Regular readers will know that I have been cautious about the equity markets over the past few months. Good investors cannot be overly dogmatic, and in that spirit, I contemplate what the bull case may be,

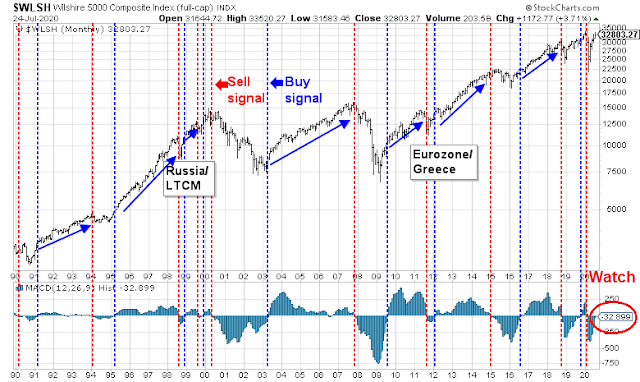

From a strictly technical perspective, price momentum has been strong. The Wilshire 5000 is on the verge of flash a monthly MACD buy signal, depending on what level the index closes at month-end. Past signals have usually seen the market rise strongly afterwards.

Let’s put on our rose-colored glasses, and consider all the elements of the bull case.

The V-shaped recovery

One of the puzzles of the recovery since the March bottom is the market’s ability to shrug off bad news. This is the worst recession since the Great Depression, but the market is behaving as if the economy executed a V-shaped recovery.

Joe Wiesenthal at Bloomberg solved the puzzle by pointing that both retail sales (yellow line) and wages plus unemployment insurance (green line) have recovered to above their pre-pandemic levels. These are clear V-shaped recoveries.

While many investors have pointed to the Fed supporting the market with a put, which is partially correct. Wiesenthal’s analysis shows that it has been fiscal policy that has been the real put option for the economy.

A cyclical recovery in 2021

In addition, there are reasons to be optimistic about the growth outlook. Viewed in the context of a V-shaped recovery, 2020 earnings are expected to be a disaster, but the market is looking ahead to 2021. FactSet reports that bottom-up derived 2021 earnings is 163.77, making the 2021 P/E 19.6, which is elevated but more reasonable.

Here are some factors that could further boost 2021 earnings, which makes valuation more attractive. First. we could see the widespread availability of a vaccine by mid-year. There are many groups racing to develop a vaccine. Several leading candidates are entering phase three trials while simultaneously setting up production. Should any of them be successful, we would see positive results by late 2020, initial availability in early 2021, and widespread availability by mid 2021. This would allow the world to start relaxing and start returning to normal by mid to late 2021. The markets would start to discount a cyclical rebound and rising earnings by Q4 or Q1.

As well, we can count on more fiscal stimulus after the election, no matter who wins. If Trump were to regain the White House, the most likely course of action is more deregulation and fiscal stimulus in the form of another tax cut. The 2017 tax cut provided a 7-9% one-time boost to earnings. Pencil something similar in for Trump’s second term. A Biden presidency would have different priorities, but expect more government spending in the form of infrastructure, green initiatives, and redistribution policies that boost middle and lower class spending. Both Trump and Biden are likely to be Modern Monetary Theory adherents, and both would spend (in different ways) with Fed support. The combination of easy fiscal and monetary policies are growth positive, regardless of the winner.

Across the Atlantic, we have already seen the EU’s €750 billion Recovery Fund. Without going into too many details, the EU has agreed to borrow up to €750 billion in the market, and disburse the funds to member states, partly as grants, and partly as loans. One often cited weakness of the euro common currency is it monetary integration without fiscal integration. The Recovery Fund represents a useful step towards fiscal integration, in the manner that the US federal government supports the activities of state and local governments with funds and services.

In short, the global economy is turning Japanese, but in a good Abenomics sort of way. Japan’s Prime Minister Abe outlined his “Three Arrows” strategy to revive the economy, and the playbook seems to be adopted in slightly different forms by countries around the world.

- Dramatic monetary easing;

- A “robust” fiscal policy, with particular focus on individual welfare, servicing the debt, and public works; and

- Policies to spur growth and private investment.

What about valuation?

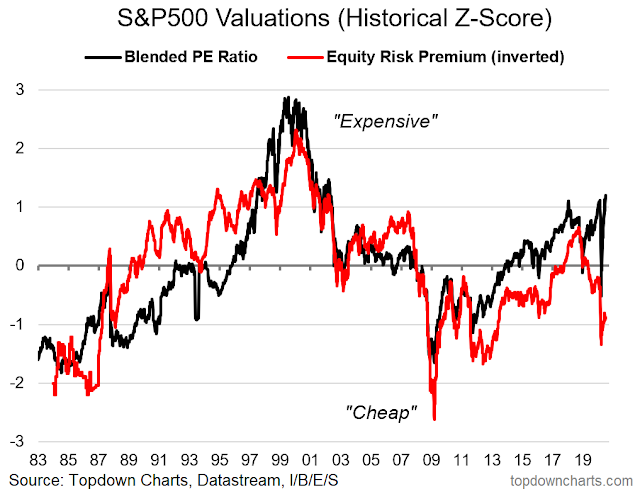

Still, isn’t the market expensive based on traditional valuation methods? Maybe not. Callum Thomas of Topdown Charts compared and contrasted the market’s forward P/E ratio to its equity risk premium (ERP), which compared the earnings to price ratio to prevailing interest rates. While the market appears expensive based on P/E, it is quite reasonably priced based on ERP.

Lisa Abramociz at Bloomberg pointed out that the size of negative yielding bonds has grown to levels last seen in early March. This is a sign that global central banks are pushing down rates and engaging in financial repression.

Real 10-year yields are negative. Under those circumstances, high P/E ratios can be justified in the face of low and negative real bond yields. TINA – There Is No Alternative to stocks.

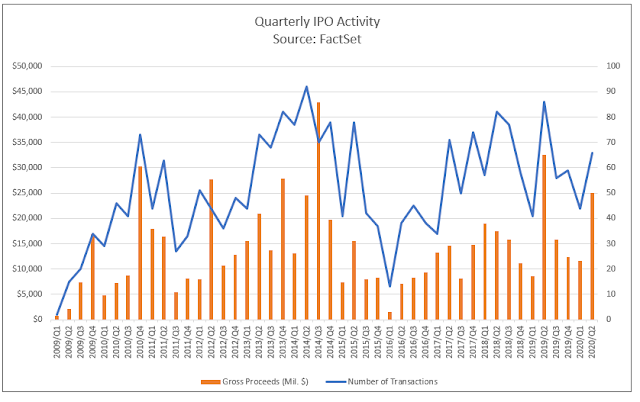

Another reason why equity prices might not be that expensive can be seen in issuer behavior. During the dot-com bubble, the cost of equity was low, and companies rushed to finance at the equity window. This time, we have seen a flood of borrowing, but not that much new supply of new equities. In fact, IPO activity is not that elevated by historical standards. This is an indication that companies that need funds do not find equity financing to be an extremely attractive option.

Stocks may not be that cheap, but they don’t look wildly expensive by these measures.

A healthy rotation

To be sure, there are pockets of froth in the market. Marketwatch reported that billionaire Mark Cuban was asked by his niece for stock tips, which is a sure sign of a bubbly market.

My 19 year-old niece is asking me what stocks [she] should invest in…Everybody’s a genius in a bull market and everybody’s making money now because you have the Fed put.

The NASDAQ 100 to S&P 500 ratio looks very extended. It has breached the Tech Bubble highs while exhibiting a 14-week RSI negative divergence, in the same way it did at the March 2000 high.

However, a recovery in the economy will allow a health rotation out of the NASDAQ leaders into value and cyclical names. The cyclically sensitive copper/gold and platinum/gold ratios are turning up, indicating that the recovery is broad based and global in nature.

The stock market can continue to advance under such a scenario.

The fine print

In summary, the bull case rests on the assumptions of a continued V-shaped cyclical recovery, supported by easy fiscal and monetary policy, the discovery of vaccines and treatments, and a mis-interpretation of P/E as a valuation metric. There are many moving parts to this scenario, and stocks can only advance based on a number of key assumptions.

One key assumption is the continuation of fiscal and monetary stimulus. While global central banks have signaled their willingness to be accommodative, the continuation of fiscal support in the US remains an open question. The $600 per week unemployment insurance benefits is set to expire at the end of July. The White House and Senate Republicans have not agreed on a common position, and the Republican and Democrat positions are far apart. As the analysis from Joe Wiesenthal pointed out, much of the V-shaped rebound is attributable to fiscal support. Consumer confidence is facing a cliff if lawmakers cannot come to an agreement. Moody’s recently issued a stark warning:

A reduction in federal support from current levels, which is likely, would constitute a financial shock for many households and businesses given still-high levels of unemployment and depressed economic activity

While we had our rose colored glasses on, we forgot about the possibility of tax increases should Biden win in November. Biden has vowed to unwind the some Trump 2017 corporate tax cuts, impose a corporate minimum tax, and proposed other investor unfriendly tax measures that are likely to compress P/E ratios.

Even if Trump were to win, the bullish scenario assumes that he does not escalate his trade wars with China, the EU, and other trading partners. Rising trade tensions would serve to dampen the global growth outlook, which also puts the V-shaped recovery into jeopardy.

The bullish scenario also assumes no vaccine development stumbles. While initial test results are promising, projecting the successful development of a vaccine at these early stages is like evaluating a promising eight yield-old dancer and thinking that she will become a successful ballerina. There are two leading vaccine candidates in the West. Based on what we know so far, the AstraZeneca-Oxford vaccine has shown itself to be protective in animal tests, but it does not prevent infection. The vaccine is likely to mitigate COVID-19 in inoculated patients, but the patients could still transmit the virus to others. As well, the vaccine needs to be injected in two stages, which creates challenges for production and deployment.

The Moderna vaccine is based on a totally news and unproven technology, which can make production difficult. In addition, the widespread insider selling of Moderna stock in the face of positive vaccine development news is disconcerting.

Any successful development of a vaccine will be too late if there is a COVID second wave in the fall. A second wave of infection would once again crater the economy, which would mean a double-dip recession. Say goodbye to the V.

As for the question of valuation, the TINA narrative of equities competing with bonds at negative real yields makes logical sense. However, investors have yet been able to explain the spread in valuation between US and non-US equities.

The BoA Global Fund Manager Survey shows that managers have piled into US equities, and FANG+ stocks in particular, as the last source of growth in a growth starved world. A rotation out of the high flying NASDAQ names into cyclical stocks is likely to see rotation out of US into other regions. US stocks would lag and may see limited upside under such a scenario.

Remember Bob Farrell’s Rule #4, “Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways.” Each decade seems to experience a mania of some sort, and we are very late in the latest FANG+ mania. If and when it deflates, is it reasonable to expect cyclical stocks, value stocks, and non-US stocks can pick up the slack?

Finally, while the pending monthly MACD buy signal is a constructive development, the buy signal can be negated by a negative RSI divergence. A negative RSI divergence is only triggered if the MACD model is on a buy signal, and the index breaks or tests a previous high while the 14-month RSI makes a lower high. This model flashed a sell signal in August 2018, just ahead of the late 2018 top (see Market top ahead? My inner trader turns cautious). If the Wilshire 5000 were to flash a monthly MACD buy signal at the end of July, and if it were to test the old highs in August, there is a strong possibility that the market would then exhibit a similar sell signal. This is something to keep an eye on.

In short, while the bull case does make some sense, but much has to go right before the market can blast off into a renewed bull phase.

Thanks, Cam. The bull case nicely summarized. As usual, you do a great job assimilating all of the supporting data/ opinions out there, and then tying it all together.

“With emergency unemployment benefits ending this week, and the Senate not even having presented a proposal for a continuation, I expect a poor reaction on the order of the January 2019 government shutdown.”

https://seekingalpha.com/article/4360774-weekly-high-frequency-indicators-no-weekly-change-emergency-unemployment-benefits-end

Thanks for posting this, Min.

Two more interesting observations from the article above:

The nowcast remains negative. The short-term forecast remains positive. The long-term forecast continues to be very positive.

I am increasingly convinced that US stock prices are reacting to the fact that the large majority of industrialized countries outside the US have contained the virus.

The chart above shows incomes up and they were up 12% to the end of May. But the wages part of incomes was down 17% because of massive layoffs. Enhanced unemployment benefits and the $1200 helicopter money was the difference to take incomes ABOVE pre-pandemic levels. Roll that around in your brain. It was an amazing government response and it happened very quickly.

Jamie Dimon, said this, “In a normal recession unemployment goes up, delinquencies go up, charge-offs go up, home prices go down; none of that’s true here,” Dimon said. “Savings are up, incomes are up, home prices are up. So you will see the effect of this recession; you’re just not going to see it right away because of all the stimulus.”

So the normal evolution of a recession has been upended. This time the heartache will happen later when the very expensive fiscal support ends. The extent of the future problem will depend on the ongoing new normal of consumer spending and the number of jobs that have been permanently lost.

If the economy is stumbling when extreme stimulus ends, that will be a time that trade wars and the anti-globalization takes hold, causing further problems. It will also lead to social unrest.

This week I listened to Denise Chisholm, Fidelity Asset Allocation Strategist. She is brilliant and has been very right. She is bullish because historically from the depths of a recession earning recovery to the cyclical companies broadens out and therefore the fundamentals will catch up to the stock prices. She isn’t worried about valuation now.

But Jamie Dimon also said this, “The word unprecedented is rarely used properly,” Dimon said this week after JPMorgan reported second-quarter earnings. “This time, it’s being used properly. It’s unprecedented what’s going on around the world, and obviously Covid itself is a main attribute.”

So maybe the Denise’s historical precedents might not be valid if given the extreme early stimulus that must be withdrawn later upends the normal sequence of fundamental recovery.

This might be upon us this week if the two houses of government can’t agree on continuing the CARES act.

Right. So Denise Chisholm is viewing the aftermath of an unprecendented event through the lens of history – perhaps a costly mistake in the context of an event that will add an interesting chapter to future history books.

Let’s not forget that a Biden Presidency would not only increase taxes on the middle class and up but we would see a 1) Job killing redistribution of wealth to non-workers, 2) Massive rush of government money into wasteful green companies, 3) A resumption of the profit killing regulations that Obama championed and, most likely, 4) A resumption of the unleashed China expansion into the South China Sea and the Pacific and further Communist China expansion and 5) The weak opposition of growth and U.S. counter to the China military and regrowth of their technology stealing ways from the U.S..

I disagree. This is fox fud.

Politics aside, proposed policy prescriptions are:

1. Higher corporate taxes

2. Higher individual taxes, possibly eliminate capital gains rules

3. Increased social spending (investments)

4. Increased healthcare spending

5. Clean Energy spending

6. Reduced Defense spending

7. Increase in regulations

8. Less confrontational foreign policy

9. Change in how senate is run ( no 60 vote threshold) for many actions

10. Change in Supreme Court structure

11. No real reform of education system, so far

Whether these changes help all of America in the long run is the real debate.

(I don’t watch FOX, MSNBC or their ilk).

I forgot about the proposed change of capital gains taxation to ordinary income and Numbers 9 and 10. But I was just trying to cover obvious changes that Cam missed in his newsletter above.

I’ve constructed an equal weight index of key growth stocks (I call the Gorilla Index) plus a S&P 493 Index with these stocks removed from the 500. Here it is;

https://tmsnrt.rs/3hrH49s

There is a recent double top and then a failure breaking below a recent low. Note, neither the S&P 500 or S&P 493 are showing this topping structure.

To reverse this topping the Gorilla index must hit new highs.

James Stack of Investech a great strategist who I’ve followed for thirty years constructed a similar index in 2000 to show the Dot.com bubble bursting. He also did the same with a real estate Gorilla Index in 2007 to witness that market peak and its bubble unwind. He recently did the same with today’s popular growth stocks. He didn’t name the components so I chose my own and constructed the indexes myself.

I’m not saying, the tech bubble is bursting but just saying this index and its relative path compared to non-FAANG+ stocks will give us a clue as to what’s happening. Just watching the S&P 500 keeps the dynamics hidden.

Keep the link as the chart is dynamically linked and updates nightly.

If we do have an unwinding of the Gorillas, it will be very confusing to investors, not unlike the confusion today where the Gorillas have the index much higher than how the economy is performing. We could see a recovery in the S&P 493 as the economy recovers while the Gorilla Index bubble is unwinding taking the overall S&P 500 down.

I saw something similar today in Mauldin. Synchronicity?

I used to think it just depends on where the money goes, which is why TA has it’s merits aside from fundamentals, I still do of course, but I wonder if at the heart of a bubble is a loss of price discovery. Is there a metric for that, other than insane price to sales, or price to earnings or whatever.

When there has been massive QE, negative interest rates, how can anyone figure out what is reasonable?

Something will eventually break.

But are we entering the endgame of a giant debt/credit cycle? Is this why price discovery is off?

Keeping the link on gorilla and I tried to contact you without luck, I had a question.

I’m at ken.macneal@tacticalfactorresearch.com

Love to hear from you or anyone.

https://twitter.com/Callum_Thomas/status/1287144608972054529

Thanks for sharing your work, Ken.

Is there a fund that invests in the S&P 493?

Might an equal-weight SPX (eg, RSP) be the next-best option?

Yes equal weight is extremely close

Thank you Cam for your excellent analysis as always. Seems like the fiscal stimulus bill in Congress will be a strong determinative factor in where we go in the short term. I’ve read that McConnell and GOP senators are very unlikely to approve the extra $600/ week. What do you think the effect would be of stimulus at a lower level, ie $300/ week for example?

I should clarify I am referring to the additional federal unemployment benefits of $600/ week. Seems like they will settle on something higher than $0 but lower than $600/ week.

Last proposal I heard was $400 per month, which is $100 per week, but to send out one-time $1200 payments. That’s not going to be very stimulative, and it will send the economy over a cliff in August.

There will likely be a rescue package of some sort once all the bickering is over. It just depends on the timing, and how much there is available and what the design is.

Here in Canada, the government is paying 75% of people’s wages up to a ceiling if the company suffered a 30% loss of revenue. The UK designed a similar rescue plan by offering to shoulder a portion of corporate payrolls. To me, that makes more sense to just blindly sending out money to people, which can distort the labor market.

They’ve missed the deadline for states to re-program their computers for a new package. The eviction moratorium is coming. It could be chaose.

Thanks! Yes, the Canada model allowed you all to crush the virus more effectively because people stayed home when they needed to at the very beginning of the outbreak. Sounds like the fiscal cliff will likely hit in early August when people realize the $600/ week is not coming back. Thank you.

The EU monetary and political integration should be seen as a positive. There has been a huge trepidation in believing that the EU union will survive, but that may fade away. That said, demographics and very high taxation and slow growth are against the EU. Zombie European banks are also an indicator of the general lack of decisive action on the European banking front (unlike the US). Euro stocks may rise slowly, but likely will face a plateauing (see VGK, last decade chart).

I remain very concerned about vaccine development. Historically vaccines do not get developed in matter of months but years. Perhaps, this time may be different (!).

Historically, since 1928, Democratic Presidents have delivered 13.3% annualized returns, with Republican Presidents only 7.7%. This is despite all the tax (and spend) policies the Democrats are famous for.

D.V. I think it is BECAUSE of the ‘spend’ policies of the Democrats. Historically when the Republicans get in they face the prospect of inflation from all the spending and feel the need to trim back the spending to get a handle on inflation which slows growth for a while.

Wally,

I guess you can look at ‘Spend’ policies of Democrats as, “You gotta spend money to make money.” We can’t all be squirrels all the time and hope the others spend but we don’t have too. Also to create demand sometimes you need to have the other side be able to afford the stuff you are selling. Ford figured that out 120 yrs ago. He paid his employees well, so they could buy his cars. A self-perpetuating loop.

I don’t understand why today’s business owners cannot see that. I try to “create wealth” in my local area by paying my employees pretty well compared to my competitors, which in turn gets me better employees with more productivity. While everyone is complaining about their employees, mine are performing and working without any complaints, through the Covid-19 Pandemic/Hoax.

Also, I believe Inflation, of course Not out of control inflation, helps create “wealth” by making your old loan amounts less today then they were yesterday. Which should, if the jobs were paying based on inflation, in all sectors not just in I.T., would have created a lot more buying power for today’s workers/consumers.

Again, not a political agenda, but looking at things logically and from a different perspective.

Some types of Spending is Good, i.e. give money to people and they will spend it, give them better paying jobs by doing Infrastructure projects, and they will spend it.

This is just my perspective, you WILL have yours.

I noticed this when comparing inflation rates from capitalistcreations.com

“When you compare the inflation rate side by side, during the Clean Sweep years for both parties, all the liberal fairy tales come crashing down. It turns out that the average inflation rate during a Clean Sweep, meaning a single party control of the White House, Senate and Congress, is grossly higher when it’s a Democratic Clean Sweep as opposed to a Republican one. The average annual inflation rate during a Republican Clean Sweep is 0.55%. The average annual inflation rate for a Democrat Clean Sweep, 5.8%.”

Wally

I agree with you. There is a “redistribution of wealth” effect with Democratic “clean sweep” that has been at work with the stock market performance.

I’m sorry, D.V. I sometimes forget that I’m not posting about Fox News articles where it is a big free for all. LOL

I’ll shut up again unless I run across something relevant to the stock market.

But for the first time since following Cam I feel like I don’t have a handle on where stocks are going in the intermediate term.

The perfect storm:

1. I remain circumspect of a quick vaccine development.

2. I am also quite worried that once schools open late August and early September, asymptomatic transmission from children back into the community will start causing huge number of cases.

3. Flu season should start in earnest around September.

I do not have a crystal ball any better than anyone else, but wonder, in my idle musing if we are leading into a correction in Q4 2020 and final bottom in March 2021. This pattern was seen both in 2003 and 2009, FWIW (if analogue comparisons carry any validity).

We are running into August now, which is not exactly a strong month, usually, September being historically weak as well.

I am sure the US Congress will come through with a stimulus, may be delayed till after August month long recess.

Thanks! Good insights and reasonable predictions.

https://www.cdc.gov/flu/weekly/flusight/index.html

RX I used to worry about getting a bad case of the flu at my age with chronic conditions. I can remember once in my early 40’s catching a flu that put me in bed for about a week with constant aches and severe head aches. That was the worst I have ever had the flu. I make sure I get a flu shot every year now.

But, now it isn’t the flu that concerns me.