We are starting our coverage of the Q2 earnings season. Let’s begin with the big picture. FactSet reported that, with 9% of the companies reported, the EPS beat rate was 73%, which was slightly above the 5-year average. The sales beat rate was 78%, which was well above the 5-year average of 60%.

The bottom-up consensus forward 12-month estimate rose 0.51% last week The market is trading at a forward P/E of 22.3, which is well ahead of historical norms.

A detailed look

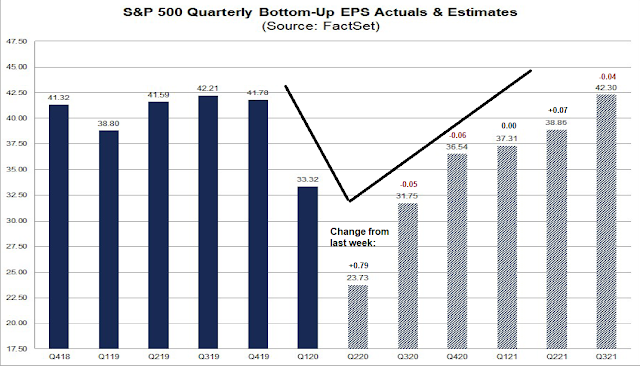

A detailed analysis of quarterly EPS estimates shows a consensus for a V-shaped rebound. Though these trends can be noisy, weekly revisions indicate that the Street had dramatically upgraded Q2 EPS estimates, but reduced H2 estimates. The trend in revisions for 2021 quarterly estimates was mixed.

The main theme of earnings calls is uncertainty. As an example, CNBC reported that JPMorgan Chase CEO Jamie Dimon remarked that the outlook depends mainly on the course of the pandemic.

“The word unprecedented is rarely used properly,” Dimon said this week after JPMorgan reported second-quarter earnings. “This time, it’s being used properly. It’s unprecedented what’s going on around the world, and obviously Covid itself is a main attribute.”

The economy would be in shambles without the safety net of the CARES Act.

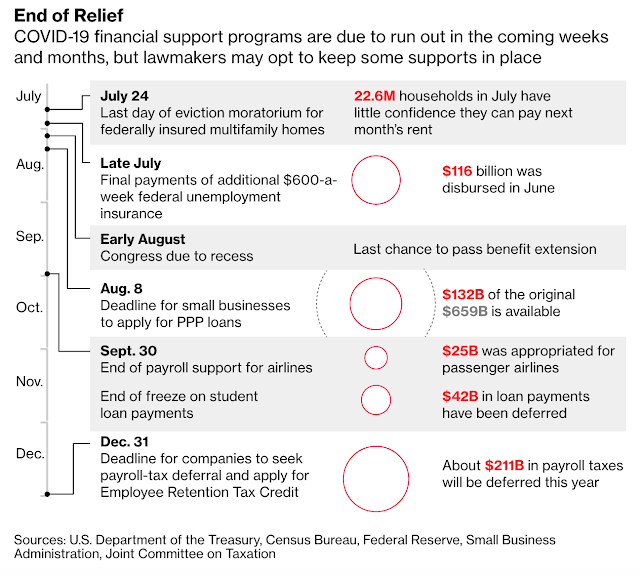

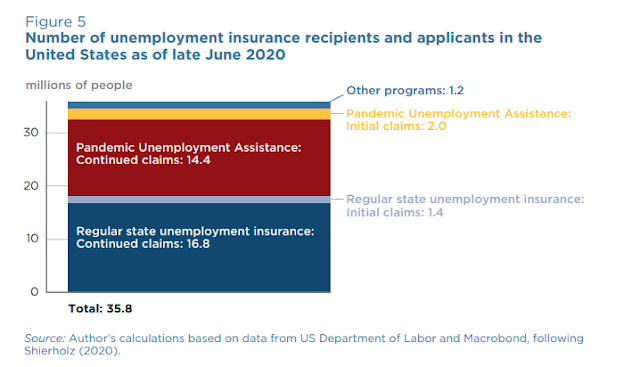

That’s because the $2.2 trillion CARES Act injected billions of dollars into households and businesses, masking the impact of widespread closures. As key components of that law begin to phase out, the true pain may begin. As many as 25.6 million Americans will lose enhanced unemployment benefits by the end of July, and it’s unclear if Congress will extend the $600 per week in additional payments that has buoyed so many households.

“In a normal recession unemployment goes up, delinquencies go up, charge-offs go up, home prices go down; none of that’s true here,” Dimon said. “Savings are up, incomes are up, home prices are up. So you will see the effect of this recession; you’re just not going to see it right away because of all the stimulus.”

The bank has provided forbearance on 1.7 million accounts; so far, more than half of credit card and mortgage customers in the programs have made at least one monthly payment. But these vulnerable customers could stop paying altogether as their federal benefits lapse.

The Transcript provided more color with themes from last week’s earnings calls:

- The economy rebounded in May and June (JPMorgan Chase, Carnival, Johnson & Johnson, Bank of America, Delta Air Lines)

- But the recovery is slowing down as infections rise (JPMorgan Chase, Goldman Sachs, Delta Air Lines, Domino’s Pizza, Fastenal)

- Businesses are beginning to plan for this slowdown to last much longer than initially expected (JPMorgan Chase, Bank of America, Goldman Sachs, Citigroup, Wells Fargo, Carnival)

- Government stimulus has softened the impact of a major blow to the economy but what happens when it runs out? (JPMorgan Chase, PepsiCo, Citigroup)

- The moment of truth is approaching quickly (JPMorgan Chase, Citigroup, Wells Fargo, DBS Group)

- Markets are betting on more stimulus (Citigroup)

- There’s a big disconnect between markets and the current reality, but remember markets discount the future (Citigroup)

- The election cycle is not playing a big role yet (Goldman Sachs)

The New York Times summarized the views of other CEOs. All had similar cautious outlooks.

“I’m less optimistic today than I was 30 days ago,” said Arne Sorenson, chief executive of Marriott International. “The virus is in so many different markets of the United States.”

“Most C.E.O.s today believe that until there is a more effective treatment or a vaccine, that work and life are not going to go back to normal,” said Julie Sweet, chief executive of Accenture.

Ms. Sweet said even in Europe, where the virus is largely under control, business leaders are anticipating flare-ups that could disrupt the economy again. “In Europe, we have clients saying, ‘We want you back,’ and in the next breath saying, ‘Of course, that will change,’” she said.

“It’s going to be one step forward, two steps back,” said Julia Hartz, chief executive of Eventbrite, the ticketing website.

There is a general feeling that Congress needs to act.

Rich Lesser, the chief executive of Boston Consulting Group, argued that it was imperative for Congress to provide more relief for the most vulnerable members of society, particularly essential workers, the elderly and those with compromised immune systems.

“Without the federal government doing something, we will miss the window,” Mr. Lesser said, adding that the virus was spreading rapidly and becoming entrenched in communities. “We need the government to say we are focused on protecting the vulnerable. If we wait to September, it will be too late.”

Mr. Sorenson of Marriott and Mr. Bastian of Delta — both of whom have large workforces vulnerable to buyouts, furloughs or layoffs if the economy does not recover swiftly — called for the expansion of unemployment coverage.

And Ms. Hartz of Eventbrite said that she wanted to see more support for small businesses.

“Something is going to have to give,” she said. “If there is not federal relief that is usable and tuned to the needs of these small businesses, they’ll go out of business.”

The elephant in the room

The elephant in the room of the earnings outlook is what happens when the fiscal support from CARES Act expires at the end of July. If Congress were to pass an additional stimulus bill, the soft deadline for state governments to re-program their computers is July 25, which is less than a week away. A Bloomberg article outlined the timeline for an economic crash landing if Congress doesn’t act.

The Washington Post reported that the White House has outlined its wish list of a payroll tax cut and business liability protection.

President Trump sought to draw a hard line on the coronavirus relief bill Sunday, saying it must include a payroll tax cut and liability protections for businesses, as lawmakers prepare to plunge into negotiations over unemployment benefits and other key provisions in coming days.

“I would consider not signing it if we don’t have a payroll tax cut,” Trump said in an interview on “Fox News Sunday.” Democrats strongly oppose a payroll tax cut, and some Republicans have been cool to it, but Trump said “a lot of Republicans like it.”

The Republicans have yet to present a united front in negotiations. The leadership has been found it difficult to persuade conservatives to sign on to extra spending. As well, CNBC reported that Senate Republicans are pushing back on a Trump proposal to cut back funding for virus testing.

The White House is trying to block billions of dollars for coronavirus testing and contact tracing in the upcoming stimulus relief bill, two Republican sources told NBC News, even as infections surge across the country and Americans face long wait times to receive test results amid high demand.

Senate GOP lawmakers, in a break with the administration, are pushing back and trying to keep the money for testing and tracing in the bill, the sources told NBC News. Some White House officials reportedly believe new money shouldn’t be allocated for testing because previous funds remain unspent.

Democrats in the House had already passed a $3 trillion relief bill, with very different priorities. In general, the Democrats’ approach can be summarized as creating a stronger safety net. The Republicans believe the current CARES Act creates too many incentives for people to stay home on unemployment, and their relief proposals focuses on limited spending and more incentives to return to work.

Can both sides come to an agreement in time?

Numerous economists and think tanks have warned about the dire effects of an abrupt stop in fiscal support. Former Obama economic advisor Jason Furman projected a further -2.5% reduction in H2 2020 GDP and 2 million additional jobs lost if the expanded unemployment insurance benefits were to expire. While he doesn’t directly come out and say it, a -2.5% decline in GDP amounts to a double-dip recession. It would also upend the Wall Street consensus of a V-shaped rebound in quarterly EPS.

The abrupt expiration of any form of expanded unemployment insurance at the end of July 2020 would create problems both for the workers directly affected and for the economy as a whole, reducing GDP by about 2.5 percent in the second half of 2020—more than a typical year’s worth of economic growth.

The Chicago Booth School conducted a survey of academic economists through its IGM Forum, and all agreed with the following three propositions.

- Employment growth is currently constrained more by firms’ lack of interest in hiring than people’s willingness to work at prevailing wages.

- Reducing supplemental levels of unemployment benefits so that no workers receive more than a 100% replacement rate would be a more effective way to balance incentives and income support than simply stopping the supplement at the end of this month.

- A well-designed unemployment insurance system would tie federal contributions to states on the basis of each state’s economic and public health conditions.

To be sure, some respondents were “unclear” about the propositions, though none disagreed. Posturing aside, these propositions form some realistic principles of relief policy design.

Will Congress listen? Legislators have a lot of work to do. Decisions in Washington in the next week could create a lot of event risk to the H2 earnings outlook.

Cam, is it the royal ‘we’ when used in ‘We are pleased to announce…’, or is there more than one person preparing the posts on this website? If the latter, how many? Just curious.

It’s the royal we.

Bonddad:

“But the bottom line is that the evidence is now overwhelming that the increased infections that began at Memorial Day weekend have finally flowed through into deaths since the beginning of July.”

http://bonddad.blogspot.com/2020/07/coronavirus-dashboard-for-july-20.html?m=1

Min, I find that chart surprisingly calm just as the death rate per infection is calm considering the supposed numbers of covid infected.

As America stumbles towards a possible (or not) support plan, Europe is on the brink of signing a one trillion dollar fiscal support financed with the first Euro-wide 27 nation bond issue. This is a big boost to their unity. That coupled with excellent Covid results and fine reopening without race riots makes it a safer bet than the US in my opinion. Also, looking at the current heights of the FAANG plus MSFT and TSLA, the US market is vulnerable to them falling.

I’m safety conscious and Europe is that in comparison.

Thanks for pointing that out, Ken.

Cam, I didn’t see any good news on Astrazeneca. I only saw this.

https://finance.yahoo.com/news/astrazeneca-vaccine-data-appear-less-174231519.html?.tsrc=rss

See https://finance.yahoo.com/news/coronavirus-update-astra-zeneca-oxford-vaccine-shows-promise-spiking-cases-ramp-up-fear-factor-185911791.html

https://www.statnews.com/2020/07/20/study-provides-first-glimpse-of-efficacy-of-oxford-astrazeneca-covid-19-vaccine/

That said, the positive protective effects were only seen in people who received two doses of the vaccine, and there were only 10 people in that sample.

Thanks, Cam. I hadn’t seen those two stories.

Until they can show that a vaccine protects against the wild virus, we don’t know.

Antibodies does not equal protection.

I read about vaccines for SARS being tested on ferrets because for some reason their lungs respond like ours. So the vaccine gave great antibody response, neutralizing and binding antibodies. But when the ferrets were exposed to the wild virus they all died. Something bad about the binding antibodies.

Recently in France they had a bunch of mink die…well they are ferrets. So maybe they got COVID?

So, for me, I have to see that people who have been vaccinated don’t start dropping dead. Only then will I trust the vaccine, and before taking I would want to know if I was already immune. Think I’ve had it already and it is a mild one for myself and wife….been about 2 weeks now so I’m hoping it stays mild.

Hope so too, with none of the lingering after effects. Best wishes.

I think about relief package not as a binary event but in terms of probabilities of outcomes. I think not doing anything is a tail risk. House laid down it’s election year priorities (not COVID-19). Trump is posturing. The outcome is likely to be unsatisfying to far left and far right. But something getting done is a high probability event. I am positioning accordingly.

Sanjay-

(a) Had the SPX closed ~3270 (rather than 2951), I was ready to pare back on my position. I would have sold ~half at that price – a one-day gain of +2% in the index is worth locking in.

(b) Instead, I’m now hoping for an early morning spike on Tuesday. If the index spikes hard (let’s say to 2980+), I plan to sell the entire position – ie, it would be ‘close enough’ to my original target of a +3% move.

(c) If the SPX opens in the hole on Tuesday – then having a +1.5% buffer relative to Friday’s opening basis allows me to sit back and watch. If it breaks below my opening basis, I may opt to bail out. However, I’m not expecting that to happen.

(d) XLE/XLF are both sectors that I expect to take off soon – but may in fact continue to underperform. So it’s a bet – IMO, a bet with 60/40 odds of paying off.

(e) I closed positions in ASHR/ FXI today because it’s prudent to lock in one-day gains of +3%/ +1.5% in the sector on the heels of last week’s ugly reversal. Longer-term, I’m quite bullish on China and plan to reopen positions as soon as tomorrow.

I remain bullish – and the higher the global indexes move the more conviction I have in buying the dips. However, at this point in the rally prices are less likely to move straight up, and I plan to trade the zigs/zags as best I can.

My thinking changes every day, and I reserve the right to turn bearish at the drop of a hat.

Why does everyone keep referring to the S&P being at 29xx?

Wishful thinking.

Thanks, RX2.

https://twitter.com/charliebilello/status/1285366325968343040

Smart money hedgers are currently betting a rise interest rate.

But Tim Duy says: The obvious implication is that interest rates will remain close to zero at the short and medium end of the curve and held down at the longer end. This is going to stress a lot of people out because “interest rates and stocks are telling different stories.”

https://blogs.uoregon.edu/timduyfedwatch/

So, are smart money dumb now?

Stephen Suttmeier, Bank of America’s technical research strategist, indicated a possible 9% upside in SPX. A summer rally??

Closing half of my positions in XLE/ XLF on premarket spikes of +1.7%/ +1.2% – basically, the two positions that I added yesterday. I’ve noticed that early morning strength in the two sectors tend to get sold, and may reopen later in the day.

https://twitter.com/eucopresident/status/1285439360771358720

The above tweet may be enough to push the sentiment needle to euphoria.

Anything Europe can do, we can do better! LOL

Closing all positions here.

(a) It feels like a ST top – I think we’ll see SPY 330 this week, but we’ll probably need a pullback to make that happen.

(b) Locking in a +2% gain here makes sense for me. It’s a relatively minor gain over two trading days, but recall that I took a -7% hit on June 8. From that perspective, my portfolio has seen a +9% gain over six weeks.

(c) Speaking of which. Navigating my way out of the -7% nosedive was hard work. Sure, buy-and-hold requires no buy and sell decisions – but the mental discipline of ignoring/combating the daily bearish headlines and narratives is real work.

In any case – still bullish and now looking for attractive reentries.

XLE – it takes off as soon as I close the position.

Sometimes it’s lack of faith in my own takes.

No coronavirus bill coming in July!

https://www.cnbc.com/2020/07/21/coronavirus-stimulus-kevin-mccarthy-says-bill-may-not-pass-in-july.html

This has to be negative for the market over the next few weeks. May be the market will swoon down to put pressure on the Congress.

Seasonality turns negative today.

As an aside – my wife and I started to notice in the late Nineties that every time we went on vacation in August our portfolios would take a hit! Like clockwork.

Indeed.

https://twitter.com/ukarlewitz/status/1284181149401485312

Great chart, thanks!

Rx, please let me know if you are hitting the road this year. Time to hedge… 🙂

This will probably be the one year we’re unable to travel, and also the one year the market decides to go up in August 🙂

Ideal reentry might be a decline to SPY 317-> perhaps an undercut to 315-> followed by recovery above 317. Target still 330. It’s never a perfect setup, but writing those numbers down provides at least a frame of reference.

A good article on where we stand now.

https://www.vox.com/21327754/coronavirus-economy-second-stimulus-unemployment-extend-congress

I like last night’s pullback in the Hang Seng, but not seeing much of a buying opp in the China indexes. Opening positions instead in BABA/ HUYA.

Also like the pullback in XLE->reopening small here.

Taking another contrarian swing @ SPY 325.7x. I don’t think it’s going to pull back much. The SPX is a train that wants to head higher, and it’s unable to do that carrying any more passengers than it already has.

Bloomberg says insiders are selling.

https://finance.yahoo.com/news/insiders-nailed-market-bottom-starting-100000776.html

However, not confirmed by OpenInsider:

http://openinsider.com/charts

Of course they’re selling. If I worked for TSLA, I’d be doing some selling!

My neighbor sold all his stock options in TSLA around $1,000. He was very happy for a day or so, not so much these days. Poor guy, no not really.

I wouldn’t bet against Elon. Guys like that never stop innovating. Another Steve Jobs.

SPY has now ticked above Tuesday’s intraday high. If it closes above, expect FOMO to kick in on Thursday.