As the FOMC conducts its two-day meeting after its big reveal of its shift in monetary policy, Fed watcher Tim Duy thinks that we won’t get much more in the way of details from the Fed after this meeting:

The odds favor the Fed maintains the status quo at this week’s meeting. It does not appear to have a consensus on enhancing forward guidance nor do I suspect FOMC participants feel pressure to force a consensus on that topic just yet. The general improvement in the data likely removes that pressure. The Fed will likely remain content to use the new strategy as justification for maintaining the current near zero rate path. Powell will continue to lean heavily on downside risks to the economy to entrench expectations that the Fed will stick to that path. The dovish risk this week is that the Fed does surprise with either more specific guidance or an alteration of the asset purchase program to favor longer term bonds. I don’t see a lot of risk for a hawkish outcome unless it was something unintentional in the press conference.

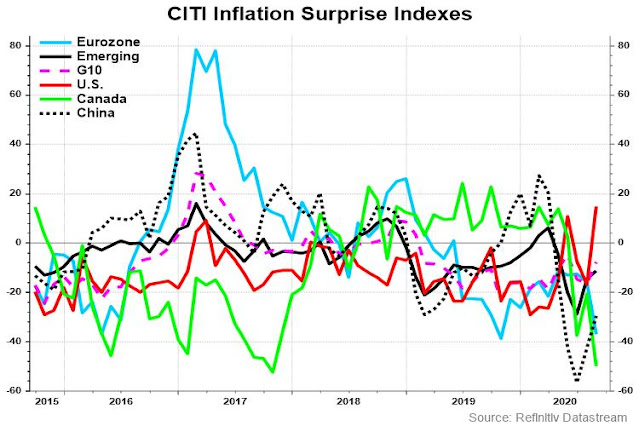

As the Citi Inflation Surprise Index edges up for the US, but remain muted for the other major regions, I have some important questions about the Fed’s new “average inflation target” policy.

Reported inflation or inflation expectations?

While other analysts are focused on the nuances of how the Fed is calculating its average, which admittedly is an important issue, I am more concerned about which inflation metric the Fed is targeting. It is mainly looking at reported inflation, in the form of core PCE and core CPI, or inflationary expectations?

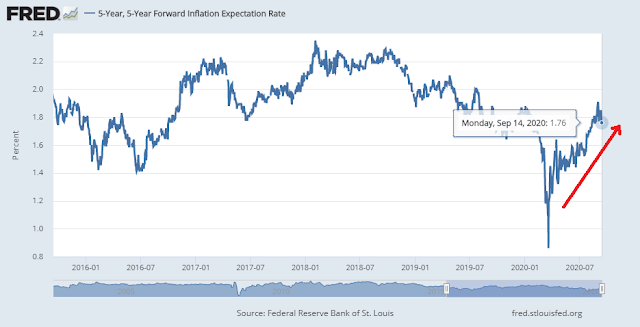

Consider how the 5×5 inflationary expectations indicator has recovered, and it is nearing the Fed’s 2% target. While I understand that the new policy is allowing inflation to overshoot its 2% target, how long will the Fed allow expectations to overshoot before they become unanchored?

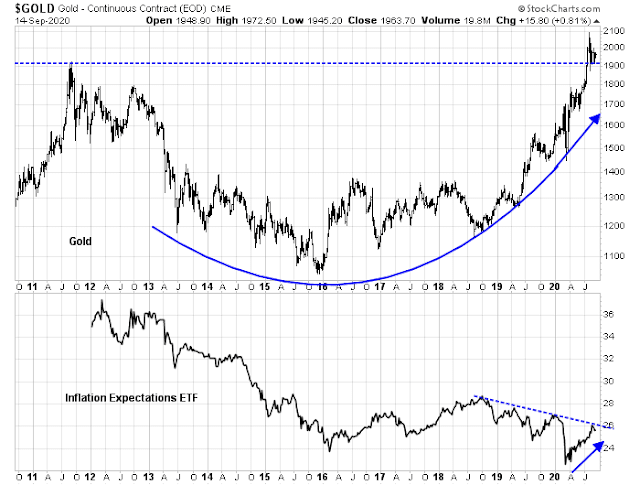

Gold is thought of as an inflation hedge, and gold prices have already staged an upside breakout to all-time highs. While bullion has pulled back to test its breakout level, further gains will create the risk of skyrocketing and “unanchored” inflation expectations. Keep an eye on the inflation expectations ETF (RINF), as it is testing a key falling trend line.

Should inflationary expectations start to rise, how will the Fed react to rising bond yields? Real rates are already negative, will the Fed engage in some form of yield curve control to suppress rates? We have already seen the effects of the ECB’s policy of financial repression has done to the European financial sector. Are these risks part of the reason why Warren Buffett lightened up on his banking sector positions?

These are all good questions that investors should ask of the Fed.

Remember the good ol’ days when the Fed didn’t tell you what they were going to do – they just did it? Then a month later you could read the minutes to find out what they were thinking last month.

Added a position in AMZN.

Completed a round-trip trade in TSLA.

Added to QQQ.

Adding to SPY + new position in IWM.

From SentimenTrader:

The Nasdaq finally sees a big positive breadth thrust

Leave it to this market to be as perverse as possible.

Just days after it became apparent that underlying momentum in the Nasdaq wasn’t just deteriorating but was turning negative, it has one of the most broadly positive days in months with more than 85% of volume on the exchange flowing into advancing stocks.

Remarkably, it had been more than 100 days since more than 85% of any day’s volume flowed into advancing stocks.

The worry over the past couple of months has been that breadth was turning questionable, with a huge number of extremely odd readings, and those have historically not turned out well. Combined with signs of astounding speculation and a neutral-at-best market environment, the risk/reward outlook was poor. If we start to see continued thrusts in some of these breadth figures, it would offset a lot of those oddities from August and make the idea of sustained gains more palatable.

Adding to AMZN.

https://www.yahoo.com/finance/news/dethroned-dollar-making-waves-across-120152785.html

1. Ken made a table thumping point that we are entering a new regime where the $ is trashed, and inflation kicks higher.

2. Inguinn, (sorry for the spelling of the handle) makes a good point, that this is not going to be your Daddy’s inflation, and I have no arguments against that. A mild uptick in inflation is usually not that bad, but it is unlikely to be the 70s type inflation.

3. That said, for longer term positioning, as Ken shared in the last few weeks, and the above article shows, non-US and non growth assets may be the place to be (EM, Value, Small caps, Commodities, gold and perhaps oil). Yes, I am aware, Ken is hiding in European assets.

4. Wally, yes, the Fed is just going “to do things”, like they did in the pre Voelcker era.

5. Watching gold and bonds today and next few days, to see how they react to FOMC segment today. Stocks usually follow later.

6. I can assure you the Mid West is locked and loaded, and will be heavily voting for DJT. Even rural Minnesota after Nixon is having second thoughts about Democrats (per NPR, last week!). If we get a divided Congress, we probably get more of the same. Such divided Congress, creates a gridlock which is usually good for stocks (no major policy changes). If Biden gets the White House, then it all falls on who controls the Senate. Please share your insights from the battle ground states.

7. I am still awaiting a October surprise. So far, everything is whisper quiet.

8. I still am searching for a trigger for stocks to correct and can find none.

Interesting thoughts D.V. I still think Biden fades. The key will be if he can debate Trump. So far he has shown that he can’t.

Today seems to be a news driven day. Vaccine news gave it a boost but we are still waiting on Powell. So, far the S&P has bounced off 3 daily fibs and gone through one without pause on the way up.

The current market reminds me of the last quarter of 2018. After a drip drip up and side ways market, we ended up with a 20% correction in the last three weeks of 2018 (it was not in October 2018). The reason for that mini correction was an attempted normalization of Fed funds rates (this is missing in 2020 and the Fed continues to be supportive).

That said, RxChen’s post above from Sentiment trader of a huge NAZ breadth thrust is scary.

The 35% correction of March 2020 could be seen as a retest of the December 2018 correction (I discussed this with Cam earlier in the year). That said, what is new in the current time frame is tepid earnings, and even worse earnings growth in US stocks. Fundamentally, I agree with Cam, of expensive valuations and have to remind myself not to get sucked into what probably is the last time to get off this bull market.

Bull markets have a devilish way to entice one into the market at the wrong time (yes, I hear you Ravindra, but historical evidence is against Ravindra’s conjecture).

Finally, because we do not have a way to treat Covid, there is going to be trepidation on the part of the public of getting vaccinated. Depending on the type of vaccine, one could get Covid infection from the vaccine, but there is no way to treat the damn thing. Who is going to volunteer for such a vaccine (without proof)? This is particularly true for senior citizens, who have a very high mortality if they get Covid (50% depending on age). So, how many senior citizens in their right mind will volunteer for a vaccine trial even if they have a small chance of getting Covid?

We could well be picking up pennies in front of a freight train here, as Cam says. Having lived through the last two major bear markets (year 2000 and 2007), I remain cautious that we may be creating a major double top here (around 3400). The Fed can provide liquidity support, but it cannot create demand.

https://www.yahoo.com/finance/news/super-rich-step-large-stock-160806514.html

The reason for that mini correction was an attempted normalization of Fed funds rates (this is missing in 2020 and the Fed continues to be supportive).

Exactly, D.V.!!

Not a good day for me. That’s the way it goes.

I don’t think we’ve seen the end of the bull move, but unless I see significant improvement on Thursday I’ll be trimming/closing positions.

RX, the market went back and forth from the high to the low and back five times today. The fact that the last of those moves was back to the low is disheartening. We’ll have to see how tomorrow morning fares after this craziness.

That’s a lot of misdirection, and for someone unable to follow the intraday action probably untradeable.

The market will show its true intentions soon enough.

If I had to take a hit – at least it wasn’t on the long bond! I would have lost twice as much holding RYGBX.