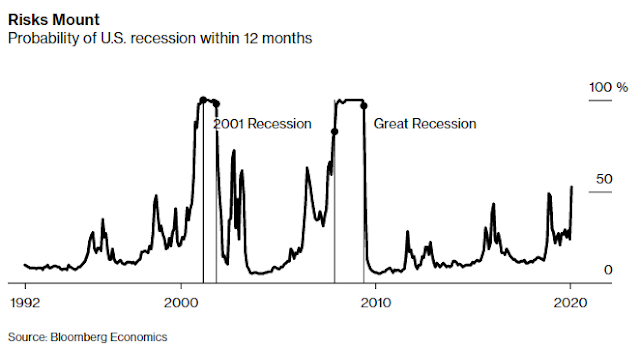

In the past week, I have had several discussions with investors about my recession call (see OK, I’m calling it). Since the publication of that note, Bloomberg Economics’ US recession probability estimate spiked recently up to 55%.

The odds of a 2020 recession at betting sites are even higher.

To reiterate, I would like to clarify the reasoning behind my recession call, which is based on a triple threat:

- The emergence of COVID-19 in China has created a supply shock that disrupted supply chains all over the world.

- The Saudi-Russia oil price war, which has devastated the oil patch in the US.

- The COVID-19 pandemic, which is expected to result in both a supply shock and demand shock in the US.

China’s supply chain shock

I covered most of the effects of the COVID-19 epidemic in China in a previous publication (see Don’t count on a V-shaped recovery), so I will not repeat myself. The Chinese leadership was faced with a painful trade-off between the health of their population, and economic growth. Once the bureaucracy got over the denial phase of the epidemic, Beijing chose to focus on the health of their people with a containment strategy of quarantine, mass-testing and contact tracing. These measures effectively shut down their own economy for Q1, and likely part of Q2. Once the infection rate stabilized, they pivoted to economic growth as a priority.

Nevertheless, the slowdown created supply chain bottlenecks all over the world, and threatened the global growth outlook. Axios reported that the coronavirus disrupted supply chains for nearly 75% of US companies. Bloomberg reported that the effects of the slowdown is worldwide:

U.S. seaports could see slowdowns of as much as 20% continue into March and much of April, according to the American Association of Port Authorities. The same trend is seen in more distant places, with Rotterdam — Europe’s economic gateway to Asia and beyond — seeing a similar cut of about 20%.

China is recovering from the virus. Even if you are dubious about China’s official statistics, consider this NY Times interview with Dr. Bruce Aylward, who led World Health Organization (WHO) team that visited China and found no apparent evidence of fudged numbers.

During a two-week visit in early February, Dr. Aylward saw how China rapidly suppressed the coronavirus outbreak that had engulfed Wuhan, and was threatening the rest of the country.

New cases in China have dropped to about 200 a day, from more than 3,000 in early February. The numbers may rise again as China’s economy begins to revive. But for now, far more new cases are appearing elsewhere in the world.

China’s counterattack can be replicated, Dr. Aylward said, but it will require speed, money, imagination and political courage.

Indirect market and anecdotal evidence does show that the worse of China’s downturn is over. Hong Kong has the epidemic well under control. Neighboring Macau announced last week that they were discharging their last COVID-19 patient.

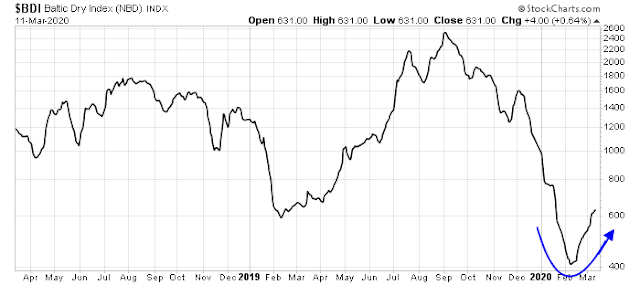

The Baltic Dry Index, which measures shipping costs, is recovering after a deep slide.

As well, Bloomberg reported that American exports of chicken is starting to return to normal:

U.S. chicken exports to China are flowing freely again as logistical bottlenecks caused by a deadly virus dissipate and the Asian nation issues tariff waivers to buyers, according to Sanderson Farms Inc.

The U.S.’s third-largest chicken producer has shipped 522 loads to China of mostly dark meat and paws, Chief Executive Officer Joe Sanderson Jr. said in a presentation Wednesday.

That’s up from 420 at the end of February, when the company reported earnings for the first quarter

.

The coronavirus outbreak, which has claimed more than 4,000 lives globally, disrupted transport operations in China and left thousands of meat containers piling up at ports. While retaliatory tariffs were until recently a hurdle for U.S. shipments, China is now giving duty waivers to buyers, Sanderson said.

China is returning to work, albeit slowly.

The Saudi-Russia oil price war

If the Chinese COVID-19 epidemic wasn’t enough, the global economy was unexpectedly hit with a oil price war when Russia could not come to terms with OPEC on oil price cuts in the face of falling global demand. Saudi Arabia responded by not only pumping at capacity, but selling above their production capacity with sales of their reserves.

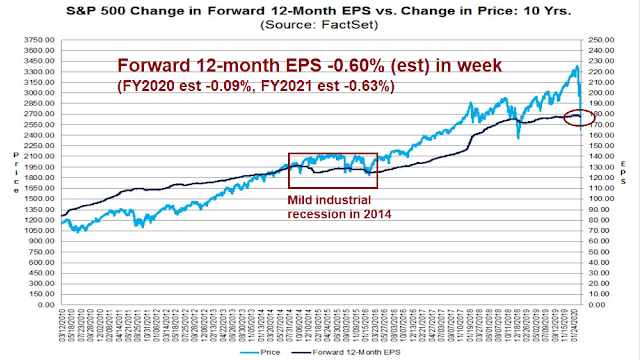

This sparked a different sort of supply shock. The market saw the effects of an oil shock in late 2014 when the price skidded from over $100 to about $40 in short order. The US economy experienced a shallow industrial recession, which was especially evident in the oil patch. Earnings estimates fell, and stock prices weakened in the latter half of 2015.

Forward 12-month consensus EPS estimates have been flat, and they have just begun to decline as a result of the Chinese supply chain disruption, indicating negative fundamental momentum. What will happen once the full effects of the oil price shock work their way through earnings expectations?

Can America flatten the curve?

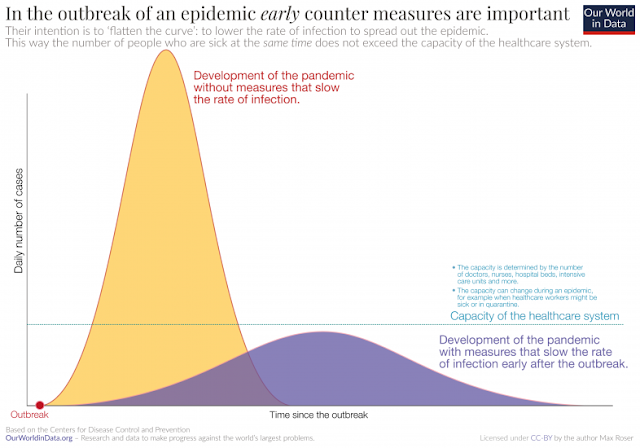

Even worse, COVID-19 has landed upon American soil and it is expanding its beachheads and spreading all over the country. Since there is no cure or working vaccine, health authorities use two types of strategies to combat the virus in order to “flatten the curve”, containment and mitigation. As shown by the stylized diagram, the infection can either run rampant in an uncontrolled fashion (yellow curve) or in a slower way (violet curve). Each country has a limit on healthcare resources, and an uncontrolled epidemic will quickly reach and overwhelm care capacity, in hospital beds, healthcare providers, and so on. Strategies to slow down the outbreak buy time so that care capacity does not become constrained.

Anecdotes from northern Italy, which has a first-rate healthcare system, indicate a society that is in a desperate fight against COVID-19, as reported by Bloomberg:

More than 80% of the region’s 1,123 acute care beds are dedicated to coronavirus, after many other patients have been moved elsewhere and 223 extra places have been opened to cope with the emergency. About half of those are occupied, Gallera said.

Newspapers and WhatsApp groups are rife with personal accounts from doctors on the front lines of the epidemic. When new patients come in with pneumonia, a symptom of advanced coronavirus infections, doctors have little time to decide whether to assign them intensive-care beds, ventilation machines or respirators that could make the difference between life and death.

Some doctors have said that they sometimes make the call on who gets treatment based on the age of the patient. In some areas, hospitals are suspending other treatments to focus personnel on the contagion.

A doctor who asked not to be named because of potential repercussions painted a dire picture of the situation in a hospital in Milan. While the coronavirus is best known for causing severe disease in elderly patients, even some young people are affected, the doctor said, and without sufficient beds and ventilators, some can’t be treated.

The hundreds of patients needing treatment for pneumonia have swamped the supply of available specialists, the Milan doctor said. Physicians such as gastroenterologists, who normally focus on the digestive system, have been conscripted to help out with lung patients, and they’re still not enough, the doctor said.

This NY Times account of a Seattle area hospital provides a glimpse of what will probably be common scenes all over the US in the very near future:

While much of the country is just starting to see clusters of cases emerge, the hospital east of Seattle offers a window into the challenges set to cascade through the nation’s health care system, testing the resilience of workers, the readiness of institutions and the flexibility of supply chains.

The past few weeks have seen medical workers operating at the very edges of their capabilities, facing a virus so virulent that some patients were dying within hours of coming down with their first symptoms.

Caregivers who had been sent home into quarantine had to be called back to work to face the overwhelming task at hand. Engineers spent late nights scrambling to overhaul rooms so that contaminated air could not escape. Sanitation and janitorial crews struggled to swab down rooms where even a trace of the virus could infect the next patient. Supplies were so strained that nurses turned to menstrual pads to buttress the padding in their helmets.

If an outbreak is caught in its initial stages, health care authorities can utilize the containment, or quarantine, strategy to prevent the virus from spreading to other patients. This approach can be useful if patients from infected regions, e.g. China, can be identified and isolated. Once the infection spreads into the community, a combination of isolation and mitigation strategies have to be employed. Mitigation include personal hygiene practices such as frequent hand washing, and wearing a mask in order not to infect others. Social distancing is another mitigation technique, which includes closing down public events where crowds gather, such as schools, arts and sports events, and any other large gatherings. The downside of social isolation strategies is an economic shock that significantly reduces the demand for goods and services.

China has been relatively successful with draconian isolation and mitigation strategies, and so did Singapore. South Korea managed to contain its outbreak with a combination of mass testing to identify patients so that they could be isolated, and social distancing strategies that made most of the country virtual ghost towns. For some perspective, read this American ex-pat’s account of living in Seoul in the Dallas Morning News, which she described as “living in end-times”.

One way of measures the success of COVID-19 countermeasures is the time it takes for confirmed cases to double, as shown at Our World in Data. Outperforming countries include China (doubled in the last 32 days), South Korea (12), and Singapore (15). By contrast, the same metric for Italy is 4, Iran is 6, France 3, and the US is 3, which is probably affected by an under-counting of cases due to a shortage of testing capacity.

While the American healthcare system is generally thought of as first rate, access is uneven. In particular, many rural counties lack primary care doctors, or even hospitals. Notwithstanding the problems of insurance coverage, and lack of sick days, which can be an obstacle to a patient seeking care, the lack of proper facilities in these under-served rural areas highlight a key US vulnerability.

The policy response

In the face of this triple threat, what can American policy makers do?

Former New York Fed President Bill Dudley laid out what the Fed can do under these circumstances in a Bloomberg op-ed. Dudley believes that lower rates is a no-brainer.

At this point, more short-term rate cuts seem certain. After all, the outlook has deteriorated since the Fed’s 50 basis point cut on March 3. Moreover, historical experience indicates that rate cuts between Federal Open Market Committee meetings have typically been followed by rate cuts at the subsequent FOMC meeting. Finally, the language accompanying the last rate cut — that the FOMC would “act as appropriate” — also has been a reliable predictor of future rate adjustments. Thus, it would be very surprising if the FOMC didn’t cut its federal funds rate target by 50 basis points, or possibly more, at next week’s meeting.

QE would be the next tool once rates have reached the zero lower bound.

The decision to use the monetary policy tools such as forward guidance and quantitative easing will be straightforward. If the Fed has pushed short-term rates to zero and the economic outlook suggests the need for greater monetary stimulus, these tools will be used. They are now part of the Fed’s standard tool kit.

Like other central bankers, Dudley called for fiscal policy support in addition to monetary policy. Monetary policy is of limited utility under the current conditions.

The stresses that emerge as a result of the coronavirus are likely to be very different from those that occurred during the financial crisis. This time we are likely to see considerable stress on small businesses that encounter cash-flow problems and on households, especially if unemployment spikes.

These types of problems probably are better addressed through fiscal policy than monetary policy. Payroll tax cuts, sick-leave pay, extended unemployment benefits, and block grants to state and local governments to forestall layoffs should all be considered.

Governments face policy trade-offs between the health of their population and economic growth, but much of the US focus has been on growth (Wall Street) over public health policy (Main Street). A coronavirus bill is working its way through Congress. as the Democrats and Republicans bargain over its many provisions. A WaPo article outlined the policy choices that lawmakers face:

The first is spending aimed directly at stopping the spread of the virus: buying masks, producing a vaccine, paying for testing and so on. Everyone, Republicans and Democrats, agrees that’s necessary.

The second set of actions is focused on the people most directly affected by the economic fallout. Some of that can be done by extending existing programs such as unemployment insurance and food stamps and paying for sick leave, but it can also include simply giving people money.

Up until Friday’s dramatic declaration of a national emergency, it appeared that the Trump administration was prioritizing economic growth (Wall Street) over public health (Main Street). It remains to be seen how quickly the federal government can make the Main Street pivot.

What’s next for Main Street?

How bad can things get for Main Street? As a reminder, I previously highlighted the results of a CBO pandemic study (see A Lehman Crisis of a different sort).

The Congressional Budget Office conducted a study in 2005-06 that modeled the effects of a 1918-like Spanish Flu outbreak on the economy. The CBO assumed that 90 million people in the U.S. would become sick, and 2 million would die. Those assumptions are not out of line with current conditions. The population of the US is about 330 million, so an infection rate of 27% (90 million infected) and a fatality rate of 2% (1.8 million dead) are reasonable assumptions.

The CBO study concluded that a pandemic of this magnitude “could produce a short-run impact on the worldwide economy similar in depth and duration to that of an average postwar recession in the United States.” A severe pandemic could reduce GDP by about 4.5%, followed by a V-shaped rebound. Demand shocks would also be evident, with an 80% decline in the arts and entertainment industries and a 67% decline in transportation. Retail and manufacturing would drop 10%.

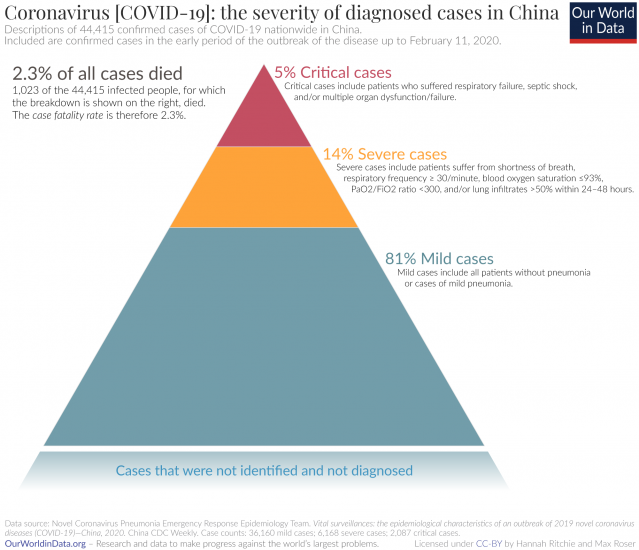

In all likelihood, somewhere between one-third and two-thirds of the population will be exposed to the coronavirus. Using the Chinese experience as a guide, 81% of the cases will be mild, 14% severe, 5% critical, and 2.5% will die. As it is set up, the healthcare system will be overwhelmed.

Add to that the recent hit to the US energy sector, which became a net exporter as fracking techniques took hold in the oil patch. We saw in 2014-15 that plunging oil could cause further weakness in business investment. In addition, China’s decision to shut down its economy to battle the COVID-19 pandemic has caused supply chain disruptions that rippled throughout the global economy. It is difficult to see how the US can avoid a recession under these conditions.

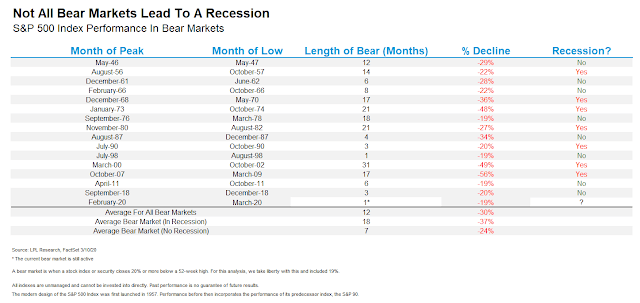

Investors should brace for an equity bear market. Ryan Detrick of LPL Financial pointed out while not all bear mean recession, bear markets that accompany recessions tended to last longer and the drawdowns are more severe.

Please stay tuned tomorrow for our tactical trading commentary.

I wonder if the declaration of emergency by President Trump, the passage of a coronavirus bill by the House and the actions taken by Frau Merkel have calmed fears over coronavirus.

Curious how many people over think that we reached the peak virus fear in the market last Thursday.

The economic consequences (and therefore market) are yet to come.

We are getting close to the quarter-end rebalancing. With equities down significantly more than bonds, it should drive money to equities. When do the fund managers begin the rebalancing process?

We are not even close to the peak in the Coronavirus cases in the USA. We cannot know how well the various health care systems will do but The Seattle example is very disturbing. This is realism not alarmism. bear markets have violent upside bursts–Monday looks to be another. Then reality sets in again. How we do dealing with the virus is far more important than anything else.

I have seen a few transcripts of the calls that funds had with infectious disease experts. I think the Wall Street is well aware of the evolution of the disease based on what we have seen in the countries battling the disease and can extrapolate that to other countries where the disease is in relatively early stages. The last two weeks were really violent. That’s why I was wondering if the investors have already absorbed the base case scenario for now.

Feels like another opportunity to sell into strength.

There was a very disturbing development last week and amazingly I’ve not read anything about what it shows. There has been a huge discount to net asset value of key bond ETFs in the U.S. By huge I mean as high 5% on the 20 Year U.S. Treasury ETF TLT, the largest U.S. High Grade Corporate ETF LQD and the huge U.S. Aggregate Bond ETF AGG. Here is a dynamic link to a chart I made; https://tmsnrt.rs/2vVbSgV

The spread is normally 0.20% or less. Here is the link to the TLT home page https://www.ishares.com/us/products/239454/TLT They show historic discount/premium data.

TLT closed at $153.94 with an asset value of $157.93. This is an extremely liquid ETF that owns only 41 U.S. Treasury bonds. The fact that the arbs can’t exploit this huge gap with such liquid assets tells me that trading desks broke down last week. There is a huge arbitrage industry that keeps ETFs trading near their asset values, near meaning pennies of discounts or premiums. This big gap tells us liquidity is bad.

Of all the strange things I saw last week this one is most disturbing. We could hear about some nasty trading losses or …….? Just think, if U.S. Treasury bond trading is broken, what’s happening in the low quality stuff, likely no bid. It appears the current market volatility is lead by the corporate bond bubble getting shaken.

Experts have been worried about what happens when passive ETF holders bail en mass. The one way nature of the crowd selling is like passengers on a ship all running to one side and over she goes.

In my opinion, until bond trading returns to normal, things will stay volatile.

Here again is the dynamic link to this chart to keep abreast of it. It updates nightly.

https://tmsnrt.rs/2vVbSgV

I agree this is disturbing as… I’m wondering about all kinds of tail risks that may manifest and how they could cascade into a wider financial crisis.

Frankly a recession, even severe, looks like a best/better case scenario.

Ken, I am not a bond guy, but a fund of mine got caught to my exasperation. Would you like to hazard a guess as to how this plays out further?

Worst case scenario is investors avoid corporate credit and the high yield issuing seizes up and companies needing financing can’t get it for new money or rolling over previous bonds coming due. This leads to large amount of defaults. Not good.

Although no ‘cure’ is available, certain drugs have been used to slow the progression of COVID-19.

Remdesivir is a nucleotide analog that showed in vitro activity against COVID-19 when used in combination with Chloroquine. In the US, Remdesivir is currently available for compassionate use or via an NIH study.

Other medications that have been used in the US include Chloroquine (an anti-malarial) and the protease inhibitors Lopinavir/Ritonavir (Kaletra). In vitro studies showed blockage of COVID 19 and Chloroquine was found to be superior to control treatment in inhibiting the exacerbation of pneumonia, improving lung imaging findings, promoting a virus negative conversion, and shortening the disease course. Lopinavir/Ritonavir (plus ribavirin) showed decreased risk (2.8% vs 28.5% for historical controls) of progression to severe respiratory illness in a small retrospective study for SARS in 2003. A case study re one patient with COVID-19 reported decreased viral load after two days on Lopinavir/ Ritonavir and a review of 5 patients receiving lower, non-therapeutic doses of Lopinavir Ritonavir within 1-3 days of oxygen desaturation was equivocal – in 3 of the 5 patients, fever resolved and supplemental oxygen requirement was reduced within 3 days, whereas 2 deteriorated with progressive respiratory failure – suggesting the need for full dose Lopinavir Ritonavir begun prior to oxygen desaturation.

Thus drug treatment represents another strategy we will begin to hear more about.

Apologies if you find this long post off topic but I find a FinTwit thread relevant to how you think about the current situation, an outside the normal distribution event causing i.e. a decline like the 1929 crash. Here it is:

There are three basic tribes on FinTwit – The Normal Distribution Tribe, the Long Tail Tribe and the Fat Tail Tribe.

The Normal Distribution tribe tends to be populated by investment bank analysts, mutual fund managers, RIA’s, Relative Value investors and a more than a few journalists. They tend to do well over benign parts of the business cycle but they tend to be benchmark-huggers by nature and thus see lower returns with low volatility. They are uncomfortable out of major consensus, prefer medium- term mean reversion and love to mock anyone who sees outside of the usual 1 standard deviation distribution of outcomes around the mean. Then they lose their jobs. (Unless they are mutual fund managers who hide in the herd of performance of the big Normal Distribution tribe). They tend to have a good career, while it lasts. Their place of worship is CNBC.

Then there is the Long Tail Tribe. They tend to be populated with hedge fund managers with short careers (but who can make HUGE wealth if they are right and get their timing right). The other part of this is the Agora newsletter readers, the Bitcoin, gold and inexperienced short-seller tourist sub-tribes. The smaller part of this crowd are skilled risk takers but have a tough fight against the odds. Others are big dreamers who dare to think differently of different futures. Others get the odds wrong through inexperience. This is a rough and tough tribe. They fight all day with the Normal Dist. Tribe. These people either are spectacularly successful or end up bitter that the world doesn’t always deal 6 sigma events. They swing big. Their place of worship is podcasts YT channels and newsletters.

Then there is the Fat Tail Tribe. The Fat Tail tribe tends to spend a lot of time within the two standard deviation distribution zone, where their volatility of returns is not as high as the Long Tail tribe and more than the Norm Dist tribe. Sometimes they have down years and other times they have bigger up years. They tend to be happy mingling with the two other tribes and learning. Both are right. But they also see the other opportunities or possibilities that the other tribes don’t. They tend to see different and more varied opportunities over time and gravitate to the 2 standard deviation zone and into the Fat Tail, when the market assigns the wrong odds, in their minds. This tribe tends to be the more success performers over time but there is a tendency to become cult followings when they are hitting well in the 2 SD zone and then people move away when they aren’t hot. They generally stay in business but can sometimes lose assets when they are not so hot, and have to close up shop. They are generally misunderstood by the other tribes. The Norm Dist tribe mock them when they dare to think differently and the Long Tail tribe hate them when their view doesn’t match with their own. The FT tribe often share views with both and drift from both. It is usually time horizon and the business cycle that separates them tho. This is the Macro Tribe. We are used to being wrong but try to be right more often and bigger. We don’t always get it right but over time the odds skew in our favour.

I was planning to travel to Japan this week. Of course, not happening now.

Japan is an interesting situation. They were early in getting infections, so I would have expected much higher totals by now. But total dead as of today is 22, with several hundred confirmed infected. Japan is the ‘oldest’ country in the world, yet the situation is not at all like that in Italy.

Their social distancing has not been all that aggressive. They did ultimately close schools. But here is a picture of current Tokyo nightlife:

https://japantoday.com/category/picture-of-the-day/night-shopping

“In all likelihood, somewhere between one-third and two-thirds of the population will be exposed to the coronavirus. Using the Chinese experience as a guide, 81% of the cases will be mild, 14% severe, 5% critical, and 2.5% will die. As it is set up, the healthcare system will be overwhelmed.”

In all likelihood? More like ultra worst case scenario. There’s no reason the US experience has to follow China’s.

The American healthcare system is totally unprepared and mitigation efforts are patchy due to uneven state and local control. I would argue that the US experience is likely to be worse than the Chinese experience.

Just read this account as just one of many examples https://twitter.com/vivek_murthy/status/1238500475068125192

How many dead do you expect six months from now?

I think our outcome will end up being somewhere between China’s (better) and Italy’s (worse). China has the benefit of an authoritarian system (granted their initial response was delayed), and an efficient and responsive government but has the disadvantage of relatively poor healthcare system. Of course, they also had the disadvantage of being the first to deal with an unknown disease. Still, they could really slow the spread of virus by quarantining 60M people.

(Based on what I little know/read about Italian culture) Italians on the other hand are very social, church-going people. People stand close and greet each other with a kiss on each cheek. It is also part of Italian culture to go around the law (e.g. quarantine). Maintaining quarantine and social distancing was hard and will be hard. Moreover, the hospitals did not have enough facilities (e.g. ventilators or beds) to treat the surge of the patients.

I agree with Cam that the US healthcare is very patchy – significant differences from state to state and city-to-city. My optimism emerges as over the last few days, many states, private sector and some individuals have realized the enormity of the situation. The quarantine and social distancing will slowly be driven by businesses and individuals, and the local governments. As tests are conducted and the number of infected people come out, businesses and individuals on their own will take mitigating actions. As public slowly realizes the impact, the governments will also feel emboldened to take more drastic actions.

In live in NYC. No one seemed to care a week ago. Today, there were waiting in lines to enter Trader Joe’s that were spanning around the block. I alerted my yoga studio 3 weeks ago about coronavirus. Finally, they took some measures a week ago. I know a family and a friend who have bailed out of the city to move to a rural community till this blows over. A restaurant decided to close because of the coronavirus.

Northern Italy is the heart of their GDP generative region. Think of world class companies like Ferrari, Gucci and other Italian design houses. They have first class medical facilities, and yet they were overwhelmed.

I would expect that an area like Boston, which has several world class hospitals, would be similar overwhelmed by sheer numbers.

Let’s do some math.

The US population is about 330 million. Harvard epidemiologist Marc Lipsitch has projected that 40-70% will be infected. Most cases will be mild.

https://www.theatlantic.com/health/archive/2020/02/covid-vaccine/607000/

Let’s take the lower 40% figure, and assume that 5% of the cases require hospitalization. That comes to 6.6 million people. While they won’t all need hospitalization all at the same time, the US just under 1 million hospital beds. Only a fraction of them are ICU beds. Assuming that a low-ish 1.5% fatality rate (lower than China), that comes to about 2 million dead.

That’s just simple math. Regardless of the quality of care, the healthcare system is likely going to get overwhelmed.

We have several physicians in our immediate group. The hospitals are better prepared than they were inH1N1 epidemic. It is much better in dense urban areas than in rural areas. Not every one will need hospitalization at the same time. So, yes the system might’ be stressed but will come through. I reject such pessimism.

Cam :Do you think gold might be an investment at this time?

It depends on what you mean by “investment”. What kind of time horizon are you looking at?

This analysis may prove to be spot on, too optimistic, or too bearish. I find it odd that this analysis did not lay out scenarios that could be better or worse with some probability estimates. No one, I repeat no one can forecast the future accurately in the best of the circumstances let alone when dealing with a biological phenomenon. Other factors not considered :

A. Our public and medical healthcare system is far superior to China, S. Korea etc.

B. Medical Science is on leading edge. Several treatment modalities are under expedited testing

C. The past week was a watershed week in public policy response. We have moved from denial to frontal attack. Our community is literally shut down – no school, daycare, public gatherings etc. No one is complaining.

D. Fiscal response is coming Monday. Fed is already engaged. No elected official can afford to be on the wrong side.

To think that none of this will make a difference is naive. Americans are more resilient than outsiders realize and come through. We always have and will do so now.

Markets will be violently volatile in the short term. But that is a time of opportunity for long term investors. Traders – be careful out there.

Stay safe and be well

Well said.

On a positive note:

Test kit production ramping up:

https://twitter.com/ScottGottliebMD/status/1238937023458795527

Growing evidence for chloroquine as treatment:

https://twitter.com/JamesTodaroMD/status/1238553266369318914

Evidence that seasonality will inhibit spread:

https://twitter.com/RyanMaue/status/1238943552530452481

Well said.

https://www.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6

Cam: What about gold as a holding for the next 24 months?

Gold is ok for a tactical negative-beta trade, but I wouldn’t want own it over the next 24 months.