Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

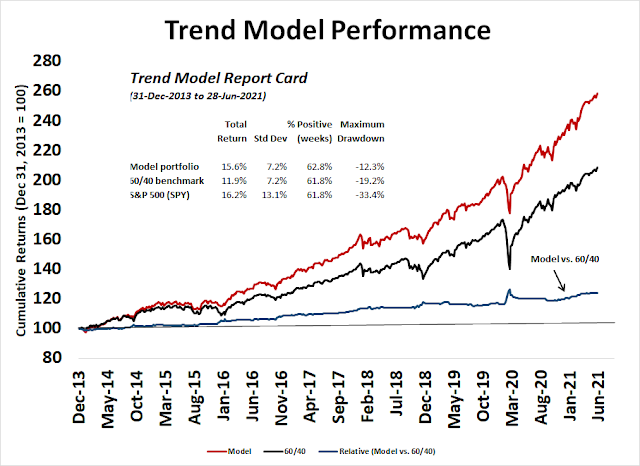

Trend Asset Allocation Model is an asset allocation model that applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

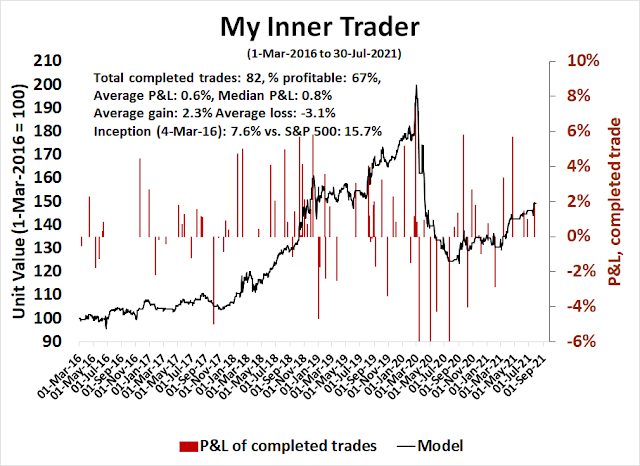

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Neutral

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

Unanswered questions

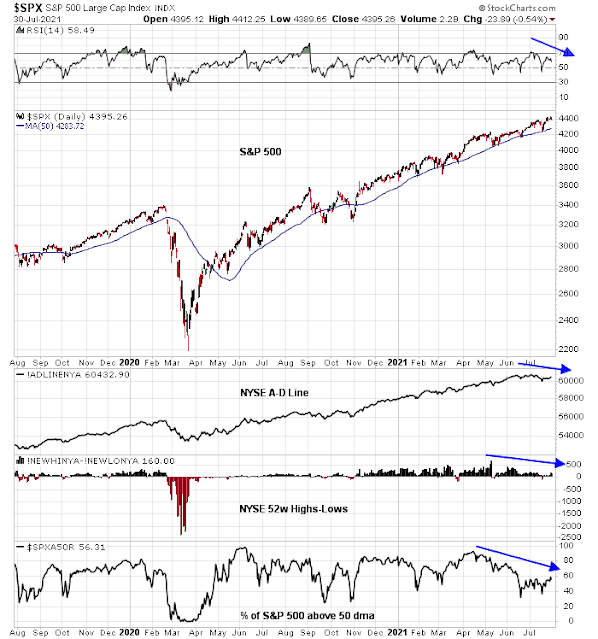

As the S&P 500 advanced to fresh highs despite widespread evidence of negative RSI and breadth divergences, the market faces a number of unanswered questions that may be indicative of possible impending leadership rotation.

How the market resolves those questions will be clues to the next major leg for stock prices.

Bearish omens

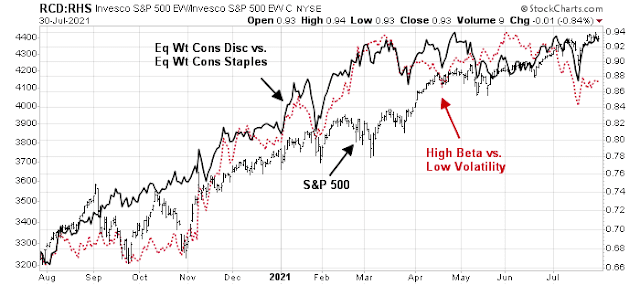

In addition to the negative breadth divergences, here are other bearish omens for the stock market. One component of my risk appetite model is persistently flashing a warning. While the equal-weighted consumer discretionary to staple ratio has confirmed the market’s highs, the ratio of high beta to low volatility stocks is exhibiting a series of lower lows and lower highs.

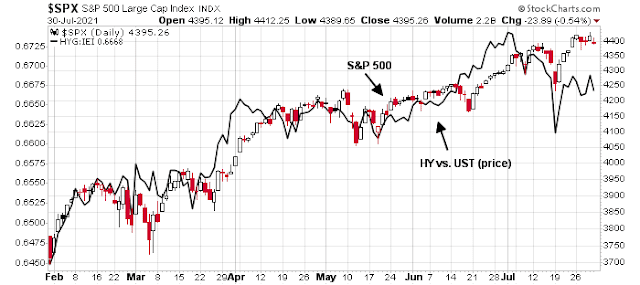

Credit risk appetite is also not behaving well. The relative performance of junk bond prices to their duration-equivalent Treasuries is also displaying a negative divergence.

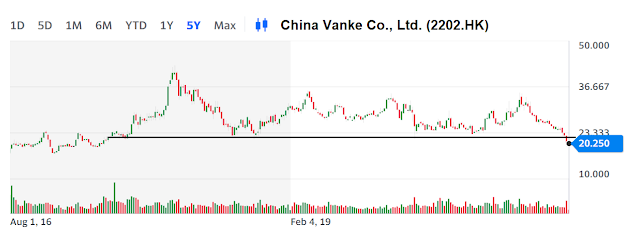

Another possible black swan is appearing from overseas. Chinese and Hong Kong equity markets recovered Thursday after regulators convened an emergency video conference to reassure banking executives that crackdowns on the education sector were localized. The measures are not part of a series of broad-based initiatives to hurt companies in other industries. The relief rally didn’t hold as the market sold off Friday.

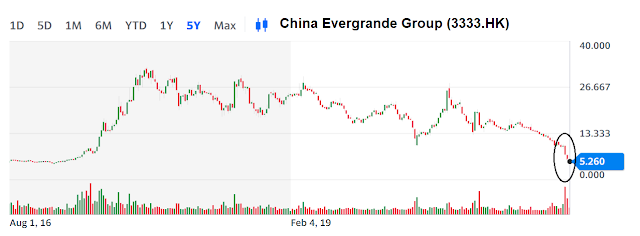

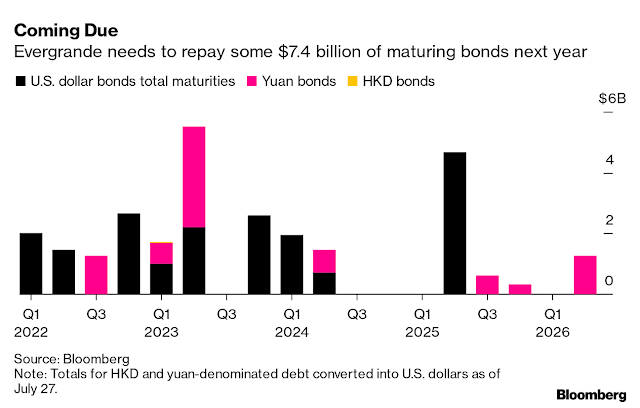

More ominously, the shares of mega cap property developer China Evergrande continued to weaken.

UBS pointed out that 77% of Evergrande’s liabilities are due in the next 12 months. This puts pressure on the company to cut sale prices on its product and depress real estate prices.

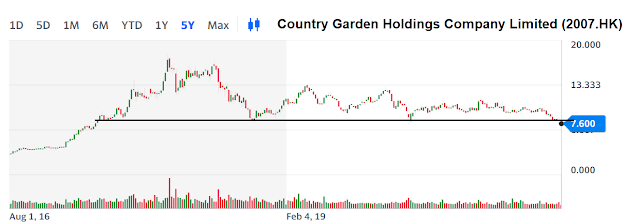

Other property developers also weakened and broke major multi-year support in sympathy. As real estate represent a major asset of Chinese households’ savings, skidding property developer shares could be the start of a Chinese Lehman Crisis.

Reflationary green shoots

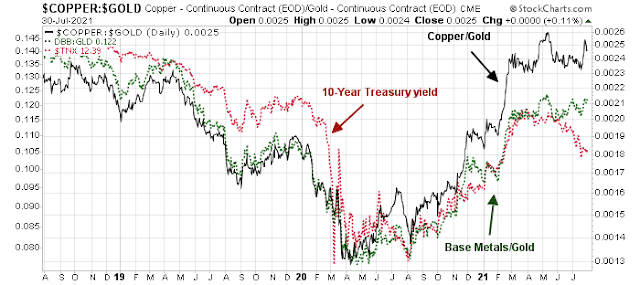

On the other hand, the cyclically sensitive copper/gold and base metals/gold ratios are strengthening. The 10-year Treasury yield normally tracks these ratios closely, but it remains depressed. Are these reflationary green shoots that investors should take notice of? What does this mean for the 10-year Treasury yield?

The rise in the copper/gold and base metals/gold ratios is surprising as it is occurring in the face of a rally in gold prices. The market interpreted the FOMC statement and Powell’s press conference comments as dovish. Real yields fell (and TIPs prices rose); the USD Index fell (bottom panel, inverted scale); and gold prices surged to test its 200 dma. This sort of market action is constructive in light of

Mark Hulbert‘s read of gold timer sentiment data, which is in the bottom 13-percentile and contrarian bullish.

A contrarian analysis of market-timer sentiment reaches a similar conclusion about the near-term outlook for both gold and stocks. The average recommended gold exposure level among short-term gold timers my firm monitors is currently lower than 87% of all daily readings since 2000. This indicates a considerable level of bearish sentiment on gold, which is bullish from a contrarian perspective.

Gold’s ability to regain the 200 dma would be a positive sign. If it holds the breakout in the coming days, it would be bullish for the yellow metal and a signal of the reflationary trade has regained the upper hand.

The Simone Biles job market?

Finally, keep an eye on the July Employment Report due out on Friday. Barron’s highlighted the problem of labor market shortages in this week’s issue, which is giving employees greater bargaining power.

The story isn’t just higher wages, but better working conditions. The employment situation is becoming a Simone Biles job market. For the uninitiated, Simone Biles is the most decorated gymnast in American history with a record haul of Olympic and World Championship medals to her name. She quit at the Tokyo Olympics just before a competition, citing mental health issues. A minor political controversy has erupted about her decision. When viewed through a labor market prism, the fundamental question becomes a worklife balance issue and how much mental health hardship individuals should endure for the sake of their employer.

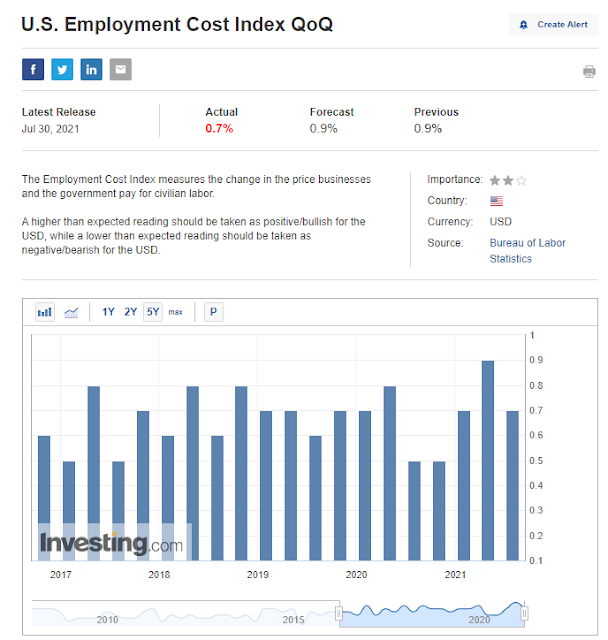

Friday’s release of the Employment Cost Index came in below expectations, which has dovish implications for Fed policy.

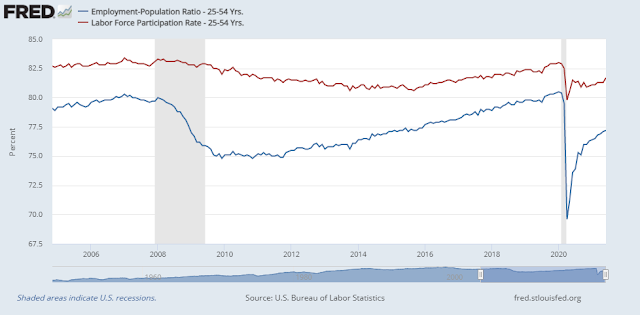

Keep an eye on prime-age EPOP and LFPR, wages, and other signs of tight labor markets in the July Jobs Report. This will affect the market’s view of the inflation outlook (see

How to engineer inflation) and be a driver of monetary policy.

Labor force participation has a lot of slack to catch up (see last graph). This would provide a powerful moderating influence on influence. Of course, if unemployment checks are sent to Americans, this will not happen.

I am surprised that you didn’t mention the new COVID outbreaks in Asia & the resultant supply chain bottlenecks that will lead to inflationary pressure . Although you discussed the delta variant in past issues and minimized its effects on the market, some of the news about delta over the weekend will add a market headwind. I see a choppy to down week at head.

Two big questions for me on Delta:

1) I’m vaccinated and thus not concerned about the worse case outcomes, but what I am concerned about is how many of the breakthrough cases will lead to long COVID?

2) I have kids under 12. If I can be vaccinated and infect them, that means I need to go back to Dec-Jan habits. When will they get vaccinated?

Both are curtailing plans for our family. We will not be traveling, not be eating out, not going indoor places, until the kids are vax’ed and we have more data.

It’s not March 2020, but I can see this repeating at some level in many households in the US, and likely will cool things a bit. How that translates to the market? I leave that to experts like Cam.

I’ll add that two weeks ago I was not concerned. Recent events have changed my perception of the current COVID risk level. I live in a county where 80% of 12+ are fully vaccinated.

I have been concerned about this for over a month and have modified our habits to lessen the chances of us being the conduits of infection for our five grandchildren. Activities are more than last year but mostly outdoors. If this is not under better control by late fall, it would have even more dampening affect. Many of our friends are thinking similarly.

Are more stimulus checks on the horizon to prop up asset prices?

I don’t think more checks are politically viable for the remainder of this year. More likely I think is more of the stick approach on vaccines, which we are already seeing. Those areas worse affected are the least likely to shut down.

As for stimulus in general, for now the accommodative Fed and upcoming infrastructure bill will buoy the markets I think.

Based on what we know from the internal memo at CDC + the data released by Israel, I would agree with the Israeli decision to offer a third vaccination to citizens older than age sixty.

When it comes to dealing with the unknown, we’re often left with making decisions based on our own best judgment. I agree with the lifestyle modifications made by Livewell and Ravindra. IMO, it’s just a matter of time before the US follows with its own booster recommendations.

After going through a super stock market bubble followed by an epic crash early in my investment advisor career, I have studied bubbles to participate in the runup and then avoid the nasty crashes. It is my specialty. I have missed all crashes in the last thirty plus years including exiting the market two business days after the February 2020 peak. I say this to establish some credibility about what I say about today’s environment.

We all sense that the Central Bankers and government fiscal overstimulation is heading us towards an asset bubble in stocks (and real estate). A bubble environment builds as markets hit new highs even as experts warn of dangers. Investors regret listening to experts because every time they sell, they have to rebuy at higher prices when danger signs recede. Eventually, they stop listening and just hold on. With little selling pressure, markets keep on going up and up.

If you look at a one year chart of the SPX, you see an incredible strong uptrend with brief and small corrections. Statistically, this is the strongest, longest Sharpe Ratio in history.

We have gone down the rabbit hole to a Wonderland of Fed guaranteed money trees. When we look at our old reliable risk indicators like RSI, high sentiment, yield curves, unemployment or anything else, down is up, up is up, and sideways is up. All roads lead to up when investors as a herd finally get the message that the overriding narrative is simply up.

Of course, this will not end well but the peaking process will not happen with the S&P 500 because of high valuation or high investor optimism. Those things don’t matter in a bubble Wonderland. They matter in your boring rational markets. What will end the party is the Fed taking away the punchbowl. But what I hear is Powell saying, “Hey guys, normally the party ends at midnight, but tonight we are going to keep the punch spiked and filled until everyone is super happy.”

China has taken away their punchbowl and you see a bear market starting. Powell has said specifically that the Fed is not even close to tightening.

Disregard what I say if you believe we are not heading into a bubble. Rational, normal indicators will work if that is the case. A contrary informed stance against the over-optimistic herd of amateur investors will win as it always has in normal markets.

But, if you believe as I do, that an irrational bubble environment is happening and will get more crazy, it’s best to go with the herd galloping joyously until you see the cliff’s edge to exit decisively. The trick is to understand what is happening and not get baffled by the new-age herd bubble logic. Their logic is that the Fed will never let the market’s fall and their proof it that the markets aren’t falling, so keep ”Diamond Hands’.

Thanks for another interesting post, Ken. I may only add that the Nikkei has failed to recover its 200day and the German Dax is underperforming the CAC40 in Europe, this indicates to me that there is indeed some worry about China. Just wondering how long US markets can continue to ignore this, but you may be right with your focus on the Fed. Just strange that the US Fed matters so much for US markets but the BoJ not nearly as much for their market.

i have paper hands!

I think the bubble just pops, then we look for explanations. We just don’t know when it pops. Credit spreads are a good warning signal, but they can be early. But if the spreads are grinding up, it’s time to beware. Right now we have a blip on the spread, keep watching it

China deserves some attention from investors. Early last week I was on Youtube watching Olympics swimming. A short clip was showing women’s 100m butterfly final competition, and then one Canadian swimmer won the gold in a nail biter. Cameras then focused on the winner whose last name is MacNeil. I thought the camera crews focused on wrong person. It’s got be a Scot or Scot-Irish. I checked again and still cannot believe my own eyes. Turns out this is a story of an abandoned Chinese infant girl adopted by a Canadian couple some 20 years ago. Although a small story, but through which we get see a very peculiar Chinese society. Never in human’s history exists such a large group of people whose collective behaviors are so hard to fathom.

China is now exactly a Potemkin Village. The support structure of its facade is being eroded bit by bit. The current path is on Cultural Revolution 2.0. It might completely collapse when least expected. What are the ramifications for the rest of the world? I hope it is not violent. And I hope our government has studied the various scenarios and mentally ready for it.

Wishful thinking about Chinese collapse. China has already taken over HK, and thumbed its nose at the CIA. Next pit stop is Taiwan. Just my 0.5 c the way I read the tea leaves (or interpret the dragon fire breath). Let us not judge China from Western centric perspectives (the Chinese have the same perspective of the West).

Totally agree. Our biases cloud our viewpoint.

So far, Covid cases are contained to a few parts of the US. I highly doubt if we get too much slow down, although we probably get a scary sell off that is much needed to get some sanity. Need a pause that refreshes (a 10-15% correction). Timing could not be better. August is usually not a very good month. Stay safe friends. Delta variant is very highly contagious.

https://www.nytimes.com/2021/07/31/us/covid-san-francisco-hospital-delta.html

We’ll probably begin to see more stories like this one, which will confirm the need for booster doses.

Followed through with the Israelis guidelines this morning.

My wife and I discussed the latest info available re the CDC/ Israeli data with our PCP, and he agreed that there was no reason NOT to seek a third dose. Our local pharmacy was OK with the rationale, and we were each given a third dose of the Pfizer-BioNTech vaccine.

What I see today is the same old same old – jack everything up at the open to bring in buyers, then sell them off into the close.

All of the usual suspects are selling off hard in the final minutes. Is it time to buy (again)? At some point, traders buying the close will get burned. Not necessarily saying that it applies here and now – but I’m going to pass on the trade today.

Media Release (as of 12 noon today):

Bay Area Health Officials Urge Immediate Vaccination and Issue Orders Requiring Use of Face Coverings Indoors to Prevent the Spread of COVID-19

Counties of Alameda, Contra Costa, Marin, San Francisco, San Mateo, Santa Clara, Sonoma, and the City of Berkeley Indoor Masking Orders Take Effect Tuesday

The orders require all individuals, regardless of vaccination status, to wear face coverings when indoors in public settings, with limited exceptions, starting at 12:01 a.m. on Tuesday, August 3rd.

Germany joins Israel in the booster camp.

https://www.marketwatch.com/story/germany-set-to-begin-vaccinating-teens-over-12-and-offering-covid-booster-shots-to-older-and-at-risk-people-01627934123?mod=mw_latestnews

https://www.reuters.com/business/healthcare-pharmaceuticals/delta-infections-among-vaccinated-likely-contagious-lambda-variant-shows-vaccine-2021-08-02/

A third dose may provide better protection against the Delta, but may also be relatively ineffective versus the Lambda.

Taking early swings at XLE/ KRE/ FXI/ BABA.

XLF/ PICK.

COIN.

JETS.

RIOT.

VTV.

Adding to all positions here.

If we fail to bounce here, it could turn ugly.

EWZ.

XLI.

Nice reversals.

All positions off here – target met for the day.

Anyone else sense a sharp decline in the offing?

Might happen when Lambda strain information gets out there. Currently in Peru and South America. It’s even more resistant to the vaccine.

Agreed. We’re a long way from winning the war against Covid – not so much because we don’t have the technology, but because homo sapiens are driven by human nature.

So much for my sixth sense.

Reopening a few positions in the premarket session. XLE/ XLF/ KRE/ JETS.

Adding to KRE/ XLE.

VTV/ XLI.

IJS.

IXC.

PICK.

Paring back on KRE.

All positions off. Mental stop for day trades comes down basically to if/when gains hit my daily target.

NIO/ PLTR/ QS.

All positions off.

Reopening positions in EWZ and GDX.

Opening a position in DIA.

Reopening XLI.

Reopening VTV.

Scaling back into KRE/ XLE.

Ditto for NIO/ QS/ PLTR.

Back into PICK.

VEU.

Here’s my take right now. The markets may hit new highs on Friday’s jobs report.

IXC.

PAVE.

IJS.

IWM.

XLF.

JETS.

I’ll go out on a limb and give 80/20 odds that the DJIA closes in the green.

Odds are now zero.

Holding all positions overnight.