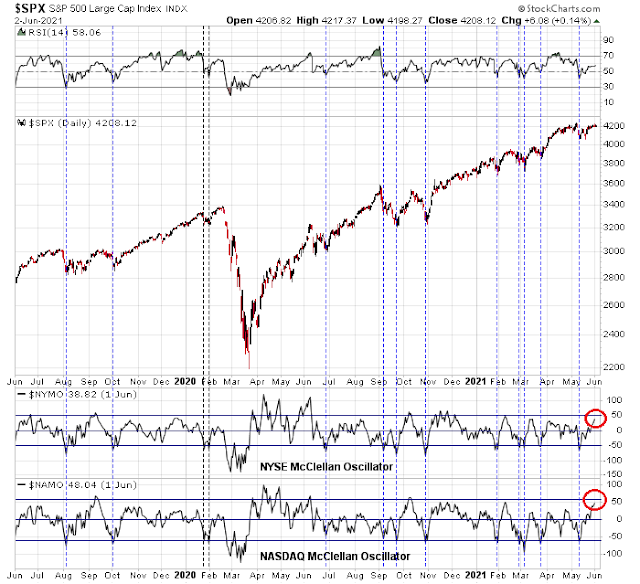

Mid-week market update: Even as the S&P 500 remains range-bound, market internals are constructive. I interpret these conditions to mean that the market can grind higher in the short-term, and the intermediate-term trend is still up.

Don’t short a dull market.

A risk appetite revival

A survey of risk appetite indicators reveals a revival. Regular readers will know that I am not a long-term bull on Bitcoin or any other cryptocurrencies (see Why you should and shouldn’t invest in Bitcoin). Nevertheless, there appears to be a lead-lag relationship between the relative performance of ARK Innovation ETF (ARKK) and Bitcoin. Tactically, this argues for a tactical revival in Animal Spirits, which can propel Bitcoin and other high-beta speculative issues higher.

I recently wrote about different pockets of investment opportunities around the world (see In search of global opportunities). I pointed out that Europe was enjoying a rebirth in relative strength. Ari Wald recently observed that Europe is staging an upside breakout from a 21-year base. That’s bullish in any chartist’s book.

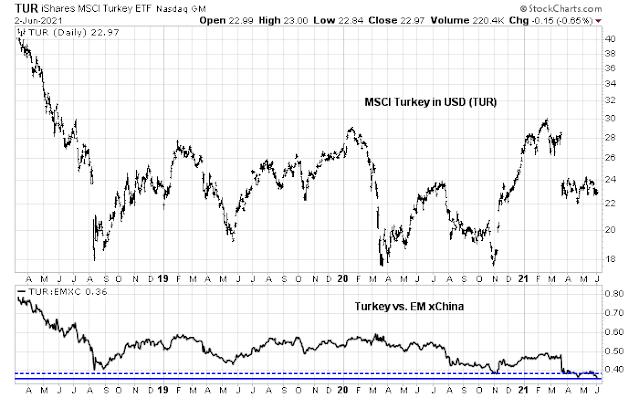

In addition, I had identified Turkish stocks as a wash-out emerging market opportunity. Another shoe dropped today. Turkish President Recep Tayyip Erdogan said in an interview on state television that it’s “imperative” that the central bank lowers interest rates, giving a vague reference to summer months as a target date. MSCI Turkey has barely reacted to the news.

You can tell a lot about market psychology by the way it reacts to the news. Speculative growth and cryptocurrencies are poised for a rebound, and value pockets of the market like Europe and Turkey are also performing well. In short, the stock market is firing on all cylinders.

Beware of the June swoon

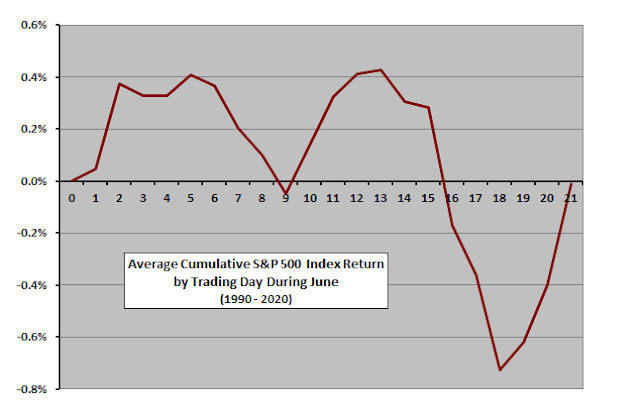

Before the bulls get overly excited, the S&P 500 is approaching a period of negative seasonality in late June.

This is consistent with the observation that both the NYSE and NASDAQ 100 McClellan Oscillators are approaching overbought levels.

My base case scenario calls for an S&P 500 rally in the next week to test or achieve new highs, followed by a late June swoon. Traders should start to position for a possible short-term top. Investors should regard any market weakness as a welcome pullback to add to positions.

Disclosure: Long SPXL

Vix up, dollar up and gold down.

May 30, 2021 at 5:32 am

As a professional trader I am getting a bit cautious here. The number of stocks above their 50 day moving average on the S&P 500 is diverging quite a bit:

http://www.indexindicators.com/charts/sp500-vs-sp100-stocks-above-50d-sma-params-6m-x-x-x/

There is possibility that there might be a short squeeze in the dollar and also VIX is extremely oversold. Both worrisome signs for Gold and the overall market.

That is a useful chart. Thanks for posting!

All positions moving against me this morning.

My approach when day trading is to take losses immediately.

1. TLT closed for a minor loss relative to Wednesday’s close – however, booking a minor gain on the trade.

2. TSLA closed for a -1.5% one-day loss.

3. QQQ closed for a -0.75% one-day loss.

Overall hit to the portfolio ~ -0.36%. It happens. All the time. The key (whenever possible) is never to allow a small loss transition into a larger one. I’m adding ‘whenever possible’ parenthetically because it was about a year that I got caught in a -7% downdraft – which also happens.

I actually think buying in the hole this morning is a decent trade. It’s just easier to navigate from a position of 100% cash.

Not that it really matters, but I like to be accurate. It was a -0.24% hit to the portfolio.

Does anyone care? Do you post your trades so we should follow you? In any case all the best wishes for your future trades. I am pretty much done posting my thoughts and comments.

Is there a relationship between your opinion re my posts and the fact that you’re ‘pretty much done posting [your] thoughts and comments?’

The world is full of different personalities and different approaches. Live and let live.

Taking swings @ QQQ/ SMH/ ARKK.

Out of all positions. That was basically enough to reverse opening losses.

I find all the opinions useful. I am not a professional and I am learning a lot with you all. Thanks!

Thanks, Alexander. All opinions, whether they support or contradict our own, are valuable and all of them inform my own trading.

Reflecting on Rajiv’s question, I developed the habit of posting trades in real time on Bill Cara’s blog in the early 2000s. A response to the common practice in that era (before Twitter) of traders posting only successful trades and only after the fact. How helpful is that? More helpful for instance to post in the heat of a decline, and often even more helpful to admit when we’re wrong and detailing where/when we decide to cut our losses.

This morning? I reopened all positions closed yesterday in the premarket session – QQQ/TLT/ TSLA + the usual suspects (NIO/QS/PLTR), and closed them all a few minutes ago. Is it more helpful to post the trades now? Or to have said nothing at all? I post daily updates underneath my first trade – if you’re not interested in hearing about them, it takes less than a second to scroll down to the next post.

I’m watching many of Cam’s scenarios play out in real time this morning. Outperformance by QQQ/ XLK relative to VTV/XLF, for instance. ARKK. TUR.

Also TLT.

In fact, I’m taking another swing at TLT here at the intraday high.

Taking partial gains on TLT end of day.