Mid-week market update: It’s always difficult to make any kind of coherent market comment on FOMC meeting days. The market reaction can be wild and price moves can reverse themselves in the coming days.

Nevertheless, experienced investors understand that it’s not the announcement that matters, but the tone announcement compared to market expectations. Bloomberg Economics conducted a survey ahead of today’s FOMC meeting and found the following:

- FOMC will raise inflation, growth forecasts for 2021

- Forecasts to shift rate liftoff to 2023

- FOMC to signal bond taper at Jackson Hole in August

- Taper announcement in December

- Powell gets reappointed — Brainard is the next option

Here how the Fed decisions fared compared to Street expectations.

Market reaction

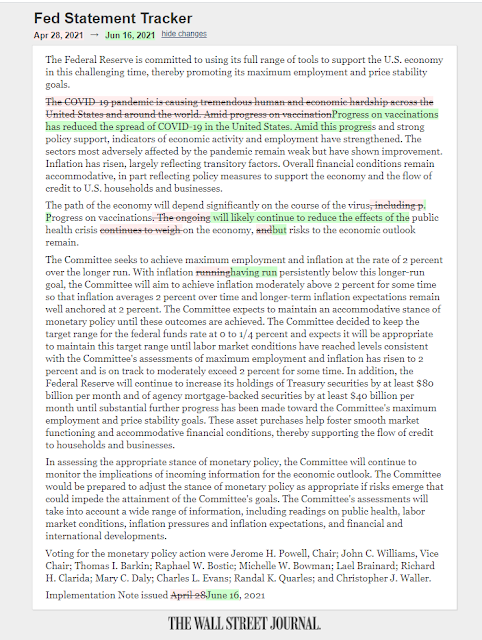

With that preface, the FOMC statement came in hot today by shading up the growth outlook.

The major changes were:

- 3.4% inflation in 2021 (previous forecast: 2.4%)

- Two rate hikes in 2023 (previous was no hikes)

- Unemployment 3.8% in 2022 (previously 3.9%)

The market`s reaction to the Fed meeting can be measured by changes in the Treasury yield curve. Since the short end is firmly anchored, that effectively means monitoring the behavior of the 10-year Treasury yield. A steepening yield curve (rising 10-year yield) translates to the expectation of tighter monetary policy, while a flattening curve indicates that the market believes the Fed isn’t moving in the near future. The 10-year Treasury yield recently broke technical support but it surged above the support-turned-resistance line after the FOMC meeting.

Ouch!

Stock market implications

Bespoke recently published a chart of how the S&P 500 performed on FOMC meeting days under different Fed Chairs since 1994. The track record under Powell is historically bearish, especially after the press conference.

While the stock market’s reaction was consistent with Bespoke’s historical experience, that’s not the point. The US equity market has become increasingly bifurcated between growth and value. Growth stocks, as measured by the NASDAQ 100, is more sensitive to falling rates than value names. Investors should be thinking about positioning in growth or value, rather than the S&P 500 because it is not a monolithic market.

Investors need to keep the bifurcated nature of the stock market in mind as the S&P 500 tries to hold its upside breakout while struggling with numerous negative divergences.

My base case scenario calls for a period of sideways consolidation. I expect that prices will have a flat to slightly negative bias while the market resolves its expectations of Fed policy.

One of the questions I am struggling with is ‘where are we in the business cycle’? An assessment of that would help shed light on capital allocation from a different perspective.

Great question. You seem to be “staying the course”. Can you please elaborate more on this? Thanks so much.

According to NBER, the last peak occurred in February 2020. The trough of economic cycle probably occurred in Spring of 2020. Are we now in expansion phase approaching ‘peak’ or we are at peak going into slower growth in coming months? As markets look ahead, it’s useful to get a feeling of where the economy is at present. Different views from different economists, as expected.

The implications are in shifting weights of the portfolio, on the margin.

I have a simple plan:

Core portfolio with a dividend income stream sleeve that stays pretty much the same. Beyond that, I have allocations to macro themes like 5G, Clean and renewable energy, BEV and AV, and hyper growth areas which are essentially more volatile but great compounders over 3-5 years. I had considered inflation hedges for the first time but decided not to.

Hope this is helpful.

It was very kind of Powell to remind us of the Fed “triple mandate” yesterday:

– Price stability

– Maximum sustainable employment

– Avoiding a “market reaction”

It is left to us to decide which one of those is the most important. I think it is time for the markets now to relax about inflation and say the Fed got it covered. They even talked about talk about tapering. What more can we expect? That’s as hawkish as it gets these days.

Closing TLT here.

Adding to VTV/ PICK/ GDX here. Conviction level isn’t high, however.

Closed TLT way too early.

Taking losses on GDX/ PICK/ VTV.

Taking gains on EEM/ FXI.

I think we may be seeing just the beginning of asset reallocations today – ones that may continue for some time. Just my opinion.

One scenario I’m leaning towards is the possibility that cash outperforms all other asset classes over the next few months.

Today is triple witch. Week after is usually bearish.

So why is TNX rallying after Fed meeting?

Cam’s base scenario has a target of SPX ~4057. So another -3% or so. For younger investors no big deal. For older folks nearing retirement a -5% decline packs a bigger punch. A year ago I managed my way through a -7% draw down- but that was in the context of global indexes recovering from a brutal -30%+ sell off. This year I’ll be exercising more patience.