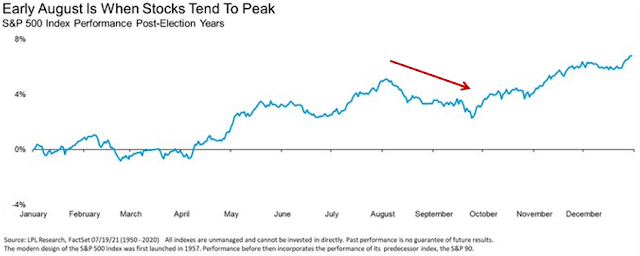

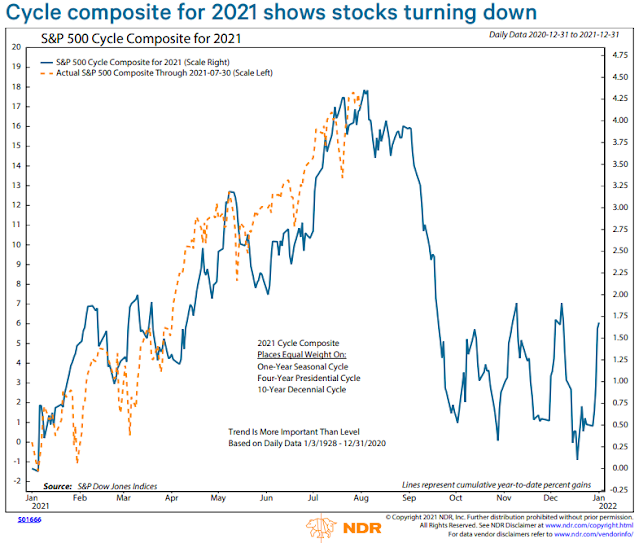

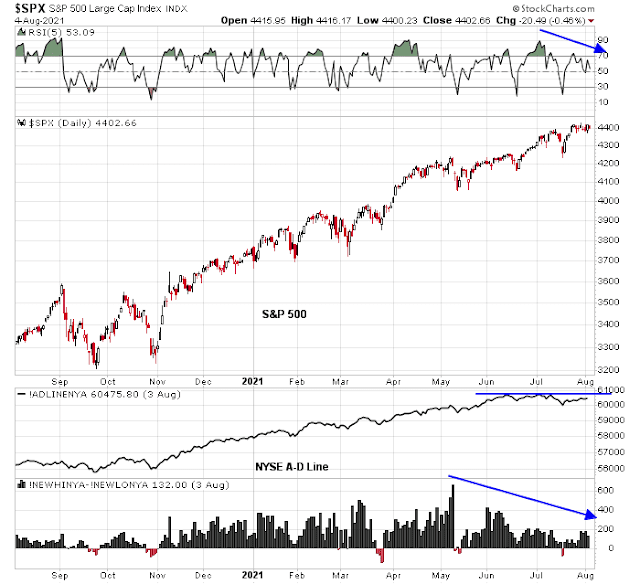

Mid-week market update: Evidence of a negative seasonal pattern has been circulating on the internet for the S&P 500. As one of many examples, LPL Financial pointed out that the S&P 500 has typically topped out in early August and slides into late September.

The bear case

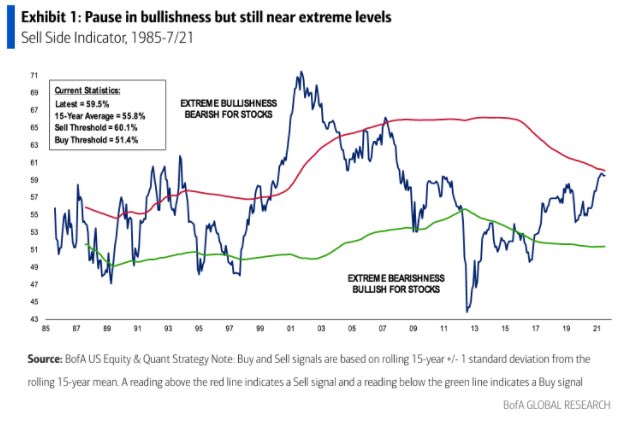

Tobias Levkovich, chief U.S. equity strategist at Citi, says there’s an almost “palpable” sense that every 1% dip is a buying opportunity. “We are less convinced,” he said. “Fund managers fully concede that the rate of profit expansion will slide but most fear more upside and relative performance issues than a double-digit decline at the moment, yet they prefer a higher quality tilt to portfolios.”

It can’t last forever, can it? Levkovich is sticking with his 4,000 year-end price target for the S&P 500 — which means he thinks the market may drop by 10%. And he has a specific month in mind when it might, if not fall apart, at least get ropey. “The paucity of immediate catalysts for a pullback is cited regularly, although we worry about higher taxes, cost pressures eating into profitability, tapering and more persistent inflation all coalescing in September (typically the toughest month seasonally for the S&P 500),” he said.

While, as Chair Powell indicated last week, we are clearly a ways away from considering raising interest rates and this is certainly not something on the radar screen right now, if the outlook for inflation and outlook for unemployment I summarized earlier turn out to be the actual outcomes for inflation and unemployment realized over the forecast horizon, then I believe that these three necessary conditions for raising the target range for the federal funds rate will have been met by year-end 2022.

A dovish Fed

Last December, the Committee indicated that it would continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward its maximum employment and price stability goals. Since then, the economy has made progress toward these goals, and the Committee will continue to assess progress in coming meetings.

The phrase “assess progress in coming meetings” (plural) is an important clue about the timing of a tapering announcement. The FOMC meeting schedule is September, November, and December. The July FOMC statement implies that the earliest that a taper announcement will be at the November meeting. Fed vice-chair Richard Clarida also said today that the Fed has no intention of surprising the market on tapering, though he could see an announcement later this year.

In addition, Fed governor Lael Brainard also gave an important clue about the conduct of monetary policy in a speech to the Aspen Economic Strategy Group. On the subject of labor market recovery, she stated that she “expect[s] to be more confident in assessing the rate of progress once we have the data in hand for September”, indicating that the Fed needs to see confirmation of a labor market recovery in its September data, which will be available in early October.

Currently, it is difficult to disentangle the effects on labor supply of caregiving responsibilities brought on by the pandemic, fears of contracting the virus, and the enhanced unemployment insurance that was designed in part to address such constraints. Importantly, I expect to be more confident in assessing the rate of progress once we have data in hand for September, when consumption, school, and work patterns should be settling into a post pandemic normal.

These signals are consistent with the consensus expectation of a tapering announcement in late 2021, with actual action in early 2022.

However, recent data is supportive of a more dovish tone. The Citi Economic Surprise Index, which measures whether economic data is beating or missing expectations, has been falling.

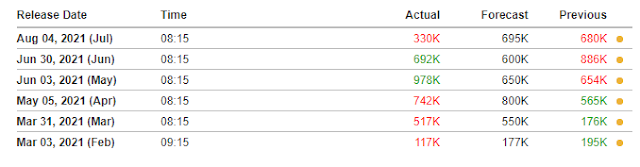

The data has been soft. As an example, today’s release of ADP Non-farm Employment Change badly missed expectations. This raises the likelihood of an NFP payroll miss on Friday.

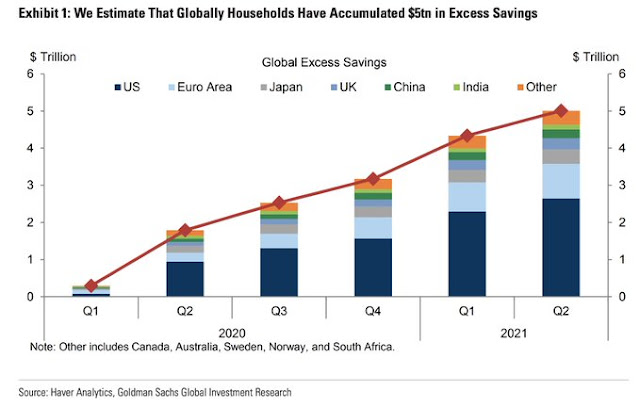

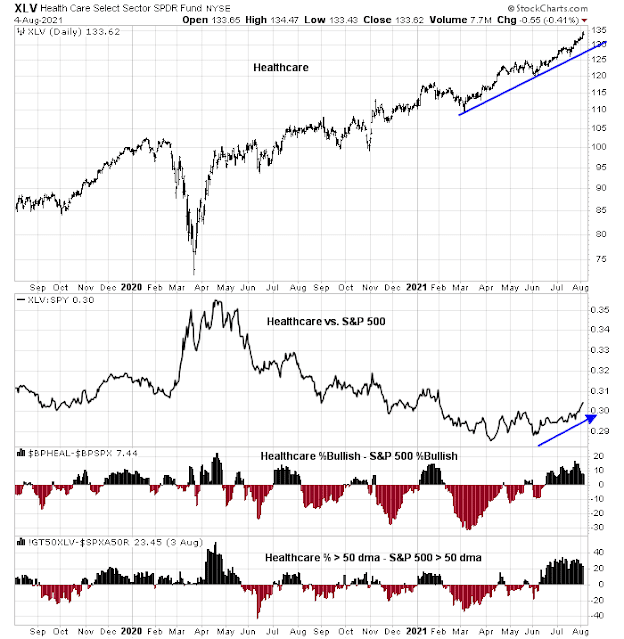

Other bullish reasons

Resolving the bull and bear cases

Petrobras earnings beat drives the stock price up +10%. Other Brazilian petrol companies may be up after hours in sympathy.

Closing EWZ here on the +1.11% after hours spike.

Plans A and B for Thursday are pretty straightforward. The ideal scenario is adding to existing positions if we open in the hole. The alternative is selling into a gap up – in which case I hope to reopen into an afternoon fade. Either way, I’m sensing Friday will be bullish.

Even if NFP misses badly? I’m taking a few chips off the table.

Right. Well, there are two sides to every trade, and the market tends to be irrational in the short term. I’ve cashed out at 2x my usual target this morning, and will be reestablishing positions on weakness throughout the day. It’s possible there won’t be any weakness, but that’s a chance I’m willing to take.

Change in NFP +943k, vs 870k survey

Unemployment rate 5.4% vs 5.7% survey

Labor force participation rate 61.7% equaling survey and +0.1% from last month.

I guess it’s back to inflation fears.

Presumably no effect from the delta variant in these numbers yet.

Earnings and guidance are coming in great, inlfationary pressures are easing a little, yields much lower than anticipated, economy potentially not running too hot – goldilocks + record earnings. Plus we are seeing strong new orders in PMI reports. Hurrah!

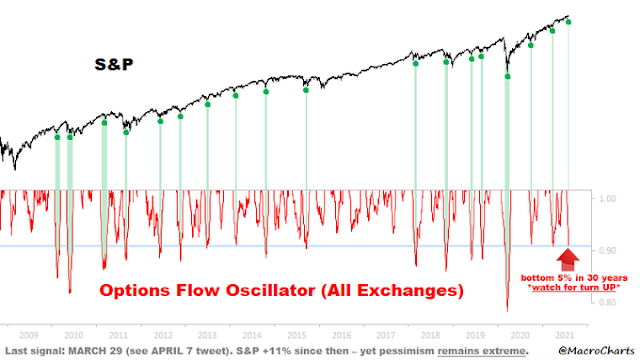

But sentiment is not crowded bullish here, many voices are calling for seasonal weakness, a correction being overdue and the usual stuff we tend to hear while the market just keeps on making new record highs.

For me it is difficult to ignore the situation in China and South-East Asia. China is trying to contain the Delta-Variant, Indonesia, India, Thailand, Vietnam and Japan seeing new outbreaks and lockdowns that come with it.

Is it really smart to join the party and trust the market’s ability to climb a wall of worry? Because worries don’t matter until they show up in earnings reports.

Opening a position in FXI premarket.

Opening a position in PBR on strength.

EEM.

Cutting back on KRE.

Adding to PICK.

Closing PBR.

Closing KRE/ XLE.

Closing DIA.

Closing XLI.

Closing VTV.

Closing JETS.

Closing PAVE.

Closing VEU.

Averaged down on PICK and GDX and closing both positions for minor losses.

Ironic that the Delta variant would be a boon to the market. In my locale, ICUs are full again with Covid patients, but you wouldn’t know it walking around retail during the day. Restaurants, bars, shopping is all humming at or near capacity. No one’s wearing a mask or distancing at all.

Chip shortage is impacting my job. We’re looking at 1 year lead times at this point but still booking orders. Will let the higher ups figure all that out. Example, we recently booked another 20k+ units order with no inventory. Once the stimulus is passed, I suspect we’ll see more of the same thing.

Closing IJS.

Adding to GDX.

Adding to PLTR.

Closing all remaining positions here. I remain bullish heading into Friday – hoping to reopen at least few positions at more attractive levels.

Taking another swing at PBR here.

Giving up here.

Limited supply of buying opps in the final hour.

1. Reopening EWZ, which has now given up all of its post-PBR spike and then some.

2. Reopening FXI near the intraday low.

3. Reopening EEM near the intraday low.

4. Reopening PLTR.

GDX.

Closing positions in EWZ/ EEM/ FXI in the premarket session for minor losses. The ETFs may bounce later in the day (maybe even following NFP), but that wasn’t the trade. No conviction either way at this point.

My take on NFP has also changed. Now giving 50/50 odds that Thursday’s rally was the bull play – traders may have made their move a day early, and now poised to sell the news. I don’t know. No conviction either way here as well.

I plan to trade any reactions from a position of 100% cash.

GDX was closed after hours on Thursday ~where it’s bidding now.

Bond yields spiking hard.

Taking a half-hearted stab at GDX ~33.5x.

Adding to GDX.

Taking the hit on GDX. It feels too much like a falling knife.

My take right now? Outright bearish. As I categorically avoid short positions, the plan is to sit in 100% cash.