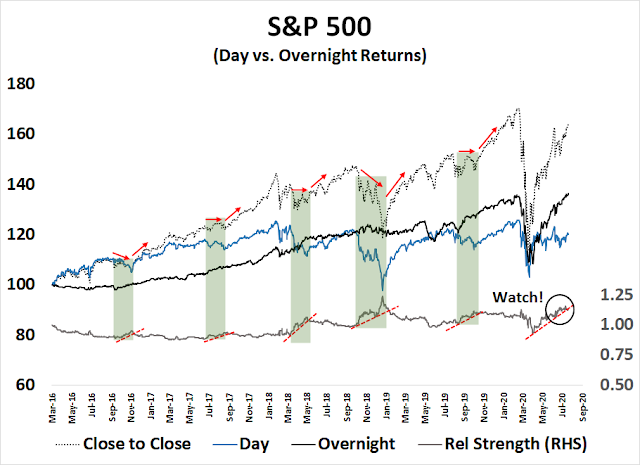

Mid-week market update:I observed in the past that the market had undergone a regime shift, and most of the gains were occurring overnight, while prices were lagging during daylight hours (see My inner trader returns to the drawing board). This is an indication of a jittery market sensitive to headlines that were released after the market close. In the past, past breaks of the overnight to daylight return ratio marked a change in market direction.

As the chart below shows, the overnight to daylight ratio is testing a key rising trend line and it may be on the verge of breaking down through the uptrend. While I am not ready to definitively declare a break, there are signs of unusual market behavior that suggest a phase shift is under way.

Unusual response to news

You can tell a lot about market psychology when it responds to news. Over the weekend, the European Union agreed to a €750bn Recovery Fund after a marathon summit. Former ECB vice president Vitor Constâncio described in superlative terms as historic, unprecedented, and essential. One of the weaknesses of the euro common currency was monetary integration without fiscal integration. While is is not perfect, this Recovery Fund is the first step towards EU fiscal integration, which is extremely positive news for the European Project.

This was very good news, but the market reaction was disappointing. The Euro STOXX 50 roared upwards out of the gate on Tuesday morning after the announcement, but it slowly weakened over the day and traded sideways Wednesday. The euro exchange rate did a bit better. It rallied strongly on Tuesday, but retraced some of its gains Wednesday.

Market indecision

The market’s reaction to the good news from Europe could be seen as a sign of a lack of risk appetite, which is bearish. However, other market reactions were confusing, which I interpret as signs of indecision.

As an example, the news that the State Department ordered China to close its Houston consulate in 72 hours was a shocker, and a sign of deteriorating Sino-American relations. The Chinese yuan weakened in response, the Hang Seng closed poorly, and overnight ES futures sold off. But the US stock market shrugged off the news to open in the green.

Today, we have the following seemingly contradictory cross-asset market signals:

- Stocks up (risk on)

- Bond prices up, and the 10-year Treasury yield testing a keys support level (risk off)

- Gold up (usually risk off)

- USD down (risk on and supportive of EM assets)

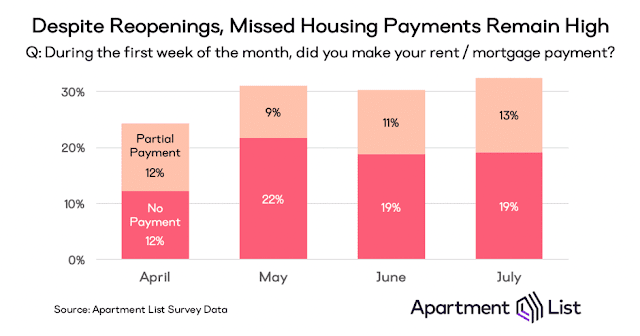

I outlined how the US is facing an economy cliff as the CARES Act stimulus expires at the end of July, and the deadline for states to re-program their computers for any new payment schemes is July 25 (see Earnings Monitor: Waiting for Congress). The situation looks dire, with eviction moratoriums expiring, a survey by Apartment List revealed that 32% of American households missed their July housing payments.

While I have no doubt that lawmakers understand the gravity of the situation and both sides of the aisle are working diligently to come to an agreement on a rescue package, time is not on their side. The White House and Republican Senators cannot even come to an agreement. CNBC reported that Republican House leader believes that legislation will not be forthcoming until early August, which is after the deadline expires.

The top Democrat and Republican in the House cast doubt Tuesday on whether Congress can pass a coronavirus relief bill in time to avoid disrupting a key financial lifeline.

“I envision that this bill doesn’t get done by the end of July,” House Minority Leader Kevin McCarthy, R-Calif., told CNBC’s “Squawk Box.” He said he expects Congress to approve legislation “probably in the first week of August.”

If lawmakers cannot pass a plan by the end of the month, a $600 per week federal unemployment insurance benefit buoying millions of Americans will at least temporarily expire. The GOP wants to change the policy or reduce the sum, while Democrats hope to extend the assistance as the unemployment rate stands above 11%.

In light of the high level of event risk, and indecisive market action, my inner trader has opted to stand aside. Do all the technical and sentiment analysis that you want, but there is a high risk that unexpected headlines can sideswipe a trading position.

Elon comes through.

A P/E of only 800! Wow! Is this Amazon all over again?

Ooops. Make that 100 if it is reproducible.

The ‘P’ always leads the ‘E.’ By the time earnings catch up, it’s usually too late to buy the stock.

Which leads me to wonder whether the market is correctly pricing in that no one is able to ‘see?’

(a) This is not the dot-com bubble. For the most part, the market is comprised of solid companies – ones which will take a temporary earnings hit due to the effects of a shutdown which will come to an end at some point. Sure, there will be a few companies which see permanent impairment to earnings – but only if they fail to find innovative solutions and/or make changes to their business models. In addition, when buying the indexes the hope is that earnings shortfalls in one company/sector may be partly or wholly offset by earnings windfalls in another.

(b) There’s a great deal of money being pumped into global economies by central banks. More than we’ve ever experienced. Perhaps there are consequences we have yet to fully comprehend – perhaps we underestimate the effect on the markets.

(c) Don’t fight the Fed. Bear markets tend to occur during tightening cycles. We’re currently experiencing the polar opposite. It begins to sound trite (don’t fight the Fed) after seeing the phrase in print so many times – but that doesn’t alter its importance. May as well be swimming against a riptide.

I don’t think the market reflects reality any more, probably because of the popularity of passive investing. Some weeks ago I was looking for a likely short and thought of AMD, the longtime Intel rival.

Sure enough it still has plenty of debt, but when I quickly checked the P/E it was 143. Right away I discarded the idea of a short sale, thankful that I had not discovered it when it was only 85.

The efficient market hypothesis may be dead.

Tesla is fortunate isasmuch as the market is willing and able to finance its negative cash flow. If we had a credit crunch, they would be toast.

Same cannot be said for wework or uber.

There must be other (X-factors) that drives TLSA

EU Recovery Fund likely puts restrictions on businesses ability to restructure and become more competitive. On the contrary, it likely ties their hand behind their backs. Negative interest rates are a millstone around bank’s necks. A stronger Euro doesn’t help them either. How would their economies grow?

American politicians know that they have to face their constituents in a few weeks. They will not go home without passing another stimulus bill. By now, we know the drill in Washington.

The missed payments-I wonder if many people have just put the stimulus payments in the bank but when chips are down, will make the payment. Otherwise based on the data above, about a third of apartment dwellers will be on the street. Hard to imagine such a scenario.

The risk/ reward for staying in the market is less appealing going forward except in reopening themes.

Before you impose your personal prejudices on Europeans, please read the details of the Recovery Fund. It allows the EU to support member states, in the manner that the US federal government is allowed to support state and local governments.

https://www.ft.com/content/2b69c9c4-2ea4-4635-9d8a-1b67852c0322

Personally, anything the EU tries to support their union is good by me. If it helps the aggregate they should do as they think best. It took two world wars on their soil to give them the motivation and political will. How things will affect business, I have no idea, but my belief is that it is energetic innovators who have raised our standard of living. We are lucky because for some reason there are a lot in the USA, and hopefully they will be allowed to continue. So, for Europe hopefully their innovators will be supported

After reading the FT article, I am more concerned than I was before. So many political bodies involved and power play by EU commission. It will take 2-3 years for all funding to get out if someone does not object.

I love Europe – just not their economic recovery prospects. I hope I am wrong.

They will do something. This is an election year to boot.

What I wonder about is when the silence on covid will end, or am I just not seeing it?

Call it a frankenvirus and maybe that is why there was such a global reaction to it. French virologist Dr. Montagnier (Nobel prize in 2008 for his work on HIV) makes no bones about this being genetically engineered. He even predicts that nature will kick out the implanted dna because it does not belong, only many will die before that happens, I dunno definitely above my expertise)

I get why Trump is silent. In 2014 the Obama administration put a moratorium on Gain of Function experiments because of security breaches at the level 4 containment centers. In 2017 the moratorium was lifted.

So are the Dems waiting till we are closer to the election?

Dr.Fauci (always makes me think of Faust in my synchronicity moments) was involved in the work being done at Wuhan. Maybe they are all trying to keep a lid on things.

So label me a conspiracy guy, but the silence is eerie.

Talking about viruses and vaccines, there is a lot I question. Remember the measles outbreaks and they got on the case of the anti-vaccine cohort? Well, if the measles was only among those who did not take the vaccine, was that not their choice? If many of the cases involved those who had been vaccinated, how good are those vaccines? If they are not that great, then why kick up a fuss over those who don’t want the vaccine? Something here does not fit….someone has an agenda or a bias or an obsession, I dunno.

When I was young I was vaccinated for polio, diphtheria ,tetanus, smallpox (which of course is probably being played with in labs around the world, and wait till that augmented one gets out) and had BCG….none of which I regret having, and would take again .

Anyways, my prediction is that at some point the lid will come off this covid thing, fingers will point….will the market shrug? Dunno

“French virologist Dr. Montagnier (Nobel prize in 2008 for his work on HIV) makes no bones about this being genetically engineered.”

Thanks for this. First virologist I’ve seen saying this. And YES! You’d think this would be important! Just weird the silence. The furin cleavage site with no ancestral line but an obvious gain of junction experiment design.

Chris Martinson has gone through this on youtube in some detail. Also Bret Weinstein.

Maybe the press should start reporting the truth about the coronavirus.

https://issuesinsights.com/2020/07/22/the-big-surge-in-coronavirus-deaths-is-a-media-fed-myth/

My wife has her office on a covid ward…for the last few days they have been airlifting people to LA because ICU beds are full, converted wards for covid patients are full. People dying every day, some are young.

Emergency is packed but no beds….this is no flu season.

This is real, but it’s weird how it kills some and others get next to nothing.

I have a friend who directs an HIV clinic in NYC for over 30 years. When NYC was deluged and they were putting the bodies in refrigerated trucks because everything was overloaded he said “This shit is real!”

This coming from a guy who treated AIDS patients in the 80s and 90s when they just basically died because they did not have the drugs we have.

Covid is real, you may not want to believe it….confirmation bias…or its evil twin…negation bias…

I don’t know why this kind of press gets out…somebody has some kind of agenda.

I’m hoping the surge of new cases is over in Bakersfield, but there is a lag between the new cases and then the hospitalizations and deaths, so my wife will be stressed for a while yet.

That a surge in new cases has preceded deaths by a few weeks supports the thesis. Kinda like cause and effect.

Right now the market is nose diving….I don’t know why..maybe some news?

Of course covid is real but the death rate is not being reported honestly. It seems treatments are getting better including use of the asthma respiratory medications with the use of a nebulizer and the study that proved hydrocloroquin saves lives if treatment is begun soon enough. Lives are being saved and the death rates reported in the press are mostly sensationalism.

The fact that the article uses the stats from state health departments and the CDC show that the false death rate reporting is a real problem that the press and the left needs to resolve if they are to have any credibility on the subject.

Just because a person doesn’t die from the disease doesn’t diminish the suffering people may endure after recovery. For the unlucky, the disease has lasting effects such as permanent reduced lung capacity and brain damage.

https://www.bbc.com/future/article/20200622-the-long-term-effects-of-covid-19-infection

Why do you have a problem with the facts that I am talking about that the death rate is not what is being reported? The spikes reported don’t exist.

Sure people suffer when they get sick. And sure people can have lasting effects after suffering from a disease. But that has NOTHING to do with what I am saying or the article I referenced is about nor denies.

I don’t think the death rate is accurate either (and neither are the numbers for infected people), but the number of people that require hospitalization due to the infection and symptoms is rising quickly in a number of cities. Its at a point that hospitals cannot operate effectively to treat patients in cities near my locale.

The website you got the article from is filled with bizarre propaganda and nonsense through and through. The reporting of the dead is not some weird ‘leftist’ conspiracy to make things look worse than they are to hurt the ‘right’. What a waste of time to even entertain what I saw there with a quick scan, but just in general – any imperfection in the minutia of how and when the deaths are reported doesn’t somehow mean there isn’t an incomprehensible level of death and misery that has been unleashed across the US. When we tally the dead and maimed after the dust settles on this someday, and we can really analyze the excess death and disability rate, I am sure we will find the reported numbers, as horrible as they are right now, will end up being actually ‘lower’ than the true death rate. The ‘fact’ that the reported spikes ‘don’t exist’ really doesn’t mean much to me when there are 146k actual reported dead (and climbing). The number is so incomprehensibly large that there is no way that reporting could be ‘overstated’. Every headline about the virus could start with “MoRe DeAd NoW ThAn DiEd iN WWI in ToTaL” and it still wouldn’t capture the actual horror of what is happening. And for the love of all that is rationale, that site is just awful. As objectively and respectfully as I can try to state this, it can’t be healthy to consume that content.

Hopefully the pause that refreshes.

Miller time.

Energy, financials, industrials and China outperformed.

The rebalance continues.

https://www.yahoo.com/news/threw-everything-coronavirus-patient-leaves-190109203.html

This guy was sick, with a big S, but he made it. Moral of the story: Please, if you are sick, in ICU, and have a breathing tube, trust American Medicine. US physicians and nurses will do everything possible to save your life. Period. Let us all pray and hope we can keep politics/politicians out of this.

FWIW, stock market remains highly dependent on vaccine development and also a drug that helps recover from the infection. So far, nothing is available.

The hospital that saved Miracle Larry’s life made a uuuuuge loss on his care, but saved his life. I shall let the readers decide if they would like to vote for a socialized health care where pooled capital pays to save your life or an insurance company makes that decision for you, based on your “label” of where you are on the $ chain (of premiums).

As far as the stock market goes, Cam our master is right, market is expensive and dependent on more morphia of stimulus. I am on record for 50 Trillion $ of money printing. Gold may well approach 5 K by then. Take your pick. McDonalds, Pizza Hut, Coke, P&G, Starbux, MSFT, AMZN, Constellation Brands and TSLA may still be there, but you may pay 10$ for a standard coffee @ Starbux, 15 $ for a Big Mac and 200$ for Johnnie Walker Black label.

$ index is 94.xy. I suppose 85-90 on the DXY is floor. Once it is below 85, things start to look dismal. Even at 94.xy, it is a very very rapid collapse of the $ index.

Inflation may well be in the pipeline at some point!

https://www.yahoo.com/gma/coronavirus-live-updates-trump-says-covid-19-testing-084900403–abc-news-topstories.html

Good chance that deaths may rise soon, but may not be as many deaths as one may have experienced earlier, in the last quarter.

https://www.youtube.com/watch?v=durcHyxpFT4

Can someone translate this from French? Thanks.

I’m seeing English sub titles…. fiddle with the settings.

Chris Martenson in detail, https://www.youtube.com/watch?v=eD3ztjqYGbg, about the COVID genome sequence and it’s origin possibilities. It’s clear the scientists, people saying “natural origins, can’t be lab made” are lying. Not to conclude anything except why would they say that?

Pulling the plug right here/ right now on all positions and moving back to cash.

It’s partly due to the overnight downdraft in China – the second in two weeks. For instance, a +2.2% gain in BABA at yesterday’s high has transitioned this morning into a -2.7% loss. (On the other hand, premarket bids for XLE/ XLF are actually higher than Thursday’s close and I’m able to close both for +1% gains.)

But here’s the main thing. As I was driving to work this morning, it occurred to me that the market may have set us all up for the ultimate fakeout. The Great Deception (a beautiful Van Morrison track off the ’73 Hard Nose The Highway album) –

‘ Have you ever been down to love city

where they rip you off with a smile

and it don’t take a gun’

The market is a great deceiver. The rally from 2179 to 3276 blindsided us all and steamrolled the bears. Are prices now about to cascade lower and teach the bulls the same lesson? It’s a pretty good bet. It’s been pretty much the same game since I started following the capital markets in 1981.

I think we’ve gotten addicted to stimulus and ahead of the virus’s timeline. It’s going to be a while, a year at least, that’s not factored in. Congress will agree to stimulus, but it won’t be as much as before and will have less impact. Business is still ok in many sectors, but people are cautious and it won’t take much IMO for the purses to slam shut. Barring a miracle, I don’t see us turning the corner until Biden is in office in January.

But hey, at least sports are back for a welcome diversion!

Love the Economist’s cover page…

Free Money

https://www.economist.com/weeklyedition/2020-07-25

Inclined to think this is a classic contrary indicator for rates, but I’m having a hard time thinking of a contrary case.

Anyone buying INTC today?

Great call RX. I was scared when market opened, (a buying opportunity) and market is climbing back. The bulls are not out if we close at or higher.

To be honest, I think we’ll close at the lows of the day. Of course, the market doesn’t know or care what I think.

It’s amazing how often market timing comes down to luck.

Had I decided to close out my week on Wednesday (I thought about it!), my account would be +1.9% higher. As it is, I’ve given up an entire week’s gains – although of course that takes me back only to last Friday’s closing balance.

Trading is a profession where one is rewarded for being right.

It doesn’t really matter how a trader makes that happen. Whether it’s superior research, a disciplined approach to trading rules, an innate understanding of crowd behavior, a black box, a lifetime of experience, or just plain luck – all that matters is the bottom line. I think a high percentage of successful outcomes can be attributed to pure chance – becoming a fund manager/ starting a fund in 1982, 1991, or 2009 for instance.

Some traders have an edge – one that often isn’t easily explained or defined. IMO, Cam has a real edge.

Whatever the underlying reason(s) for outperformance, all successful traders share one thing – they’ll be spectacularly wrong at some point. Bill Miller, for instance. They all share something else – they come back from periods of underperformance to succeed again. Bill Miller, for instance. Being right 100% of the time just isn’t possible.

There is support around 42-44$.