not to lose (too much) money – which I think is what Buffett means with his Rule Number One.

I know Cam prefers to focus on process rather than P/L, but as we get older the game transitions into one of capital preservation – which boils down to keeping P/L at all-time highs as much as possible.

Taking another swing at BABA here, as well as ASHR and EWZ.

And out of trading positions in BABA once more as price breaks 166 support.

Many traders seem to hold a relatively large core position and then trade smaller positions around it. I prefer the reverse. Hold a relatively small core, and trade larger positions around it. The smaller core position size allows me to weather the volatility.

Re China – it’s important to remind myself to take a bear market perspective as there’s no question it’s a bear market. I would use much wider stops in a bull market.

While other (shocking) news have been dominating the headlines today, I continue to see several key risks and I’m reluctant to belive they can be dismissed as transitory or that they are priced in. TSMC’s reported price hikes remind us of the cost that come with moving manufacturing facilities out of China’s sphere of influence. Moving factories to China has been a massive deflationary force and that is slowly going away (current supply chain issues are adding fuel to that trend) TSMC said making chips in Japan, US and Europe will be more expensive and huge investments have to be made. On the other hand the details of a 3.5 trillion budget are going to be worked out and if that doesn’t get paid with corporate tax increases, the treasury will be issuing a lot of bonds and notes and I do not believe the Fed is hell bent on monetizing all of it. In addition there is a whole lot of stuff going on in China and apparently some significant changes on how companies and government authorities interact – while economic growth is slowing down according to recent PMIs. Consumer confidence in US and Europe disappoint, retail sales slowing. While some of this can attributed to supply chain issues, it may as well be possible that some “payback in demand” is going to play out for some sectors after a strong recovery. I continue to stay positive on some sectors with pricing power, like semiconductor materials suppliers for instance.

‘In addition there is a whole lot of stuff going on in China and apparently some significant changes on how companies and government authorities interact.’

I would agree with that, and in fact I have now unloaded even my core position in BABA. US shareholders are not shareholders of the company in the traditional sense – rather, they indirectly own only a share of company profits via a Variable Interest Entity (VIE) agreement. I don’t pretend to fully understand what that means, nor do I have the time or interest to learn. All I need to know is that the VIE structure introduces a level of contractual complexity to what I’m buying – one which the Chinese government is free to declare ‘unconstitutional’ at any time. Forget it! There are better stocks to own, and more than likely better times to own them.

It’s not just about the internet companies and recent IPOs, they have also finally started to let “zombie companies” default on their debt as long as they feel this does not expose the economy to systemic risk. The current state of China Evergrande is really just proof that the old ways of doing things cannot continue forever. China does not see value for society in letting individuals become ultra-rich and successful and they are also seeing the danger of incentivizing speculation. This is not exclusive to property developers, but also for smaller semiconductor companies which were able to extract significant amounts of loans and subsidies from local governments just by saying they want to expand semiconductor manufacturing capabilities. Of course some of these companies are failing and Chinese authorities are making public comments about their willingness to step in if they see this kind of behaviour again. For many many years local authorities have been incentivized in China to provide risky loans in order to prop up economic growth numbers, this has created imbalances, but it did not matter as long as no one was willing to “let the bubble pop”. This course of action has reversed now in China some months ago and in some instances this delevaraging may be a little painful.

How many traders still expect a selloff? Now that it’s more or less off the table, have the odds have shifted in favor of a steep decline?

Can’t do it before Powell has spoken

Looks as if I exited BABA just in time.

Among other things, it’s another example of something I’ve observed over the years: there is no such thing as easy money in the markets. To be sure, BABA is a solid large-cap company that has pulled back -50% from its highs. But there’s no guarantee that buying it now is a sure thing. For one thing, why is it -50% off its highs? I always start with the assumption that the person or persons on the other side my trades will be smarter than I am.

Cam- what’s your interpretation of the action in TIPS ($TIP) today?

https://www.mercurynews.com/2021/08/27/new-ucsf-study-vaccine-resistant-viruses-are-driving-breakthrough-covid-infections/